Ghmc Property Tax Demand Year

PTI NO Know Property Tax Dues. Online applications launched by the SDMC to file property tax.

This should be paid before the deadline for the One Time Settlement OTS scheme under which up to 90 interest waiver on the outstanding amount can be availed.

Ghmc property tax demand year. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. On 1 April 2021 the SDMC launched around six online applications to file property tax. The Greater Hyderabad Municipal Corporation GHMC collected more than Rs 1500 Crore from 1173218 taxpayers in property tax this financial year even after the State was hit by the COVID-19 induced pandemic and the subsequent lockdown.

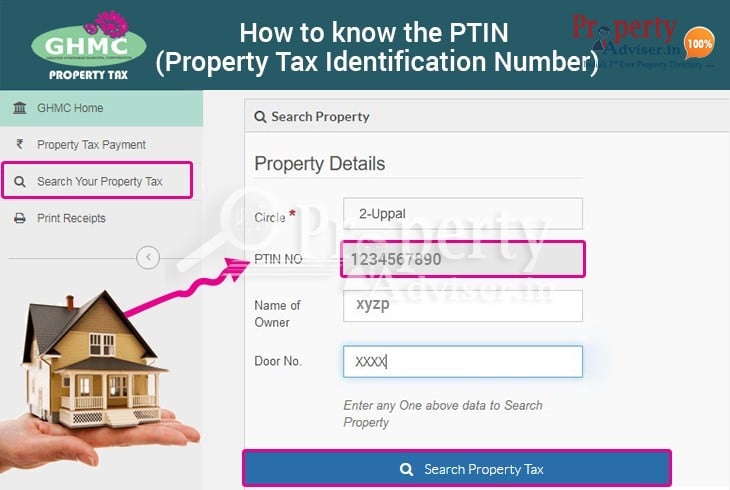

Monthly Rental Value in Rs General Tax. News About SDMC Property Tax. Enter your PTINASMT Property Tax Identification Number to check the Dues.

05012016 authorized GHMC for exempting property tax of any residential building occupied by the owner wherein the Annual Rental Value does not exceed Rs. The County assumes no responsibility for errors in the information and does not guarantee that the. The dates are half-yearly where citizens have ample time to pay tax.

John Smith Street Address Ex. GHMC Collects 1500 Crore Property Tax For Financial Year 2021 Mar 28 2021 1049 IST HYDERABAD. Thats because as home values rise so do property taxes.

In the GHMC area the tax demand was about Rs 1488 crore against 1639 lakh property owners. The GHMC has already set dates for tax payments. Self Assessment Abstract Report.

The applications are in regard to the death of residents registration of birth and property tax filing. Despite the prevailing conditions the GHMC has collected over Rs 1189 crores in the period between April and December 2020 as of mid-December as property tax an increase of Rs 140 crores when compared to the same period in 2019. The property tax payment is by July 31 st and 1st October.

The MAUD issued a memo on Thursday directing the GHMC to implement the Early Bird Scheme in GHMC for residential properties for the year 2020-21 capping. The objective is to increase the collections by encouraging property owners through a discount. 1200- Property Tax per annum subject to condition that the beneficiaries of exemption shall pay a nominal amount of Rs.

Property owners who have been paying property tax up to Rs 15000 annually in GHMC limits and up to Rs 10000 in other municipalities and corporations would be eligible to avail the benefit. Tax Details Demand Year Tax Amount InterestTotal Payment Status. The rebate will be applicable for the current financial year 2020-2021 as a one-time relief to owners.

No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection GHMC offers the following modes Handheld machines of Bill Collectors are integrated with central server. Search your Property Tax. But while rising prices are great for people looking to sell they can put pressure on those looking to stay.

After collecting a record property tax collection of more than Rs750 crore in the last financial year 2012-2013 ending 31 Mar 2013 the GHMC has announced its intent to go after the chronic defaulters of about five lakh property owners. 123 Main Parcel ID Ex. Greater Hyderabad Municipal Corporation GHMC announced that property tax dues have to be paid by 31 March for all dues up to the years 2019 to 2020.

You dont need to have bank account to pay the property tax Any Online failure transaction status can be updated in 5-mins Information Provided Online is up-to Date and Physical Visit to the GHMC Office Department is Not Required. The GHMC is offering the Early Bird scheme benefit of a 5 per cent rebate to those paying property tax for 2021-22 starting April 1. The EBS grants a five-per cent rebate on property tax to the owners without any outstanding dues of previous years.

101- per annum towards property tax. In Property tax No manual transactions in Tax assessment issue of special notice issue of annual demand notices and receipts 100 computerization of assessments notices collection. Annual property tax Gross Annual Rental Value GARV x 17 30 Slab rate to be determined based on MRV as fixed by GHMC 10 depreciation 8 library cess GARV Plinth area x Monthly rental value in Rs sq ft x 12.

Search for a Property Search by. An estimated annual property tax of about Rs 2129 crore is expected from about 3542 lakh property owners in the State including 301 lakh residential 368 lakh commercial and 162 lakh mixed-use properties. A Columbus lawmaker wants to rein in those tax.

The housing market in Central Ohio is booming. Compared to the last fiscal the GHMC has collected Rs 1 crore more in property tax. Delays attract a penalty of 20percent interest every month for the given amount.

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Procedure For Ghmc Property Tax Online Step By Step Guide

Procedure For Ghmc Property Tax Online Step By Step Guide

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Collects 1500 Crore Property Tax For Fy 2021

Ghmc Collects 1500 Crore Property Tax For Fy 2021

Ghmc Property Tax Payment Online

Ghmc Property Tax Payment Online

Hyderabad Ghmc Goes Back On Tax Rebate Promise

Hyderabad Ghmc Goes Back On Tax Rebate Promise

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Gov In Ghmc Online Property Tax Payment Greater Hyderabad Municipal Corporation Onlinepropertytax Com

Ghmc Gov In Ghmc Online Property Tax Payment Greater Hyderabad Municipal Corporation Onlinepropertytax Com

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Payment Online

Ghmc Property Tax Payment Online

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Procedure For Ghmc Property Tax Online Step By Step Guide

Procedure For Ghmc Property Tax Online Step By Step Guide

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Ghmc Property Tax Property Tax Search Calculation Pay Online Offline Finacbooks

Ghmc Property Tax Property Tax Search Calculation Pay Online Offline Finacbooks

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home