Jackson County Tn Property Tax Rate

View an Example Taxcard. The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021.

Waterfront Rare Chance To Own A Waterfront Home In The Cravens Lding Area Of Savannah 3bd 2 Bth 1600 Sqft W Remodeled Waterfront Homes Home Hardwood Floors

Waterfront Rare Chance To Own A Waterfront Home In The Cravens Lding Area Of Savannah 3bd 2 Bth 1600 Sqft W Remodeled Waterfront Homes Home Hardwood Floors

Comptroller of the Treasury Jason E.

Jackson county tn property tax rate. The Jackson County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Jackson County and may establish the amount of tax due on that property based on the fair market value appraisal. For Assessment information please use the State of Tennessee Real Estate Assessment Data website. City of Jackson TN.

Go to Tennessee County Clerk and click the All Counties bar then click Jackson County for yor online renewals. Jackson County Courthouse 415 E 12th Street Kansas City MO 64106 Phone. The median property tax in Jackson County Tennessee is 52600 All of the Jackson County information on this page has been verified and checked for accuracy.

Five numbers with decimal added. New residents of Jackson County from another county in Georgia must bring in proof of residency here and your current insurance card. Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse.

The average effective property tax rate in Tennessee is 064. This website gives you the ability to view search and pay taxes online and is beneficial for all taxpayers locally and worldwide. This service gives you the freedom to pay and search 24 hours a day 7 days a.

We are very proud to offer this as a source of information for the tax payer and encourage you to use this for your convenience. Three numbers with up to two optional letters following. The assessment rate on commercial property is 40 of appraised value personal property assessed at 30 of appraised value and public utilities assessed at 55 or 40 for real estate of appraised value.

If your house is within the City limits of Jackson TN go to the City Revenue Office website or call 731 425-8212 AND go to the Madison County Trustees Office website the link is on the left of the page or call 731 423-6027. Tax Due Dates Based on the January 1 2019 ownership taxes are due and payable the following year in two equal installments. Property tax information last updated.

Jackson County residents can now renew vehicle registrations online. Comptroller of the Treasury Jason E. Jackson County collects on average 059 of a.

Jackson County Assessors Office Services. Property Taxes Mortgage 1174000. Tax bills are mailed once a year with.

Property Taxes No Mortgage 1562100. The median annual property tax paid by homeowners in Tennessee is 1220 about half the national average. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

There will be a convenience fee. Submit a report online here or. If you have received a renewal from your previous county you may bring it with you.

Who to Contact For information regarding the payment of taxes. Submit a report online here or. Due to millage rate differences from one county to the other the tax amount due will probably be different.

April 14 2021 You may begin by choosing a search method below. Overview of Tennessee Taxes. The median property tax also known as real estate tax in Jackson County is 52600 per year based on a median home value of 8920000 and a median effective property tax rate of 059 of property value.

Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. If you reside in Madison County only go to the Madison County Trustees Office website the link in on. Residential property is assessed at 25 of the appraised value and taxes are levied on each 100 of assessed value.

PaySearch Property Taxes Welcome to the Tennessee Trustee Tax Payment Solution Service. Tennessee has some of the lowest property taxes in the US. The median property tax in Jackson County Tennessee is 526 per year for a home worth the median value of 89200.

The state and local governments will not pay the convenience fee on credit or debit card transactions for customers. Up to two optional letters.

Real Estate For Sale In Alamo Tn For 72 900 In 2020 Commercial Property For Sale Real Estate Commercial Property

Real Estate For Sale In Alamo Tn For 72 900 In 2020 Commercial Property For Sale Real Estate Commercial Property

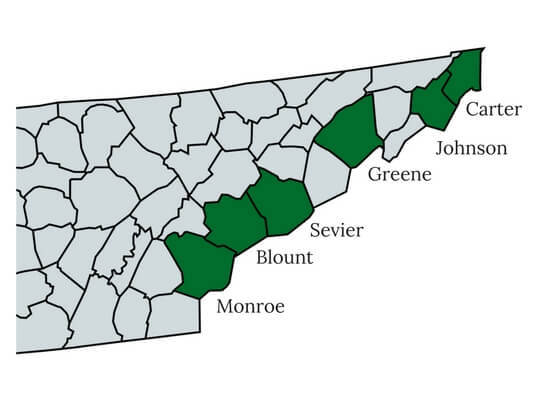

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Gainesboro Tennessee Tn 38562 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2021 Counties With The Lowest Cost Of Living In Tennessee Niche

2021 Counties With The Lowest Cost Of Living In Tennessee Niche

Gainesboro Tennessee Tn 38562 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Remax Green Checklist Remax Homeowner Green Lifestyle

Remax Green Checklist Remax Homeowner Green Lifestyle

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

County Information Putnam County Tn

County Information Putnam County Tn

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

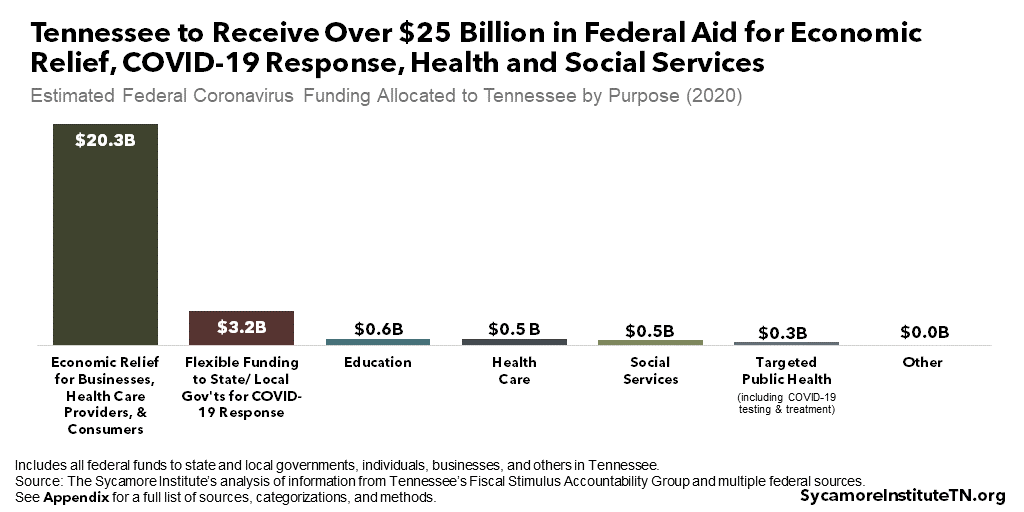

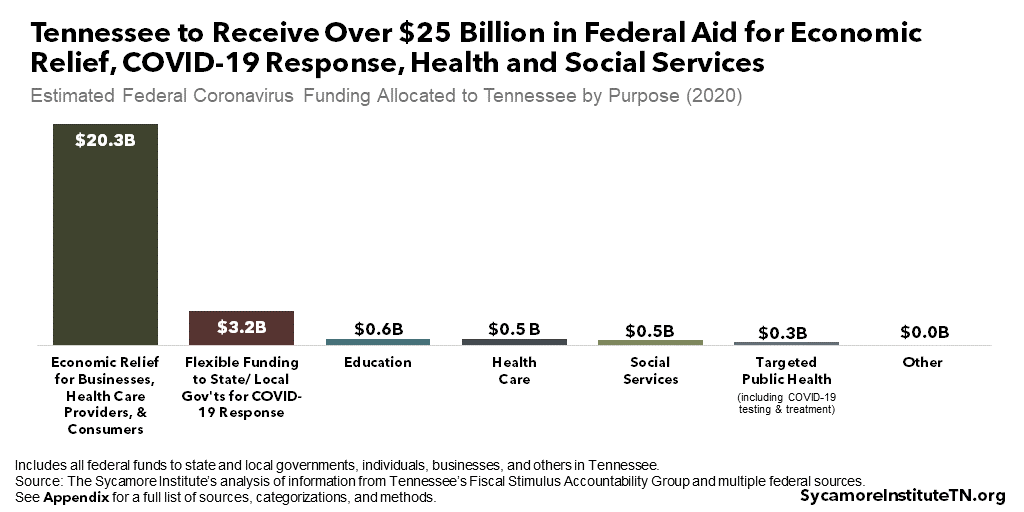

Federal Coronavirus Funding For Tennessee Who Why And How Much

Federal Coronavirus Funding For Tennessee Who Why And How Much

How Much You Need To Live Comfortably In 50 Major Us Cities City Calgary Canada Sioux Falls

How Much You Need To Live Comfortably In 50 Major Us Cities City Calgary Canada Sioux Falls

Jackson Wy Jackson Wy Beautiful Homes Cabins In The Woods

Jackson Wy Jackson Wy Beautiful Homes Cabins In The Woods

The Minimum Wage And The Cost Of Housing Sociological Images Minimum Wage Wage Rent

The Minimum Wage And The Cost Of Housing Sociological Images Minimum Wage Wage Rent

Extended Stay Short Term Housing Jackson Tn Home 4 Awhile Extended Stay Travel Nursing House

Extended Stay Short Term Housing Jackson Tn Home 4 Awhile Extended Stay Travel Nursing House

Business In Humboldt Tn Real Estate Outdoor Decor Humboldt

Business In Humboldt Tn Real Estate Outdoor Decor Humboldt

Gainesboro Tennessee Tn 38562 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Great Waterfront Lot Right On The Tennessee River Great For Building Or Temporary Camping Boat Ramp Access For Lot Own Savannah Chat Land For Sale Waterfront

Great Waterfront Lot Right On The Tennessee River Great For Building Or Temporary Camping Boat Ramp Access For Lot Own Savannah Chat Land For Sale Waterfront

Gibson Tennessee Tn 38343 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home