Property Tax Due Dates All States

Extended due dates for furnishing 2020 Forms 1095-B and 1095-C. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

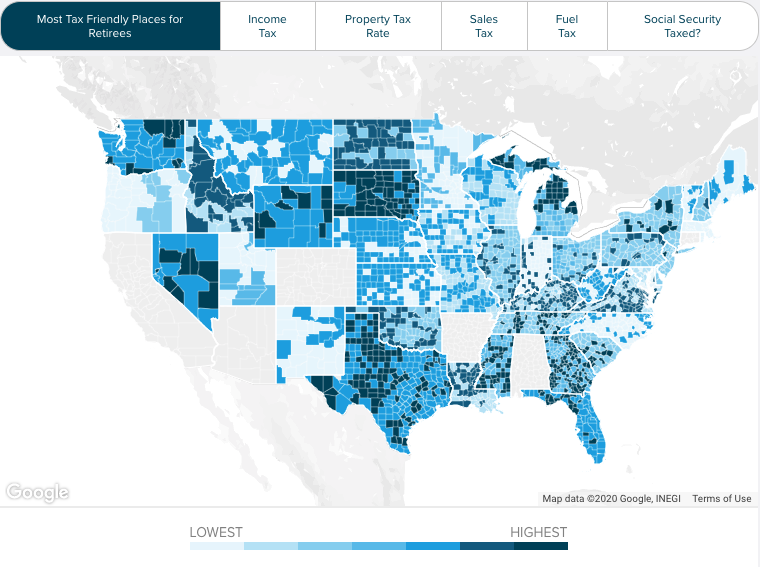

Rv Living How To Make It Without A House Infographic Map Property Tax Map

Rv Living How To Make It Without A House Infographic Map Property Tax Map

Kansas Real Estate Ryan Contact.

Property tax due dates all states. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. More states where real property tax breaks hinge on where exactly you live. Next year states will return to their normal due dates.

This includes fiduciary tax returns for estates and trusts Form MI-1041 or any corporate tax returns. Income Taxes by State. The temporary revised state tax filing and payment deadline for 2020 taxes applies for the 2021 filing season only.

Start to prepare and eFile your 2020 Tax Returns. The average American household spends 2471 on property taxes for their homes each year according to the US. A handful of states have a later due date April 30 2021 for example.

Sangamon County taxes normally due June 12 can be paid through September 12. First Installment Due Delinquent Date Dec. Federal income taxes for tax year 2020 are due April 15 2021.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. The due date for providing the 2020 Form 1095-B and 2020 Form 1095-C has been extended from February 1 2021 to March 2 2021. Compared to 10 State Returns on TurboTax 500.

For example if you buy unsecured property on January 1st your taxes will become due on August 31. Not all state income tax returns and tax rates are created equally. Ohios Taxes March 31 2020 Agency This page contains a complete list of every tax administered by the Ohio Department of Taxation grouped according to.

The same is true for most state taxes. States prefer you e-file use direct deposit or electronic payments when possible. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and.

Delinquent tax refers to a tax that is unpaid after the payment due date. Second Installment Due Delinquent Date May 10 of the following year. Single Payment Due Delinquent Date NA.

Depending on where you live property taxes can be a small inconvenience or a major burden. April 15 2021 May 17 2021 will be the postponed tax deadline or Tax Day for 2020 Tax Returns. The postponement only applies to state tax payments and state tax returns for tax year 2020 due April 15 2021.

For most states the standard state tax extension to file if. Illinois New Jersey Ohio Pennsylvania Wisconsin and Washington. All state tax returns and state income tax payments not related to Form MI-1040 are still due April 15 2021.

Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. If you purchase unsecured property in August the due date becomes September 30 delinquency occurs on November 1st. See detailed state related tax deadline and payment information.

And if you make estimated tax payments. Ohio is ranked number twenty two out of the fifty states in. Personal Property Tax Bill Payment Information.

52 rows Scroll down to discover all that goes into property tax calculation as well as a complete. When Are Taxes Due. Census Bureau and residents of the 27 states.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Of course the extension for filing a return granted by the IRS due to the ongoing pandemic doesnt mean we can all. For example there are nine states which dont impose a state income tax.

Most state income tax returns are due on that same day. Income tax returns must be postmarked on or before the 2021 filing due date to avoid penalties and late fees. 1st half installment Spring.

The latest 2020 Tax Return deadlines are listed here for the 2020 return due in 2021. June 15 of the year taxes are due if notice of assessment is mailed on or after May 1 of the assessment year. The due dates for providing certain information returns related to health insurance coverage has been extended.

2nd half installment Fall. The federal government and most states pushed back the date to May 17 but others have gone their own way. Delinquency follows one day later on September 1st.

Colorado Sales Tax Due Dates Tax Guide Sales Tax Business Tax

Colorado Sales Tax Due Dates Tax Guide Sales Tax Business Tax

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Websit Sales Tax Tax Rules State Tax

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Websit Sales Tax Tax Rules State Tax

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Property Tax Maui Maui Real Estate Property Tax Maui

Property Tax Maui Maui Real Estate Property Tax Maui

Income Tax Filing Deadline 2020 Income Tax Filing Taxes Small Business Bookkeeping

Income Tax Filing Deadline 2020 Income Tax Filing Taxes Small Business Bookkeeping

Important Sales Tax Dates For April 2019 Accuratetax Com Sales Tax Tax Dating

Important Sales Tax Dates For April 2019 Accuratetax Com Sales Tax Tax Dating

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With The Highest And Lowest Property Taxes Property Tax Tax States

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

States With The Highest And Lowest Property Taxes Property Tax Social Studies Worksheets States

Sales Tax What Is A Sales Tax Tax Basics Tax Foundation

Sales Tax What Is A Sales Tax Tax Basics Tax Foundation

San Diego County Public Records Public Records San Diego Records

San Diego County Public Records Public Records San Diego Records

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Property Taxes In America Property Tax Business Tax Tax

Property Taxes In America Property Tax Business Tax Tax

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Staging

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Staging

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

What Are The Best And Worst States For Property Taxes Property Tax Property Tax

What Are The Best And Worst States For Property Taxes Property Tax Property Tax

2019 Tax Deadline Calendar Infographic Ageras Small Business Bookkeeping Bookkeeping Business Tax Tricks

2019 Tax Deadline Calendar Infographic Ageras Small Business Bookkeeping Bookkeeping Business Tax Tricks

Utah Retirement Tax Friendliness Smartasset

Utah Retirement Tax Friendliness Smartasset

Property Tax Isn T The Only Tax To Be Concerned With We Saved 20 000 In One Year Just From Living In A State With All Around Lower In 2020 Property Tax Low Taxes

Property Tax Isn T The Only Tax To Be Concerned With We Saved 20 000 In One Year Just From Living In A State With All Around Lower In 2020 Property Tax Low Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home