North Carolina Property Tax For Disabled Veterans

Eligibility for some benefits may depend on residency military component and Veteran. North Carolina excludes from property taxes the greater of 25000 or 50 percent of the appraised value of a permanent residence owned and occupied by a qualifying owner.

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

6 rows As people who risk their lives for the motherland veterans deserve all the help they can get from.

North carolina property tax for disabled veterans. The permanent residence includes the dwelling the dwelling site not to exceed one acre and related improvements. Summary of North Carolina Military and Veterans Benefits. Statistical Abstract 2004 - Part II.

34 rows A disabled veteran in North Carolina may receive a property tax exemption of up to the. North Carolina veterans who have 100 VA-rated disabilities may be eligible for a property tax break on the first 45000 of assessed real property value. Property Tax Reduction for qualifying Senior Citizens and persons permanently disabled.

Unmarried surviving spouses of honorably discharged veterans may also apply. North Carolina residents who qualify can apply for. Disabled Veterans Exclusion North Carolina excludes from property taxes 45000 of the appraised value of a permanent residence owned and occupied by a qualifying owner if you are an Honorably Discharged Veteran with a 100 total and permanent service connected disability or.

If you had at least five years of creditable military service as of Aug. Statistical Abstract 2004 - Part I. See all North Carolina Veterans Benefits.

North Carolina Disabled Veteran Property Tax Exclusion North Carolina residents who are honorably discharged veterans with qualifying VA-rated disabilities or service-connected medical issues may be eligible for a property tax break for primary residences. Application for ElderlyDisabled. Any Veteran discharged honorably and have a 100 permanently and totally disability rating are eligible for up to a 45000 deduction in the assessed value of their home.

Under current law veterans who are 100 percent disabled dont have to pay property taxes on the first 45000 of the value of their homes. North Carolina has several programs available that are designed to lower the property tax bills for disabled homeowners and disabled veterans. 12 1989 all your military.

1012 who is entitled to special automotive equipment for a service-connected disability. - A veteran of any branch of the Armed Forces of the United States whose character of service at separation was honorable or under honorable conditions and who satisfies one of the following requirements. Floyd and Szoka are Army veterans.

Application for ElderlyDisabled Disabled Veteran and Circuit Breaker Homestead Exclusions. Disabled Veteran Surviving Spouse Exclusion Veterans and surviving spouses that qualify for this program will receive an exclusion of the first 45000 of assessed value on their permanent residence. As used in this section disabled veteran means a person as defined in 38 USC.

Summary Of State General Fund Revenue Collections. Taxes And North Carolina Gross State Product. North Carolina offers three Property Tax Relief programs for qualifying taxpayers.

A motor vehicle owned by a disabled veteran that is altered with special equipment to accommodate a service-connected disability. Any surviving spouse of a Veteran is also eligible if they are drawing DIC from the VA. The State of North Carolina offers special benefits for its military Service members and Veterans including property tax exemptions state employment preferences education and tuition assistance vehicle tags as well as hunting and fishing license privileges.

Elderly or Disabled Exclusion. North Carolina Veteran Financial Benefits Income Tax. In cases where there are co-ownersspouses individually eligible for the benefit the veteran s can receive the total exemption of 90000.

Property tax relief programs apply only to the permanent residence. Totally and permanently disabled homeowners in North Carolina can qualify for up to a 50 or 25000 reduction in their propertys appraised value as long as their income is under 31000. NCDVA-9 Certification of Disabled Veterans for Property Tax Exclusion under North Carolina General Statute 105-2771C Disabled veteran.

Honorably discharged North Carolina veterans who are 100 permanently and totally disabled.

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

2021 Local Veterans Day Deals For Veterans Military Benefits

2021 Local Veterans Day Deals For Veterans Military Benefits

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Https Www Co Cumberland Nc Us Docs Default Source Veterans Services Documents Veterans Services Brochure Pdf Sfvrsn 25774dd4 2

Applying For Social Security Benefits Can Be A Challenging Especially If You Are Not Familiar With Disability Lawyer Social Security Disability Va Disability

Applying For Social Security Benefits Can Be A Challenging Especially If You Are Not Familiar With Disability Lawyer Social Security Disability Va Disability

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

Started By The Wisconsin Legislature Wheda Has Over 2 Billion In Assets And Is Dedicated To Expanding Affordable Housing For Citize In 2020 Wisconsin Home Loans Loan

Started By The Wisconsin Legislature Wheda Has Over 2 Billion In Assets And Is Dedicated To Expanding Affordable Housing For Citize In 2020 Wisconsin Home Loans Loan

Sheridan County Is Home To The Best School District In Wyoming Wyoming Sheridan Wyoming School District

Sheridan County Is Home To The Best School District In Wyoming Wyoming Sheridan Wyoming School District

North Carolina Veteran S Benefits Military Benefits

North Carolina Veteran S Benefits Military Benefits

100 Disabled Veteran Housing Allowance Hill Ponton P A

100 Disabled Veteran Housing Allowance Hill Ponton P A

Louisiana Housing Corporation Is Responsible For Federal And State Funds To Help Borrowers Find Affordable Energy Efficient In 2020 Home Loans Louisiana The Borrowers

Louisiana Housing Corporation Is Responsible For Federal And State Funds To Help Borrowers Find Affordable Energy Efficient In 2020 Home Loans Louisiana The Borrowers

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

Veteran Benefits For North Carolina Veterans Guardian

Veteran Benefits For North Carolina Veterans Guardian

Veterans Property Tax Relief Department Of Military Veterans Affairs

List Of Benefits For Veterans 90 Percent Disabled Cck Law

List Of Benefits For Veterans 90 Percent Disabled Cck Law

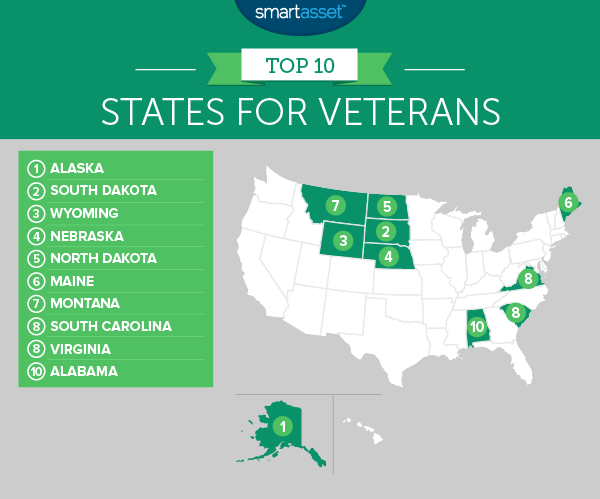

The Best States For Veterans Smartasset

The Best States For Veterans Smartasset

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Pay Military Retirement Military Benefits

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Pay Military Retirement Military Benefits

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home