What Is The Property Tax Rate In King County

Mailing addresses for property taxes. See or print a tax statement.

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

The median property tax on a 40770000 house is 358776 in King County.

What is the property tax rate in king county. The portion King County receives 11B in 2020 funds numerous services such as criminal justice programs roads and transportation elections and general government parks and emergency services. King County Washingtons average effective property tax rate is 093. Renewal of the EMS regular property tax levy at a rate of 02651000 for the.

King County has one of the highest median property taxes in the United States and is ranked 102nd of the 3143 counties in order of median property taxes. Instead of a fixed amount the annual income limit is now indexed at 65 of the median household income in King County which for 2019 was 58423. The City of Mercer Islands share of the total property tax bill equates to 124.

View or print King County tax statements here. King County is the next largest taxing jurisdiction receiving 162 of the total property tax bill in 2019. Thats exactly equal to the state of Washingtons overall average effective property tax rate.

In-depth King County WA Property Tax Information. A common misunderstanding surrounds the property tax levy. Washington State law RCW 8456010 doesnt allow county treasurers to collect property taxes until February 15 of the year that they are due.

The average effective property tax rate in King County is 093. The King County Tax Assessor has issued a press release two days before 2020 property taxes will be released. Rates in many King County cities have been falling as home values have been increasing.

King County Treasury 500 Fourth Avenue Room 600 Seattle WA 98104. King County tax parcel search. Taxes for the second half of the year can be paid in advance but the first half cant.

King County Property Taxes average 137 Higher for 2020. The median property tax in King County Washington is 3572 per year for a home worth the median value of 407700. Pay King County Property Taxes Online.

88 rows King County. King County collects on average 088 of a propertys assessed fair market value as property tax. These changes take effect for property taxes collected in 2020.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the King County Tax Appraisers office. At the least it halts the tide of soaring property taxes which grew 43 percent in the prior four years increasing from 4140 in 2014 to 5904 in 2018 for the median homeowner countywide. About 55 percent of property tax revenues collected in King County in 2019 pays for schools.

Renewal of the EMS regular property tax levy at a rate of 02651000 for the first year of the six-year levy an increase in rate of 0047381000 from the previous year. Make checks payable to. Its also the county with the states highest median annual property tax payment at 4611.

From the press release. King Countys 39 cities Sound Transit the Port of Seattle and the Library systems also receive funding from property taxes. The median property tax also known as real estate tax in King County is 357200 per year based on a median home value of 40770000 and a median effective property tax rate of 088 of property value.

88 rows King County receives about 17 percent of your property tax payment for roads police. King County mails out a statement in the middle of February. O King County.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Please visit the Assessors Office website for detailed eligibility information and how to.

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Property Tax Cycle King County Wa Property Tax Tax Property

Property Tax Cycle King County Wa Property Tax Tax Property

Honolulu Property Tax 2020 21 Fiscal Year

Download Your Free Copy Of Our Ultimate Home Buyer S Guide At Https H Bergandberghomes Com Buyers Guide Shelteredbygo Sale House Pierce County Real Estate

Download Your Free Copy Of Our Ultimate Home Buyer S Guide At Https H Bergandberghomes Com Buyers Guide Shelteredbygo Sale House Pierce County Real Estate

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

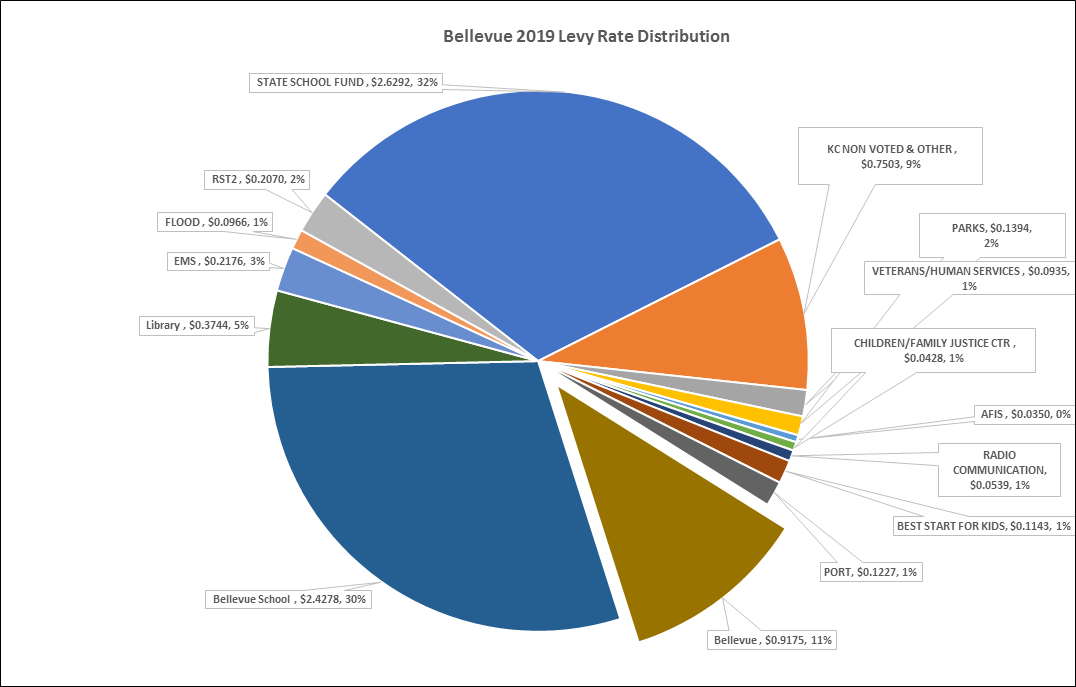

Bellevue Property Taxes City Of Bellevue

Bellevue Property Taxes City Of Bellevue

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Honolulu Property Tax 2020 21 Fiscal Year

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home