Who Can Claim Michigan Homestead Property Tax Credit

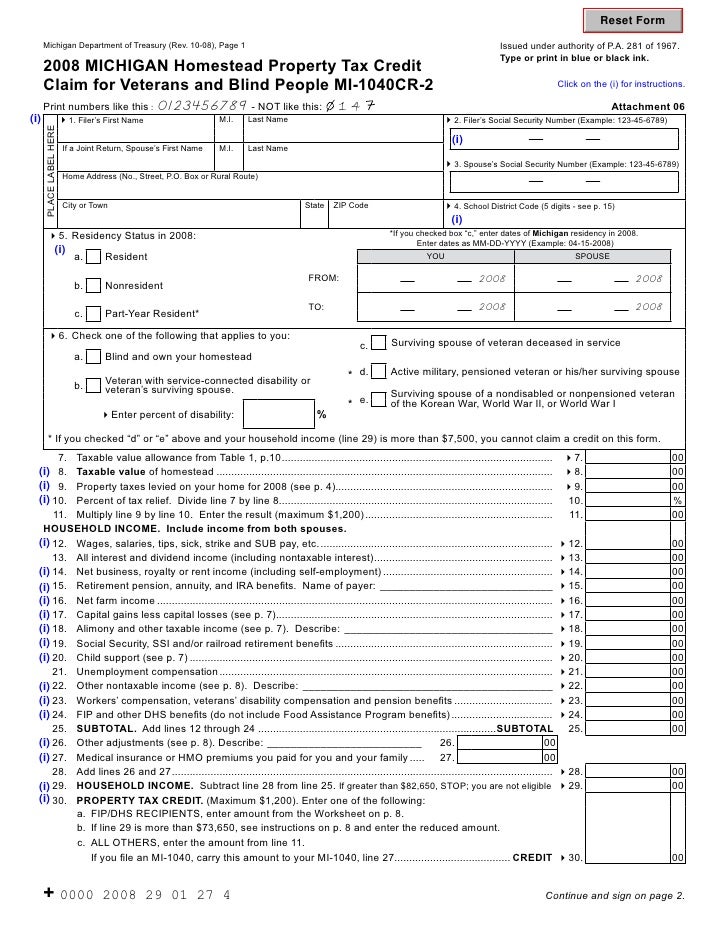

Homestead Property Tax Credit for Veterans and Blind People. Before calculating your Michigan Homestead Tax Credit print out both the MI-1040CR form and instructions from the Michigan Department of Treasury website.

Working Families And Individuals Eligible For Homestead Property Tax Credit

Working Families And Individuals Eligible For Homestead Property Tax Credit

If you own your home your taxable value was 135000 or less.

Who can claim michigan homestead property tax credit. Michigan Department of Treasury Rev. 48 Home Heating Credit. For the full list of rules pertaining to this credit see MCL 206501 - 206532 linked below.

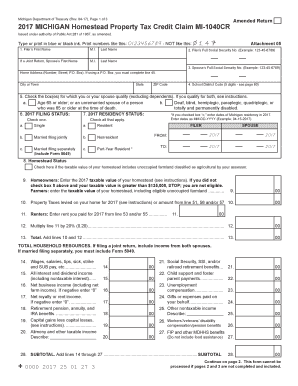

A claim for refund andor credit must be made within 4 years from the due date set for filing the annual return. Your homestead is located in Michigan You were a Michigan resident at least six months of 2019 Youwnour o y Michigan homestead and property taxes wereevied l in 2019rouaid o. 05-20 Page 1 of 3 Amended Return 2020 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR Issued under authority of Public Act 281 of 1967 as amended.

MCL 206508 3. You should complete the Homestead Property Tax Credit Claim form MI-1040CR to see if. You can claim only one homestead exemption as of January 1.

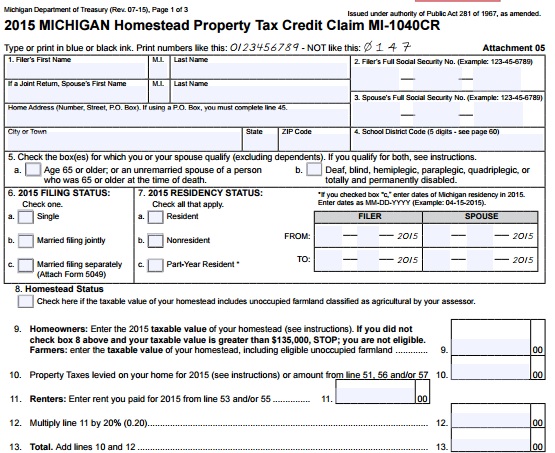

The credit that is computed is reduced by 10 for every 1000 or part of 1000 that the total household resources exceed 51000. The taxpayer can claim a homestead property tax credit not only for 2015 but also for 2014 2013 2012 and 2011. You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied.

Type or print in blue or black ink. Who May Claim a Property Tax Credit You may claim a property tax credit if all of the following apply. Your homestead is located in Michigan You were a Michigan resident at least six months of 2019 Youwnour o y Michigan homestead and property taxes wereevied l in 2019rouaid o.

52 Farmland Preservation Tax Credit. Your total household resources do not exceed 60000. You can claim the credit even if you did not pay property taxes.

Of course filing a claim for back years can only be done if you have not already claimed for that year. For example the 2016 homestead property tax credit must be filed by April 15 2021. You own your home and your taxable value does not exceed 135000.

In order to receive a homestead exemption an affidavit must be filed with the Rusk County Appraisal District. Youaylaim m c a property tax credit if all of the following apply. You may qualify for a homestead property tax credit if all of the following apply.

The Michigan Homestead Property Tax Credit For Senior Filers. The Michigan Homestead Tax Credit gives some Michigan residents a refund on the amount of property taxes they owe or the amount of property taxes their landlord owes. You own or were contracted to pay rent and occupied a Michigan homestead for at least 6 months during the year on which property taxes andor service fees were levied.

If you meet residency income and value requirements for your mobile home lot you can be eligible for Michigans Homestead Property Tax Credit and get some money deducted from your state tax obligations. 100 of your total household resources is not received from Michigan Department of Health and Human Services. If you are blind and own your own home complete the MI-1040CR and the MI-1040CR-2.

This can add up to quite a bit of money. The purpose of the homestead tax credit is for the state to help you pay some of your property taxes if you are a qualified homeowner or renter and meet the requirements. All exemptions such as homestead over 65 disabled persons and disabled veterans require execution of an affidavit with the Rusk County Appraisal District.

As well you cannot claim a property tax credit if your taxable value exceeds 135000 this excludes vacant farmland classified as agricultural. File the form that gives you the larger credit. If you are active military an eligible veteran or the surviving spouse of a veteran complete the MI-1040CR and the MI-1040CR-2 Michigan Homestead Property Tax Credit Claim for Veterans and Blind People.

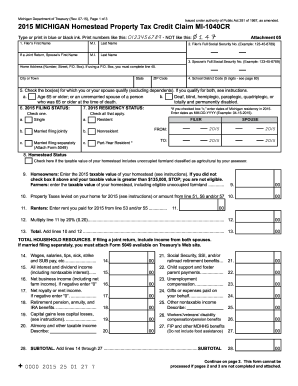

Michigans homestead property tax credit is how the State of Michigan can help you pay some of your property taxes if you are a qualified Michigan homeowner or renter and meet the requirements. Your homestead is located in Michigan You were a Michigan resident at least six months of 2015 You pay property taxes or rent on your Michigan homestead You were contracted to pay rent or own the home you live in. To file for the credit complete the Michigan Homestead Property Tax Credit Claim MI-1040CR.

Yes dependents may still be eligible to claim the homestead property credit. Who qualifies for a homestead property tax credit. Who May Claim a Property Tax Credit Youaylaim m c a property tax credit if all of the following apply.

This number is entered on line 42 with a maximum of 1200. How to compute your homestead property tax credit if your PRE is between 1 and 99 PRE. Be careful to compute household resources properly which.

Filers First Name. Who May Claim a Property Tax Credit. Can I file a homestead property tax credit for prior years.

Senior Filer take the number from line 35 which is the difference between 35 of total household resources and total property taxes paid and multiply it by a reducing factor based on their total household resources. After subtracting the school operating tax from your property tax bill you can claim 90 of the remaining property tax for the credit.

Homestead Property Tax Credit Claim For Veterans And Blind People

Homestead Property Tax Credit Claim For Veterans And Blind People

Michigan Homestead Property Tax Credit Form 2017 Property Walls

Michigan Homestead Property Tax Credit Form 2017 Property Walls

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

What Is Michigan S Homestead Property Tax Credit Kershaw Vititoe Jedinak Plc

Form Mi 1040cr Homestead Property Tax Credit Claim

Applying For The Michigan Homestead Property Tax Credit Advancing Smartly

Applying For The Michigan Homestead Property Tax Credit Advancing Smartly

Http Origin Sl Michigan Gov Documents Taxes Mi 1040cr 711858 7 Pdf

Homestead Credit Michigan Fill Out And Sign Printable Pdf Template Signnow

Homestead Credit Michigan Fill Out And Sign Printable Pdf Template Signnow

Michigan Homestead Property Tax Credit 2019 Instructions Fill Out And Sign Printable Pdf Template Signnow

Michigan Homestead Property Tax Credit 2019 Instructions Fill Out And Sign Printable Pdf Template Signnow

Form Mi 1040cr 2 2011 Homestead Property Tax Credit Claim For Veterans And Blind People

Mi 1040cr Fill Online Printable Fillable Blank Pdffiller

Mi 1040cr Fill Online Printable Fillable Blank Pdffiller

Working Families Individuals Eligible For Homestead Property Tax Credit Newsnet Northern Michigan

Https Www Michigan Gov Documents Taxes Mi 1040cr 5 711881 7 Pdf

Form Mi 1040cr Fillable Homestead Property Tax Credit Claim

Homestead Property Tax Credit Claim For Veterans And Blind People Ins

Homestead Property Tax Credit Claim For Veterans And Blind People Ins

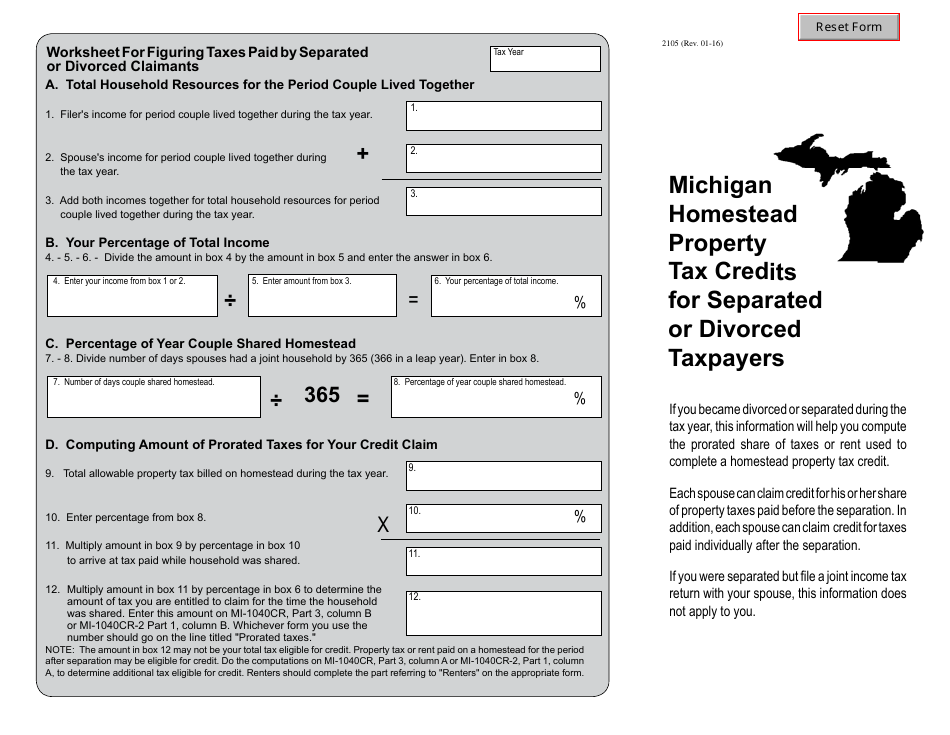

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

Form 2105 Download Fillable Pdf Or Fill Online Michigan Homestead Property Tax Credits For Separated Or Divorced Taxpayers Michigan Templateroller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home