Capital Gains Tax Quebec Property

A 100000 capital gain for someone with 75000 of other income in Ontario will generate about 19859 of tax payable 20. Capital Gains Taxes on Property.

How To Pick And Analyze Where To Invest Out Of State Blog Cash Flow Investing Positive Cash Flow

How To Pick And Analyze Where To Invest Out Of State Blog Cash Flow Investing Positive Cash Flow

A good capital gains calculator like ours takes both federal and state taxation into account.

Capital gains tax quebec property. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. A capital gain rate of 15 applies if your taxable income is 78750 or more but less than 434550 for single filers. When selling an inherited property you are liable for the taxation of 50 of the capital gains.

Long-term capital gains tax rates are set at 0 15 and 20 based on your income. The passing of a primary residence through inheritance is considered a primary residence sale and as such there is no capital gains tax. The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year.

But you may be able to. These rates apply to properties held for longer than one year. Which rate your capital gains.

The Canadian Annual Capital Gains Tax Calculator is updated for the 202122 tax year. When selling your primary residence capital gains are not taxable. 50000 - 20000 30000 long-term capital gains.

Instead of owing capital gains taxes on the 350000 profit from the sale you would owe taxes on 250000. Capital Gains and Losses IN-120-V This guide is intended for individuals including trusts who disposed of capital property including incorporeal capital property during their taxation year or who are members of a partnership that disposed of such property during a. If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. 461700 for head of household or 244425 for. Capital Gains Taxes on Owner-Occupied Real Estate If you sell your home for a profit thats considered a capital gain.

When selling a commercial. Since your property is in Canada 50 of the total capital gains profit is subject to tax. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

Now if the property is under your personal name the 75000 is added to your overall income. The taxes are determined by a unique tax bracket that is lower than the ordinary tax rates that apply to income. If someone bought shares for 10000 and sold them for 15000 the total capital gain amount would be 5000 and they would pay the marginal tax rate on the 5000 capital gain.

In that case youd meet the requirements for a capital gains tax. And in Quebec someone with 150000 of. Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income.

If your gains are greater than your losses 50 of the excess must be. If you disposed of capital property such as shares virtual currency bonds debts land or buildings including a principal residence you may have to include a portion of the gain realized in your income. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on.

For instance if you earn 80000 taxable income in Ontario and you sold a capital property in BC with a total capital gain of 1000 you will pay 15740 in capital gains tax based on the capital gains tax rate of 1574 in Ontario. Capital Gains Tax Rate In Canada 50 of the value of any capital gains are taxable. To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price.

Capital Gains Tax Rate British Columbia. So for 2020 the maximum you could pay for short-term capital gains on rental property is 37. 488850 for married filing jointly or qualifying widower.

When selling secondary residences capital gains are taxable. If you have more than 3000 in excess capital losses the amount over 3000 can be carried forward to future years to offset capital gains or income in those years. New Hampshire and Tennessee dont tax income but do tax dividends and interest.

When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. 150000 x 50 75000. Divide that number in half 50 and that amount will be taxed according to your income tax bracket the province you live in and your personal living situation.

The total taxable amount for this property is 75000. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2021.

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Steps To Take In Calculating Capital Gains For Selling Foreign Property

A Guide To Buying Property In Panama Buying Property Real Estate Buying Real Estate Values

A Guide To Buying Property In Panama Buying Property Real Estate Buying Real Estate Values

Pin On Real Estate Money Laundering

Pin On Real Estate Money Laundering

Condominium Tax Rebate Gst Hst Housing Rebate Canada Home Tax Rebate Rebates Condominium Tax

Condominium Tax Rebate Gst Hst Housing Rebate Canada Home Tax Rebate Rebates Condominium Tax

Suez Canal Critical Waterway Comes To A Halt The Briefing The Suez Canal Is One Of The Worlds Most Important Waterways Connecting Asia A In 2021 Suez Waterway Canal

Suez Canal Critical Waterway Comes To A Halt The Briefing The Suez Canal Is One Of The Worlds Most Important Waterways Connecting Asia A In 2021 Suez Waterway Canal

Canada Capital Gains Tax Calculator 2021 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2021 Real Estate Stocks Wowa Ca

Faults In Project Documentation That Can Break Claims Consultancy Quora Budgeting Agile Software Development Software Development

Faults In Project Documentation That Can Break Claims Consultancy Quora Budgeting Agile Software Development Software Development

Important Ways To Increase Home Value Within A Short Time Home Values House Removals House

Important Ways To Increase Home Value Within A Short Time Home Values House Removals House

Toronto Realtors Frustrated By The Soaring Housing Market Marketing House Prices Housing Market

Toronto Realtors Frustrated By The Soaring Housing Market Marketing House Prices Housing Market

This News Could Not Be Found Lease Rent Rent To Own Homes

This News Could Not Be Found Lease Rent Rent To Own Homes

Health Insurance Plans Best Money Making Apps Health Insurance Plans Insurance Policy

Health Insurance Plans Best Money Making Apps Health Insurance Plans Insurance Policy

New Housing Tax Rebate Canadahometaxrebate Rebates Tax Canada

New Housing Tax Rebate Canadahometaxrebate Rebates Tax Canada

Jerusalem Israel Old City At The Western Wall And The Dome Of The Rock Sponsored Ad City Israel Jerusalem Western Travel Culture Travel Escorted Tours

Jerusalem Israel Old City At The Western Wall And The Dome Of The Rock Sponsored Ad City Israel Jerusalem Western Travel Culture Travel Escorted Tours

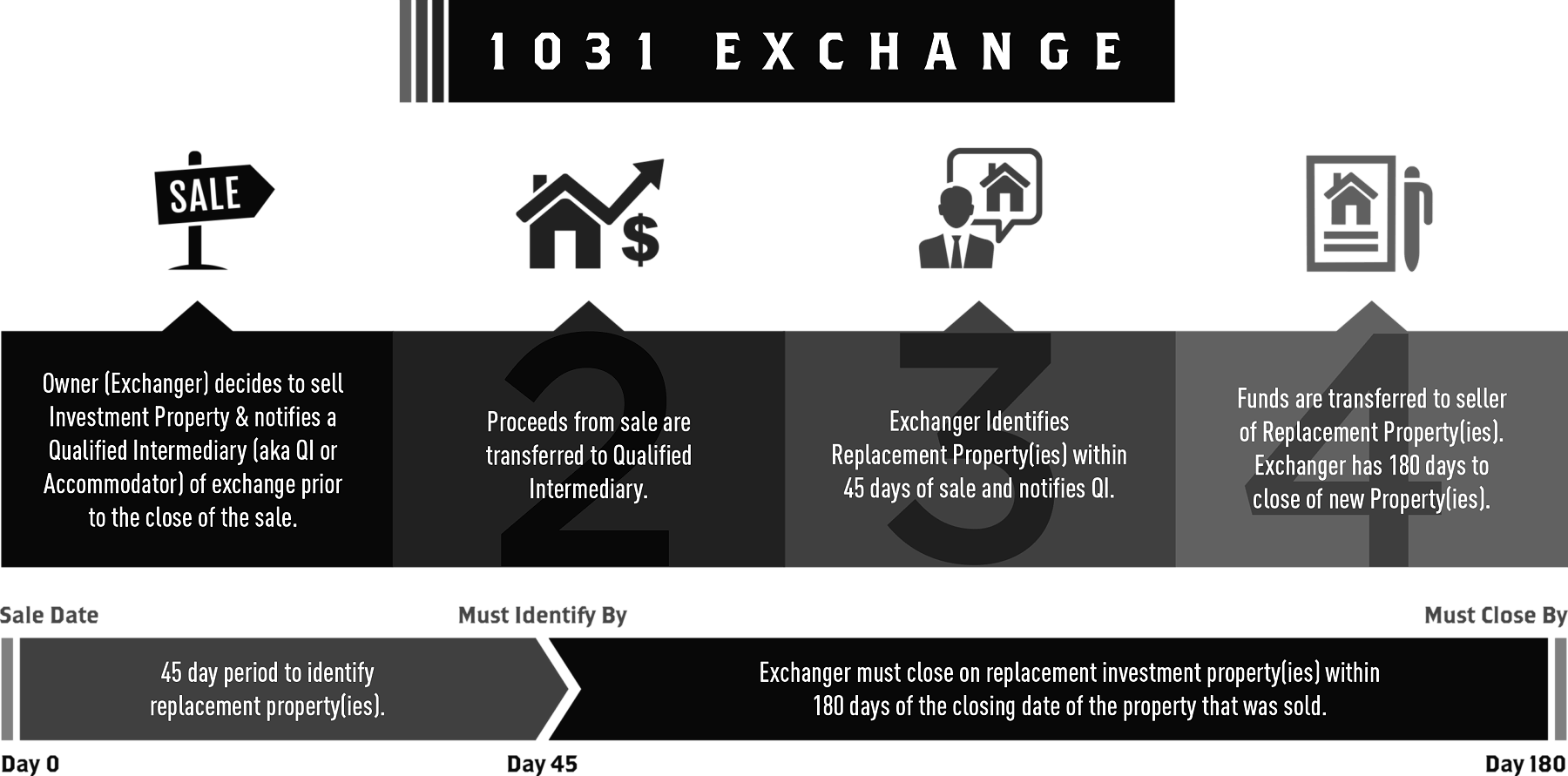

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

Understanding The Tfsa Updated For 2021 Tax Free Savings Finance Saving Savings Account

Understanding The Tfsa Updated For 2021 Tax Free Savings Finance Saving Savings Account

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert Taxithere Helps To File Your Income Tax Re Income Tax Income Tax Return Paying Taxes

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert Taxithere Helps To File Your Income Tax Re Income Tax Income Tax Return Paying Taxes

Tokenmarket Announces Inaugural Token Economy Conference In Gibraltar Token Economy Inauguration Economy

Tokenmarket Announces Inaugural Token Economy Conference In Gibraltar Token Economy Inauguration Economy

Rsus Explained Tax Saving Strategies Cordant Wealth Partners

Rsus Explained Tax Saving Strategies Cordant Wealth Partners

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home