What Is The Property Tax Rate In Seminole County Florida

The median property tax on a 24100000 house is 195210 in Seminole County. Seminole County Tax Collector 1101 East First St Room 1200 Sanford FL 32771.

Most Local Governments Propose Same Tax Rate But Will Get A Windfall Thanks To Soaring Property Values Orlando Sentinel

Most Local Governments Propose Same Tax Rate But Will Get A Windfall Thanks To Soaring Property Values Orlando Sentinel

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

What is the property tax rate in seminole county florida. This file is constantly being updated and may change daily. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Seminole County ˈ s ɛ m ɪ n oʊ l SEM-i-nohl is a county located in the central portion of the US.

These are levied by the county municipalities and various taxing authorities in the county. Within 30 days after the warrants are prepared the Tax Collector applies to the Circuit Court for an order directing levy and seizure of the property for the amount of unpaid taxes and costs. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Miami can help you out.

Seminole County is part of the Orlando-Kissimmee-Sanford Florida Metropolitan Statisticial Area. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Seminole County Tax Appraisers office. In-depth Seminole County FL Property Tax Information.

The Seminole County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Seminole County local sales taxesThe local sales tax consists of a 100 county sales tax. The Seminole County sales tax rate is. The median property tax on a 24100000 house is 233770.

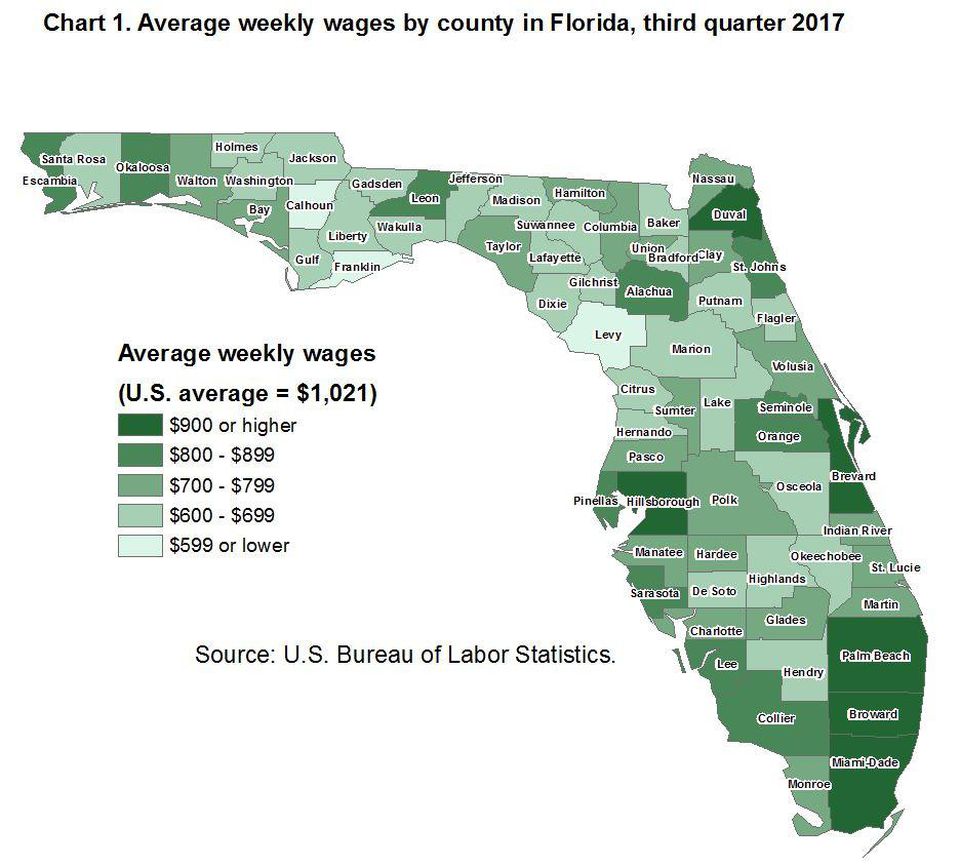

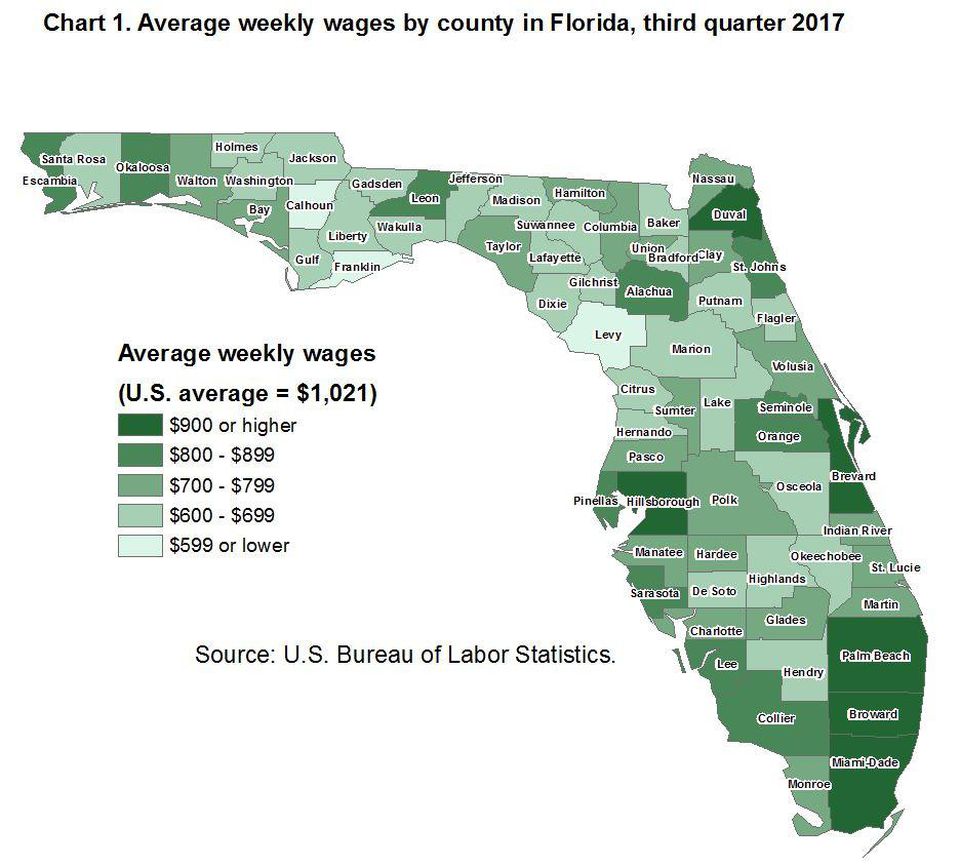

Hillsborough 2168 Lee 2197 St. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem tax assessments. The Seminole County Tax Collector makes every effort to produce and publish the most current and accurate information possible.

Electronic payment transactions made online will incur a third-party processing fee added to your total payment amount. The median property tax also known as real estate tax in Seminole County is 194500 per year based on a median home value of 24100000 and a median effective property tax rate of 081 of property value. Property and Tangible Tax Payments.

The Seminole County Sales Tax is collected by the merchant on all qualifying sales made within Seminole County. The 2018 United States Supreme Court decision in South Dakota v. Seminole County collects on average 081 of a propertys assessed fair market value as property tax.

Unincorporated County residents must pay for county county bond school school bond fire road and St. Johns Water Management District. PROPERTY TAX BENEFITS FOR PERSONS 65 OR OLDER.

City residents must pay for. No warranties expressed or implied are provided for the data herein its use or its interpretation. Has impacted many state nexus laws and sales tax collection requirements.

2 days agoHow Seminole County uses Florida COVID-19 data to determine what areas need more vaccines Orange County lost access to vaccine data by zip. Do not use this information for a title search. Locally you can reach Seminole Countys Citizens Information Line at 407-665-0000 which is staffed with Seminole County Office of Emergency Management and Florida Department of Health-Seminole personnel Monday through Friday 800am.

Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. Groceries are exempt from the Seminole County and Florida state sales taxes. Florida Property Tax Valuation and Income Limitation Rates see s.

Its county seat and largest city is Sanford. They may also include assessments such as street lighting solid waste and others. Lucie 2198.

As of the 2010 census the population was 422718. To review the rules in Florida visit our state-by-state guide. Canceled or Stop-Payment checks may result in further delays andor penalties or higher fees.

The county has an effective property tax rate of 097. The median property tax in Seminole County Florida is 1945 per year for a home worth the median value of 241000. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

Florida Counties With the HIGHEST Median Property Taxes. Florida Counties With the LOWEST Median Property Taxes. The Department of Revenueswebsitehas more information about property tax benefits for persons 65 or older and contact information for county.

Taxes are based on the assessed value and the. Dixie 503 Holmes 555 Jackson 630 Hamilton 668 Washington 687 Liberty 695 Calhoun 725 Franklin 726 Levy 735 Madison 736. Pursuant to Florida Statutes Tax Warrants are prepared on May 1st of the following year on all unpaid Tangible taxes.

Thats slightly lower than the 107 national average.

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Understanding Your Tax Bill Seminole County Tax Collector

Understanding Your Tax Bill Seminole County Tax Collector

Do You Pay Property Tax In Florida Property Walls

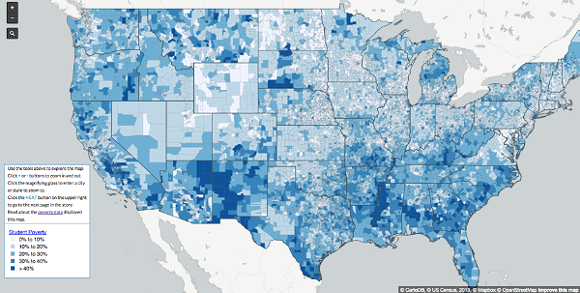

How Property Taxes Keep Florida Students In Impoverished School Districts Blogs

How Property Taxes Keep Florida Students In Impoverished School Districts Blogs

Florida Property Tax Records Florida Property Taxes Fl

Florida Property Tax Records Florida Property Taxes Fl

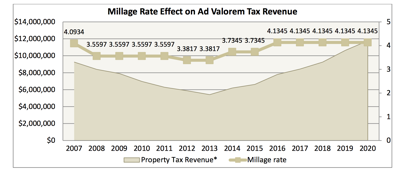

Millage Rates Seminole County Tax Collector

Millage Rates Seminole County Tax Collector

Cities With The Highest And Lowest Property Tax Rates In Pinellas County

Cities With The Highest And Lowest Property Tax Rates In Pinellas County

Https Www Seminolecountyfl Gov Core Fileparse Php 3177 Urlt Fy 2018 19 Budget Worksession Final Pdf

How Property Taxes Keep Florida Students In Impoverished School Districts Blogs

How Property Taxes Keep Florida Students In Impoverished School Districts Blogs

Florida County Map With Abbreviations

Florida Property Tax Records Florida Property Taxes Fl

Florida Property Tax Records Florida Property Taxes Fl

Florida Property Taxes By County 2021

Most Local Governments Propose Same Tax Rate But Will Get A Windfall Thanks To Soaring Property Values Orlando Sentinel

Most Local Governments Propose Same Tax Rate But Will Get A Windfall Thanks To Soaring Property Values Orlando Sentinel

The Economic Policies Of Florida S Gubernatorial Candidates James Madison Institute

The Economic Policies Of Florida S Gubernatorial Candidates James Madison Institute

Dunedin Again Holds The Line On Property Tax Rate North County Tbnweekly Com

Dunedin Again Holds The Line On Property Tax Rate North County Tbnweekly Com

Florida Property Tax H R Block

Florida Property Tax H R Block

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home