Kansas Personal Property Tax Deduction

The Kansas Department of Revenue has Taxpayer Assistance Centers to help residents and businesses answer tax questions or file taxes. See Part C of Schedule S.

Farmers Unfazed By End Of Kansas Income Tax Exemption Kcur 89 3 Npr In Kansas City Local News Entertainment And Podcasts

Farmers Unfazed By End Of Kansas Income Tax Exemption Kcur 89 3 Npr In Kansas City Local News Entertainment And Podcasts

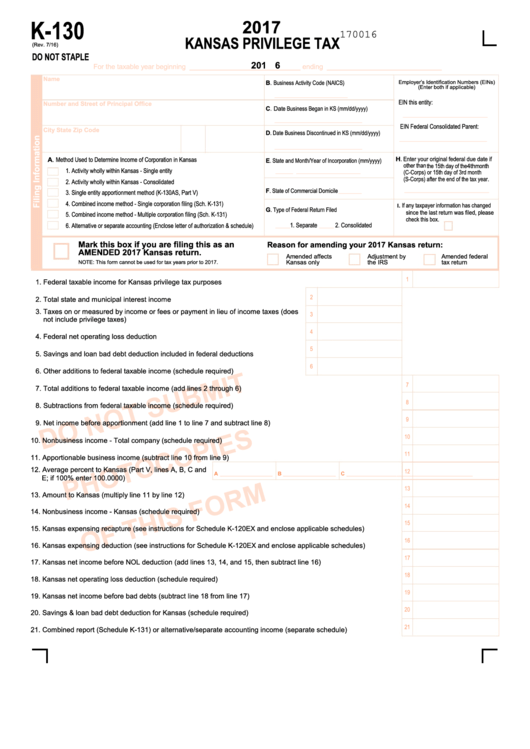

Individual Income Tax K-40 Original and Amended - 2019.

Kansas personal property tax deduction. Personal property taxes You may be able to deduct 75 of personal property taxes you deducted on your federal return. The first half tax must be paid on or before December 20th. Laura Kelly speaks with reporters after vetoing a plan from Republican legislators for cutting state income taxes Friday April 16 2021 at.

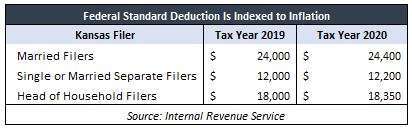

If the first half taxes are paid in December the second half is due on or before May 10th. However you are able to deduct personal property tax on the vehicle. Otherwise taxpayers can claim the Kansas standard deduction which is 3000 for single filers 7500 for joint filers 3750 for married persons filing separately and 5500 for heads of household.

The County Treasurer will reduce the claimants 1st half of the 2020 property tax by 1000 or the amount of the property tax whichever is less. Prior to 2018 there is not a cap for these deductions although large amounts of these deductions can cause you to be subject to the Alternative Minimum. IRS Publication 17 Chapter 22 Taxes.

After that date the full amount of Personal Property taxes are due plus interest. This online service is provided by Kansasgov a third-party working under a contract awarded and administered by the Information Network of Kansas INK. The state of Kansas does not assess taxes based on value.

Married Filing Joint or Qualified Widow er 1260000. Kansas Payment Voucher K-40V - 2019. The Personal Property Sections responsibilities include.

Individual Income Tax Supplemental Schedule Schedule S - 2019. Head of Household 930000. Maintaining guidelines for the valuation and taxation of personal property.

Full unpaid personal property taxes are sent to the Sheriff for collection in March. Chapter 79 Article 51 motor vehicles. View solution in original post.

Married Filing Separate 630000. The business portion is deducted as a business expense and the remainder as a personal deduction when property is used partly for business and partly for personal reasons. I have attached a checklist of common Itemized Deductions to help you look for more deductions and maximize you Tax Return.

Sole proprietors can deduct these taxes on Schedule C. You may only itemize your deductions on your Kansas return if you. The online price of items or services purchased.

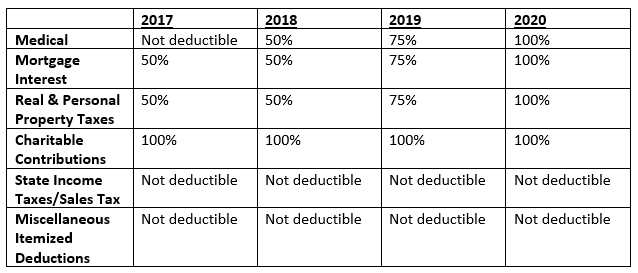

Kansas itemized deductions are calculated using 100 charitable contributions 50 qualified medical expenses 50 qualified residential interest and 50 real and personal property taxes as claimed on your federal itemized deductions. The Kansas Property Tax Payment application allows taxpayers the opportunity to make property tax payments on their desktop or mobile device. 1 day agoKansas Gov.

Real estate taxes If you deducted real estate taxes on your federal return you may be able to deduct 75 of that amount on your Kansas state income tax return. For example if the claimants 1st half of the property tax is 800 the County Treasurer will receive 800 from the Kansas Department of Revenue. The taxes must be assessed annually and must be based on the value of personal property you own.

Personal property tax paid on equipment used in a trade or business can be deducted as a business expense. For more information see. Maintaining values for KSA.

Kansas Individual Income Tax Instructions for Armed Forces Personnel IA-36 Questionnaire of Earnings Allocation IA-22 Credit Schedules. Contact a Tax Representative. Beginning in 2018 deductions for state and local taxes including personal property taxes are capped at 10000 per tax return.

In addition you can call or email a Taxpayer Assistance Center representative for general information. Holding workshops for counties and other interested parties. Kansas allows itemized deductions but only for taxpayers who claim itemized deductions on their federal tax return.

Https Www Ksrevenue Org Pdf Tr600 Pdf

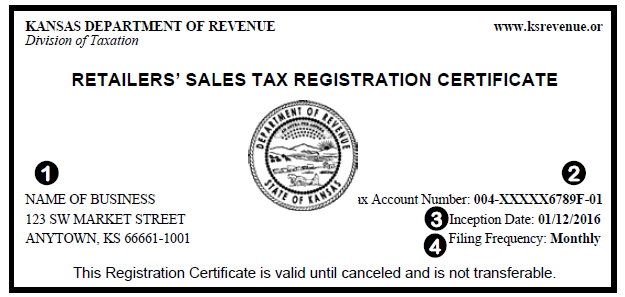

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

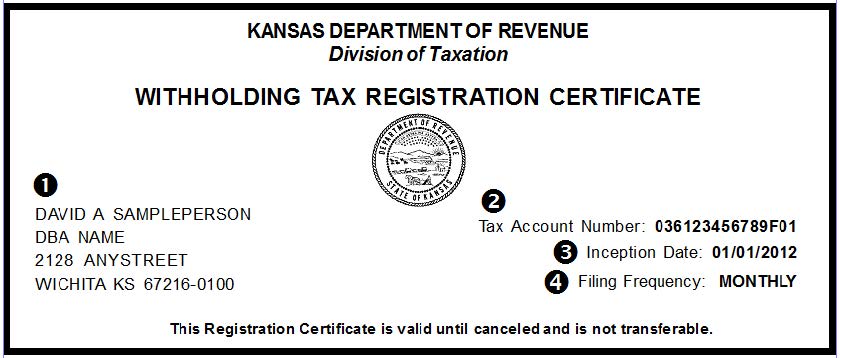

Http Rvpolicy Kdor Ks Gov Pilots Ntrntpil Ipilv1x0 Nsf Ae2ee39f7748055f8625655b004e9335 04601409db06280c86256cc60070b109 File Ks 100 20kansas 20withholding 20tax 20guide 20rev 2011 18 Ada Fillable Pdf

Https Www Hrblock Com Tax Center Wp Content Uploads 2016 03 Hr Block Tti Business Travel Deductions Pdf

Form St 201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

Form St 201 Download Fillable Pdf Or Fill Online Integrated Production Machinery And Equipment Exemption Certificate Kansas Templateroller

Https Www Ksrevenue Org Pdf Kw100 Pdf

Https Www Ksrevenue Org Taxnotices Notice18 02 Pdf

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

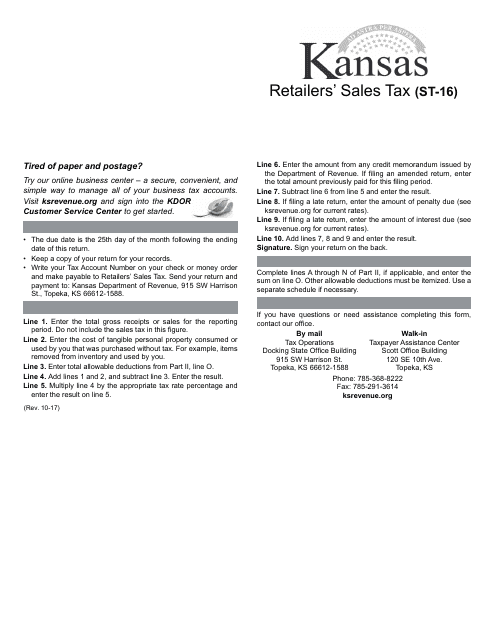

Form St 16 Download Fillable Pdf Or Fill Online Retailers Sales Tax Return Kansas Templateroller

Form St 16 Download Fillable Pdf Or Fill Online Retailers Sales Tax Return Kansas Templateroller

Http Rvpolicy Kdor Ks Gov Pilots Ntrntpil Ipilv1x0 Nsf Ae2ee39f7748055f8625655b004e9335 04601409db06280c86256cc60070b109 File Ks 100 20kansas 20withholding 20tax 20guide 20rev 2011 18 Ada Fillable Pdf

Http Rvpolicy Kdor Ks Gov Pilots Ntrntpil Ipilv1x0 Nsf Ae2ee39f7748055f8625655b004e9335 9321b9ed6b1b0c7e862565da005b8de9 File Pub1510 3 18 Pdf

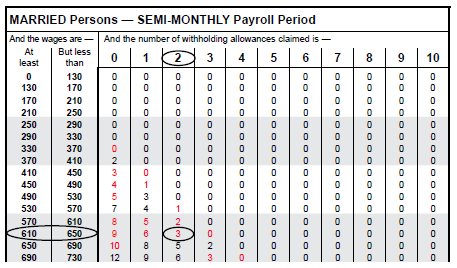

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Https Www Streamlinedsalestax Org Docs Default Source Comm Cric Cric Documents Cric 2009 Revised Publication Ks 1520 Kansas Exemption Certificate Pdf Sfvrsn C9503876 4

Kansas Tax Law Changes Part Ii Topeka Accountants Bt Co

Kansas Tax Law Changes Part Ii Topeka Accountants Bt Co

Http Www Kslegresearch Org Klrd Web Publications Taxfacts 1993taxfacts6thed Pdf

1021 Kansas Tax Forms And Templates Free To Download In Pdf

1021 Kansas Tax Forms And Templates Free To Download In Pdf

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Will Thousands More Kansans Fall Into The 2020 Windfall Veto Trap Kansas Policy Institute

Will Thousands More Kansans Fall Into The 2020 Windfall Veto Trap Kansas Policy Institute

Will Thousands More Kansans Fall Into The 2020 Windfall Veto Trap Kansas Policy Institute

Will Thousands More Kansans Fall Into The 2020 Windfall Veto Trap Kansas Policy Institute

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home