King County Property Tax Increase 2021

CBSNewYork Property taxes are front and center in Nassau County. In 2021 Clyde Hill will be increasing its property tax rate for the first time since 2015.

Occupy as a primary residence 6 months each year for tax year 2021 Income earned in 2020 for tax year 2021 Income earned in 2019 for tax year 2020.

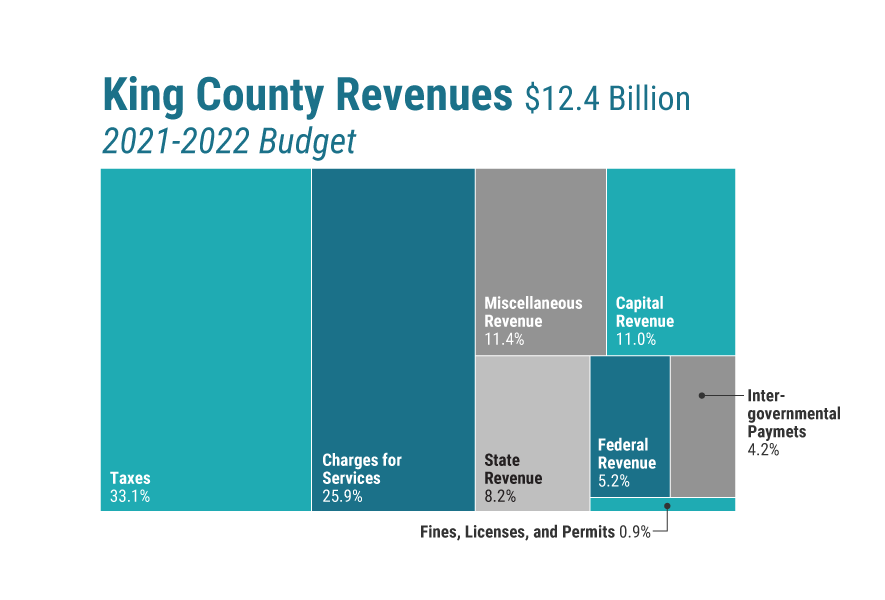

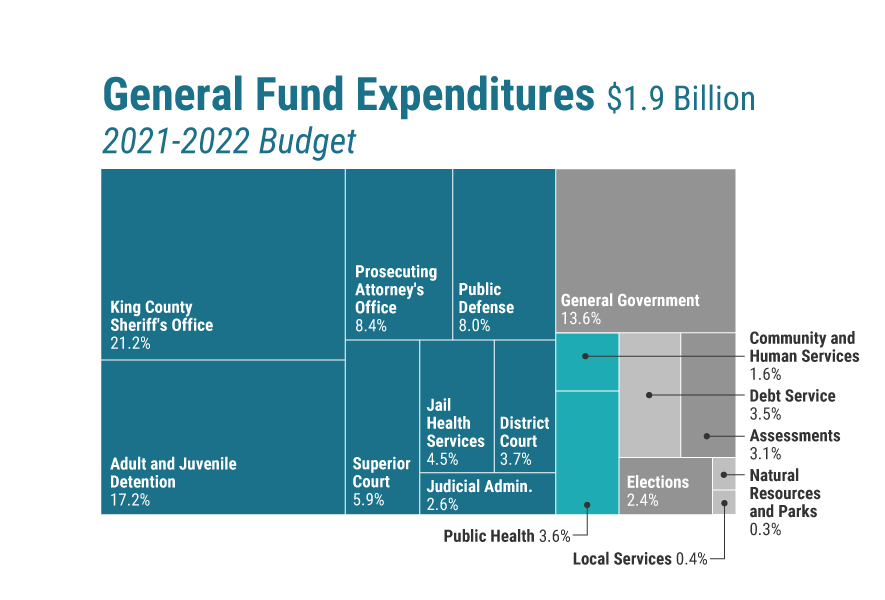

King county property tax increase 2021. King County Council for final approval. King County Property Tax Payment Information. 88 rows Voter approval of special levies in conjunction with a strong housing market will generate a 403 general increase in King County property tax collections for 2021 although some jurisdictions will see double digit increases.

Many more people in King County are now eligible for help with their property taxes. 2020 - 2021 Comparison. And in neighboring Pacific the 2021 property tax bill will jump 13.

According to the King County Assessors Office voter approval of special levies in conjunction with a strong housing market is responsible for a 403 percent general increase in King County property tax collections for 2021. 4 127036778 x 111409. Each agency will update its pages with current information.

King County collects on average 088 of a propertys assessed fair market value as property tax. In the state of Washington the median amount of property taxes paid by residents is 3601. The King County Assessor Office reported 2021 property taxes in Algona have jumped 18.

Passage of Proposition No. The Board of Governance of Valley Regional Fire Authority has adopted Resolution No. 2021 Property Tax City of North Bend.

Annual household income under the new threshold of 58423 including Social Security and other sources RCW 84363835 The information below pertains to the current program. Renewal of the EMS regular property tax levy at a rate of 02651000 for the first year of the six-year levy an increase in rate of 0047381000 from the previous year. Many King County services are continually adapting because of the COVID-19 pandemic.

If approved this proposition would authorize restoration of the regular property levy rate of 1001000 assessed value for collection in 2021 as described in the Resolution. Overall King County property owners pay a median of 4611 in property taxes. This means that the amount you pay in property taxes to Clyde Hill will generally increase depending on how much your property is worth.

King County residents awaiting their property tax bills shouldnt expect a break because of the pandemic County Assessor John Wilson said Wednesday. Approval of points and a current use valuation of 30 and conditional approval of 5 additional points and 20 of assessed value for 862 acres of the property are consistent with KCC Chapter 2036 and w ith the purposes and intent of King County to. The King County Assessors Office announced that it started sending out 2021 property tax bills on Tuesday the first issued since the beginning of the COVID-19 pandemic.

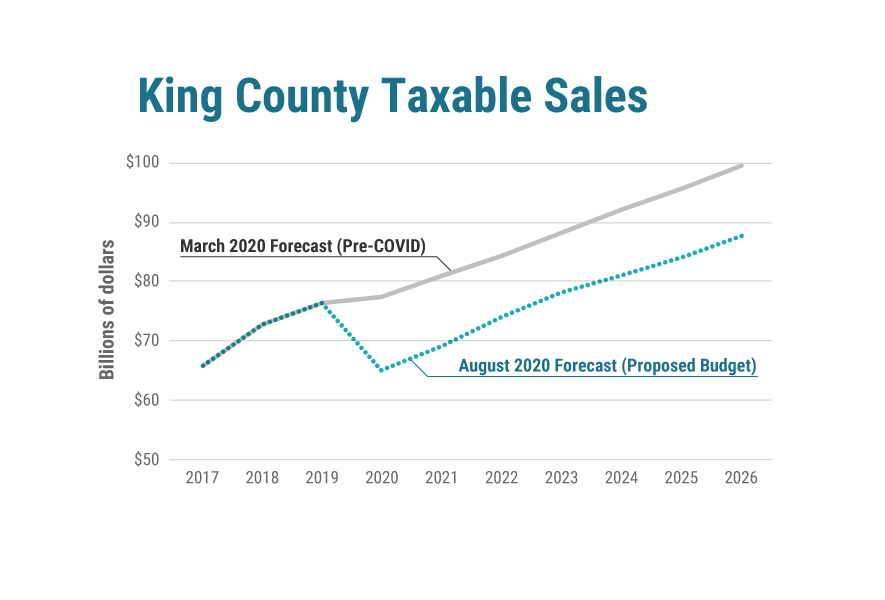

For faster service we recommend applying online. 1000 AV 110115 These calculations are based on King Countys preliminary values. The August 2020 Forecast Proposed Budget estimates King County taxable sales of approximately 65 million in 2020 and less than 70 million in 2021 rising to.

King County Elections and Seattle Foundation to Commit 950000 in Grants to Break Down Barriers to Voting Among Historically Excluded Communities. O King County. State County Port Emergency Medical Road Rural Library Cities and Towns Schools Water Fire Sewer and Miscellaneous Districts.

The effect of this increase on the average Clyde Hill household is estimated to be 200year. Overall countywide property tax collections for the 2021 tax year are 66 billion an increase of 256 million from the previous year of 63 billion. Part of the Voter Education Fund grants will go to over 30 selected organizations to support voter education efforts and increase.

Final values will be released in late November and may update this number. Payment deadline for first half of property taxes is April 30 2021 and second half November 1 2021. The median amount of property taxes paid by King County residents also varies ranging from 1375 in Baring to more than 10000 in places like Clyde Hill and Medina.

408 for collection in 2021 the levy of 41187668 for collection in 2022 the levy of 45055190 for collection in 2023 and the levy of 49285872 for collection in 2024. King County has one of the highest median property taxes in the United States and is ranked 102nd of the 3143 counties in order of median property taxes. Assessed Valuation Levy Year.

Download 2021 paper application and instructions. Most residents can expect. 156 concerning restoring the regular property tax levy to its original rate.

2002 - 2021 Comparison. 1 would allow the levy of 37652132 in property taxes within Auburn School District No. After a county-wide reassessment with more than half of homeowners taxes.

Passage would fund educational programs including all athletics and activities staffing for school resource officers. The median property tax in King County Washington is 3572 per year for a home worth the median value of 407700.

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

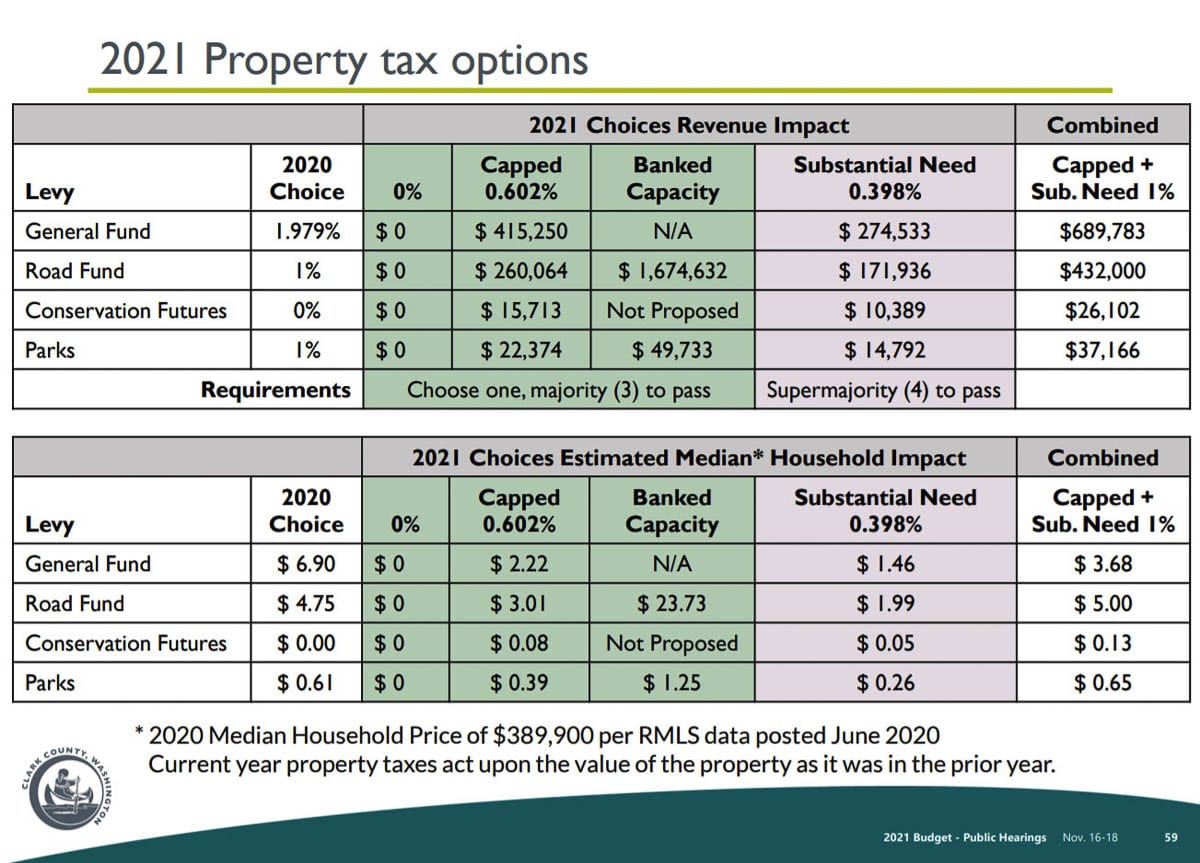

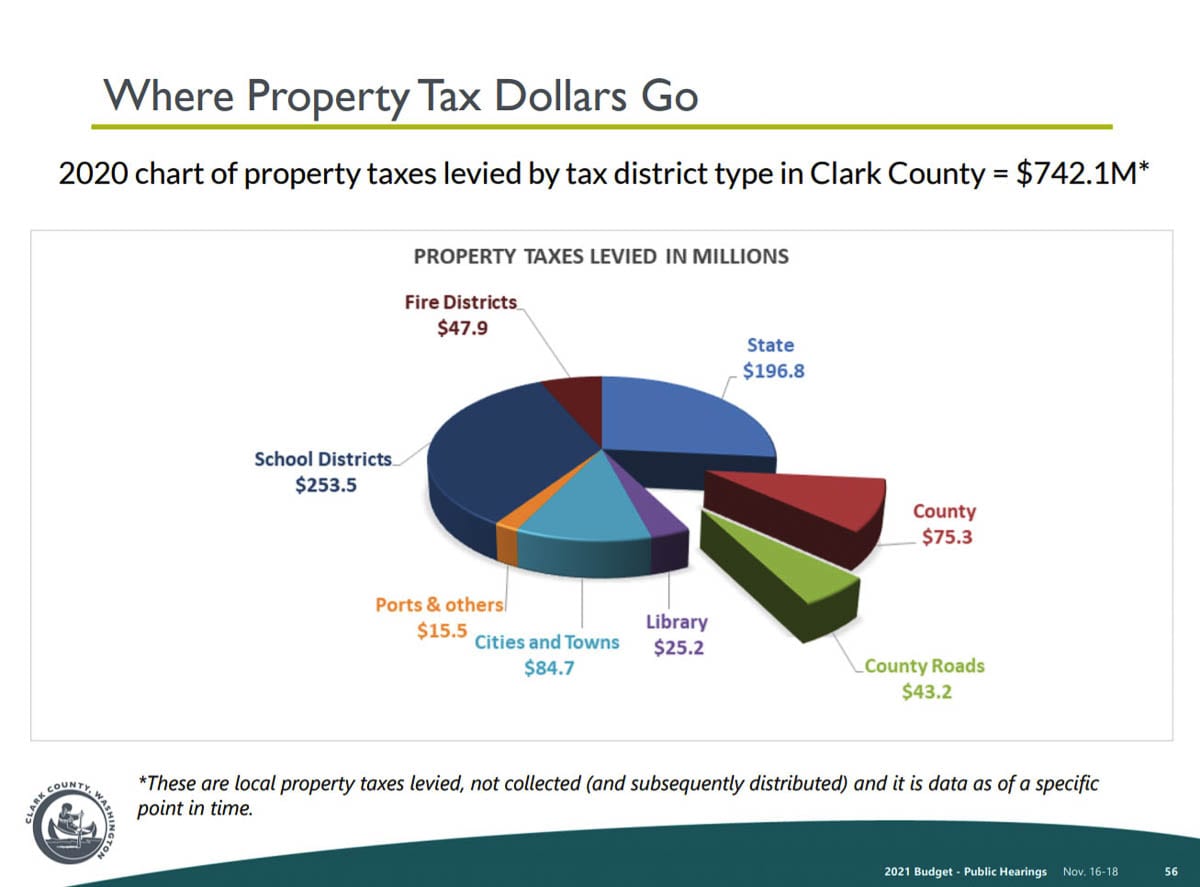

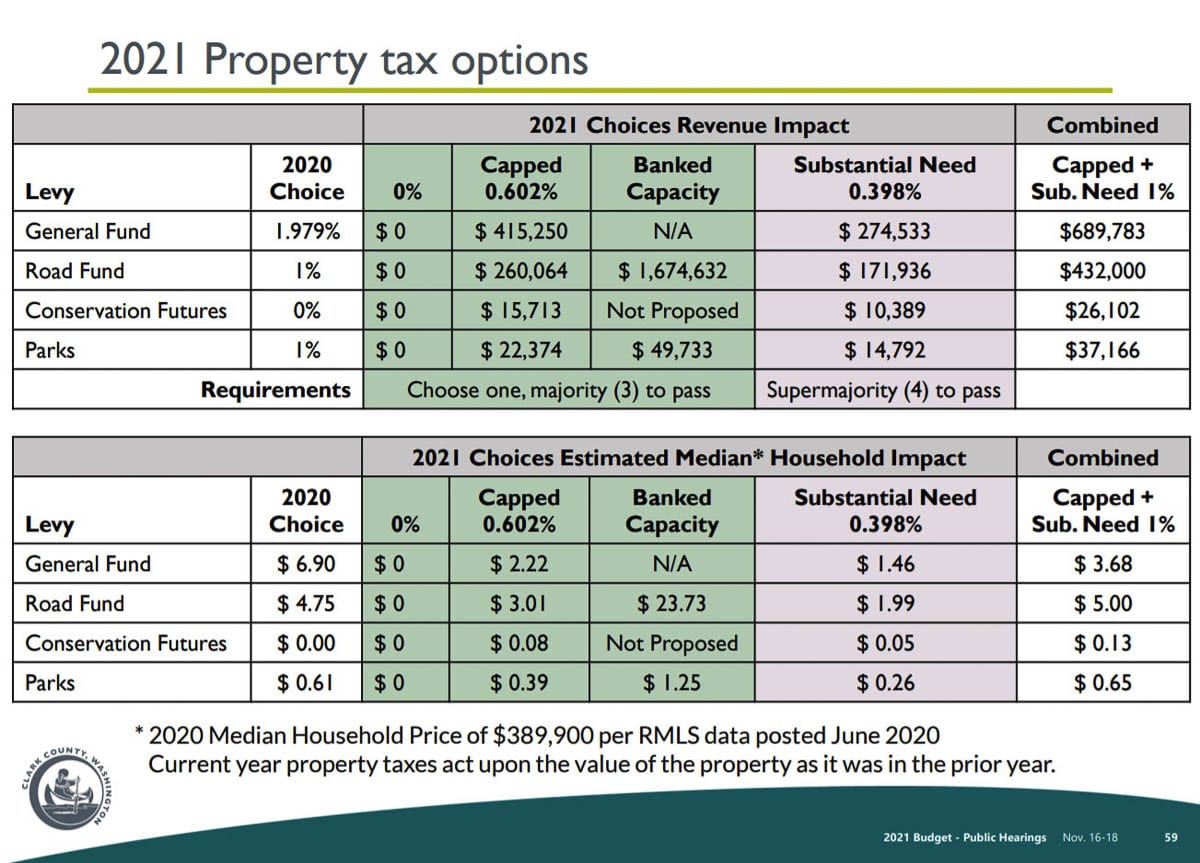

Clark County Council Approves 557 Million Budget For 2021 Clarkcountytoday Com

Clark County Council Approves 557 Million Budget For 2021 Clarkcountytoday Com

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Honolulu Property Tax 2020 21 Fiscal Year

Clark County Council Approves 557 Million Budget For 2021 Clarkcountytoday Com

Clark County Council Approves 557 Million Budget For 2021 Clarkcountytoday Com

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Honolulu Property Tax 2020 21 Fiscal Year

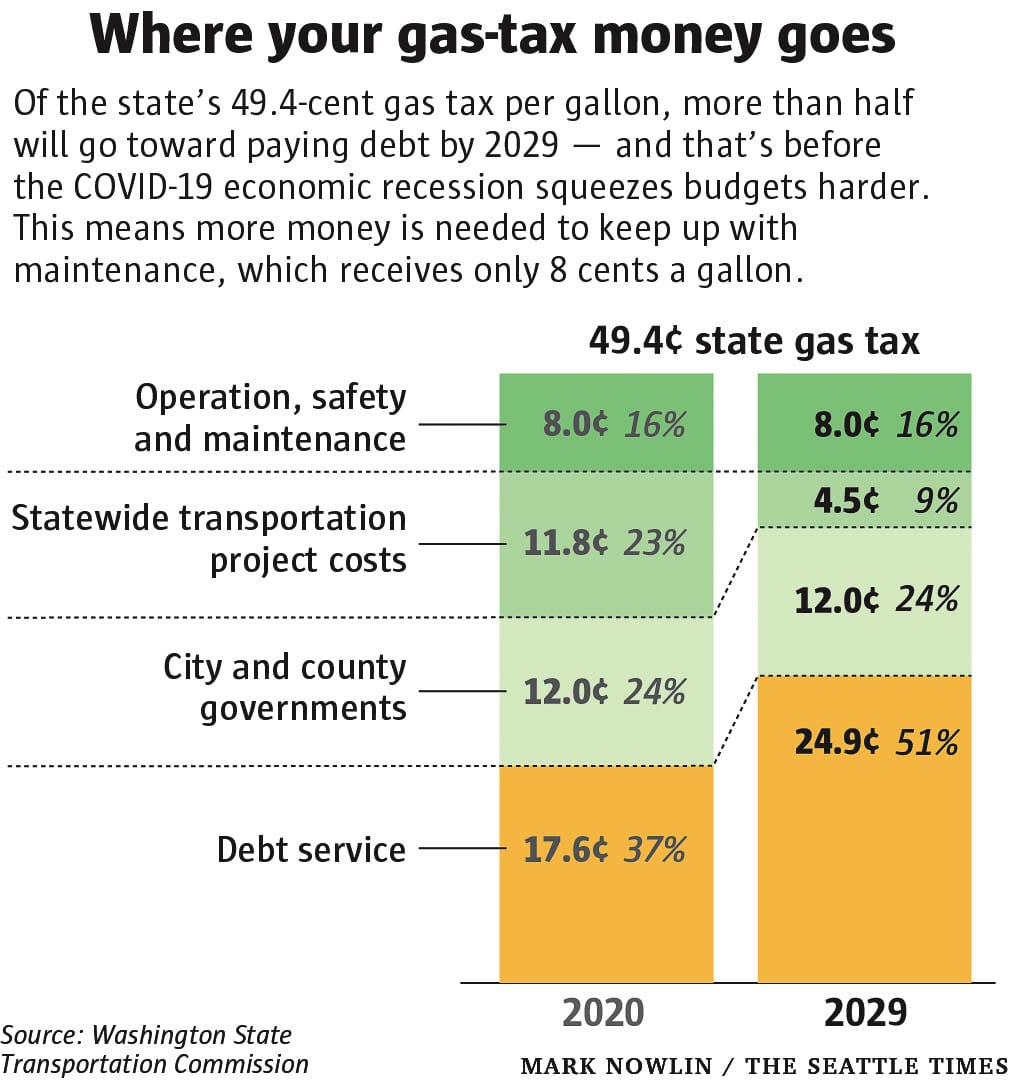

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

Will A Transportation Funding Package Be In The 2021 Legislative Session Clarkcountytoday Com

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home