Property Tax Rate For King County Washington

Please note you will need your completed 2019 tax return prior to applying. Payment deadline for first half of property taxes is April 30 2021 and second half November 1 2021.

To qualify for taxes payable in 2020 andor 2021 you will need to meet the following criteria.

Property tax rate for king county washington. The median property tax on a 40770000 house is 375084 in Washington. King County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. The average effective property tax rate in King County is 093.

The income limit is now indexed to 65 of the median household income in King County. A common misunderstanding surrounds the property tax levy. For example if the assessed value of your property is 200000.

The median property tax on a 40770000 house is 358776 in King County. For property in King County you can apply for taxes payable in 2020 as early as January 2020 when 2020 application is readily available. The median property tax on a 40770000 house is 428085 in the United States.

Renewal of the EMS regular property tax levy at a rate of 02651000 for the first year of the six-year levy an increase in rate of 0047381000 from the previous year. The new limit is 58423 rather than set at a fixed amount. Its also the county with the states highest median annual property tax payment at 4611.

Thats exactly equal to the state of Washingtons overall average effective property tax rate. Renewal of the EMS regular property tax levy at a rate of 02651000 for the first year of the six-year levy an increase in rate of. Skip to Main Content Sign In.

88 rows A number of levies and other property tax measures were approved by voters in 2019 for collection in 2020. The exact property tax levied depends on the county in Washington the property is located in. Rates in many King County cities have been falling as home values have been increasing.

King County collects the highest property tax in Washington levying an average of 357200 088 of median home value yearly in property taxes while Ferry County has the lowest property tax in the state collecting an average tax of 94100 064 of median home value per year. O King County. The City of Mercer Islands share of the total property tax bill equates to 124.

Taxpayers should remember that King County will not process applications that are not complete and without supporting documents. King County collects the highest property tax in Washington levying an average of 357200 088 of median home value yearly in property taxes while Ferry County has the lowest property tax in the state collecting an average tax of 94100 064. King County is the next largest taxing jurisdiction receiving 162 of the total property tax bill in 2019.

King County Property Tax Payment Information. Under state law current year King County property tax statements are mailed once a year in mid-February. The King County Sales Tax is collected by the merchant on all qualifying sales made within King County.

After years of big property-tax increases in King County taxes are going up just 20 this year for the median homeowner while homeowners in about half of cities will actually see a slight. To compare King County with property tax rates in other states see our map of property taxes by state. Please note that you dont get receive additional statements ahead of the April and October payment deadlines from the county Treasurers office.

You can estimate what your property taxes will be if you know the assessed value of your property and the tax levy rate. King County Washingtons average effective property tax rate is 093. View and pay for your Property Tax bills for King County Washington online.

The median property tax also known as real estate tax in King County is 357200 per year based on a median home value of 40770000 and a median effective property tax rate of 088 of property value. In-depth King County WA Property Tax Information. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

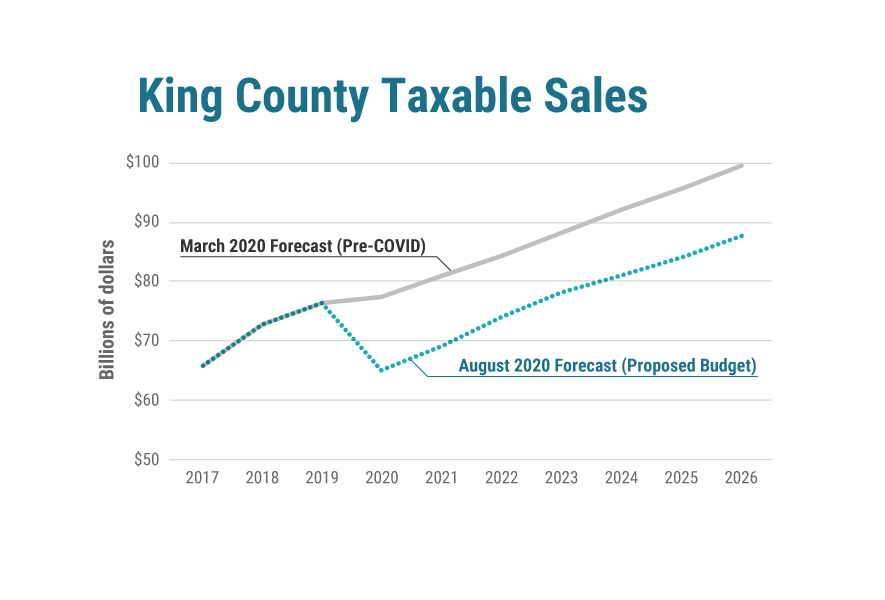

Many King County services are continually adapting because of the COVID-19 pandemic. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in King County. Each agency will update its pages with current information.

The King County Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 King County local sales taxesThe local sales tax consists of a 350 special district sales tax used to fund transportation districts local attractions etc.

Create Livable Communities Strategic Initiatives Seattle King County Area Agency On Aging King County Community Seattle

Create Livable Communities Strategic Initiatives Seattle King County Area Agency On Aging King County Community Seattle

Property Tax Cycle King County Wa Property Tax Tax Property

Property Tax Cycle King County Wa Property Tax Tax Property

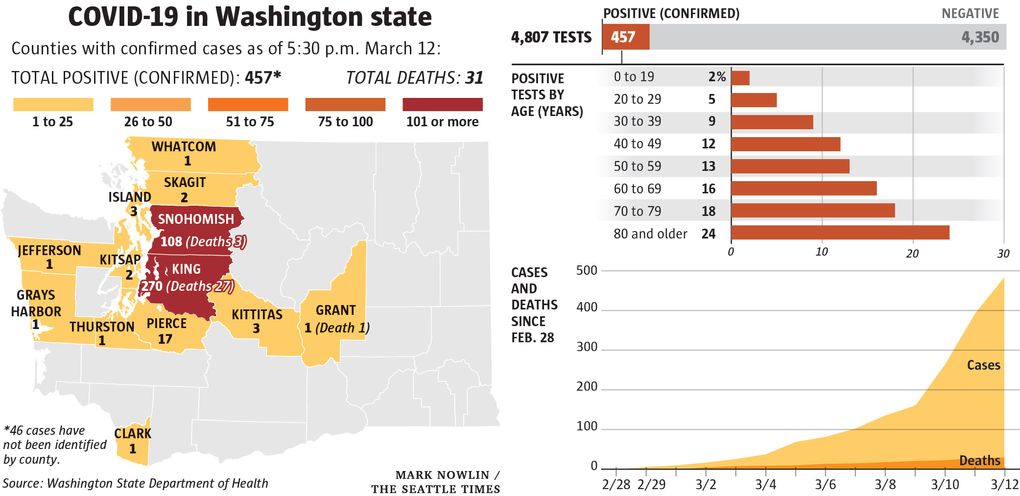

Coronavirus Daily News Update March 12 What To Know Today About Covid 19 In The Seattle Area Washington State And The Nation The Seattle Times

Coronavirus Daily News Update March 12 What To Know Today About Covid 19 In The Seattle Area Washington State And The Nation The Seattle Times

Seattle Real Estate Short Sales Realtor And Seattle Mortgage Mediation Attorney Jonathan Smith Offers Ful Sales Strategy Mortgage Assistance Sales Motivation

Seattle Real Estate Short Sales Realtor And Seattle Mortgage Mediation Attorney Jonathan Smith Offers Ful Sales Strategy Mortgage Assistance Sales Motivation

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Https Www Kingcounty Gov Depts Health Data Media Depts Health Data Documents The Race Gap Ashx

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

How Healthy Is King County Washington Us News Healthiest Communities

How Healthy Is King County Washington Us News Healthiest Communities

Covid 19 Homelessness Response King County

Covid 19 Homelessness Response King County

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Data Toolbox Communities Count

Data Toolbox Communities Count

Labels: county, king, property, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home