Property Tax Rate Nyc 2020

Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. Property Tax Rates for Tax Year 2020.

Property Tax Map Reforming Government

Property Tax Map Reforming Government

The property tax is an ad valorem tax meaning that it is based on the value of real property.

Property tax rate nyc 2020. In fact the earliest known record of property taxes dates back to the 6th century BC. Class 4 - 10537. In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107.

Payment is due on. NYC property owners receive a property tax bill from the Department of Finance a few times a year. Class 2 - 12473.

July 1 October 1 January 1 and April 1. In the US property taxes predate even income taxes. Quarterly 4 times a year.

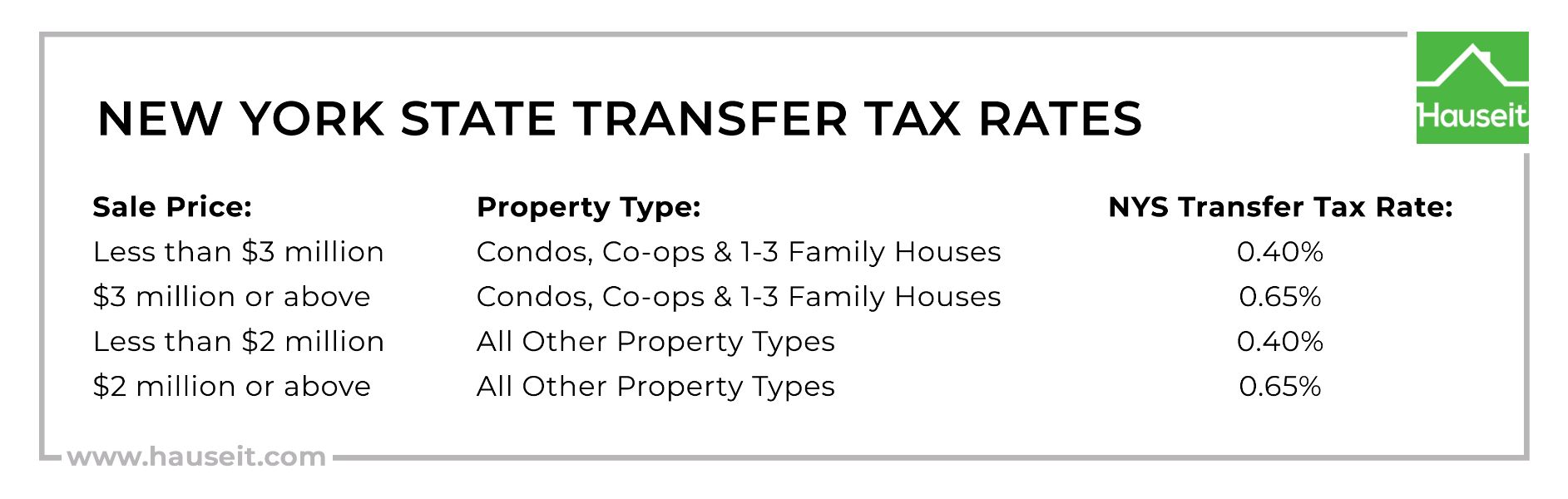

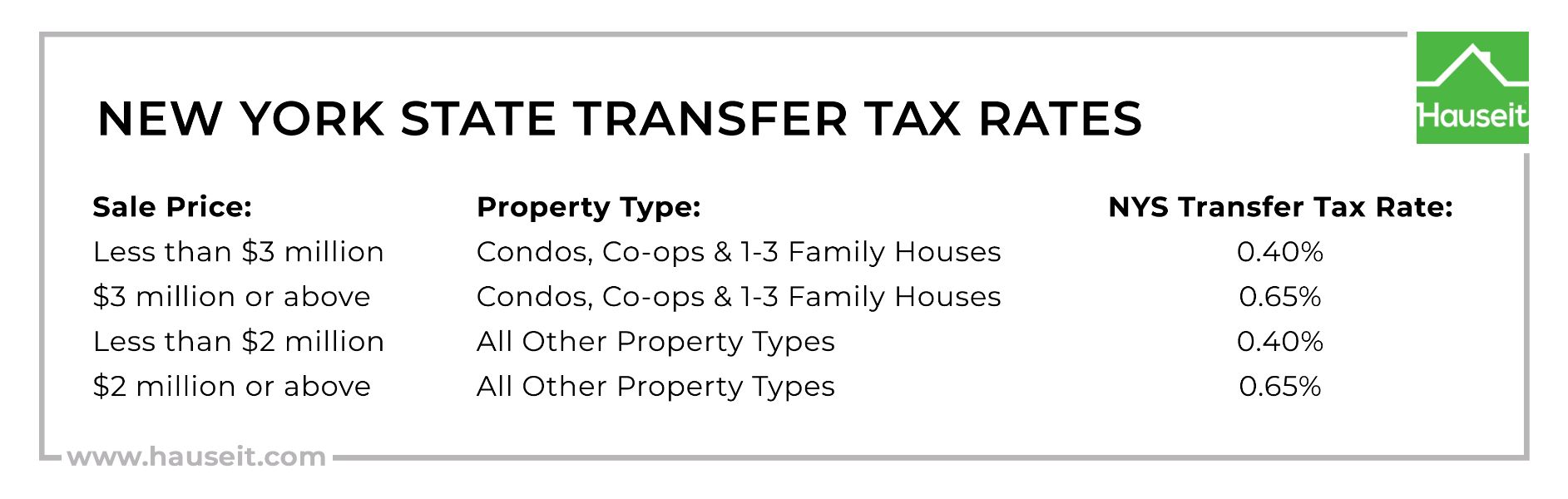

In addition to those taxes previously imposed beginning on July 1 2019 certain conveyances of real property or interests therein located in New York City where the consideration for each conveyance is 2 million or more are subject to new taxes under the New York State Tax Law. This section will help you understand how your property is valued and how those values are used to calculate your property taxes. See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff.

The homes are each worth roughly 175 million but the combined property tax bill is slightly under 9000 far less than homes of comparable value in less gentrified parts of New York. NYS taxable income LESS than 65000. Class 1 - 21167.

The median property tax in New York is 375500 per year for a home worth the median value of 30600000. New York City Resident Tax. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

The Department of Finance determines the market value differently depending on they type of property you own. Or log in to Online Assessment Community. A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate.

Part-year NYC resident tax. Estimate the propertys market value. The remaining 21.

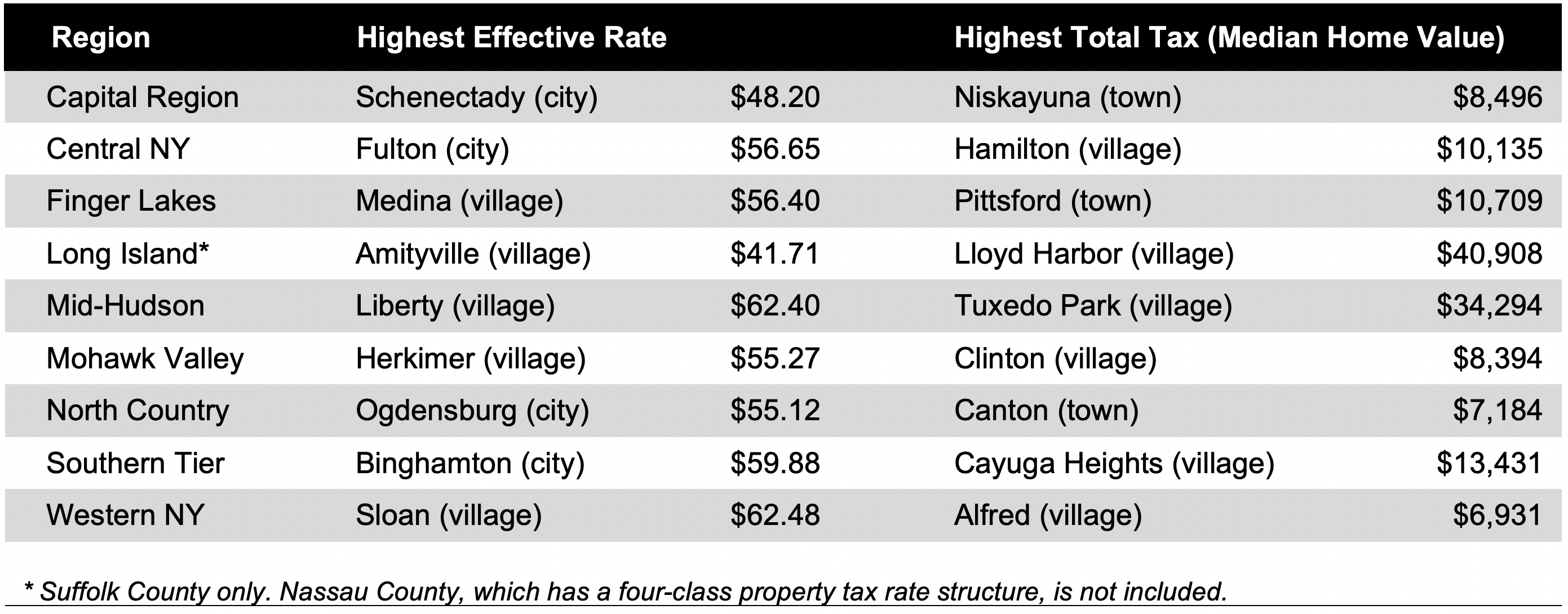

Local governments and school districts outside of New York City levied 2887 billion in property taxes. While some states dont levy an income tax all states as well as Washington DC have property taxes. The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169.

Last night the New York City Council passed the property tax rates for fiscal year 20202021. 025 discount on the last three quarters if you wait until October to pay the entire amount due for the year. NYC tax rate schedule.

NYS taxable income 65000 or MORE. Married and filing a joint NYS return and one spouse was a full-year New York City resident and the other was a nonresident for all of the tax year. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance.

Local assessment officials. In New York City property tax rates are actually fairly low. For more information download the Class 1 and Class 2 property.

Tax Class 4 commercial increased 148 to 10694 the highest rate in 14 years. Of that 62 percent was levied by schools and 17 percent by counties. Tax Class 2 apartment buildings decreased 165 to 12267 the lowest rate in 13 years.

Because the calculations used to determine property taxes vary widely from county to county the best way to compare property taxes on. 05 on the full amount of your yearly property tax if you pay the full years worth of tax shown on your bill by the July due date or grace period due date. For state and local governments property taxes are necessary to function.

The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOOL 317465 497465 257465 377465 357465 537465 FENNVILLE PUBLIC SCHO 286041 466041 226041 346041 326041 506041 BLOOMINGDALE PUBLIC S 310193 489689 250193 369689 350193 529689 Leighton Twp 031130. Property taxes are based on the value of real property.

Class 3 - 12536. Real Property Transfer Tax Dividing Merging Lots Directory of City Agencies Contact NYC Government City Employees Notify NYC CityStore Stay Connected NYC. NYC is a trademark and service mark of the City of New York.

What Is The Nyc Senior Citizen Homeowners Exemption Sche Senior Citizen Property Tax Nyc

What Is The Nyc Senior Citizen Homeowners Exemption Sche Senior Citizen Property Tax Nyc

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

Apartment Viewing Tips For Buyers In Nyc Hauseit Nyc First Time Home Buyers Home Buying

Apartment Viewing Tips For Buyers In Nyc Hauseit Nyc First Time Home Buyers Home Buying

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Coop Closing Costs Seller Hauseit Closing Costs Nyc Cost

Nyc Coop Closing Costs Seller Hauseit Closing Costs Nyc Cost

Ucc Financing Statement For A Coop In Nyc Hauseit Finance Nyc Statement

Ucc Financing Statement For A Coop In Nyc Hauseit Finance Nyc Statement

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

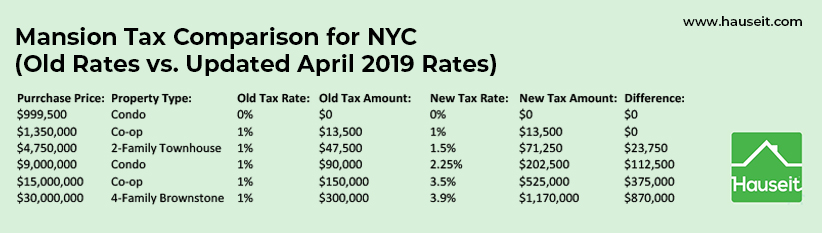

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit Mortgage Nyc Tax

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2021 Hauseit Mortgage Nyc Tax

Closing Costs Nyc Buyer Hauseit Closing Costs Nyc Cost

Closing Costs Nyc Buyer Hauseit Closing Costs Nyc Cost

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Annual State Of The City S Economy And Finances Office Of The New York City Comptroller Scott M Stringer

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit Mansions Nyc Visiting Nyc

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit Mansions Nyc Visiting Nyc

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home