Orange County Florida Property Tax Bill Search

To pay by mail search for and print your bill then mail it with your check or money order to. Orange Avenue Suite 1700 Orlando FL 32801 Office Hours.

Orange County Real Estate Market Report And Trends

Orange County Real Estate Market Report And Trends

Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Orange county florida property tax bill search. Orange County Property Appraiser. Its municipality is Un-Incorporated. Orange County Tax Collector PO.

3 Oversee property tax administration involving 109. PayReviewPrint Property Tax Bill COVID-19 Penalty Cancellations Certain property owners directly affected by COVID-19 may submit a Penalty Cancellation Request Form along with payment if they were unable to pay property taxes by the April 10 2020 December 10 2020 or April 12 2021 payment deadlines in accordance with the Governors. See Orange County FL tax rates tax exemptions for any property the tax assessment history for the past years and more.

Orange County Property Appraiser 200 S. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. There are four ways to pay your property taxes online with Paperless or Property Tax Search in person or by mail.

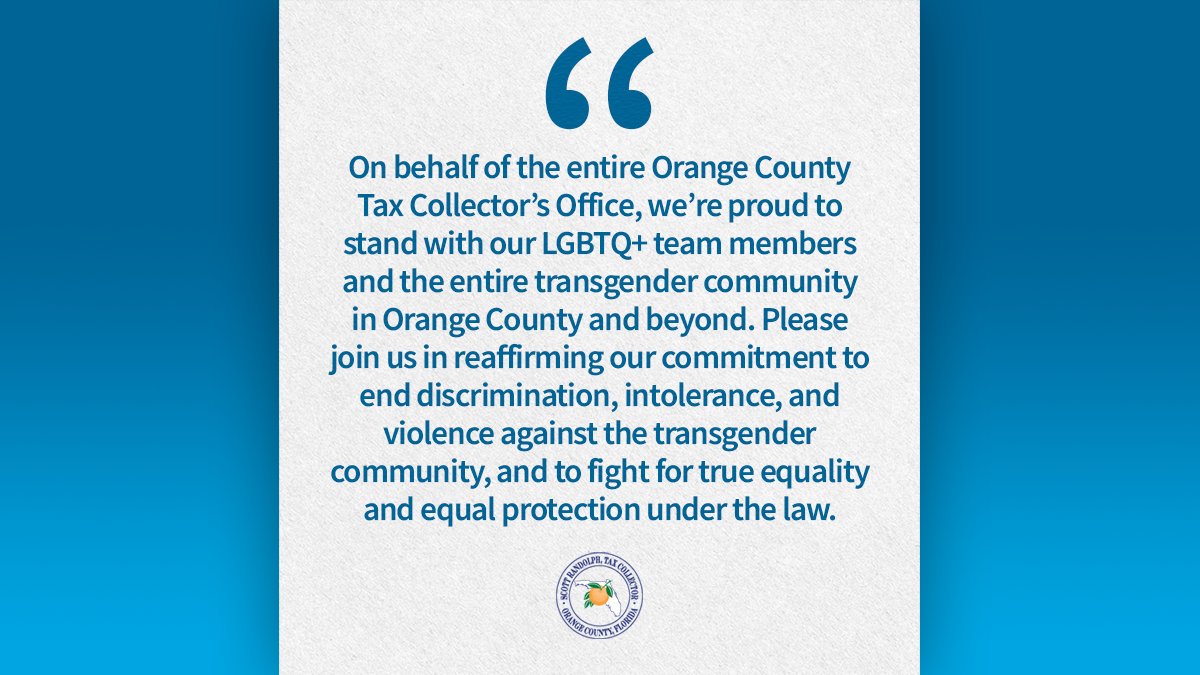

Orange Avenue Suite 1700 Orlando FL 32801 Office Hours. Visit our Property Tax. Scott Randolph was elected Orange County Tax Collector in November 2012 and reelected in 2016.

Its property use is 0103 - Single Fam Class III. Orange County Property Appraiser 200 S. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County.

See what the tax bill is for any Orange County FL property by simply typing its address into a search bar. Orange County Tax Office PO Box 8181 Hillsborough NC 27278-8181. Monday - Friday Phone.

Clinton Thomas R Clinton Margaret G. Monday - Friday Phone. Monday - Friday Phone.

This owner is responsible for the tax bill for that year. Certain property owners directly affected by COVID-19 may submit a Penalty Cancellation Request Form along with payment if they were unable to pay property taxes by the April 10 2020 December 10 2020 or April 12 2021 payment deadlines in accordance with the Governors Executive OrderTo qualify the property must be either. Orange County Tax Collector.

Orange County collects on average 094 of a propertys assessed fair market value as property tax. Any proration of tangible taxes must be determined between the buyer and seller and handled at the closing of the sale. Solid Waste Programs and Stormwater Fees do not constitute a lien on the real property.

Pay by check made payable to Scott Randolph. The full amount of taxes owed is due by March 31. Property Tax bills are mailed to property owners by November 1 of each year.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Find real estate tax bills and pay real estate taxes. The Tangible Personal Property Tax Bill is issued to the owner who appears on the certified tax roll provided by the Orange County Property Appraiser.

Contact Orange County Tax. In-depth Property Tax Information. Some information relating to property taxes is provided below.

This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. In cases where the property owner pays their real estate taxes through an escrow account the mortgage company normally will request and be sent the tax bill and the owner will receive an informational notice. Prior to becoming the Orange County Tax Collector Mr.

Orange County Property Appraiser 200 S. All property owners are responsible for knowing that their property taxes are due each year. Monday - Friday Phone.

Orange County FL Property Tax Search by Address. Yearly median tax in Orange County The median property tax in Orange County Florida is 2152 per year for a home worth the median value of 228600. The Orange County Property Appraiser parcel with id 09-24-28-8935-01-270 is located at 10533 Boca Pointe Dr Orlando Fl 32836It is owned by.

Orange County Property Appraiser 200 S. Orange Avenue Suite 1700 Orlando FL 32801 Office Hours. Randolph represented Orange County residents in the Florida Legislature where he served as a senior member on the Finance and Tax.

Detach and return the notice to Property Tax Department PO. Box 545100 Orlando FL 32854. The following early payment discounts are available to Orange County taxpayers.

Orange Avenue Suite 1700 Orlando FL 32801 Office Hours. Find out if you qualify for a Homestead Exemptions search property records and find property taxes and ownership information. Box 545100 Orlando FL 32854.

Parcel Search Orange County Property Appraiser

Parcel Search Orange County Property Appraiser

New Orange County Property Appraiser Amy Mercado Talks Disney Lawsuits And Jiu Jitsu Orlando Business Journal

New Orange County Property Appraiser Amy Mercado Talks Disney Lawsuits And Jiu Jitsu Orlando Business Journal

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Homeowners Can Save 4 On Their Property Tax Bill By Paying In November Orange County Tax Collector

Homeowners Can Save 4 On Their Property Tax Bill By Paying In November Orange County Tax Collector

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Calculator Smartasset

Orange County Sheriff S Office Services Administrative Services Support Services Division Records Identification Section

Orange County Sheriff S Office Services Administrative Services Support Services Division Records Identification Section

Orange County Property Tax Records Orange County Property Taxes Ny

Orange County Property Tax Records Orange County Property Taxes Ny

Oc Tax Collector Octaxcol Twitter

Oc Tax Collector Octaxcol Twitter

Orange County Real Estate Market Report And Trends

Orange County Real Estate Market Report And Trends

Oc Tax Collector Octaxcol Twitter

Oc Tax Collector Octaxcol Twitter

Oc Tax Collector Octaxcol Twitter

Oc Tax Collector Octaxcol Twitter

Vehicle Sales Purchases Orange County Tax Collector

Vehicle Sales Purchases Orange County Tax Collector

Orange County Real Estate Market Report And Trends

Orange County Real Estate Market Report And Trends

Save Our Homes Amendment And Its Effects Orange County Property Appraiser

Save Our Homes Amendment And Its Effects Orange County Property Appraiser

Orange County Tax Collector Payments

Orange County Tax Collector Payments

Orange County Real Estate Market Report And Trends

Orange County Real Estate Market Report And Trends

Orange County Property Tax Records Orange County Property Taxes Ny

Orange County Property Tax Records Orange County Property Taxes Ny

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home