Property Tax Gwinnett County Georgia

R8001 001 or R8001 A 001 OR Property Owner Name OR. Gwinnett Justice Administration Center 75 Langley Drive Lawrenceville GA 30046 Phone.

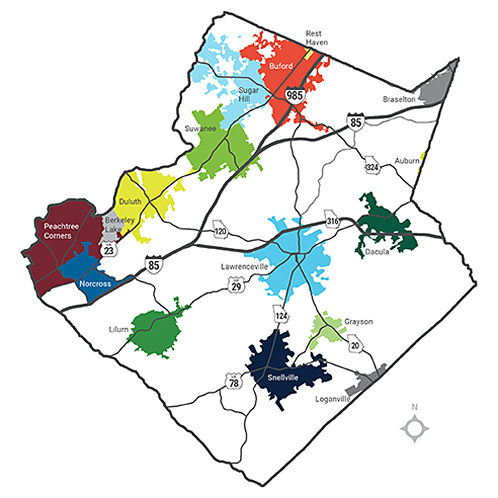

Map Of Gwinnett County Ga Maps Catalog Online

Tax amount varies by county.

Property tax gwinnett county georgia. The median property tax on a 19420000 house is 194200 in Gwinnett County. The best bang for your property tax buck in Georgia is Wilkes County. SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett GA.

Your Parcel Number example. If you are submitting your return by mail metered mail will not be accepted as proof of a timely property tax return. The median property tax on a 19420000 house is 161186 in Georgia.

259 18th Lowest in US Georgia Individual Income Tax. The Tax Commissioner is an elected Constitutional Officer responsible for every phase of collecting property taxes from processing. By viewing the web pages at the Local Government Services Divisions website taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide.

April 14 2021 Part-Time Class Summary. 083 of home value. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

In the Gwinnett County area tax planning is often included with other services like asset management estate planning and retirement planning. Gwinnett County Property Records are real estate documents that contain information related to real property in Gwinnett County Georgia. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties.

Enter one of the following in the search box above. Tax planning strategies will differ depending on depending on where you live. SEE Detailed property tax report for 4544 Lakefaire Ct Gwinnett County GA.

Gwinnett County Lawrenceville GA. The median property tax on a 19420000 house is 203910 in the United States. Georgia does not have a statewide property tax.

Georgia does not have a statewide property tax. This page contains local information about a specific county. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Gwinnett County.

The law provides that property tax returns are due to be filed with the county tax receiver or the county tax commissioner between January 1 and April 1 OCGA. See sample report. Steps to search for additional property information and sales in your neighborhood.

1 day agoGwinnett County Tax Commissioner Tiffany Porter is highlighting several actions her office has taken this year to address accessibility efficiency and operations costs as she reaches her first. 160 rows In general property taxes in Georgia are relatively low. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. In metro Atlanta the best ranking is Gwinnett 81st in the state. Search Help Search Hints.

The median real estate tax. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties. Residents of Georgia are required to file a return of their real property in the county where the real property is located.

238 23rd Highest in US. Bang for the Property Tax Buck. County Property Tax Facts Gwinnett County Property Tax Facts - 1 Top.

7708228000 Open Records Request.

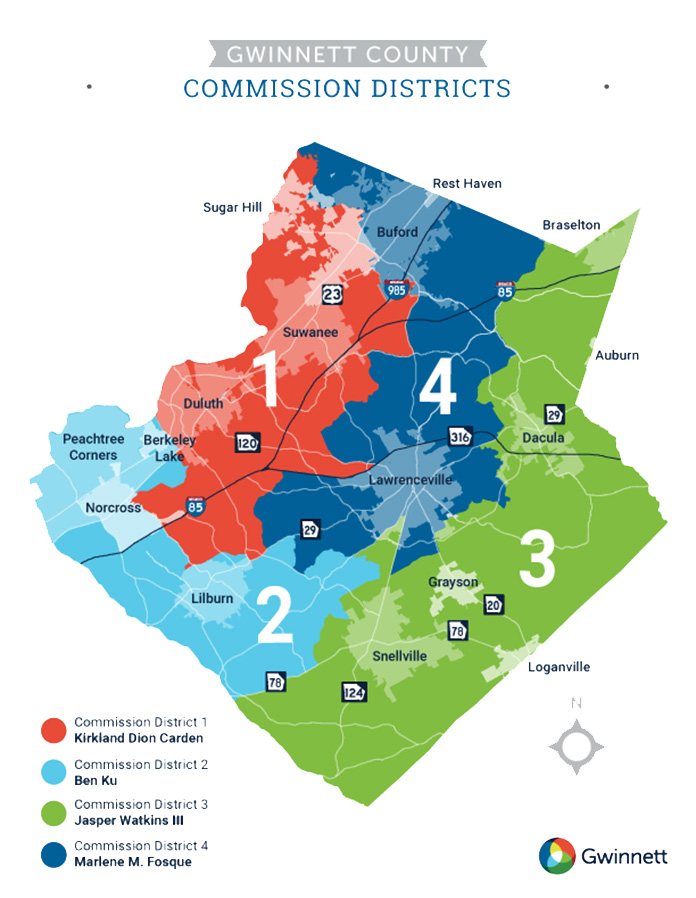

About Gwinnett Gwinnett County

About Gwinnett Gwinnett County

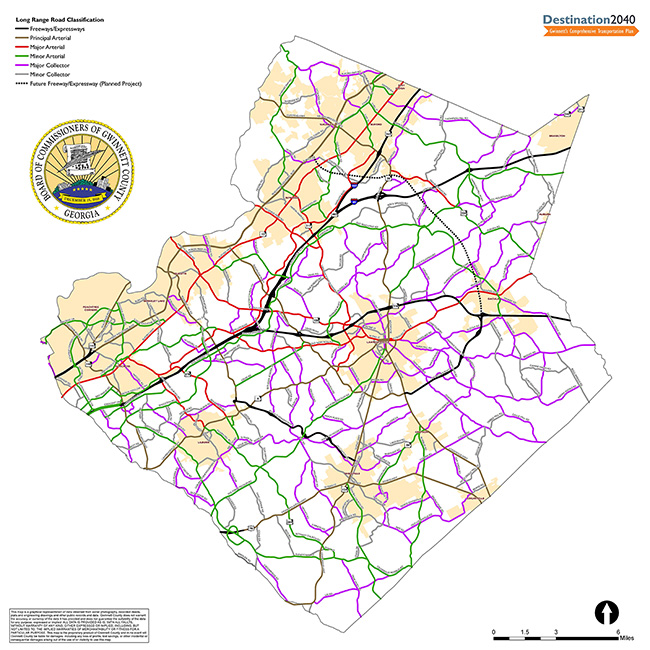

Long Range Road Classification Map Gwinnett County

Long Range Road Classification Map Gwinnett County

Gwinnett County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Gwinnett County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Gwinnett County Property Taxes Due By Oct 15 News Cbs46 Com

Gwinnett County Property Taxes Due By Oct 15 News Cbs46 Com

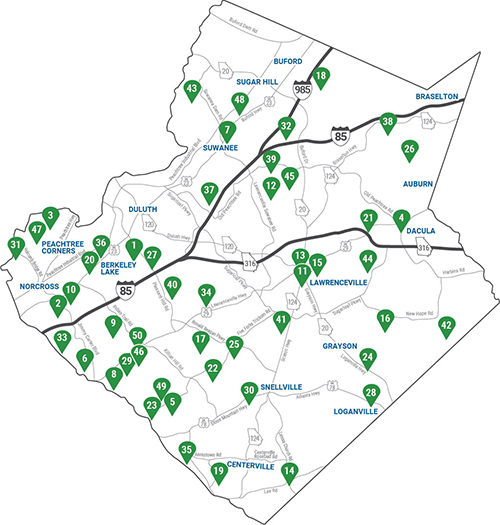

Explore Your Parks Gwinnett County

Explore Your Parks Gwinnett County

Newcomer Magazine Relocation Lifestyle And Living In Atlanta

Gwinnett County Property Tax Bills To Be Mailed By Thur Accesswdun Com

Gwinnett County Property Tax Bills To Be Mailed By Thur Accesswdun Com

Map Of Gwinnett County Ga Maping Resources

Map Of Gwinnett County Ga Maping Resources

Are There Ways To Lower Your Gwinnett County Property Tax

Are There Ways To Lower Your Gwinnett County Property Tax

Municipalities Gwinnett County

Municipalities Gwinnett County

Gwinnett County Property Tax Records Online Property Walls

Gwinnett County Property Tax Records Online Property Walls

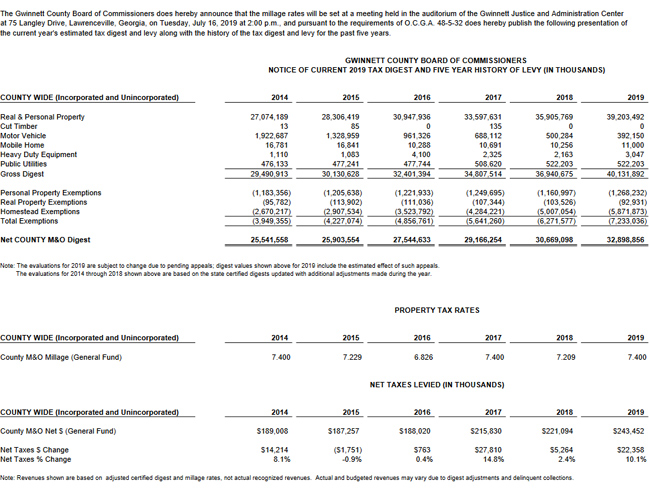

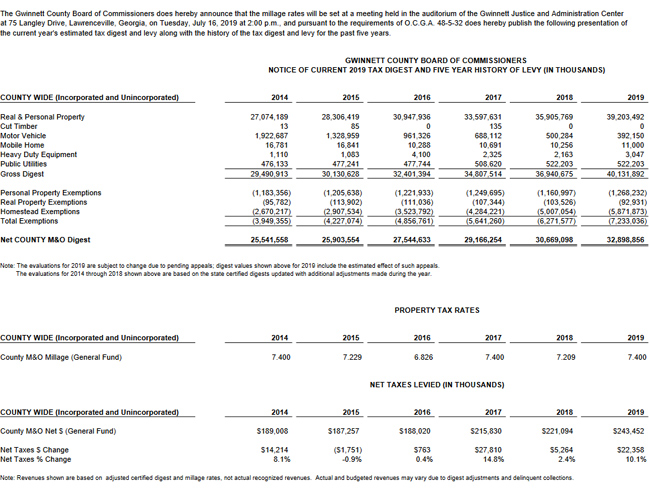

Gwinnett S New Property Tax For Economic Development And Increases

Gwinnett S New Property Tax For Economic Development And Increases

Gwinnett Property Owners Your Tax Bill Is Due

Gwinnett Property Owners Your Tax Bill Is Due

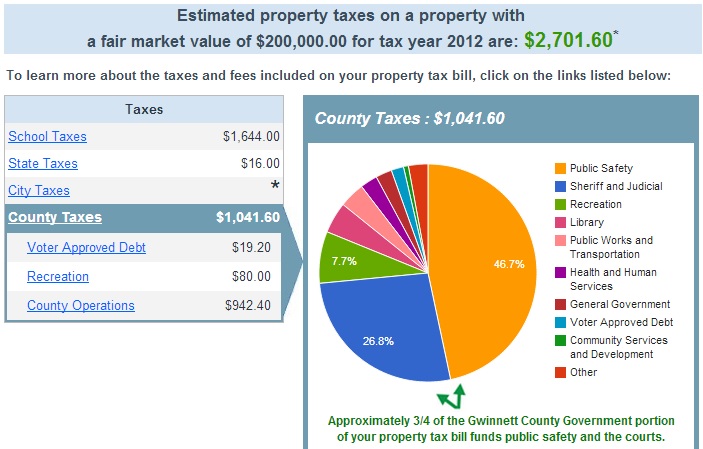

How Your Property Tax Bill Is Calculated In Gwinnett County Ga

How Your Property Tax Bill Is Calculated In Gwinnett County Ga

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home