Property Sale Tax Washington State

In some cases the tax sale list may include the tax collectors assessed value of the property. See property tax exemptions and deferrals for more information.

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Property taxes make up at least 94 percent of the states General Fund which supports public services for Washington residents.

Property sale tax washington state. Generally most Washington tax sale lists will identify the property owner parcel number legal description and the amount due. Tax on sale of property. Use this search tool to look up sales tax rates for any location in Washington.

1 There is imposed an excise tax upon each sale of real property. In addition the proposed Washington capital gains tax expressly exempts many asset sales by a business such as. The county treasurer shall be the receiver and collector of all taxes RCW 8456020.

Voter-approved property taxes imposed by school districts. The following properties are available on a first come first served basis at the minimum bid price. Please see paragraph 12 of our General Sale Terms for additional information on this process.

ZIP--ZIP code is required but the 4 is optional. In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019. Be notified of the upcoming Surplus Property Auctions Please view our General Sale Terms for information on our auction process.

Determine the location of my sale The rate you charge your customer depends on the type of transaction involved. To calculate sales and use tax only. Free Washington Property Records Search.

Tax amount varies by county The median property tax in Washington is 263100 per year for a home worth the median value of 28720000. 128 on homes between 500000 and 1500000. If the total sale price is 600000 then the first 500000 is taxed at 110.

The tax would equal 9 percent of your Washington capital gains. Sale or exchange of certain depreciable tangible personal property used in a business. Capital assets are personal property you own for investment or personal reasons and do not usually sell in the course of business.

The rate charts range from 70 percent to 205 percent and calculate up to a 100 sale. Tax Rate Charts show how much sales tax is due based on the amount of a sale. But home buyers and sellers should note that many local jurisdictions impose their own additional transfer tax in addition to the REET.

If the tax rate search result indicates No but you know the property to be Trust Land it still meets the definition of. State funding for certain school districts. This proposal would tax individuals for the sale or exchange of capital assets they have held for more than one year unless an exemption applies.

Calculating the graduated state real estate excise tax. This amount is the minimum collected by the state of Washington and may be subject to additional local taxes. Find Washington residential property records including property owners sales transfer history deeds titles property taxes.

Attorney if applicable paid to the attorney that represents the seller Brokers Commission the fee charged by the listing broker for marketing the property. Revenue at a Glance provides more detail on. Top Real Estate Agents in Washington.

Any sales tax paid to another state may be used to offset the amount of use tax due in Washington. Home sellers in Washington can expect closings costs that average from 5 to 9 of the sales price. Each sale of real property is subject to a tax of 128 percent of the purchase price as of 2011.

Sale or exchange of certain expensed tangible personal property used in. A Through December 31 2019 the rate of the tax imposed under this section is 128 percent of the selling price. The 2020 Foreclosure sale will be held January 456 2021 and continue until properties are sold or the Treasurer closes the auction.

275 on homes between 1500000 and 3000000. Most people are aware that property tax applies to real property. The remaining 100000 is taxed at 128.

The listing agents commission will make up the bulk of the fees. I 11 percent of the portion of the selling price that is less than or equal to. Where does your property tax go.

Attorney Generals Office The Washington State Attorney Generals Office has some helpful information if you are facing foreclosure on your property. Thurston County does not issue Tax Lien Certificates as Washington state is not a Tax Lien state. 3 on homes more than 3000000.

Personal property used in a business such as equipment furniture and supplies is also subject to personal property tax. B Beginning January 1 2020 except as provided in c of this subsection the rate of the tax imposed under this section is as follows. Deferral of property taxes Depending on your income you can defer property tax payments.

Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year.

Statistics Reports Washington Department Of Revenue

Statistics Reports Washington Department Of Revenue

Washington Income Tax Calculator Smartasset

Washington Income Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Washington Estate Tax Everything You Need To Know Smartasset

Washington Estate Tax Everything You Need To Know Smartasset

Oregon Property Tax Calculator Smartasset

Oregon Property Tax Calculator Smartasset

Taxes Fees In Lakewood City Of Lakewood

Taxes Fees In Lakewood City Of Lakewood

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Free Washington Bill Of Sale Form Pdf Template Legaltemplates

Free Washington Bill Of Sale Form Pdf Template Legaltemplates

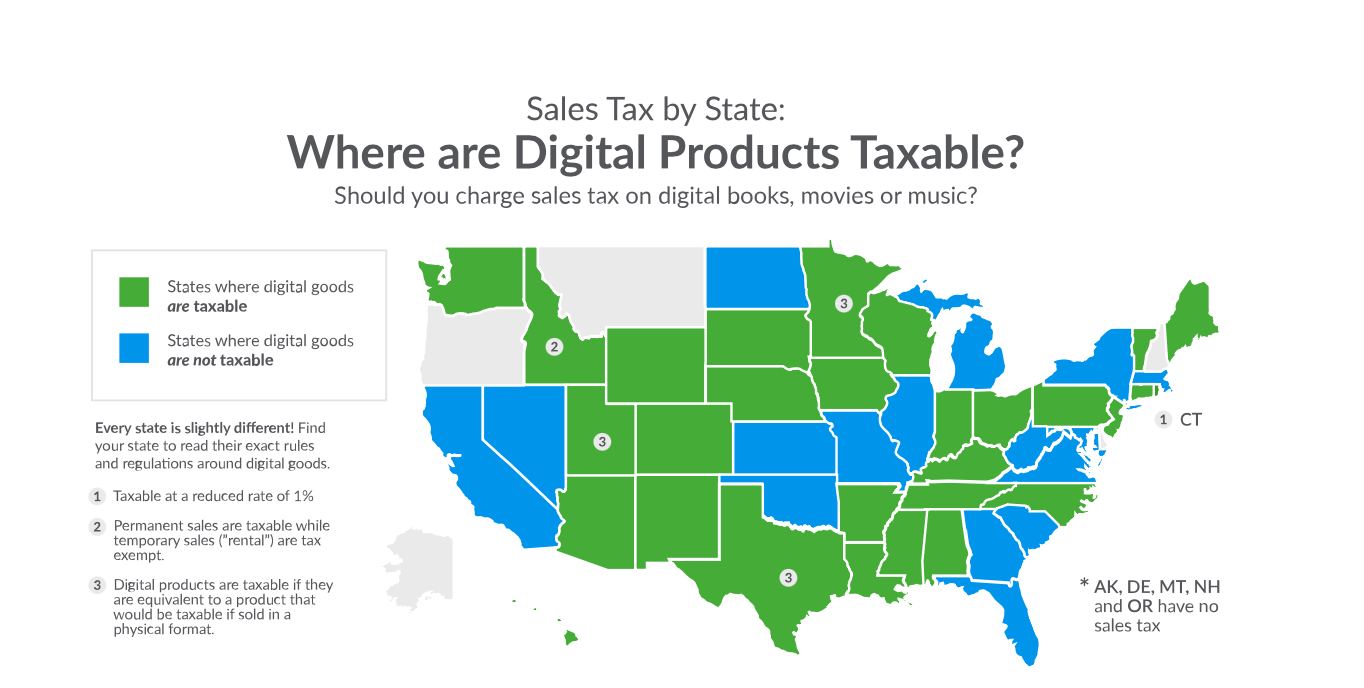

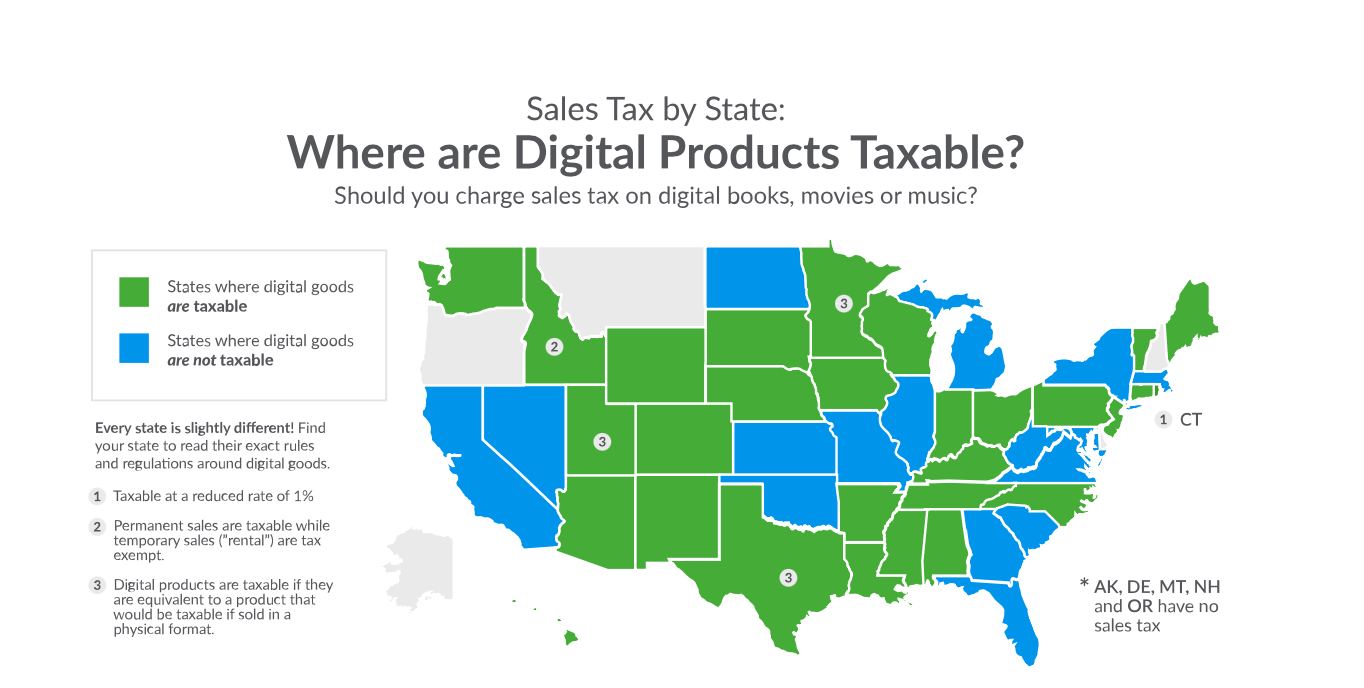

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar Blog

Sales Tax By State Should You Charge Sales Tax On Digital Products Taxjar Blog

Former Washington Ag Proposed Capital Gains Tax Is Income Tax In Disguise

Former Washington Ag Proposed Capital Gains Tax Is Income Tax In Disguise

Closing Costs In Washington State

Closing Costs In Washington State

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

State Local Government Revenue Sources Office Of Financial Management

State Local Government Revenue Sources Office Of Financial Management

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home