California Property Tax Rate San Francisco

San Francisco County collects on average 055 of a propertys assessed fair market value as property tax. A taxable PI is created when real property owned by a government agency is leased rented or used by a private individual or entity.

Understanding California S Property Taxes

Understanding California S Property Taxes

If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500.

California property tax rate san francisco. 1788 rows San Francisco 8500. The tax rate changes every year. Enter only the values not the words Block or Lot and include any leading zeros.

Property Tax Rate. The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200. How Property Taxes in California Work.

If you choose to use a browser other than the ones listed your experience may not be optimal or secure. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The median property tax on a 78520000 house is 431860 in San Francisco County.

Property tax rates in California generally fall within the range of 11 percent to 16 percent of assessed value with an average close to 111 percent. A tax rate of 11723 percent 0011723 11723 100. Finally multiply the assessed value of your property by the converted tax rate.

Yearly median tax in San Francisco County. The average effective property tax rate in California is 073. The minimum combined 2021 sales tax rate for San Francisco California is.

A taxable PI may be created or acquired in a number of ways including but not limited to through a contract lease concession agreement. PIs are subject to property taxes under California law unless a qualifying exemption applies eg welfare exemption etc. 504 The property tax rate shown here is the rate per 1000 of home value.

The median property tax on a 78520000 house is 581048 in California. California property taxes are based on the purchase price of the property. View and pay a property tax bill online.

Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer Tax Collector Office. This is the effective tax rate. The median property tax also known as real estate tax in San Francisco County is 431100 per year based on a median home value of 78520000 and a median effective property tax.

225 with 200 minimum. It is designed to give readers a general understanding of Californias property tax system. San Francisco County has one of the highest median property taxes in the United States and is ranked 52nd of the 3143.

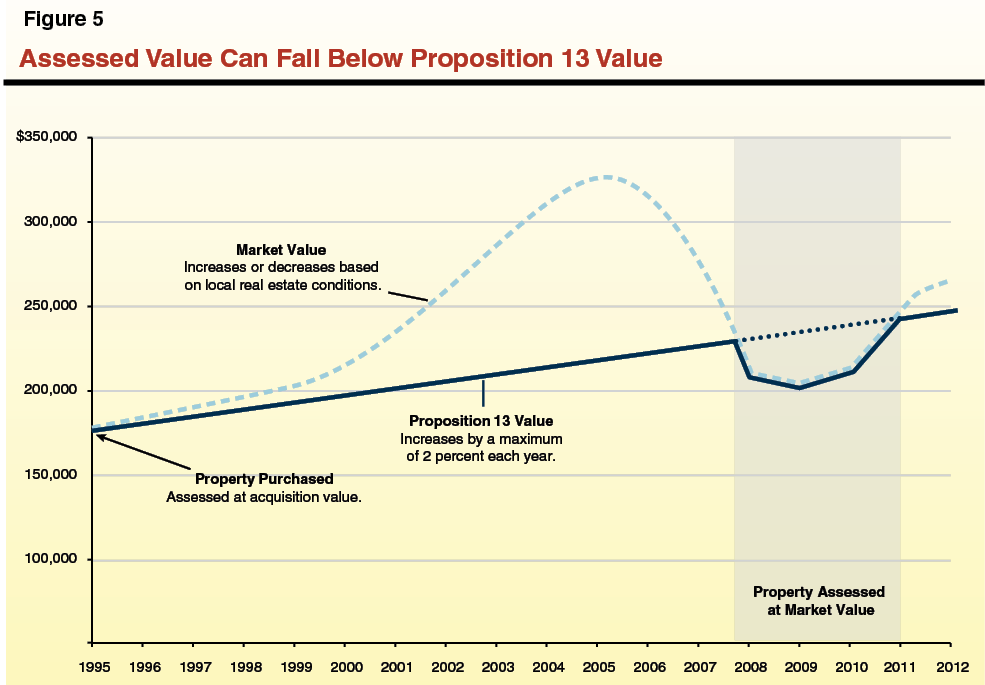

Our payment systems support Microsoft Internet Explorer 11 Windows EDGE and current versions of Google Chrome Mozilla Firefox and Apple Safari. The publication begins with a brief history of Proposition 13 which since 1978 has been the foundation of Californias property tax system. The California sales tax rate is currently.

The County sales tax rate is. Learn about the Citys property taxes. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Francisco County Tax Appraisers office.

The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20. This compares well to the national average which currently sits at 107. 250 with 200 minimum.

In 2017 Investopedia reported the average. COVID-19 Tax Relief for Businesses The Board of Supervisors recently passed legislation that provides pandemic business tax relief to certain businesses that have gross receipts of. The answer will be the amount of property tax owed.

Property owners pay secured property tax annually. This is the total of state county and city sales tax rates. So when you buy.

The Office of the Treasurer Tax Collector serves as the banker tax collector collection agent and investment officer for the City and County of San Francisco. For best search results enter your bill number or blocklot as shown on your bill. The San Francisco sales tax rate is.

In-depth San Francisco County CA Property Tax Information. The secured property tax amount is based on the assessed value of the property as established annually by the Citys AssessorRecorder. California Property Tax provides an overview of property tax assessment in California.

The assessed value is initially set at the purchase price.

Understanding California S Property Taxes

Understanding California S Property Taxes

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

California Prop 15 Explained Voters To Decide Split Roll Property Tax Hike On Big Business Abc7 San Francisco

California Prop 15 Explained Voters To Decide Split Roll Property Tax Hike On Big Business Abc7 San Francisco

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

San Francisco Property Tax Rates Redmond Realty

San Francisco Property Tax Rates Redmond Realty

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Understanding California S Property Taxes

Https Www Attomdata Com News Market Trends Top 10 Metros With The Lowest Property Tax Rates

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Labels: california, property, rate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home