How To Get Property Identification Number Bangalore

DiGi7 represents a 7 digit unique number with GPS coordinates for each property. Citizens can get their DiGi-7 numbers by sending an SMS or calling BBMPs call centre and submitting their property identification number PID logging on to DiGi-7 portal or downloading the.

Brigade Topaz Bangalore Find Price Gallery Plans Amenities Bangalore City Best Social Media Campaigns Brigade

Brigade Topaz Bangalore Find Price Gallery Plans Amenities Bangalore City Best Social Media Campaigns Brigade

BBMPs DiGi7 app is a GPS driven digital door numbering mechanism for properties in Bangalore.

How to get property identification number bangalore. A unique street number has been. Form see rule 8cc ii bruhat bengaluru mahanagara palike self assessment of property tax form return. Enter your details First name last name 10-digit mobile number valid email ID and Aadhaar number Step 6.

Login to wwwlandrecordskarnatakagovin Step 2. Check mortgage documents associated with your property. 4 Enter the application number you used for your 2008-2009 property tax payment or enter your old PID Number and click on Search.

At the site go to the right side of the homepage that is property tax filing and payment. The seven-digit unique ID is a permanent number which will not change even if the property ownership changes said BBMP Special Commissioner finance revenue and advertisement Manoj Rajan. Click on Property tax payment.

Step 1. The Property Identification Number will contain the information of ward number new street ID and newly allotted property number. Call or visit your local county assessor.

Click on iRTC Step 5. Check latest updates on DiGi7 app in this article. Property type is residential commercial or industrial.

BBMP has developed a GIS based Property Tax System covering whole BBMP jurisdictional area as part of this System BBMP has provided a unique Property Identification Number PID to each every Property in Bangalore. Those details are given below-. In search type you need to select option such as survey number TP number block number etc.

A complete new page will be opened where at the bottom some details will be asked to continue. You can mail BBMP at bbmpsasbbmpgovin and provide your 2008-2009 application no to check your PID detail. Register through your first number and mobile number.

As the property tax cannot be paid without the PID number property owners headed to the BDA local office to collect the numbers. Under projects tab click on Bhoomi Step 3. TIN is applied for both sale and purchase of goods and services in a state or between different states.

But that came at a price tag of Rs 2300. You will be redirected to a new page where you have to choose GIS Enabled Property Tax Information System. All the real estate properties in Bangalore have been given a new PID number.

Go to bhoomi app or BBMP Web site enter door no or PIDproperty index directory number you will get the owner details. How to get PID. In property wise option you need to give district sub registrar office Index 2 Property type Search type and TP no or survey number.

Tax ID numbers are often listed. You property ID number is mentioned on the tax receipts you received in the past. The seven-digit unique ID is a permanent number which will not change even if the property ownership changes said BBMP special commissioner finance revenue and advertisement Manoj Rajan.

You need to be aware that the e-khata can be only used by property owners who have been allotted a Property Identification number PID number. A unique street number has been assigned to each and every Street and within. The PID Number is a combination of Ward number- Street Number-Plot number.

1 Go to the link bbmpgovin. TIN or Tax Identification Number is a unique number which is assigned to business enterprises by the Commercial Tax Department of the respective state in which the applicant has applied. Look at a recent copy of your property or school tax bill or receipt see below.

Though BBMP has alloted Property Identification Numbers for properties in Bangalore currently there is no online facility for checking or finding a PID number. To find the PID number online for any property users needs to visit the BBPM website httpbbmpgovin. BBMP How to find new PID number to pay property taxThe PID Number is a combination of Ward number- Street Number-Plot number.

Citizens can get their DiGi-7 numbers by sending an SMS or calling BBMPs call centre and submitting their property identification number PID logging on to the DiGi-7 portal or. Form for the block period in respect of taxpayers who have filed returns in the previous year in form i property with pid number or form ii property without pid but have a khatha number or form iii property that have no pid or khatha but a revenue survey number. With the advancement of technology you can now file it by logging on to the BBMP official website.

Look at your propertys deed and locate the number in the property description. The property mapped on your mobile number will be shown on the map. 3 Go to the bottom of the page and click on To Know your New PID Click Here.

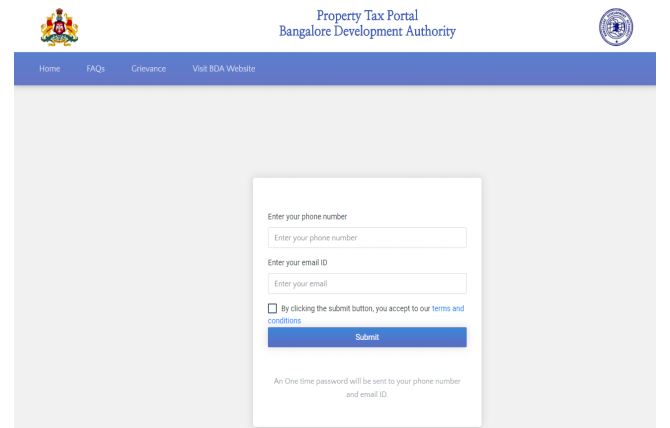

If you are a new tax payer you can find out the ID by keying in all the other details about your property on the MCG website httpswwwmcggovin. You need to enter your name mobile number and e-mail address. Click on Citizen services Step 4.

Visit BBMP official website and select Citizen Services.

Read more »Labels: identification, number, property