Average Property Tax In King County Wa

King County collects the highest property tax in Washington levying an average of 357200 088 of median home value yearly in property taxes while Ferry County has the lowest property tax in the state collecting an average tax of 94100 064 of median home value per year. Property tax single family residential and non-single family residential property.

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

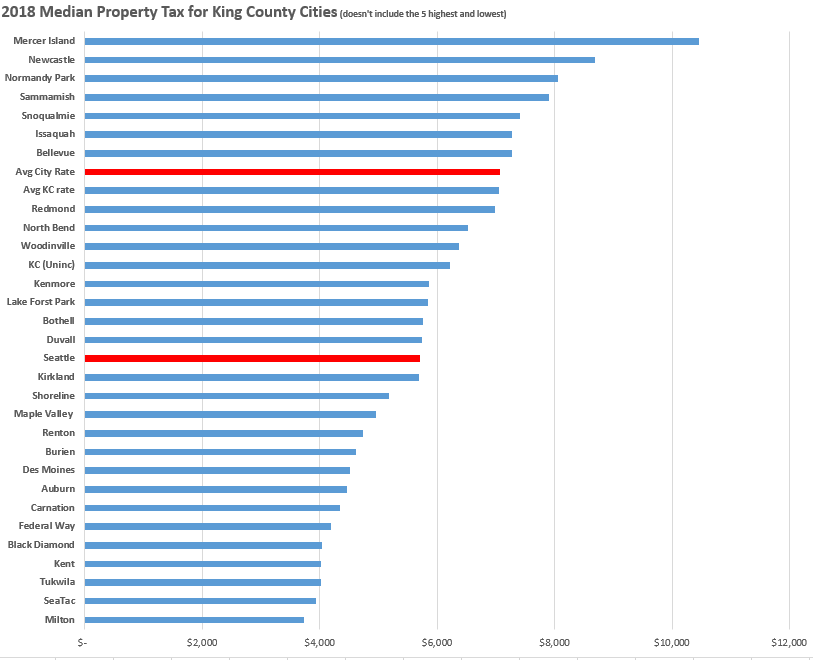

King County residents on average paid 4611 annually in property taxes the highest such tax levies among all regions of Washington according to a new Tax Foundation analysis.

Average property tax in king county wa. This chart shows the households in King County WA distributed between a series of property tax buckets compared to the national averages for each bucket. To qualify for taxes payable in 2020 andor 2021 you will need to meet the following criteria. New data shows King County homeowners pay among the highest property taxes in the country and that tax bills have been growing quickly with soaring property values and newly approved tax hikes.

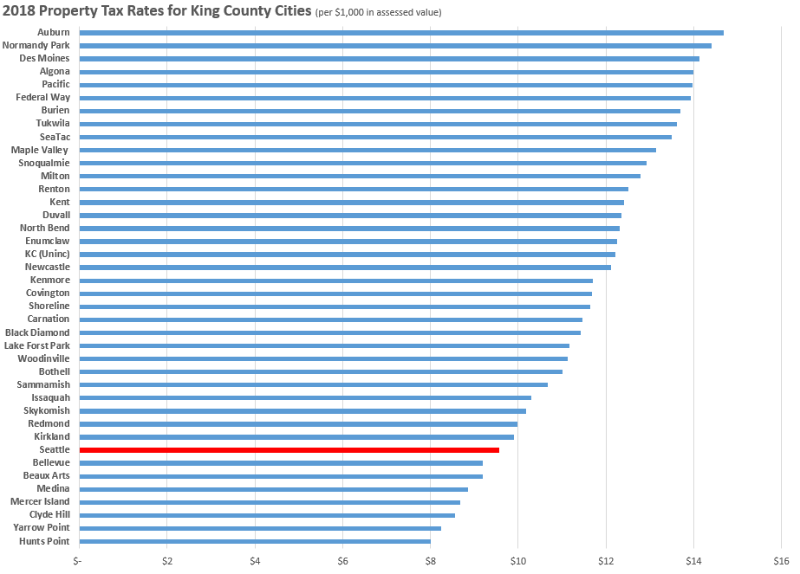

Rates in many King County cities have been falling as home values have been increasing. 88 rows King County. Real property taxes for homes buildings and land and personal property taxes for equipment machinery and mobile homes located in mobile home parks.

Renewal of the EMS regular property tax levy at a rate of 02651000 for the. The statewide average levy rate was 1120 per 1000 assessed value for taxes due in 2017. Instead of a fixed amount the annual income limit is now indexed at 65 of the median household income in King County which for 2019 was 58423.

Its also the county with the states highest median annual property tax payment at 4611. The median property tax on a 40770000 house is 375084. The exact property tax levied depends on the county in Washington the property is located in.

King County Assessor John Wilson Taxpayer Transparency Tool 2021 Taxes Tax Relief Commercial COVID Impact Electronic Valuation Notices Look up Property Info eReal Property eSales eMap Go Paperless eValuations. King County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Property tax residential values by county.

King County residents pay two different types of property taxes. For example if the assessed value of your property is 200000 and the levy rate is 13 per thousand dollars of value. Property tax relief programs.

The median property tax on a 40770000 house is 358776 in King County. The Tax Foundation study was based on median property taxes paid within counties in. 2019 Property tax statistics - all tables available February.

200 200000 divided by 1000 x LEVY RATE. Of this the combined local regular tax rate was 485 the local voter-approved rate was 430 and the state school levy was 189. The average effective property tax rate in King County is 093.

In King County WA the largest share of households pay taxes in the 3k range. The median single-family home value in Seattle dropped slightly from 690000 to 674000 and taxes for the median home dropped about 15 or about 9250 according to the assessors office. Overall King County property owners pay a median of 4611 in property taxes.

In the state of Washington the median amount of property taxes paid by residents is 3601. The income limit is now indexed to 65 of the median household income in King County. King county unincorporated4390001426220 49200013638026.

How does the one percent levy limit affect property taxes on individual homes. 2020 Property tax statistics - all tables available August 2020. The new limit is 58423 rather than set at a fixed amount.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the King County Tax Appraisers office. These changes take effect for property taxes collected in 2020. The median property tax also known as real estate tax in King County is 357200 per year based on a median home value of 40770000 and a median effective property tax rate of 088 of property value.

Property tax state assessed utility values.

Washington Property Tax Calculator Smartasset

Washington Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Herbold Where Do Your Property Taxes Go Why Are They Increasing In 2018 Westside Seattle

Herbold Where Do Your Property Taxes Go Why Are They Increasing In 2018 Westside Seattle

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

How Much Is The Property Tax In Seattle Akopyan Company Cpa Seattle Accounting Firm Taxes Payroll Property Tax Accounting Firms Payroll

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

What Is The Olympic Rain Shadow Rain Shadow Map Evergreen State

What Is The Olympic Rain Shadow Rain Shadow Map Evergreen State

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Times Are Tight For Many But King County Still Has To Mail Out Property Tax Bills Knkx

Times Are Tight For Many But King County Still Has To Mail Out Property Tax Bills Knkx

Assessments Are In Pierce County Property Values Continue To Climb Courier Herald

Assessments Are In Pierce County Property Values Continue To Climb Courier Herald

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

King County Wa Property Tax Calculator Smartasset

Some Homeowners In The Puget Sound Region Will Face Big Property Tax Increases Knkx

Some Homeowners In The Puget Sound Region Will Face Big Property Tax Increases Knkx

Herbold Where Do Your Property Taxes Go Why Are They Increasing In 2018 Westside Seattle

Herbold Where Do Your Property Taxes Go Why Are They Increasing In 2018 Westside Seattle

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home