How Much Is Personal Property Tax On Vehicles In Missouri

You can find these fees further down on the page. Personal Property Tax - A.

Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

How much is personal property tax on vehicles in missouri. Missouri Vehicle Sales Taxes Missouri vehicle sales tax and County personal property tax are 2 different types of tax. You pay tax on the sale price of the unit less any trade-in or rebate. Are Missouri Personal Property Taxes on vehicles considered car registration fees.

Calculate personal property tax vehicle missouri. Personal property tax paid on equipment used in a trade or business can be deducted as a business expense. Overview of Missouri Taxes.

Market value of vehicles is determined by the October issue of the NADA. The maximum tax that can be charged is 725 dollars on the purchase of all vehicles. Once market value has been determined the assessor calculates a percentage of that value to arrive at the assessed value.

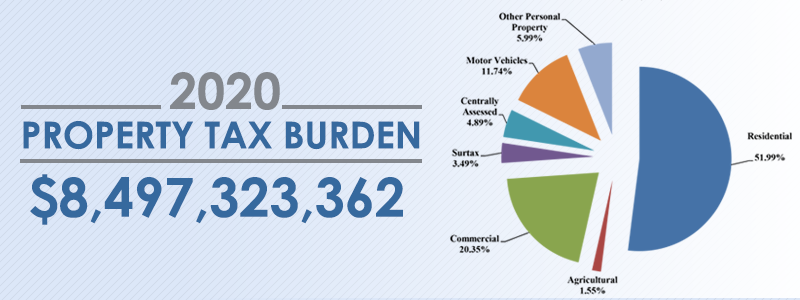

The average effective property tax rate in Missouri is 093. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

Missouri Sales Tax - A One-Time Tax Sales Tax is paid to the State usually at the Department of Motor Vehicles when the vehicle is first purchased. Trucks Commercial Vehicles Registration fees for trucks including all pickup trucks and all utility-type vehicles that are registered as trucks are determined by your trucks weight and whether you will be using the truck locally within 50 miles from home or over a wider area. Registration for motorcycles expires in June and is pro-rated based on the month of application.

Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan 2018s highest-selling car valued at. Sole proprietors can deduct these taxes on Schedule C. Missouri refers to the fees you pay at the time of purchasing a car as registration fees but then requires that we pay personal property taxes yearly based on the value of our cars.

1 Best answer. Is there a calculator that anyone is aware of. All Personal Property Taxes are due by December 31st of each year.

137075 Every person owning or holding taxable personal property in Missouri on the first day of January including all such property purchased on that day shall be liable for taxes thereon during the same calendar year. That comes in a bit lower than the national average which currently stands at 107. I am looking for a way to calculate what my personal property tax will be on my car for the state of Missouri.

Total Personal Property Tax. Information and online services regarding your taxes. In addition to taxes car purchases in Missouri may be subject to other fees like registration title and plate fees.

Calculate Personal Property Tax - Vehicle - Missouri. If you live in a state with personal property tax consider the long-term cost when you buy a vehicle. 0 1 1642 Reply.

The OFallon resident got a surprising welcome to Missouri letter in the form of a personal property tax bill on her well-worn van. 61115 Your family has to pay more than 600 each year in personal property taxes for your vehicles. For personal property it is determined each January 1.

The states median annual property tax payment is 1563. Only the Assessors Office can change the vehicles or addresses on a personal property tax bill. The business portion is deducted as a business expense and the remainder as a personal deduction when property is used partly for business and partly for personal reasons.

Who owes personal property tax. Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

This Area Is Password Protected 401 Honda Civic 2014 Cool Things To Buy Rolla

This Area Is Password Protected 401 Honda Civic 2014 Cool Things To Buy Rolla

Georgia Real Estate Property Power Of Attorney Form Power Of Attorney Form Power Of Attorney Maryland Real Estate

Georgia Real Estate Property Power Of Attorney Form Power Of Attorney Form Power Of Attorney Maryland Real Estate

Https Dor Mo Gov Forms 426 Pdf

Lease A New 2013 Mazda3 Starting At 239 Mo Skyactiv Engine Bluetooth Hands Free Technology Remote Start Mp3 Player Keyl Mazda Mazda3 Nissan Sentra Mazda

Lease A New 2013 Mazda3 Starting At 239 Mo Skyactiv Engine Bluetooth Hands Free Technology Remote Start Mp3 Player Keyl Mazda Mazda3 Nissan Sentra Mazda

Https Dor Mo Gov Forms Missouri Titling Manual Pdf

Acura Rdx 2021 Lease Design Acura Rdx Acura New Cars

Acura Rdx 2021 Lease Design Acura Rdx Acura New Cars

Https Dor Mo Gov Forms 5687 Pdf

1889 Tax Bill Cassville Mo Missouri Barry County For P Tranthum 80 Acres County Missouri Bills

1889 Tax Bill Cassville Mo Missouri Barry County For P Tranthum 80 Acres County Missouri Bills

Missouri Valley Insurance Bismarck Nd Life Insurance Quotes Insurance Quotes Home Insurance Quotes

Missouri Valley Insurance Bismarck Nd Life Insurance Quotes Insurance Quotes Home Insurance Quotes

Tips To Put Into Your Toolbox Of Money Saving Hacks How To Keep Car Repair Costs At A Minimum Car Savings Savemoney Mo Car Repair Preventive Maintenance

Tips To Put Into Your Toolbox Of Money Saving Hacks How To Keep Car Repair Costs At A Minimum Car Savings Savemoney Mo Car Repair Preventive Maintenance

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home