How To Claim Tax Relief For Working From Home On Self Assessment Form

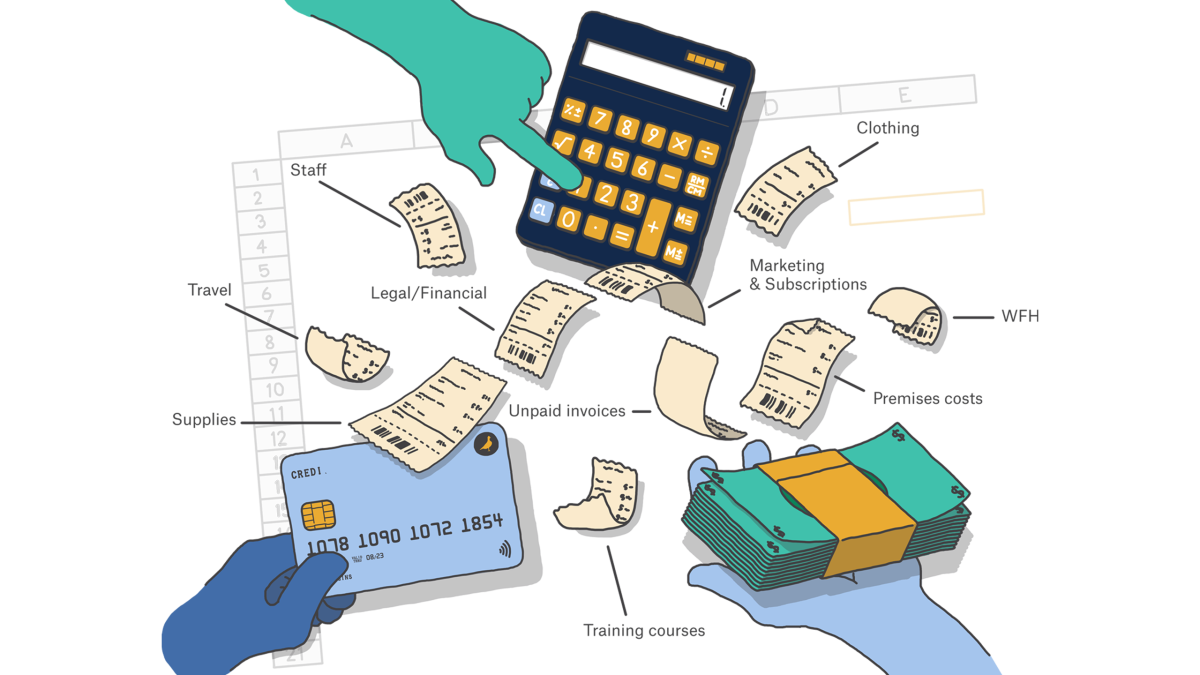

If you do self-assessment you wont be able to use HMRCs online portal. Self Assessment Expenses you can claim back as an employee 060121 Wondering what everyday work expenses you can claim back on your self-assessment form.

Different Ways To Claim Tax Relief When Working From Home

Different Ways To Claim Tax Relief When Working From Home

Online by post and by phone.

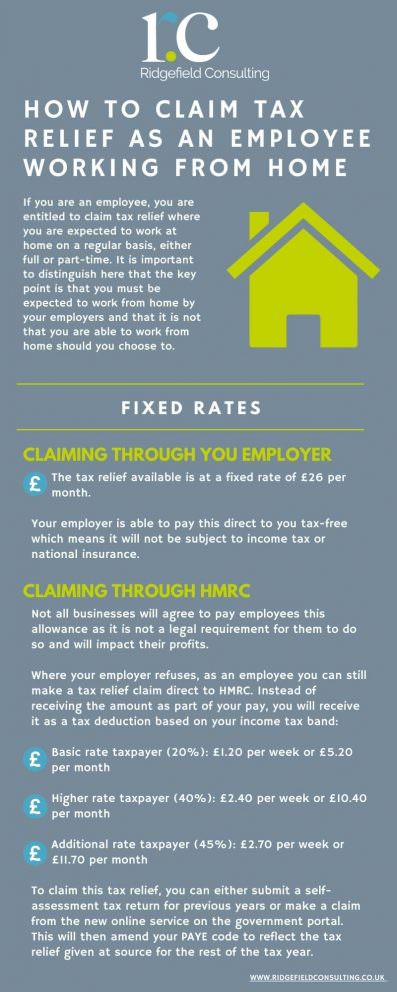

How to claim tax relief for working from home on self assessment form. You do not need to file a return to claim working from home expenses. You can only claim via a self-assessment tax return which as a self-employed worker youll have to submit each year anyway. You would need to claim this online or with a P87 claim form.

If you normally do a self-assessment form you can claim when you submit that. Due to that there is essentially a flat rate of 6 a week available to you. Your work Self Employment Full Form Details Expenses breakdown 1 tick the top of the page to report your expenses in details and input the entry in the box labelled Rent rates power and insurance costs.

I assume box 20 in SA102 is the place but there will be others who can confirm this or. Claim tax relief for your job expenses. Instead apply for the tax relief.

This includes if you have to work from home. You cannot claim tax relief if you choose to work from home If you go through the calculator it simply tells you to claim the expenses on your self assessment return. You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

As self-employed workers are taxed on their profits expenses incurred from working from home can be deducted therefore reducing the amount of tax youll pay. Here are some expenses that a. If you usually complete a self-assessment returns form.

To claim the tax relief you must have and declare that you have had specific extra costs due to working from home. If you are a group of flatmates working from home then you can all claim it. To be eligible for tax relief you must carry out work which form all or part of the central duties of your employment and in doing so you must have additional costs such as heating metered water bills or business calls that are incurred as a direct result of working from home.

If you are already filing a self-assessment tax return you can claim for this under the section on the form called Using Your Home As An Office otherwise you will need to fill in a P87 form. If you do not it will involve making a claim online through the Government Gateway - or with a P87 postal form. There are two ways to claim expenses - either on your annual tax return if you file one or on a special form called a P87 which is available electronically via Government Gateway or on paper.

If you are self-employed and work from home understanding and calculating the expenses youre allowed to claim. For others youll need fill out the online P87 form through your Government Gateway account or by filling out a postal P87 form. There are three ways to claim tax relief.

This includes customers claiming through self-assessment. Yet apportioning extra costs such as heating and electricity is tough. Claim your tax relief online if your employer has not paid back any.

If you do a tax return you will have to wait for the 2020-21 form to claim for working from home after 5 April 2020. Working from home - allowances for the self-employed updated for 2122 This article was published on 03082020 Self-employed guide to claiming allowances for working at home. Your work Self Employment Short Form Details Allowable expenses Complete the box labelled Rent power insurance and other property costs Full Form.

If you have already. Self Assessment Guide by Listentotaxman 310321 Our guide to making your online self-assessment return with tips on reducing your tax bill and avoiding fines. Claim tax relief for other job expenses If you are an employee and have to pay.

To submit claims employees can access HMRCs dedicated working from home online service that will automatically apply the whole tax years relief via their tax code. For those who normally do a self-assessment form you can claim on it. If you fill in a self-assessment form you wont be able to use the Governments online service to apply for the tax relief but you will be apply via your self-assessment.

The Importance Of A P60 P60 And Why Your Accountant Or Employer By Mahzeb Monica Medium

The Importance Of A P60 P60 And Why Your Accountant Or Employer By Mahzeb Monica Medium

Martin Lewis Gives An Update On How Working From Home Tax Relief Works Youtube

Martin Lewis Gives An Update On How Working From Home Tax Relief Works Youtube

How Do I Tailor My Self Assessment Tax Return Youtube

How Do I Tailor My Self Assessment Tax Return Youtube

How To Claim The Working From Home Tax Relief Times Money Mentor

How To Claim The Working From Home Tax Relief Times Money Mentor

Hmrc Confirms People Working From Home For At Least One Day In 2021 Can Claim Tax Break For Whole Year Daily Record

Hmrc Confirms People Working From Home For At Least One Day In 2021 Can Claim Tax Break For Whole Year Daily Record

Work From Home Tax Relief Guide Theformfiller Youtube

Work From Home Tax Relief Guide Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

Working From Home Tax Deductions Covid 19

Working From Home Tax Deductions Covid 19

Tackling Your Tax Return The Pain Free Guide Self Assessment Tax The Guardian

Tackling Your Tax Return The Pain Free Guide Self Assessment Tax The Guardian

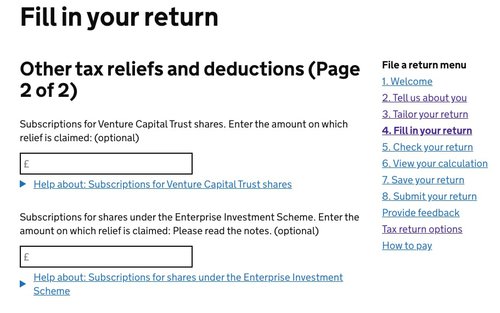

How To Claim Eis Income Tax Relief A Step By Step Guide

How To Claim Eis Income Tax Relief A Step By Step Guide

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

Coronavirus And Home Office Deductions H R Block

Coronavirus And Home Office Deductions H R Block

What Is A P87 Form How To Make The Most Of Form P87 Reliasys

What Is A P87 Form How To Make The Most Of Form P87 Reliasys

The Importance Of A P60 P60 And Why Your Accountant Or Employer By Mahzeb Monica Medium

The Importance Of A P60 P60 And Why Your Accountant Or Employer By Mahzeb Monica Medium

Work From Home Tax Relief Guide Theformfiller Youtube

Work From Home Tax Relief Guide Theformfiller Youtube

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home