Jackson County Property Tax Collector

B You may pay by mail with check or money order to. You may also obtain a duplicate of your original property tax.

News Citrus County Tax Collector

If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Jackson county property tax collector. Acceptable Payments Payments made in the treasurers office must be in the form of Cash check money order or cashiers check. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees.

MasterCard DebitCredit American Express Discover and Visa Credit. If you need tax information from the Town of Sylva you may. If monies paid result in an overpayment of taxes Please contact this office for assistance.

Suite 124 Brownstown IN 47220. Planning Board Clerk 518-441-8641. If the taxes are not paid by the date set for the tax deed sale the property is sold by the Clerk of Courts Office to the highest bidder.

Property Tax Payment FAQ Pay Online Pay by Phone Pay Using Online Bill Pay Pay by Mail Pay in Person. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Jeff Arnold Jackson County Revenue Commissioner.

For real property tax questions call 816 881-3530. Please contact this office at 732-928-1200 to obtain further information on accounts that are noted as having special charges. Newport Arkansas 72112 870 523-7413.

The Jackson County Tax Collectors Office is responsible for the timely collection and disposition of real and personal property taxes within Jackson County. 12th Street in Kansas City and the Historic Truman Courthouse at 112 W. If a tax bill is not received by December 1 contact the Collectors Office at 816-881-3232.

Anyone who has paid Jackson County personal or real estate property taxes may get a duplicate tax receipt. Bills are generally mailed and posted on our website about a month before your taxes are due. For individual personal property tax questions call 816 881-1330.

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due. For general tax questions call 816 881-3232. ASSESSORS OFFICE JACKSON COUNTY COURTHOUSE 10 South Oakdale Ave Room 300 Medford Oregon 97501.

Jackson County Tax Collector 208 Main St. Lafayette St Suite 107 PO Box 697Marianna FL 32447 850-482-9653 FAX850-526-3821 Monday - Friday 800am-400pm CST Map It. Jackson County Treasurer 111 S.

Once taxes are paid online refunds will not be permitted. The tax deed may be applied for two 2 years from April 1 of the year of issuance. About the Taxes Taxes are a lien against the real estate and remains with the property not the specific owner of that property.

The Collectors Office mails tax bills during November. A You may come to the Revenue Commissioners Office at the courthouse and make payment in person by cash check or money order. Telephones are staffed during normal business hours.

You may also make tax payments online at. Tax Lien - A lien for property taxes effective January 1 of the tax year. For questions related to a pending BOE appeal call 816 881-3309.

Effective May 18 2020 Jackson County Assessment Department offices in the Jackson County Courthouse at 415 E. If a tax bill is not received by December 10 contact the Collectors Office at 816-881-3232. Jackson County does not collect or retain any portion of the fee.

You may obtain a duplicate of your original property tax receipt for free online. If your propertys Assessed Value is. Payment may be made as follows.

Taxes not paid in full on or before December 31 will accrue interest penalties and fees. Tax Collector The office of Tax Collector was established by the Mississippi Constitution Article 5 Section 135. 25 of transaction 200 minimum Electronic Check250.

How much is a duplicate receipt. In addition the Collectors Office is responsible for the collection of taxes levied by the Town of Dillsboro Village of Forest HillsTown of Highlands and the Town of Webster. For business personal property tax questions call 816 881-4672.

Lexington in Independence will be reopened to the public in a limited capacity. Taxes are due November 1 and are payable prior. Jackson County is one of 17 counties in Mississippi with separate tax assessors and collectors offices since the Countys total assessed value is above 65 million.

Town Supervisor 518-854-7883 jskelliewashing toncountynygov.

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

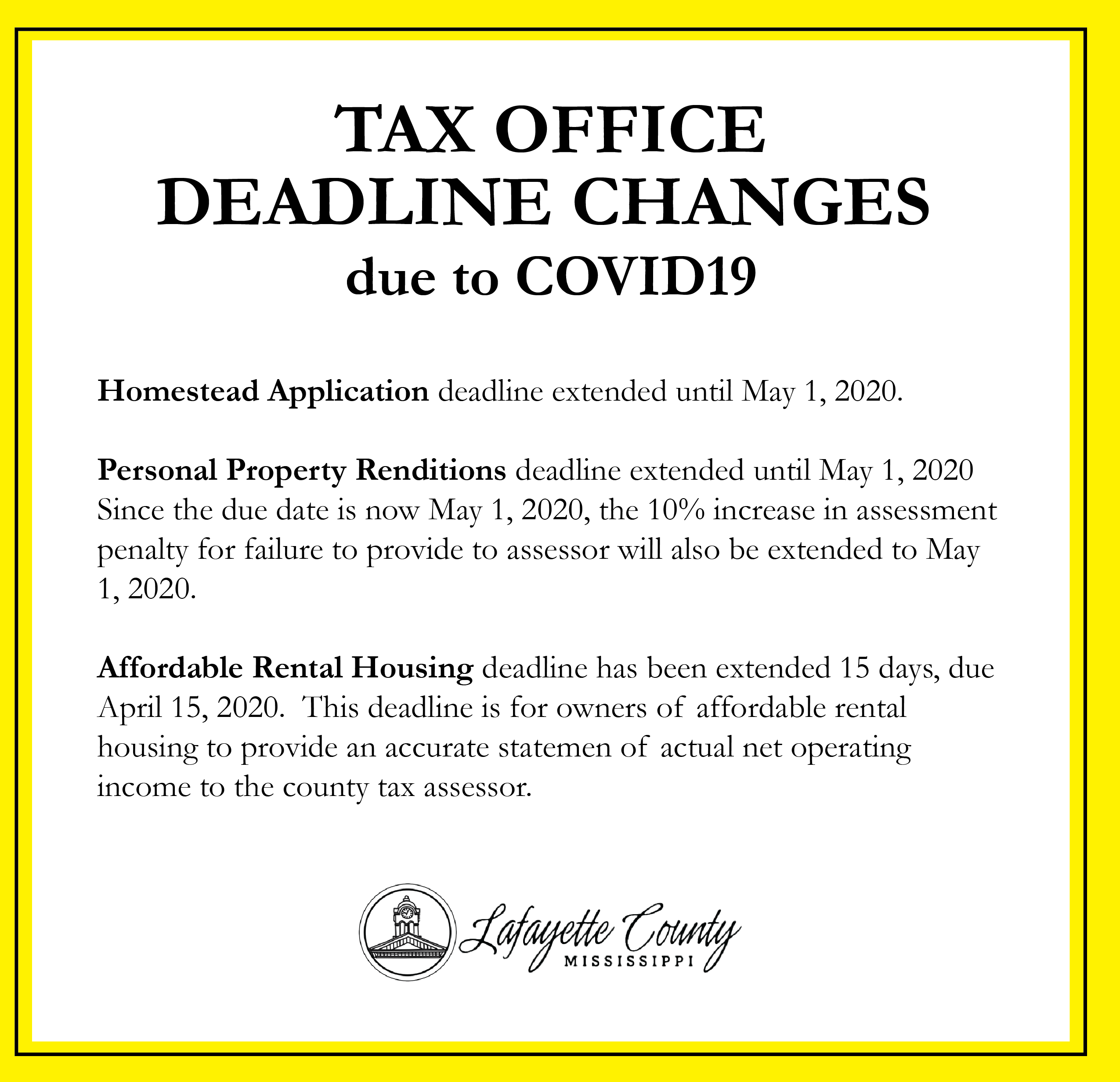

Tax Assessor Collector Lafayette County

Tax Assessor Collector Lafayette County

Fourth Lawsuit Asks Judge To Stop Collection Of Rising Property Taxes In Jackson County Investigations Kctv5 Com

Fourth Lawsuit Asks Judge To Stop Collection Of Rising Property Taxes In Jackson County Investigations Kctv5 Com

Delinquent Property Tax Sale Greene County Ga

Tax Bills Are Being Delivered Jackson County Mo

Jackson County Tax Collectors Office Closed For In Person Transactions From April 6th Through The 17th Wxxv 25

Jackson County Tax Collectors Office Closed For In Person Transactions From April 6th Through The 17th Wxxv 25

Sale Of Loise For Owner S Back Taxes July 25 1849 Tslac African American History Texas History History Lessons

Sale Of Loise For Owner S Back Taxes July 25 1849 Tslac African American History Texas History History Lessons

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Jackson County Florida Property Search And Interactive Gis Map

Jackson County Florida Property Search And Interactive Gis Map

The Plain Dealer S Front Page For January 5 2015 Plain Frank Jackson Plains

The Plain Dealer S Front Page For January 5 2015 Plain Frank Jackson Plains

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home