Property Tax Exemptions For Tarrant County

All residence homestead owners are allowed a 25000 homestead exemption from their homes value for school district taxes. Its January 22 and my taxes are due January 31st.

Public Map Viewer Map Public Viewers

Public Map Viewer Map Public Viewers

Homeowner exemptions The available Texas homeowner exemptions are listed below.

Property tax exemptions for tarrant county. Property Tax exemptions can save you a good chunk of money. If you qualify for an exemption the property tax rate will be applied to a lower home value resulting in a lower property tax bill. A homestead exemption is available to any homeowner who qualifies.

Instead they exempt a certain portion of the assessed value of your home usually between 5000 and 15000 from property taxes. Tarrant County has the highest number of property tax accounts in the State of Texas. Plus the owner pays 7 percent interest for each year from the date the taxes would have been due.

In Texas there are several types of exemptions that can help seniors. Youre taxed from taxing units in Tarrant and Parker Counties the protest services offered by the Firm will only affect your Tarrant County tax liability. Pay taxes in four equal installments.

Contact the Tarrant County Veteran Services Office at 817-531-5645 if you have any questions. Homeowners may also defer the portion of the tax on their residence homestead if the. If you qualify for the over 65 exemption you would be entitled to a tax ceiling on school and locally adopted city county and special district assessments.

To be clear property tax exemptions dont let you off the hook completely. If you qualify for the over 65 or disabled person exemption you are also entitled to a ceiling on school and locally adopted city county and special district taxes. Property Tax Exemption Disabled veterans who meet certain requirements their surviving spouses and the spouses and minor children of a person who dies on active duty in the U.

You would have to obtain at least a 150001 reduction at your Property Tax Protest hearing in order to reduce your Tax Liability. Residence homeowners of any age are allowed a 25000 homestead exemption from their homes value for school taxes. Others who qualify for an exemption are homeowners with disabilities disabled veterans or the survivors of disabled veterans or veterans who were killed while on active duty.

Follow the links for a description of each exemption and to download exemption forms. These exemptions are in addition to the residential homestead exemption. Payments are due January 31 March 31 May 31 and July 31.

Download Agricultural and Timber Exemption Registration Number form. In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. An exemption is also available for those who are age 65 or older.

Armed Forces are eligible for property tax exemptions on the appraised value of their property. Or 3 must have a Disability Exemption. Persons who are over 65 years of age may file for an exemption in addition to the residential homestead exemption with TAD.

Business and Other Exemptions Links to a description of business and other exemptions are located below. If your property is located on a split boundary eg. Download Form The form used to apply for a Texas agricultural and timber exemption registration number that can be used to claim an exemption may be downloaded below.

Tax Code Section 1113 b requires school districts to offer a 25000 exemption on residence homesteads and Tax Code Section 1113 n allows any taxing unit the option to decide locally to offer a separate residence homestead exemption of up. Our primary focus is on taking care of citizens. If a county collects a special tax for farm-to-market roads or flood control a residence homestead owner is allowed a 3000 exemption for this tax.

79 rows 2020 Tax Rates per 100 Valuation. In order to qualify for this option the property 1 must be your residence homestead and 2 must have an Over 65 Exemption. There are several types of exemptions you may receive.

A property tax exemption is subtracted from the appraised value and lower the assessed value and the property tax. To qualify a home must meet the definition of a. The ceiling will provide additional tax relief for future years.

The exemption and freeze lower the property tax burden for seniors and help them stay in their home even in times of increasing home valuations. 78 rows 2020 Tax Rates Exemptions. The City of North Richland Hills Tarrant County the school district and other taxing entities offer senior tax exemptions as well as a senior tax freeze also known as a tax ceiling for homeowners age 65 and up.

WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION. Lets take a look at what is available to those 65 older. In-depth Tarrant County TX Property Tax Information.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. If any of your properties are outside of Tarrant County I can refer you to another property tax attorney for those properties.

Rent Vs Own Learn The Facts Eastvalleyrealtorcass Thelancergroupaz Realestate Real Being A Landlord Arizona Real Estate Florida Real Estate

Rent Vs Own Learn The Facts Eastvalleyrealtorcass Thelancergroupaz Realestate Real Being A Landlord Arizona Real Estate Florida Real Estate

Proud And Honored Thank You Century21 And Century21judgefite Honor Society Sha Hair Century

Proud And Honored Thank You Century21 And Century21judgefite Honor Society Sha Hair Century

Pin On Minteer Team Blogs Videos

Pin On Minteer Team Blogs Videos

Developing A Change Management Approach Provides Direction And Purpose For All Other Change Management Activities Digital Marketing Inbound Marketing Marketing

Developing A Change Management Approach Provides Direction And Purpose For All Other Change Management Activities Digital Marketing Inbound Marketing Marketing

Buying A House For The First Time Can Be Daunting Here S A Few Tips To Make The Process Easier Home Buying Process This Or That Questions Tips

Buying A House For The First Time Can Be Daunting Here S A Few Tips To Make The Process Easier Home Buying Process This Or That Questions Tips

Thanks For A Great 2013 A Message From Our Team Leader Chris Minteer Real Estate Trends Dfw Real Estate Team Leader

Thanks For A Great 2013 A Message From Our Team Leader Chris Minteer Real Estate Trends Dfw Real Estate Team Leader

Pin By Stephanie Allen On Social Media Content Ideas Realtors Valentine Charm Romantic Dates Texas Real Estate

Pin By Stephanie Allen On Social Media Content Ideas Realtors Valentine Charm Romantic Dates Texas Real Estate

Reminders For Closing Day Closing Day Loan Officer Day

Reminders For Closing Day Closing Day Loan Officer Day

Property Taxes Mysouthlakenews

Property Taxes Mysouthlakenews

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

How To File Homestead Exemption Ellis County Real Estate Agent Marketing Dallas County Tarrant County

How To File Homestead Exemption Ellis County Real Estate Agent Marketing Dallas County Tarrant County

Pin By Stephanie Allen On Social Media Content Ideas Realtors Valentine Charm Romantic Dates Texas Real Estate

Pin By Stephanie Allen On Social Media Content Ideas Realtors Valentine Charm Romantic Dates Texas Real Estate

Equestrian Estate For Sale In Shelby County Texas Welcome Home To Your Texas Paradise With Breath Taking Sunrises An Equestrian Estate Horse Property Estates

Equestrian Estate For Sale In Shelby County Texas Welcome Home To Your Texas Paradise With Breath Taking Sunrises An Equestrian Estate Horse Property Estates

Keller City Council Approves Increase To Property Tax Homestead Exemption Community Impact Newspaper

Keller City Council Approves Increase To Property Tax Homestead Exemption Community Impact Newspaper

Looking South On Hemphill Just North Of Magnolia 1930s Old Photos Fort Fort Worth

Looking South On Hemphill Just North Of Magnolia 1930s Old Photos Fort Fort Worth

Dfw Dollar Deals Pick What You Want Cell Phone Covers Dfw Deal

Dfw Dollar Deals Pick What You Want Cell Phone Covers Dfw Deal

Always Great To Get Testimonials Like These Thank You Realestate Century21 Shahair Homesale Arlingtontexas Century How To Plan Marketing Plan

Always Great To Get Testimonials Like These Thank You Realestate Century21 Shahair Homesale Arlingtontexas Century How To Plan Marketing Plan

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Tax Disabled Veteran Home Exemption Information

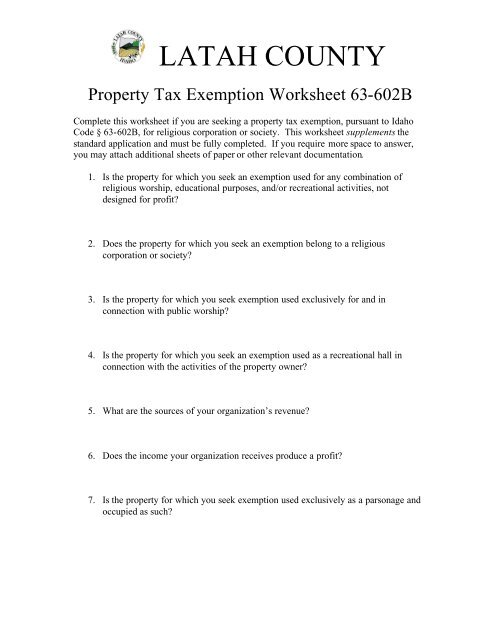

Property Tax Exemption Worksheets Latah County

Property Tax Exemption Worksheets Latah County

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home