Is There A Grace Period For Property Taxes

Payment must be received or postmarked within 10 calendar days of the due date. April 29 2020 152 PM1 min read.

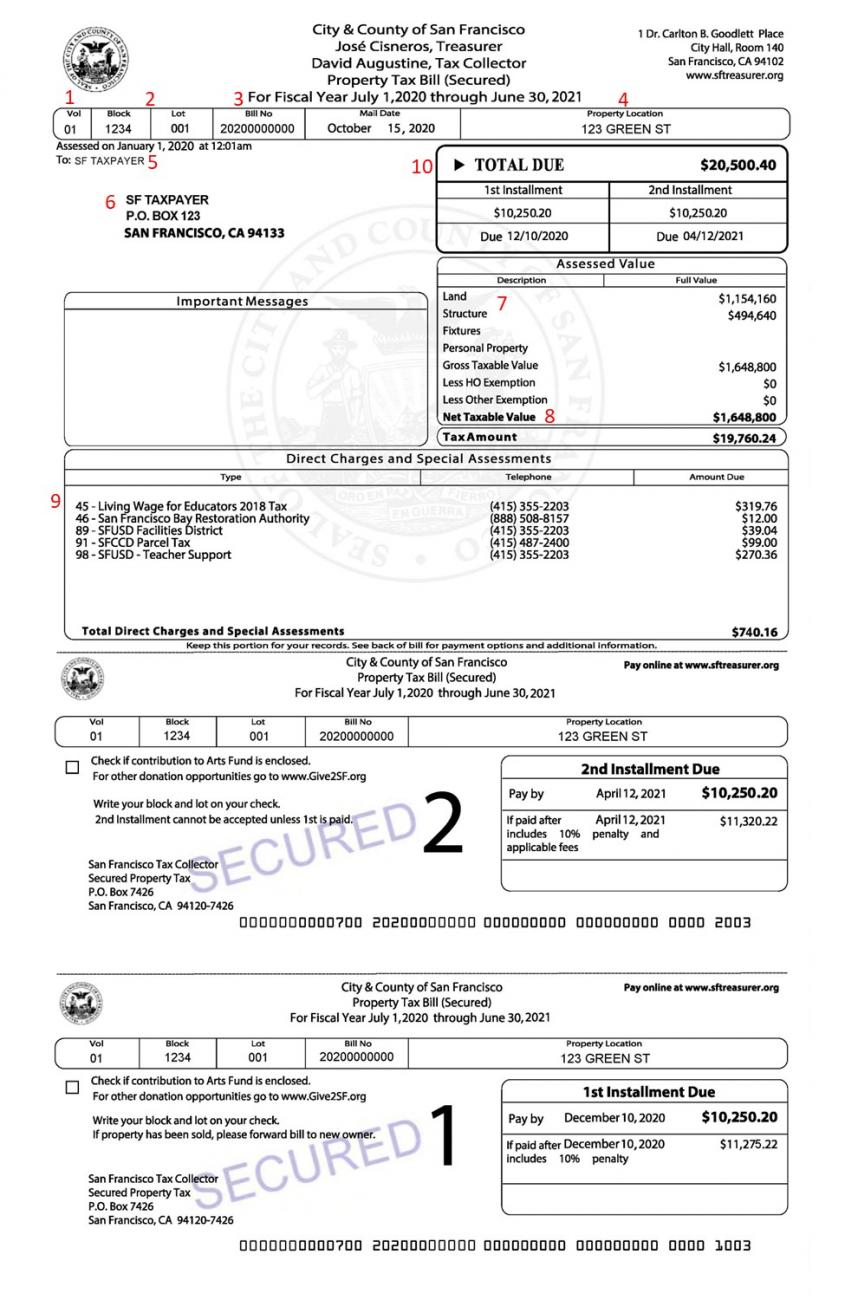

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property taxes make up at least 94 percent of the states General Fund which.

Is there a grace period for property taxes. One of the most enduring costs when it comes to owning real estate is the real estate or property tax. Their next payment is due June 1. See the tax deadline for extensions when taxes are due for estimated payments how to save on taxes before the deadline.

You can deposit the insurance premiums and tax payments in that account and the lender will pay them off on your behalf. Under existing law towns may only allow for a grace period of up to 10 days after the property tax deadline without interest or penalty. And there is no money to pay it said Karpf.

Thus once the one-month grace period passes taxpayers who are late will owe interest for that month plus any additional months or partial months that pass before they pay. The Karpfs pay 10000 a year in property taxes. HILLSBOROUGH NJ Hillsborough Mayor Doug Tomson and the.

The first installment deadline for 2020 property taxes is due on March 2 but property owners will now be able to pay without a late fee until May 3. Where does your property tax go. Tax Day this year is May 17 2021.

Treasurer Maria Pappas has announced a two month grace period on property tax late fees. There is a ten day grace period. State funding for certain school districts.

Late fees also will be waived for two months for the second installment due later this year. In fact taxes on your real estate endure long after any mortgage loan on it has ended. You can go ahead and open an escrow account with your lender.

Hoosiers are being given a 60-day grace period to pay the first installment of their property tax bills without penalty in this coronavirus-plagued. In the aftermath of Superstorm Sandy the law was amended to allow towns that have experienced a flood hurricane superstorm tornado or other natural disaster to extend the grace period for up to a month in certain circumstances. In 2018 the Legislature made additional changes to lower the levy rate for taxes in 2019.

As long as you do so within the grace period also called the perfection period your filing will be considered on time. Due dates for paying property taxes vary depending on a propertys assessed value. Each due date has a two-week grace period during which payments can be made without a late interest penalty.

Under existing law towns may only allow for a grace period of up to 10 days after the property tax deadline without interest or penalty. Towns have only limited statutory authority to waive interest on delinquent property taxes. As far as I know there is a grace period for mortgage payments but I havent heard of grace period for tax payments.

Generally speaking the grace periods are 5-10 calendar days for e-filed returns and 5 calendar days for extensions. Extra Time for Quarterly Payers If you pay your property taxes quarterly you are entitled to pay interest-free if you pay by the 15th July 15 October 15 January 15 or April 15. This is called a grace period.

Any taxes remaining unpaid nine calendar days following the due date are subject to interest at the rate of 8 per annum on the first 1500 and 18 per annum for any amount over 1500 retroactive to the first of the month. Thus once the one-month grace period passes taxpayers who are late will owe interest for that month plus any additional months or partial months that pass before they pay. The township grants a 10-day grace period.

Hillsborough Extends Grace Period For Property Tax Payments. Voter-approved property taxes imposed by school districts. Property taxes are due in June and September.

If the last day of the grace period falls on a weekend or a federal holiday the payment is due the. Property taxes imposed by the state. For properties with assessed values less than 250000 property owners make quarterly tax payments on July 1 October 1 January 1 and April 1.

Is there a grace period for property taxes. Taxpayers must pay their property taxes within one month after the due date.

Quickbooks Updates New Quickbooks Accounting Software Updates Tax Software Earn More Money Tax Preparation

Quickbooks Updates New Quickbooks Accounting Software Updates Tax Software Earn More Money Tax Preparation

How To Hire A Good Title Company Title Insurance Home Protection Title

How To Hire A Good Title Company Title Insurance Home Protection Title

How Many Days Can You Be Late On Your Real Estate Taxes

How Many Days Can You Be Late On Your Real Estate Taxes

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

17 Big Advantages And Disadvantages Of Foreign Direct Investment Investing Directions Foreign

17 Big Advantages And Disadvantages Of Foreign Direct Investment Investing Directions Foreign

How To Create A Budget I Can Follow Family Budget Budgeting Budgeting Money

How To Create A Budget I Can Follow Family Budget Budgeting Budgeting Money

New Budget Spreadsheet Excel Template Exceltemplate Xls Xlstemplate Xlsformat Exc Budget Spreadsheet Excel Templates Budget Spreadsheet Household Expenses

New Budget Spreadsheet Excel Template Exceltemplate Xls Xlstemplate Xlsformat Exc Budget Spreadsheet Excel Templates Budget Spreadsheet Household Expenses

Office Lease Agreement Template Fresh 10 Fice Lease Agreement Templates Rental Agreement Templates Lease Agreement Good Essay

Office Lease Agreement Template Fresh 10 Fice Lease Agreement Templates Rental Agreement Templates Lease Agreement Good Essay

Why Homes Are More Affordable Now Video Real Estate School Real Estate Agent Real Estate

Why Homes Are More Affordable Now Video Real Estate School Real Estate Agent Real Estate

State Of Florida 2020 Sales Tax Holiday Mortgage Masters Group Tax Holiday Sales Tax State Of Florida

State Of Florida 2020 Sales Tax Holiday Mortgage Masters Group Tax Holiday Sales Tax State Of Florida

Home Buyers Looking In Chicago Uic Little Italy Taylor Dt Neighborhood Video In 2021 Homeschool Organization Chicago School Counselor

Home Buyers Looking In Chicago Uic Little Italy Taylor Dt Neighborhood Video In 2021 Homeschool Organization Chicago School Counselor

How To Not Get Lost In The World Of Security Deposits Security World Deposit

How To Not Get Lost In The World Of Security Deposits Security World Deposit

Room Rental Agreement Template Real Estate Forms Room Rental Agreement Rental Agreement Templates Lease Agreement Free Printable

Room Rental Agreement Template Real Estate Forms Room Rental Agreement Rental Agreement Templates Lease Agreement Free Printable

Doctors Notes For School Check More At Https Nationalgriefawarenessday Com 40085 Doctors Notes For School

Doctors Notes For School Check More At Https Nationalgriefawarenessday Com 40085 Doctors Notes For School

Are Appraisals Being Delayed And Modified To Speed Loan Deals Appraisal Mortgage Info Loan Signing Agent

Are Appraisals Being Delayed And Modified To Speed Loan Deals Appraisal Mortgage Info Loan Signing Agent

Shocking Truth About Renting An Apartment Apartments For Rent In Michigan Brookfield Management Rental Property Investment Being A Landlord Property Management

Shocking Truth About Renting An Apartment Apartments For Rent In Michigan Brookfield Management Rental Property Investment Being A Landlord Property Management

How To Back Out Of An Accepted Home Purchase Offer Bankrate Real Estate Nj Buying Investment Property Multifamily Property Management

How To Back Out Of An Accepted Home Purchase Offer Bankrate Real Estate Nj Buying Investment Property Multifamily Property Management

House Rental Contract Lease Agreement Free Printable Contract Template Rental Agreement Templates

House Rental Contract Lease Agreement Free Printable Contract Template Rental Agreement Templates

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home