King County Unsecured Property Tax

Disclaimer This service has been provided to allow easy access and a visual display of county property tax information. You can now look up Secured and Unsecured property tax bills as well as pay a Property Tax Bill online.

Penalty Cancellation Requests Related To Covid 19 Treasurer And Tax Collector

Penalty Cancellation Requests Related To Covid 19 Treasurer And Tax Collector

The average effective property tax rate in King County is 093.

King county unsecured property tax. The Tax Collector now has drop boxes available for your convenience. PLEASE CONTACT THE TAX COLLECTORS OFFICE TO INQUIRE ABOUT YOUR BILL AT 559 852-2479. Unsecured Property taxes are ad-valorem value based property tax that is a.

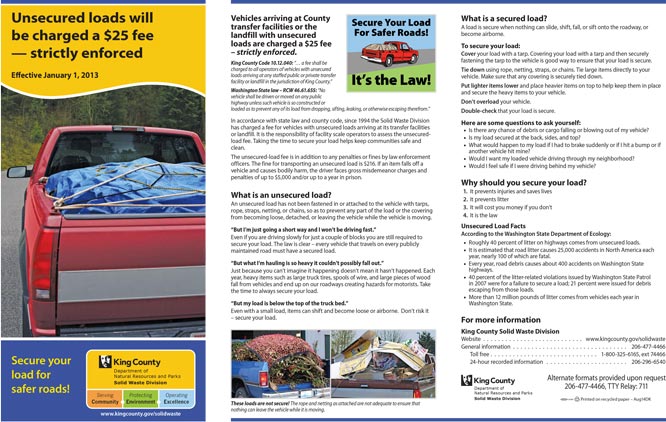

The rope and netting as attached are not adequate to ensure that nothing can leave the vehicle while it is moving. Renewal of the EMS regular property tax levy at a rate of 02651000 for. 88 rows King County.

Assessors handbook section 506 property tax audits and audit program. Minimum fee 1 Covers up to 320 pounds 2253. UNSECURED PROPERTY TAX BILLS ARE NOT AVAILABLE ONLINE.

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. These loads are not secure. Many more people in King County are now eligible for help with their property taxes.

Moderate risk waste surcharge 2. All reasonable effort has been made to ensure the accuracy of the data provided. Charitable organizations To qualify for this fee charitable organizations must meet the criteria as defined in King County Code Title 10.

Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. This includes Secured and Unsecured supplemental escaped additional and corrected tax. Although property taxes are collected by the TreasurerTax Collector in Santa Barbara County.

Its also the county with the states highest median annual property tax payment at 4611. PLEASE CONTACT THE TAX COLLECTORS OFFICE TO INQUIRE ABOUT YOUR BILL AT 559 852-2479. You can apply online here.

SECURED PROPERTY TAX BILLS ARE NOT AVAILABLE ONLINE. Secured property taxes are those taxes that are assessed against real property such as. September 8 2014 john chiang.

The most recent secured annual property tax bill and direct levy information is available online along with any bills issued andor due in the most recent fiscal tax year through e-Prop-Tax Sacramento Countys Online Property Tax Information system. To county assessors and interested parties. Property Tax Property taxes are a major source of funding for King County.

Additional property tax information is provided on the secured and unsecured tax pages. Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. The tax laws as described above are enacted by the California State Legislature.

Rates in many King County cities have been falling as home values have been increasing. Please visit this page for more information. WA state refuse tax 36 Total.

King County basic fee. Real Property Tax Real Estate 206-263-2890. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844.

King County Treasury Operations 201 S. This is normally the base year value of the property established in accordance with Proposition 13 plus the annual inflation factor or current market value whichever is lower. One drop box is located in the parking lot behind the Tax Collectors Office and the other one is located in the courtyard in front of the Tax Collectors office adjacent to the front door.

RCW 7093097 external link and King County Code 1012040 require an unsecured-load fee which is charged by facility scale operators. Solid Waste Chapter 1004020. Jackson Street Suite 710 Seattle WA 98104 NOTE NEW MAILING ADDRESS.

King Countys 39 cities Sound Transit the Port of Seattle and the Library systems also receive funding from property taxes. The value upon which your taxes are calculated. More than half of the revenue levied from property taxes is directed to our state and local schools to fund education.

Senior CitizensDisabled Exemption. Property and special taxes department 450 n street sacramento california po box 942879 sacramento california 94279-0064 1-916 274-3350 fax 1-916 285-0134 wwwboecagov.

Https Www Co Monterey Ca Us Navid 9122

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Https Www Co Monterey Ca Us Navid 9122

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Penalty Cancellation Due To A Lost Payment Affidavit Treasurer And Tax Collector

Unsecured Property Taxes Treasurer And Tax Collector

Unsecured Property Taxes Treasurer And Tax Collector

Unsecured Property Taxes Treasurer And Tax Collector

Unsecured Property Taxes Treasurer And Tax Collector

Https Www Co Monterey Ca Us Navid 9122

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

Property Tax Balance Due Unsecured Treasurer And Tax Collector

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home