Property Tax Rate Houston Texas

Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in Terrell County. The typical Texas homeowner pays 3390 annually in property taxes.

Why Are Texas Property Taxes So High Home Tax Solutions

Why Are Texas Property Taxes So High Home Tax Solutions

The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by the name of each taxing unit.

Property tax rate houston texas. The Commissioners Court sets the Harris County property tax rates. Ranked by median yearly property tax. The 2020 property taxes are.

1 of the following year as required. The move comes five days after Houston City Council voted to lower its property tax rate to 56 cents on each 100 of taxable value about a 1. Houston County collects on average 111 of a propertys assessed fair market value as property tax.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Jun Jul Aug HCAD Facebook HCAD Twitter HCAD LinkedIn. The Comptrollers Property Tax Assistance Division PTAD publishes this list not later than Jan.

Created with RaphaÃl 210. View listing photos review sales history and use our detailed real estate filters to find the perfect place. HOW TO CALCULATE THE TAX RATE BEFORE EXEMPTIONS.

The median property tax in Houston County Texas is 750 per year for a home worth the median value of 67600. For example Harris County Texas property taxes can fall around 3200 for homes with a median value of 154000 and a property tax rate of 208. When shopping for your next home in the Houston area you shouldnt pass on a house because the tax rate is 37 versus 32.

In Houston the median home value is 161300 and the average effective property tax rate is 182. Because of these factors the state has been known for having some of the highest property tax rates in the country. State Summary Tax Assessors.

The Harris County Tax Assessor-Collectors Office Property Tax Division maintains approximately 15 million tax accounts and collects property taxes for. The property tax account is being reviewed prior to billing. 800 AM - 500 PM Monday - Friday Saturday Hearings.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. 254 rows Property taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169. This might sound like an insignificant topic to discuss but Ive witnessed and heard of buyers who literally walk.

City of Houston 0561840 Humble ISD 1384050 Harris County 0694546 TOTAL TAX RATE. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. Texas is ranked 1944th of the 3143 counties in the United States in order of the median amount of property taxes collected.

In 2017 the Legislature twice failed to pass similar property tax reform measures that could have set the election trigger higher between 4 and 6. You can only claim Homestead on the home you reside in and you can only claim it on one property. Municipal property tax rates across the Houston area range from zero in Clear Lake Shores to very high as in West Columbia where the city rate is8319 per 100 in.

The amount that residents pay in property taxes is also based on property appraisals. Zillow has 31 homes for sale in Houston TX matching Low Tax Rate. 2640436 x 300000 Divided by 100.

Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property. Property tax workshops holiday schedules and closings application deadlines and more. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

The tax break usually equates to a small discount on your property taxes. Total City ISD County x Price of home 100 EXAMPLE. 2640436 Multiplied by 300000 home.

7921308 100 TOTAL OWED. The effective tax rate is the total tax rate needed to raise the same amount of property tax revenue for City of Houston from the same properties in both the 2018 tax year and the 2019 tax year. Harris County Appraisal District 13013 Northwest Freeway Houston Texas 77040-6305 Office Hours Hours.

792130 Tax rates are rounded to the nearest thousandth. 95 rows Property tax tates for all 1018 Texas independent school districts are available by clicking. Compare that to the national average which currently stands at 107.

A tax rate of 0567920 per 100 valuation has been proposed by the governing body of City of Houston.

Houston Property Tax Rates H David Ballinger

Houston Property Tax Rates H David Ballinger

How School Funding S Reliance On Property Taxes Fails Children Npr

How School Funding S Reliance On Property Taxes Fails Children Npr

Tac School Property Taxes By County

Tac School Property Taxes By County

Harris County Tx Property Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Understanding The Property Tax Protest Industry Of Houston

Understanding The Property Tax Protest Industry Of Houston

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

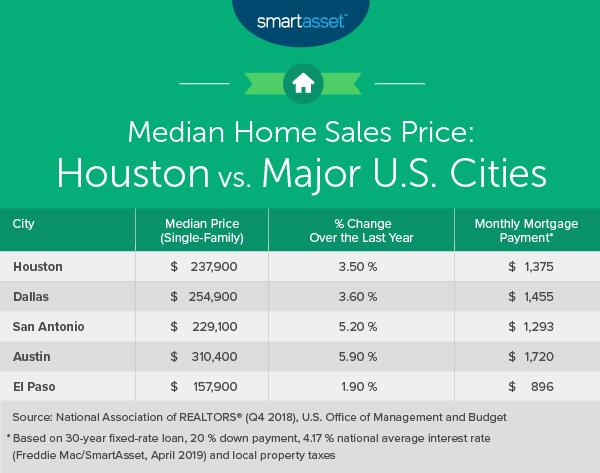

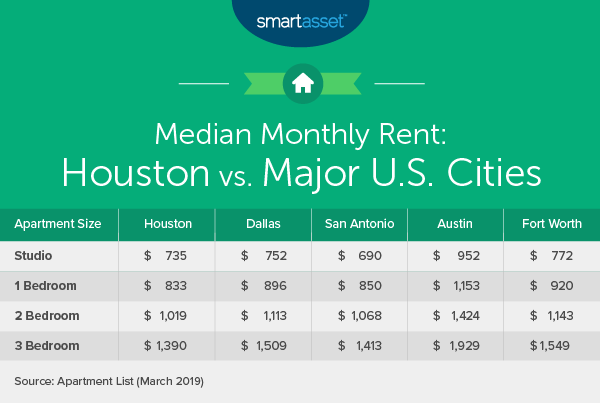

The Cost Of Living In Houston Smartasset

The Cost Of Living In Houston Smartasset

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Harris County Home Values Rise By 6 On Average Coronavirus Disaster Will Not Trigger Tax Relief Community Impact Newspaper

Harris County Home Values Rise By 6 On Average Coronavirus Disaster Will Not Trigger Tax Relief Community Impact Newspaper

Property Taxes In Texas Harris County Commissioners Eyeing Property Tax Rates Abc13 Houston

Property Taxes In Texas Harris County Commissioners Eyeing Property Tax Rates Abc13 Houston

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Tac School Property Taxes By County

Tac School Property Taxes By County

The Cost Of Living In Houston Smartasset

The Cost Of Living In Houston Smartasset

Houston Property Tax Altus Group

Houston Property Tax Altus Group

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Tac School Property Taxes By County

Tac School Property Taxes By County

Lowest Property Tax Counties In Texas Property Walls

Lowest Property Tax Counties In Texas Property Walls

Houston Property Tax Altus Group

Houston Property Tax Altus Group

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home