Property Tax Texas Due Date

Taxes are due upon receipt of the tax notice but may be paid without penalty and interest until January 31. The first payment on quarter payment plans for over sixty-five and disability homestead accounts is due on or before this date.

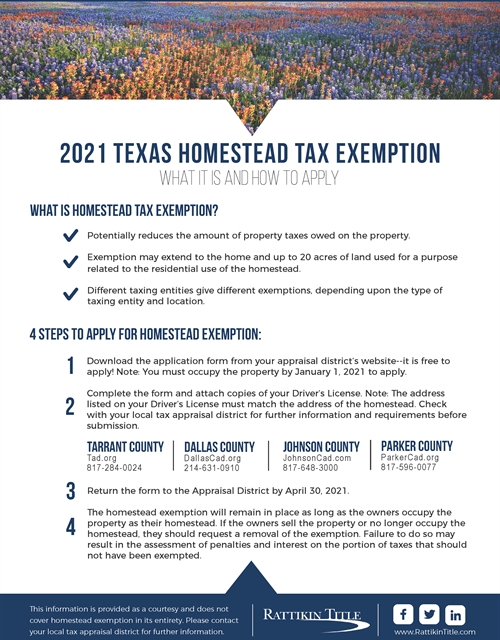

2021 Texas Homestead Tax Exemption

2021 Texas Homestead Tax Exemption

NOVEMBER 30 This is the last day to make the first payment on the half payment option.

Property tax texas due date. If the last day to perform an action falls on a Saturday Sunday or a legal holiday Property Tax Code Section 106 designates the next regular business day as the deadline. The last day to pay taxes without penalty and interest is January 31. If payment is mailed in late January please be sure to have the envelope postmarked by.

January 31 This is the last day to pay taxes before delinquency. 26 instead of Dec. The delinquency date is Monday February 1.

The Texas Comptrollers property tax calendars include important dates for appraisers taxpayers and professionals. However you have until January 31st to pay without accruing interest fees or penalties. Tax notices are usually mailed in October.

Texas Businesses Must File Property Tax Renditions by April 15 AUSTIN Texas Comptroller Glenn Hegar reminds business owners that for many property types April 15 is the deadline to file property tax renditions with their county appraisal districts. Different deadlines apply for certain regulated property. When are my property taxes due.

Mary and Jim Horn Government Center. To find Texas COVID-19 test collection sites use the online mapping tool. Last day to make a payment arrangement for past due taxes in order to avoid attorney fees if an active lawsuit does not exist.

Include your property address account number the property owners email address and phone number. It also applies to the quarterly payroll and excise tax returns normally due on April 30 2021. Hours Monday through Friday except holidays.

Taxes are due upon receipt of the statement. The June 15 2021 deadline applies to the first quarter estimated tax payment due on April 15. Date extended to the next business day.

In addition it applies to tax-exempt organizations operating on a calendar-year basis that have a 2020 return due on May 17 2021. 25 which is Christmas day and a legal holiday. The final Texas property tax due date is January 31st every year.

They will be able to make payments online in person or through the Tax Offices new drop-box in Tyler until Monday February 1 2021. Taxes are due and payable on October 1 and are delinquent if not paid on or before January 31. Specific information on due dates for payment payment options and instructions can be found on their website under Tax Information.

2020 property taxes must be paid in full on or before Sunday January 31 2021 to avoid penalty and interest. JUNE 30 2021 - 2ND HALF-PAYMENT due. Technically your property taxes are due as soon as you receive a tax bill.

The tax office accepts payments by check cash e-check credit or debit card money order or cashiers check. Tax bills are mailed on October 1 or as soon as possible thereafter to real and business personal property owners throughout the county. Payments are commonly made by mail and MUST BE POSTMARKED by the United States Postal Service on or before January 31.

APRIL 1 2021 -Last day to pay 2020 business personal property taxes without accruing attorney fees. The 2020 property taxes are due January 31 2021. For example for reports normally due on the 25th of the month a taxpayer files Dec.

Payments are posted according to postmark. 972-434-8835 Phones answered between the hours of 8 am to 4 pm. When should property taxes be paid.

Penalty Interest begins to accrue on February 1st. For applicable taxes quarterly reports are due in April July October and January. When a reporting due date happens to fall on Saturday Sunday or a legal holiday the reporting due date becomes the next business day.

State law requires that penalty and interest be charged on taxes paid after January 31. If a tax bill is returned undelivered to a taxing unit by the United States Postal Service a taxing unit must waive penalties and interest if the taxing unit does not send another tax bill at least 21 days before the delinquency date to the current mailing address furnished by the property owner and the property owner establishes that a current mailing address was furnished to the CAD for the tax bill before Sept. Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program.

2020 Property Tax Information. 2020 Property tax statements will be mailed the week of October 12th. The agency response and changes to business operations button below contains news on how we have adapted and altered various agency functions during the COVID-19 crisis including audit treasury operations warrant distribution property tax assistance and more.

Smith County Tax Assessor-Collector Gary Barber said since January 31 falls on a Sunday this year those mailing their property tax payments must have them postmarked on or before February 1.

Property Tax Basics Milam Ad Official Site

Property Tax Basics Milam Ad Official Site

![]() Property Tax Jefferson County Tax Office

Property Tax Jefferson County Tax Office

How To Compute Real Estate Tax Proration And Tax Credits Illinois

How To Compute Real Estate Tax Proration And Tax Credits Illinois

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Property Taxes In Fort Bend Tx Bret Wallace

Property Taxes In Fort Bend Tx Bret Wallace

Https Ttara Org Wp Content Uploads 2018 09 Ttaratestimonyonbusinesspersonalproperty 2 20 18 Pdf

Tax Calendar Bexar County Tx Official Website

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

List Of State Federal Tax Office Closings Filing Delays Extensions Due To Coronavirus

List Of State Federal Tax Office Closings Filing Delays Extensions Due To Coronavirus

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Texas Property Tax Travis Central Appraisal District

Texas Property Tax Travis Central Appraisal District

Tarrant County Tx Property Tax Calculator Smartasset

Tarrant County Tx Property Tax Calculator Smartasset

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Property Tax Basics Milam Ad Official Site

Property Tax Basics Milam Ad Official Site

Tax Calendar Bexar County Tx Official Website

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home