California Property Tax Rate History

For more current information regarding tax policy click here. The Tax Collectors office is responsible for the collection of property taxes.

Understanding California S Property Taxes

Understanding California S Property Taxes

Secured Property Tax History.

California property tax rate history. This compares well to the national average which currently sits at 107. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. This means that the amount in property taxes you have to pay can only be up to 1 of the assessed value of your home.

Property Tax Division Mission Statement. The system may be temporarily unavailable due to system maintenance and nightly processing. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

The undersigned certify that as of June 28 2019 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 28 2019 published by the Web. For tax balances please choose one of the following tax types. For payments made online a convenience fee of 25 will be charged for a credit card transaction.

The tax type should appear in the upper left corner of your bill. Tax amount varies by county. Tax policy in California.

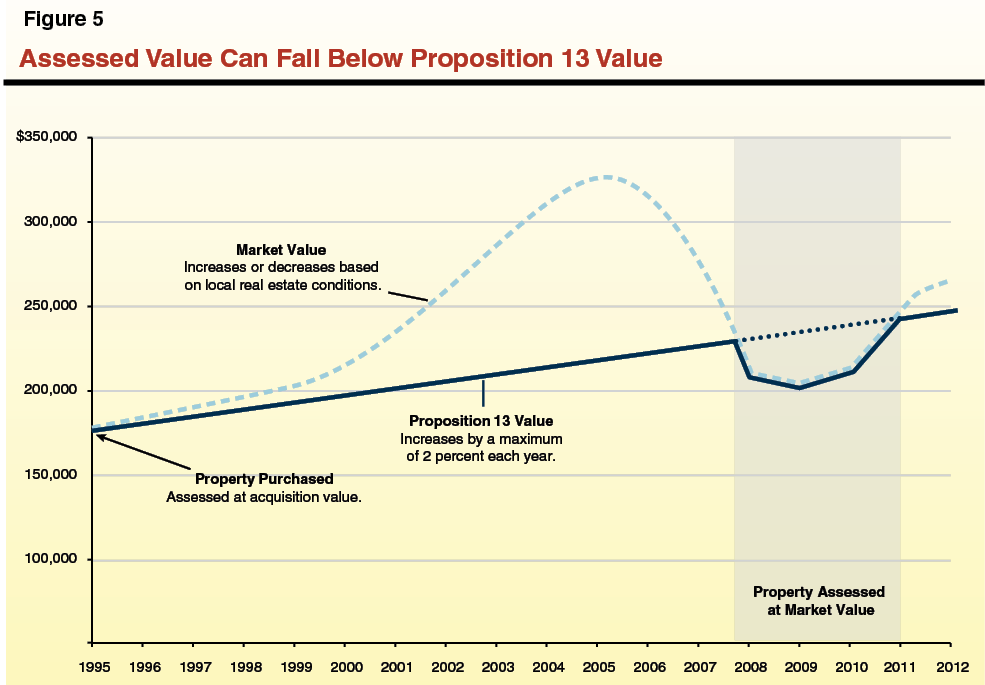

So when you buy a home the assessed value is equal to the purchase price. Look Up Your Property Taxes. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in 1955.

A California Property Records Search locates real estate documents related to property in CA. The assessed value of homes cannot exceed the 1975-76 assessed value and can increase based on the Consumer Price Index CPI by. Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. Beginning on April 11 2020 my office will begin accepting requests for penalty cancellation related to COVID-19 on our website.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents. To administer accurately and efficiently the billing collection and reporting of property tax revenues levied as directed by California State Law and County Ordinances and assist the public with understanding property tax information in a prompt efficient and courteous manner. Certain property owners directly affected by COVID-19 may submit a Penalty Cancellation Request Form along with payment if they were unable to pay property taxes by the April 10 2020 December 10 2020 or April 12 2021 payment deadlines in accordance with the Governors Executive OrderTo qualify the property must be either.

No fee for an electronic check from your checking or savings account. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. Supplemental Property Tax History.

Taxpayers who are unable to pay their property taxes by April 12 2021 because of the COVID-19 crisis are encouraged to submit a request for a penalty waiver online. Revenue Taxation Codes. Property owners affected by COVID-19 may have late penalties cancelled if they are unable to pay their property taxes by April 10 2020.

How Property Taxes in California Work. Historical Tax Rates in California Cities Counties. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. You can view and print your current property tax statements or view past payment history by visiting the Property Tax Payment Portal. California property taxes are based on the purchase price of the property.

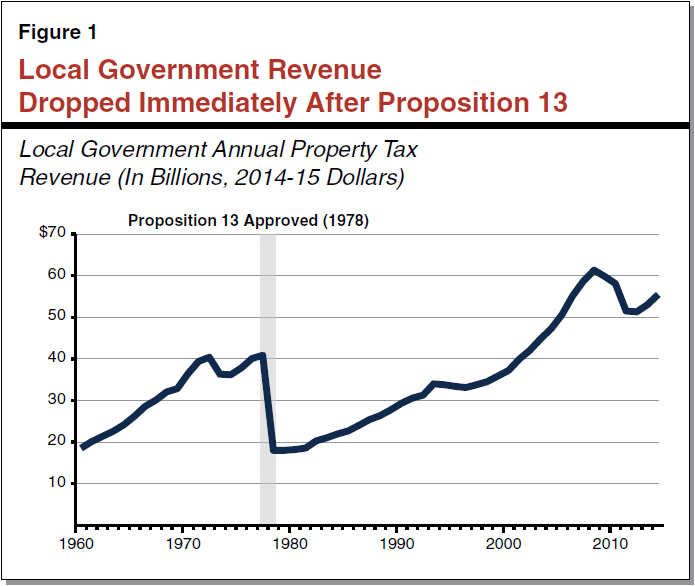

Property Tax Postponement The program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including 40 percent equity in the home and an annual household income of 45000 or less. The average effective property tax rate in California is 073. The property tax rate was set at a 1 cap.

Tax rates in 2015. The historical California tax policy information below is presented as it was written on Ballotpedia in 2015.

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

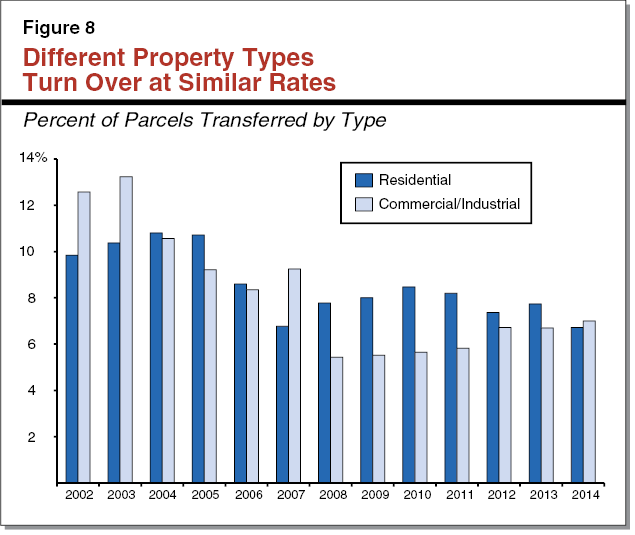

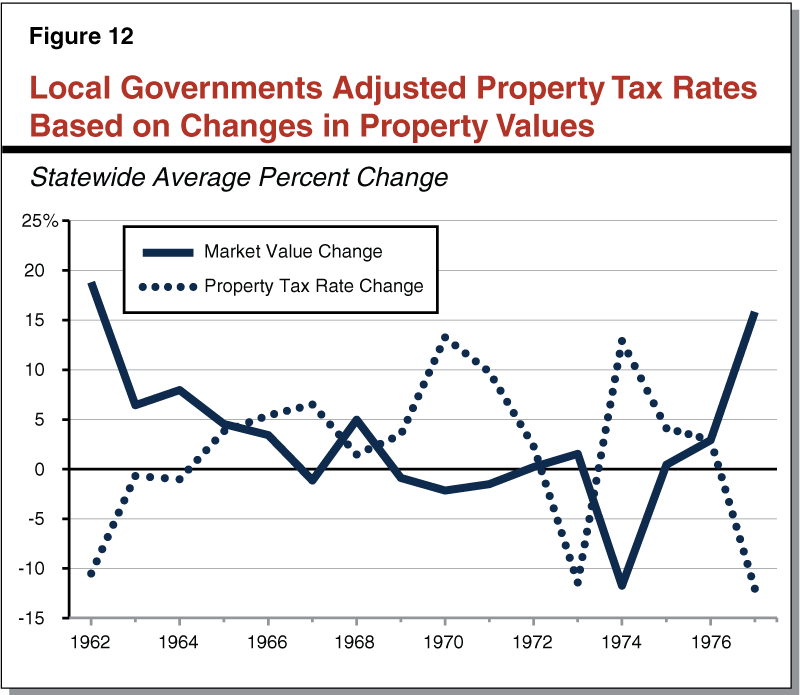

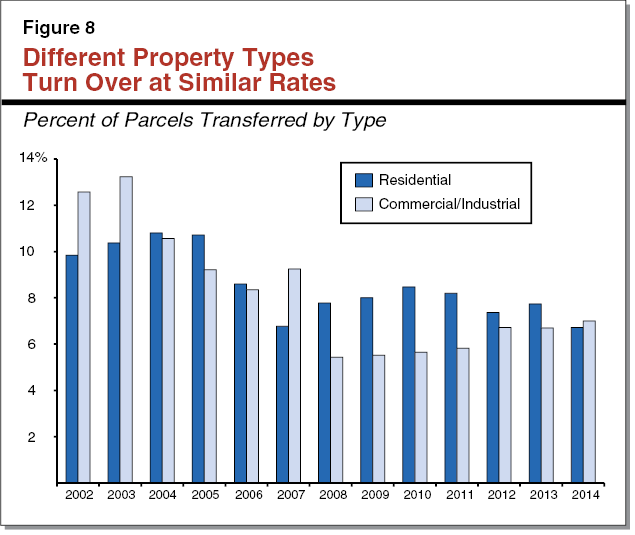

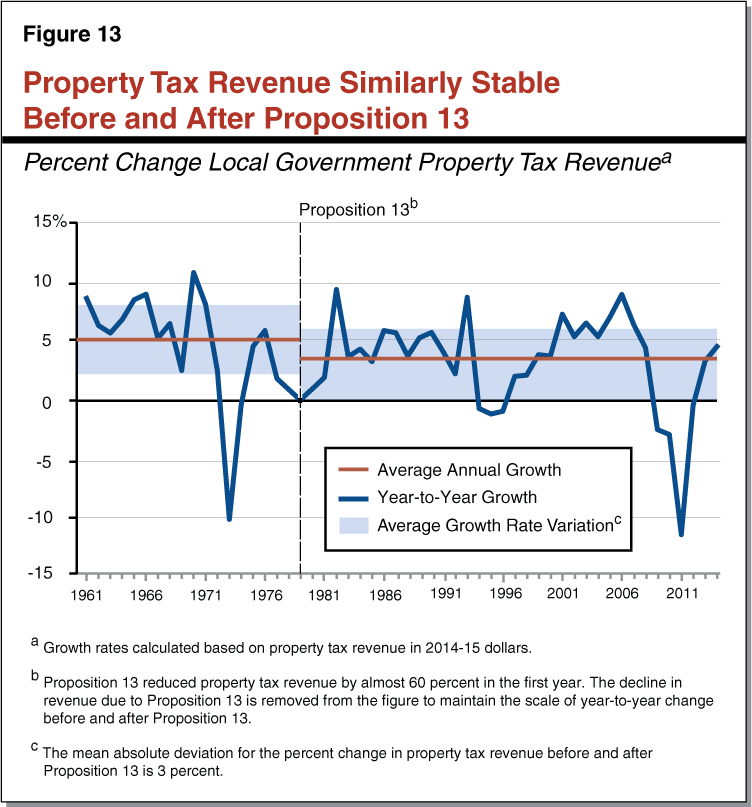

Common Claims About Proposition 13

Common Claims About Proposition 13

Common Claims About Proposition 13

Common Claims About Proposition 13

Understanding California S Property Taxes

Understanding California S Property Taxes

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Understanding California S Property Taxes

Understanding California S Property Taxes

Common Claims About Proposition 13

Common Claims About Proposition 13

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

Understanding California S Property Taxes

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

The History Of Taxes Here S How High Today S Rates Really Are

Common Claims About Proposition 13

Common Claims About Proposition 13

Labels: california, property, rate

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home