King County Washington Property Tax Calculator

Overview of King County WA Taxes King County Washingtons average effective property tax rate is 093. Help slow the spread of COVID-19.

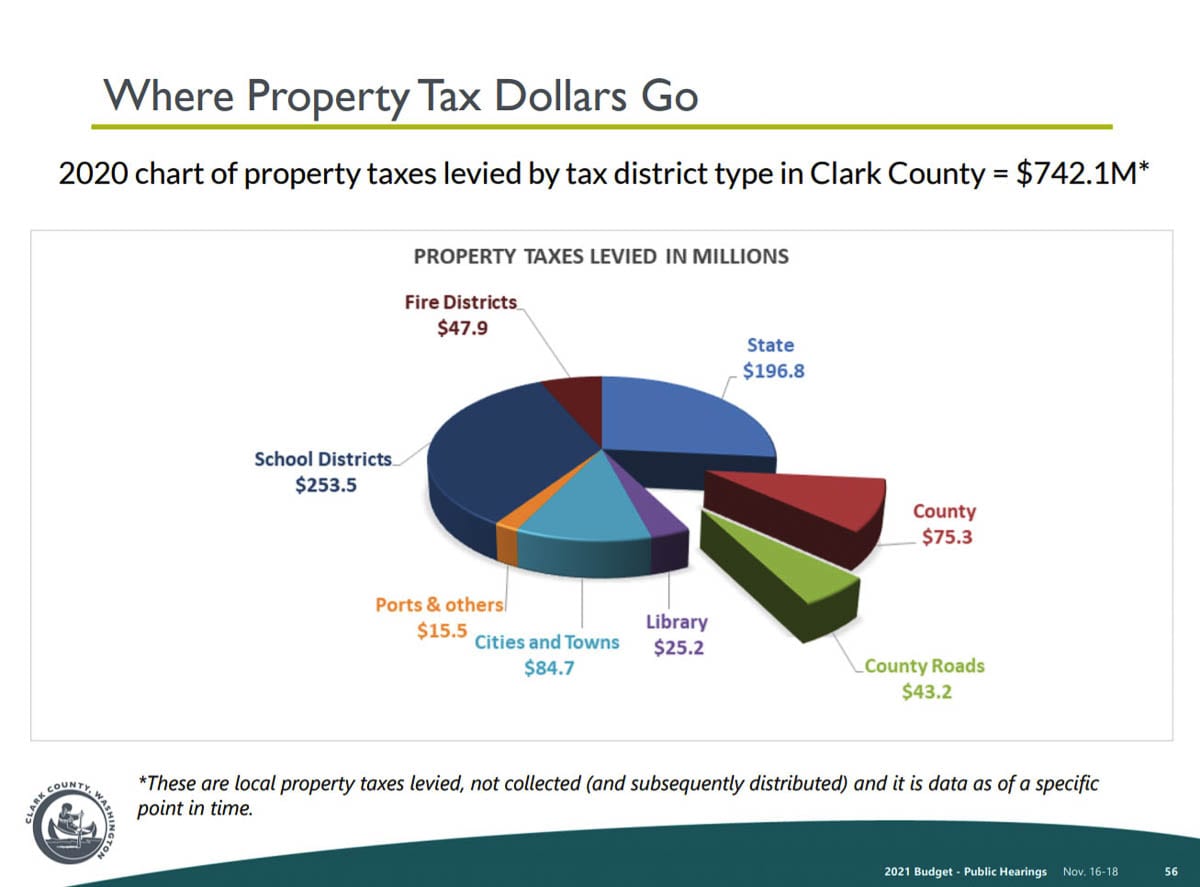

Clark County Council Approves 557 Million Budget For 2021 Clarkcountytoday Com

Clark County Council Approves 557 Million Budget For 2021 Clarkcountytoday Com

King County Treasury Operations 201 S.

King county washington property tax calculator. Its also the county with the states highest median annual property tax payment at 4611. Tax season is here and Washington vehicle and boat owners can view their registration fees taxes and donations paid since January 2019. Continue to wear a mask avoid crowds and keep 6 feet apart.

King County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Controlling interest transfer returns and payment should be mailed directly to the department at the address on the top left corner of the return. Rates in many King County cities have been falling as home values have been increasing.

The median property tax also known as real estate tax in King County is 357200 per year based on a median home value of 40770000 and a median effective property tax rate of 088 of property value. Thats exactly equal to the state of Washingtons overall average effective property tax rate. King County is now in Phase 3 of the states Healthy Washington - Roadmap to Recovery plan.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. Our Washington Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Washington and across the entire United States.

I-976 30 car tab ruled unconstitutional On October 15 2020 the Washington State Supreme Court ruled I-976 unconstitutional. County assessor and treasurer websites. Tukwila WA 98188 Tel.

Washington State Department of Revenue Taxpayer Account Administration PO Box 47464 Olympia WA 98504-7464. King County Washington Property Tax Calculator Show 2015 Show 2016 Show 2017 Show 2018 Show 2019 Show 2020 Places Receiving the Most Value for Their Property Taxes. Tukwila WA 98188 Tel.

You can estimate what your property taxes will be if you know the assessed value of your property and the tax levy rate. King County Assessor John Wilson Taxpayer Transparency Tool 2021 Taxes Tax Relief Commercial COVID Impact Electronic Valuation Notices Look up Property Info eReal Property eSales eMap Go Paperless eValuations. Learn how to get the COVID-19 vaccine in King County.

The assumption is the sole provider is working full-time 2080 hours per year. King County collects on average 088 of a propertys assessed fair market value as property tax. The average effective property tax rate in King County is 093.

View free COVID-19 testing locations hours and contact information. For example if the assessed value of your property is 200000 and the levy rate is 13 per thousand dollars of value. Jackson Street Suite 710 Seattle WA 98104 NOTE NEW MAILING ADDRESS.

Living Wage Calculation for King County Washington. 1368000 reduced value x 11 current RTA excise tax rate 15000 due This method of calculating the tax ensures that owners of the same type of vehicle pay the same amount of tax. Real Property Tax Real Estate 206-263-2890.

Our King County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Washington and across the entire United States. While local sales taxes in Seattle Tacoma and some other metro areas are significantly higher than the national average all areas in Washington are devoid of local income taxes. Department of Revenue REET.

88 rows King County. King County WA Property Tax Calculator Houses 5 days ago City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. Renewal of the EMS regular property tax levy at a rate of 02651000 for.

Section 8 Office 700 Andover Park W. Yearly median tax in King County The median property tax in King County Washington is 3572 per year for a home worth the median value of 407700. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

A financial advisor in Washington can help you understand how taxes fit into your overall financial goals.

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Washington County Or Property Tax Calculator Smartasset

Washington County Or Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

10785 North Little Point Road Buying First Home Mortgage Rates Mortgage

10785 North Little Point Road Buying First Home Mortgage Rates Mortgage

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Labels: calculator, king, property, washington

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home