Tax Deduction For Property Taxes Escrow

Property tax is not technically a box of your 1098. Escrow accounts are maintained by your mortgage lender.

What Exactly Goes Into Your Closing Costs Check Out This Amazing Breakout Of Costs Today Realestatefacts Title Insurance Closing Costs Septic Inspection

What Exactly Goes Into Your Closing Costs Check Out This Amazing Breakout Of Costs Today Realestatefacts Title Insurance Closing Costs Septic Inspection

The amount you pay into escrow each month is based on the yearly total amount you owe for property taxes and homeowners insurance.

Tax deduction for property taxes escrow. Tax pros say these home-related tax mistakes can cost you money or draw the IRS to your doorstep. How to Clean Outdoor Wood Furniture. You can deduct up to 10000 or 5000 if married filing separately of state and local taxes including property taxes.

Heres a quick rundown of home-related deductions with some tips and common mixups. Some taxing authorities work a year behind that is youre not billed this. 1 Deducting the Wrong Year for Property Taxes.

Never use a power washer to clean outdoor furniture. However many lenders provide the information somewhere on the 1098 paper as a courtesy. It shows how much mortgage interest points and PMI you paid during the previous year.

Your mortgage lender would remit payment to the taxing authority on your behalf in this case. Are Escrowed Real Estate Taxes Deductible. If you didnt get the mortgage interest statement contact the county or other agency that collects your property tax to.

Reserves - deductible when paid from escrow. 7 Homeowner Tax Deductions to Save You Apr 16 2021. We are using cookies to give you the best experience on our website.

Its also called an ad valorem tax. Even though you put money aside in an escrow account youre not paying property taxes until your lender actually pays the tax which could be significantly less than what you put aside for the year. If you decide to claim the standard deduction you cant also deduct your property taxes.

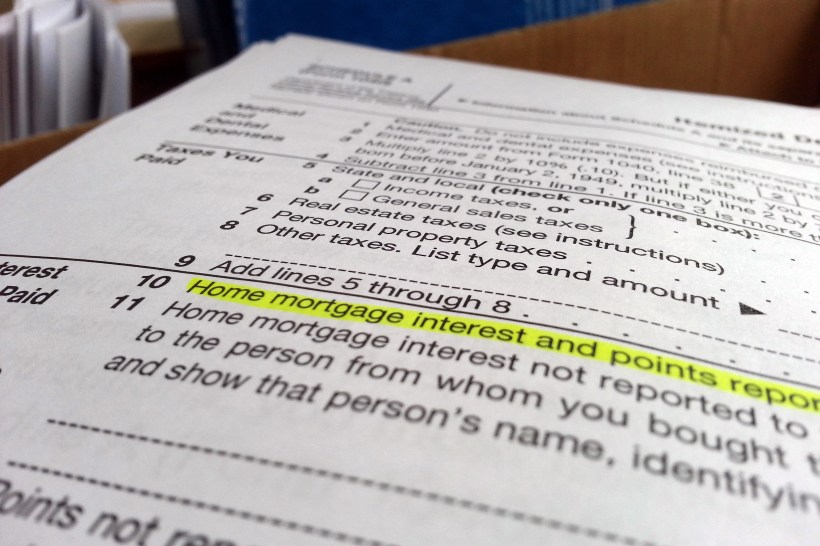

Power washers remove soft wood between grain lines and force water into pores. Multiply line 1 by line 3. Form 1098 without any letter suffix is a mortgage interest statement.

For married taxpayers filing jointly the standard deduction is 24800. Reserves - deductible when paid from escrow. Reserves - deductible as itemized deduction when paid from escrow.

You will find the amount of property taxes paid through escrow on your Form 1098. Deduct the amount of taxes you actually pay. The 1098 boxes are only about your mortgage.

Property Taxes Paid Through Escrow. The amount you deduct on your taxes must match your actual property-tax bill therefore you cannot simply deduct your full escrow amount. Reserves - deductible as itemized deduction when paid from escrow.

If youre using an escrow account to pay property taxes dont deduct the amount you put in. Yes your property taxes are still deductible if you pay them through via an escrow account. Enter the number of days in the property tax year that you owned the property.

So its not in one of the 1098 boxes but you should see your escrow info along the page. If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment make sure you dont treat the entire payment as a property tax deduction. This is your deduction.

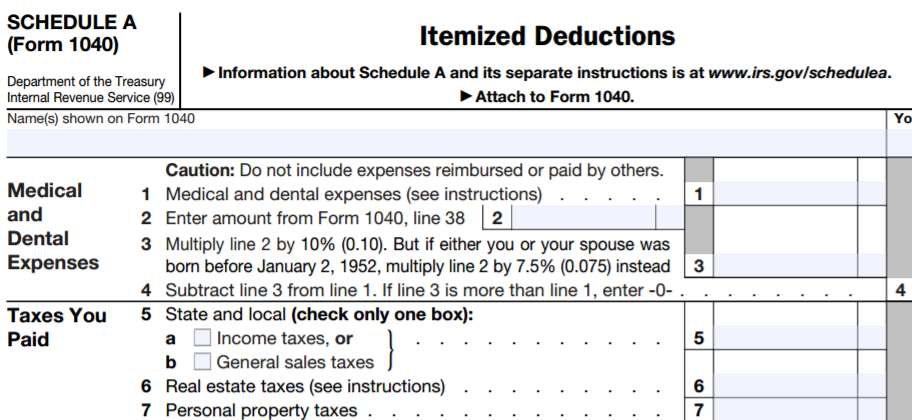

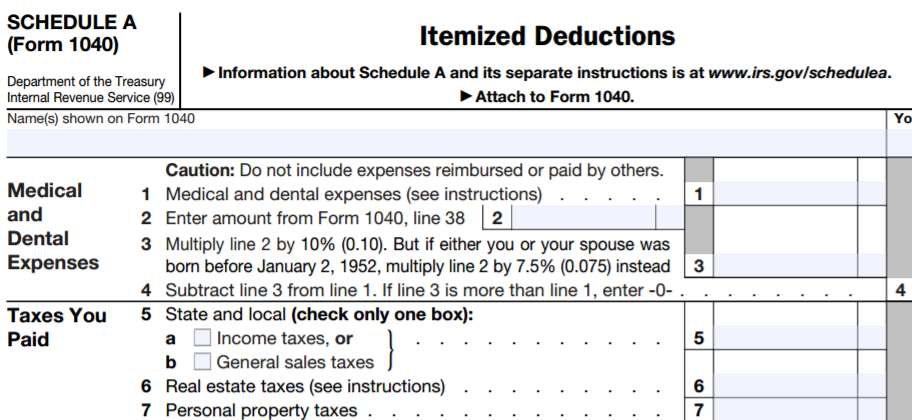

You take a tax deduction for property tax in the year you or the holder of your escrow account actually paid them. Enter it on Schedule A Form 1040 line 5b. Enter the total real estate taxes for the real property tax year.

Everyones favorite time of year. If you participate in an escrow. Its not about monies you pay to your town or home insurance provider.

Divide line 2 by 366. This deduction was unlimited until the Tax Cuts and Jobs Act TCJA imposed an annual cap of. You can deduct property tax payments that you make directly to the taxing authority as well as payments made into an escrow account that are included in your mortgage payments.

Only deduct what your lender pays out which. For the 2020 tax year the standard deduction for single taxpayers and married taxpayers filing separately is 12400. Deducting Property Taxes for Real Estate Where to Look Your mortgage lender might pay your real estate taxes from an escrow account.

Counties townships and cities collect property taxes from their residents. To claim them you have to itemize. Generally only the amount that the bank or lender reports to the Internal Revenue Service IRS often noted on Form 1098 qualifies for the deduction.

Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point. Each taxing authority has. The amount you are allowed to deduct should be located in box four of the 1098 Mortgage Interest Statement given to you by your lender.

California Property Tax Calendar Property Tax Home Ownership July 1

California Property Tax Calendar Property Tax Home Ownership July 1

5 Potential Homeowner Tax Credits And Deductions

5 Potential Homeowner Tax Credits And Deductions

Help Out Your First Time Homebuyers With A Little Cheat Sheet On The Real Estate How To Pay Off Mortgage Q Home Mortgage First Time Home Buyers Mortgage Tips

Help Out Your First Time Homebuyers With A Little Cheat Sheet On The Real Estate How To Pay Off Mortgage Q Home Mortgage First Time Home Buyers Mortgage Tips

How To Deduct Property Taxes On Irs Tax Forms

How To Deduct Property Taxes On Irs Tax Forms

Mortgage Points Deduction Itemized Deductions Houselogic

Mortgage Points Deduction Itemized Deductions Houselogic

Questions And Answers About The Irs Status Currently Not Collectible Tax Help Irs Tax Refund

Questions And Answers About The Irs Status Currently Not Collectible Tax Help Irs Tax Refund

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Realtor Tax Deductions And Tips You Must Know Real Estate Education Tax Deductions Small Business Tax Deductions

Realtor Tax Deductions And Tips You Must Know Real Estate Education Tax Deductions Small Business Tax Deductions

Tax Season Is Among Us Tax Season Seasons Tax

Tax Season Is Among Us Tax Season Seasons Tax

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

How To Pay Property Taxes Through An Escrow Account Property Tax Escrow Tax Help

How To Pay Property Taxes Through An Escrow Account Property Tax Escrow Tax Help

Irs Where S My Refund 13 Most Common Questions Answered Tax Refund This Or That Questions Irs Taxes

Irs Where S My Refund 13 Most Common Questions Answered Tax Refund This Or That Questions Irs Taxes

Taxes What Parts Of My House Payment Are Tax Deductible La Financial

Taxes What Parts Of My House Payment Are Tax Deductible La Financial

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Real Estate Tax Deductions 2021 Tax Guide Millionacres

First Time Home Buyer Vocabulary Cheat Sheet Buying First Home First Time Home Buyers Home Buying Tips

First Time Home Buyer Vocabulary Cheat Sheet Buying First Home First Time Home Buyers Home Buying Tips

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin On Real Estate Awesomeness

Pin On Real Estate Awesomeness

Matthew Ledvina Fintech Aerium Strategies Director Advertising Costs Fintech Estate Tax

Matthew Ledvina Fintech Aerium Strategies Director Advertising Costs Fintech Estate Tax

Property Taxes 101 How To Claim A Tax Deduction Rapidtax

Property Taxes 101 How To Claim A Tax Deduction Rapidtax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home