How To Calculate Homestead Exemption

This calculator is for illustrative purposes only. This can be a savings of 87 to134 depending on which area of the county you are located.

What Property Owners Need To Know About Homestead Savings Runnels County Appraisal District Official Website

254 rows The most common is the homestead exemption which is available to homeowners in their.

How to calculate homestead exemption. Each city and county uses a specific tax rate to calculate the. As of 2012 the homestead exemption is a flat 25000 for all people who qualify. Homestead Exemption is an exemption of 1000 off the assessed valuation.

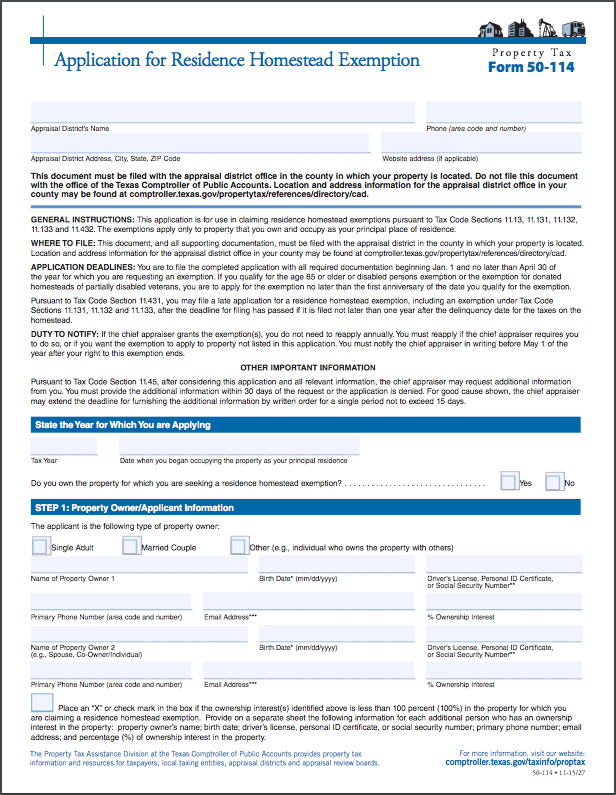

House Bill 3613 of 81st Texas Legislature authorized the creation of Section 11131 of the Texas Property Tax Code. The homestead tax exemption should not be confused with the homestead exemption which is a legal tool used to protect the value of. Homestead exemptions reduce the total amount of property value subject to taxation.

Then the next 25000 the assessed value between 50000 and 75000 is exempt from all taxes except school district taxes. It is my intention to stay in close contact with those who qualify for the Homestead Exemption. Homestead exemptions remove part of your homes value from taxation so they lower your taxes.

Montgomery County Homestead Exemption Calculator. Flat-dollar exemptions or percentage exemptions. Properties incur a property tax to help the city or county pay for certain public services.

Press Release from Commissioner Noack. This amount is deducted from the assessed value of the applicants home and property taxes are computed based upon the remaining assessment. A flat-dollar homestead exemption reduces the taxable value of your home by a set amount like 25000 or 50000.

Tax Code Section 1113b requires school districts to offer a 25000 exemption on residence homesteads and Tax Code Section 1113n allows any taxing unit the option to decide locally to offer a separate residence homestead exemption of up to 20 percent of a propertys appraised value. Residence Homestead of 100 or totally Disabled Veterans. You pay full taxes on any value between 25000 and 50000.

For example your home is appraised at 100000 and you qualify for a 25000 exemption this is the amount mandated for school districts you will pay school taxes on the home as if it was worth only 75000. The remaining 5000 in assessed value is taxable though. Homestead exemptions work in two primary ways.

The next 25000 the assessed value between 25000 and 50000 is subject to taxes. Homestead Exemption is a form of property tax reduction in real estate taxes for those who qualify. Homestead exemption as a tax break.

The local option exemption cannot be less than 5000. The value of the homestead exemption for the 2019-2020 assessment years is 39300. Subtract the homestead exemption from your homes assessed value.

All legal Florida residents are eligible for a Homestead Exemption on their homes condominiums co-op apartments and certain mobile home lots if they qualify. You must be the homeowner who resides in the property on January 1. 2 days agoPointer 1.

The first 25000 would be exempt from all property taxes. For example if your homes assessed value is. This newly created Section entitles a 100 exemption for a residence homestead of a qualifying Disabled Veteran.

For value above 75000 you pay full taxes. The Florida Constitution provides this tax-saving exemption on the first and third 25000 of the assessed value of an owneroccupied residence. How does the homestead exemption work.

To calculate how much equity a debtor can have in their home while obtaining a Chapter 7 discharge and without having to pay a Chapter 7 trustee it is important to know the value of the house then subtract the liens then subtract the homestead exemption that would apply. You may apply for homestead exemptions on your principal residence. Your Homes Appraised Value.

For any assessed value between 50000 and 75000 an additional 25000 is eligible for exemption but this exemption does not apply to school district taxes. I hope you find the information provided on this web page helpful and worthwhile.

How To File For The Homestead Tax Exemption Property Tax Tallahassee

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Homestead Exemptions And Taxes Madison Fine Properties

Homestead Exemptions And Taxes Madison Fine Properties

Florida Homestead Tax Exemption

Florida Homestead Tax Exemption

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Inequities In Colorado S Senior Homestead Property Tax Exemption Colorado Fiscal Institute

Homestead Exemption In Naples Fl

Tax Information For New Homeowners Republic Title

Tax Information For New Homeowners Republic Title

Here S What Homeowners Should Know About The Homestead Exemption

Here S What Homeowners Should Know About The Homestead Exemption

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Texas Property Taxes Homestead Exemption Explained Carlisle Title

Dekalb County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Homestead Savings Explained Van Zandt Cad Official Site

Homestead Savings Explained Van Zandt Cad Official Site

Florida Homestead Exemptions Emerald Coast Title Services

Florida Homestead Exemptions Emerald Coast Title Services

How To File For Florida Homestead Exemption Tampa Bay Title

How To File For Florida Homestead Exemption Tampa Bay Title

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

Why Is Closing By December 31 So Important For The Florida Homestead Exemption Usda Loan Pro

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Your Taxes For Your Southlake Southlake Tx Official Website

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home