Property Tax Statement King County

Mail the payment in a sealed envelope properly addressed and with the required postage. It is mailed in March just before the first half of your property tax is due in May the second half is due in October.

For complete instruction for listing of personal property either by hard copy or electronically please contact your local assessor.

Property tax statement king county. Aggregate property tax collections in King County for the 2019 tax year will be 56 billion a decrease of about 1 from the 2018 collection of 57 billion. Business Property Statement BOE-571-L California law prescribes a yearly ad valorem tax based on property as it exists at 1201 am. I have requested copies of the public records of the Assessors Property Information Files.

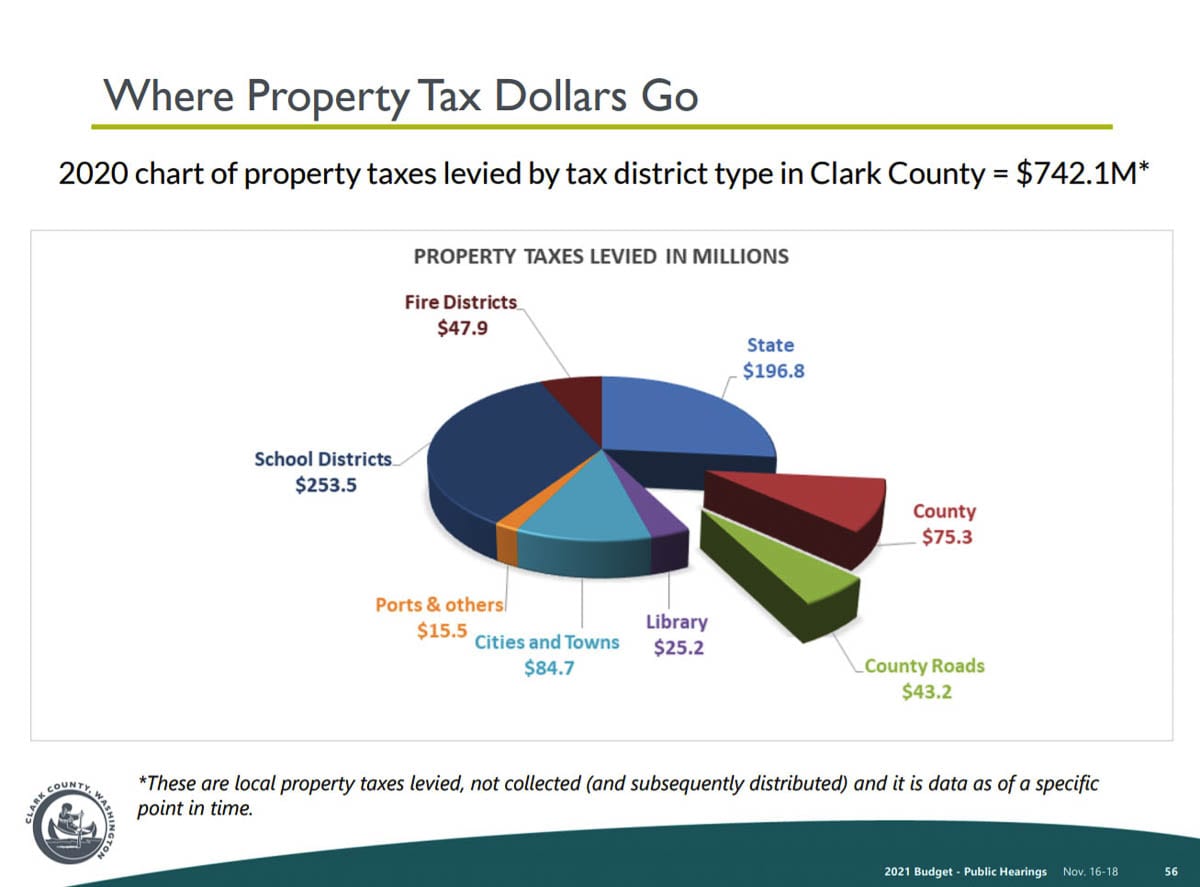

Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. King Countys 39 cities Sound Transit the Port of Seattle and the Library systems also receive funding from property taxes. Tax bills requested through the automated system are sent to the mailing address on record.

Public Utility Annual Reports Refund and Waiver forms. PAY NOW View and pay for your Property Tax bills for King County Washington online. Write the Assessors Identification Number on the lower left-hand corner of your check or money order.

It also includes payment coupons which can be used when making your tax payment. Do not attach staples clips tape or correspondence. More than half of the revenue levied from property taxes is directed to our state and local schools to fund education.

Jackson Street Suite 710 Seattle WA 98104 NOTE NEW MAILING ADDRESS. This form is for declaration of all assessable business property situated in Kings County which you owned claimed possessed controlled or managed on the tax lien date cited on the form. The assessors staff is available to assist you in any way we can.

I understand that Washington State law RCW 4256070 9 prohibits the use of lists of individuals for commercial purposes I understand that the use for commercial purposes of said record may also violate the rights of the individual s named. Real Property Tax Real Estate 206-263-2890. 88 rows Two changes in our states school funding formula will lead to a 137 increase in property.

Property taxes are a major source of funding for King County. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Last Updated November 15 2017.

You with the current year tax distribution and billing information to help you better understand where your tax dollars go. Public utility reporting forms. Aggregate property value in King County increased by more than 13 percent from the previous year going from 5347 billion to 6066 billion.

This statement shows your property tax value the amount of taxes due and when they are due. Under state law current year King County property tax statements are mailed once a year in mid-February. If you have question or concerns please feel free to call us at 206-296-7300.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. Httpwwwkingcountygovpropertytax or contact our office at 206-296-0923 to request a tax statement. If your taxes areno longer collected as partof your mortgage or you havepaid offyour mortgage and you are now responsible for paying the taxes please visit our website.

King County Treasury Operations 201 S. Please note that you dont get receive additional statements ahead of the April and October payment deadlines from the county Treasurers office. Median Property Taxes No Mortgage 4691.

If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy. In-depth King County WA Property Tax Information. Enclose your payment stub s from your Property Tax Bill.

Personal property listing forms. Median Property Taxes Mortgage 4583. Please verify your mailing address is correct prior to requesting a bill.

Petition for Property Tax Refund Fill-In 64 0001e Income Qualification Worksheet Fill-In. Go Paperless eValuations. King County Property Tax Payments Annual King County Washington.

Under state law current year King County property tax statements are mailed once a year in mid-February. Other than that one mailing we do not mail additional statements ahead of the April and October payment deadlines unless we receive a request to do so.

Read more »