Is Toll Tax Free For Defence Personnel

Also new ambulances and funeral vehicles can apply for FASTag exemption under this category. Private vehicles of defence personnel exempted from toll tax on Delhi-Gurgaon Expressway Clear instructions have now been issued regaring toll exemption to defence personnel and their private vehicles on the Delhi-Gurgaon Expressway.

Https Www Hqmc Marines Mil Portals 61 Docs Hq 20svc 20bn Sop Headquarters 20and 20service 20battalion Hqmc 20sop 20signed 2018 20jun 2019 Pdf Ver 2019 11 13 160603 603

If the toll staff ask for a scan of the ID the personnel show the service ID but present another ID for scanning officials said.

Is toll tax free for defence personnel. All defense personal are exempted from paying toll tax fee as per section 3 of Army and Airforce Act 1901 Tollswhether they are on duty or not and it extented to even hired vehicle ie. While i was on my way from kalka to kasaulii was in hired taxy at kalka parwanoo Tollway. Pl make the above blog complete and total as an authority for all.

Yes Defence personnels are exempted from toll tax when they are on duty. Defense civilians should be exempted from submission of toll tax since they also perform their duties in challenging situations of do or dieif defense secretary consider this issue it will be helpful to restore right image of government toward defense civilian employees. Exemption of Road Toll Tax to Defence Civilian.

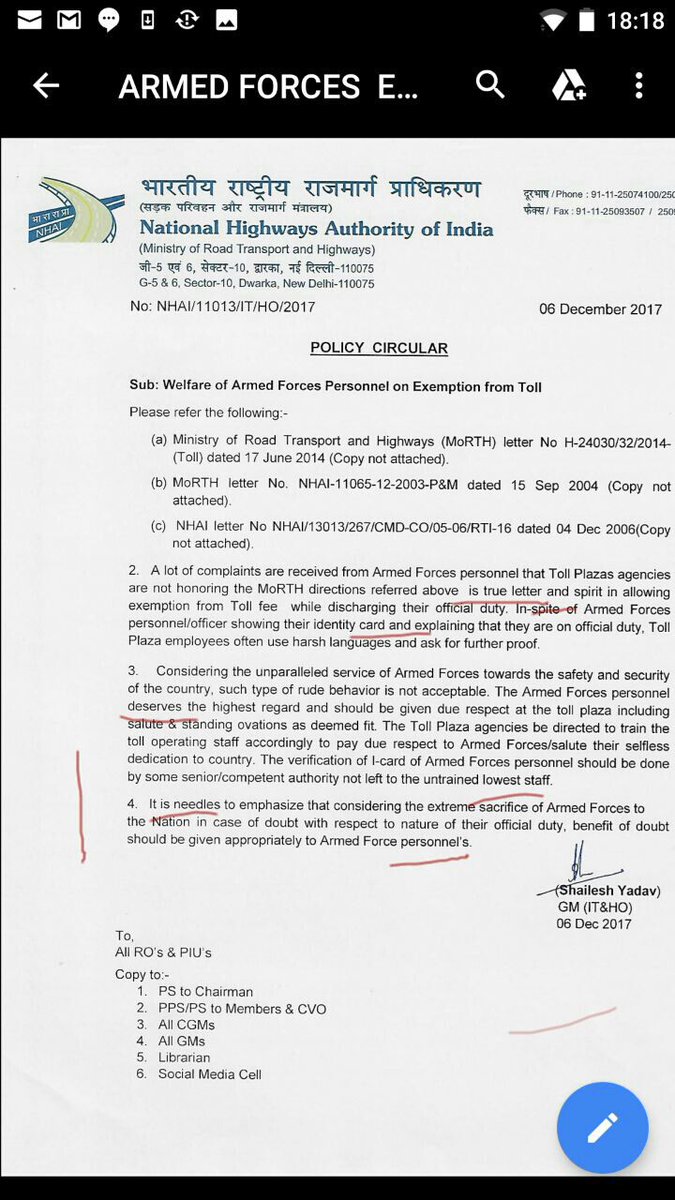

Services are exempted from paying toll charges under the Toll Act. There is another blog which says that all defence personnelex-servicemen and thier families are exempted from paying toll tax on national highways. It clarified on the vehicles used for official purpose by the Ministry of Defence including those that are eligible for exemption in accordance with the provisions of the Indian Toll Army and.

Please clarified this problem. Toll Tax Exemption Paramilitary Personnel in Hindi. Chandigarh shimla highwya via kalka on production of my service identity card i was forced to pay the toll tax where as i showed them that in their exemption list it is mentioned that for defence personnel on production of the same are exempted for paying toll rather they.

This is to ensure that all vehicles plying through ETC operated toll plazas use FASTag for seamless movement. Exemption of Road Toll Tax to Defence Civilians Respected Sir With due regards your attention is invited to the Agenda Point No. Defence personnels has to show their defenceservice Id card for this exemption.

Toll Tax Exemption for Defence Personnel 2020. On 13 jun12 at 0618 hrs. A section of serving and retired defence personnel has however raised doubts over the veracity of the letter since the Indian Tolls Act 1901 only provides for toll exemption to serving military personnel.

Quoting the letter from Ex-servicemen welfare deptt and NHAIThanks. Reproduced below is a self-explanatory letter sent to the Army Navy and the Air Force by me on the issue -. Even the Supreme Court had in 2006 upheld toll exemption to private vehicles of serving defence personnel even if they were not on duty.

BHARATIYA PRATIRAKSHA MAZDOOR SANGH AN ALL INDIA FEDERATION OF DEFENCE WORKERS AN INDUSTRIAL UNIT OF BMS REF. To The Dy Secretary CP Govt of India Min of Defence B Wing Sena Bhawan New Delhi 110011. Toll Tax Exemption for Ex Servicemen.

BPMS MoD 90th SCM 41M Dated. However sources said the condition was only applicable to the Territorial Army and National Cadet Corps NCC personnel. You dont need to be gazetted defense personnel to be exempted from paying tolls.

65 raised by this federation BPMS in the Steering Committee meeting for the 90th Departmental Council JCM MoD held on 27092013 Refer MoD FNo. The transport ministry also cited a noting of the law ministry that Section 3 b of the Act only permits toll exemption to defence personnel who are on duty. The Ministry of Road Transport and Highways states that only those travelling on-duty through the highways are exempted from the tolls personnels not travelling on-duty will have to pay tolls.

As per NH Fee Rule 2008 and subsequent amendments exempted FASTag will be issued free of cost to all vehicles under this category. Defence personnel are exempt from toll tax or not because toll plaza person showing letter that defence personnel are not exempt for toll tax. Taxi or personal vehicle.

Are Defence Personnel Exempted From Toll Tax Quora

Https Www Sam Usace Army Mil Portals 46 Docs Foia 150 19 150 20contract 20vol1 Pdf Ver 2019 09 26 143912 227

Https Www Americanbar Org Content Dam Aba Administrative Taxation Probono Military State Tax Guide2021 Pdf

Veterans Rue Withdrawal Of Toll Tax Exemption To Serving Army Personnel Hindustan Times

Veterans Rue Withdrawal Of Toll Tax Exemption To Serving Army Personnel Hindustan Times

Ex Servicemen Welfare Update Toll Tax Exemption To Armed Forces Personnel

Ex Servicemen Welfare Update Toll Tax Exemption To Armed Forces Personnel

Defence Personnel New Toll Tax And Fast Tag Rules 2020 Nhai Letter Toll Tax Exemption For Army Youtube

Defence Personnel New Toll Tax And Fast Tag Rules 2020 Nhai Letter Toll Tax Exemption For Army Youtube

Ram Hari Sharma On Twitter Singhnavdeep Ji Salute For Fighting For Disabled Armed Forces Personnel There Is A Letter Of Nhai Is Floating Now Can You Update Regarding A Letter Written To

Ram Hari Sharma On Twitter Singhnavdeep Ji Salute For Fighting For Disabled Armed Forces Personnel There Is A Letter Of Nhai Is Floating Now Can You Update Regarding A Letter Written To

Is An Army Personnel Exempted From Toll Tax While He Is Travelling In A Personal Vehicle And Produces His Identity Card Quora

Are Defence Personnel Exempted From Toll Tax Quora

Are Defence Personnel Exempted From Toll Tax Quora

Toll Tax Exemption Tax Exemption Tax Tolls

Toll Tax Exemption Tax Exemption Tax Tolls

Army Personnel Seek Clarity On Toll Exemption The Hindu

Exemption From Toll Tax For Army Personnel Terafiq

Exemption From Toll Tax For Army Personnel Terafiq

Fastag Rollout Free Pass For Government Officials But Only With Id Gurgaon News Times Of India

Fastag Rollout Free Pass For Government Officials But Only With Id Gurgaon News Times Of India

Are Lawyers Really Exempted From Paying At Toll Plazas Here S The Truth The New Indian Express

Are Lawyers Really Exempted From Paying At Toll Plazas Here S The Truth The New Indian Express

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home