Property Tax Search Maricopa County Az

According to the Office of the Maricopa County Assessor this is the physical location of the property being represented by this bill. Go to Data Online.

City Limits Maricopa County Az

Maricopa County AZ Property Tax information.

Property tax search maricopa county az. Do not include city or apartmentsuite numbers. Maricopa Assessor 602 506 - 3406. Enter the property owner to search for and then click on Go.

Maricopa County Assessors Office. Prior to the economic downturn property values were. How does the City calculate its property tax rate.

Maricopa County AZ Property Tax Search by Address. Contact the county treasurer. Maricopa NETR Mapping and GIS.

Arizona is ranked 874th of the 3143 counties in the United States in order of the median amount of property taxes collected. See Maricopa County AZ tax rates tax exemptions for any property the tax assessment history for the past years and more. 20 rows Property taxes are paid to the county treasurers office.

Historic Aerials 480 967 - 6752. The Judicial Branch of Arizona in Maricopa County is dedicated to providing a safe fair and impartial forum for resolving disputes enhancing access to our services and providing innovative evidence based programs that improve the safety of our community and ensure the publics trust and confidence in. The median property tax in Maricopa County Arizona is 1418 per year for a home worth the median value of 238600.

Property valuation of County Down Drive Chandler AZ. Go to Data Online. The Maricopa County Supervisors only control a small portion of the property tax bill.

The chart below is based on average property taxes paid by Goodyear residents. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. Once youve selected the specific parcel in question look in the upper right of the parcel detail results.

The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars. Maricopa Treasurer 602 506 - 8511. Enter the Assessor Parcel Number APN to search.

Maricopa Recorder 602 506 - 3535. Forms Library AgricultureLand Appeals Business Personal Property Common Area Forms Historic Property Tax Reclassification Mobile Homes Organizational Exemptions Personal Exemptions Residential Property Valuation Relief Programs. Relationship Between Property Values Taxes.

Maricopa County collects on average 059 of a propertys assessed fair market value as property tax. If the Parcel Type is ResidentialRental then we have the property registered as a rental. In-depth Property Tax Information.

Visit the Maricopa County Treasurers Office for information on reading and understanding your tax bill. The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with full cash value of more than 6075 billion in 2020. Enter the address or street intersection to search for and then click on Go.

Search for a property by name parcel number agent name street name or subdivision. More information can be found at Tax Court or Small Claims Court at 125 W Washington Phoenix AZ or call 602-506-8297 For Superior Court wwwsuperiorcourtmaricopagov Rental Registration To register your parcel as a residential rental please complete the printable Residential Real Property Registration form link below or search for your parcel and click Register Rental in the bar above Property. Go to Data Online.

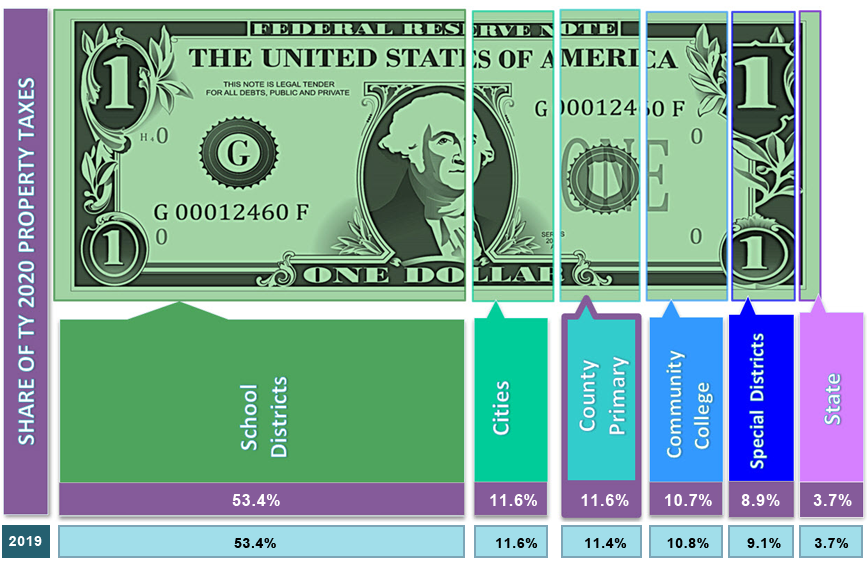

The School District taxes are the largest portion of the property taxes followed by cities the community college districts special districts and the State. Maricopa Mapping GIS. Your property tax bill lists each agencys tax rate and the exact amount that each agency receives.

Maricopa County Tax Records httpstreasurermaricopagovPagesLoadPage Find Maricopa County Arizona tax records by name property address account number tax year ticket number and district map and parcel. Go to Data Online. 3804 3805 3824 3825 3834 3835 3844 3845 3854 3855 tax assessments.

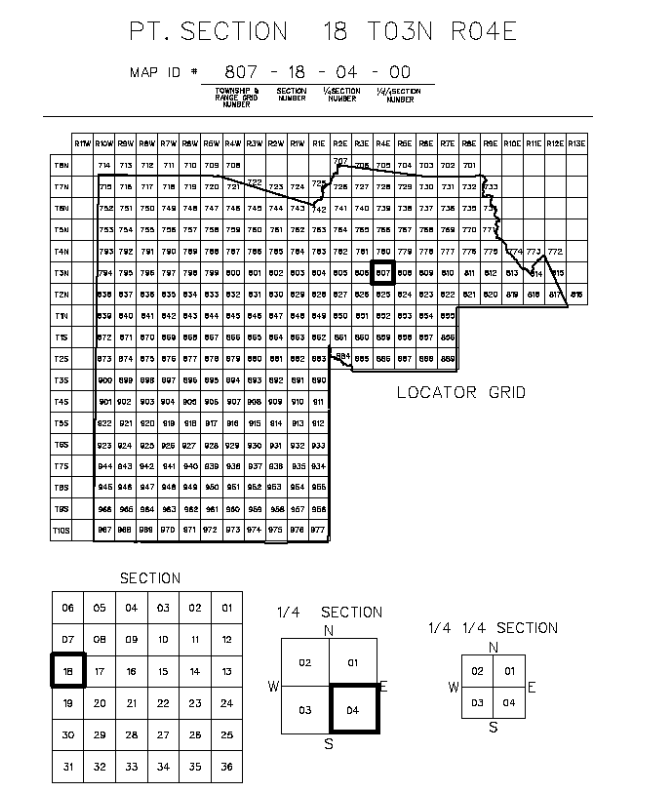

The Maricopa County Assessors Office is open to serve you by phone email and by appointment only at this. The number is composed of the book map and parcel number as defined by the Maricopa County Assessors Office. See what the tax bill is for any Maricopa County AZ property by simply typing its address into a search bar.

Maricopa County Assessor S Office Mcassessor Twitter

Maricopa County Assessor S Office Mcassessor Twitter

Maricopa County Assessor S Office

Maricopa County Assessor S Office

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Land Academy Weekly Webinar April 27 2017 Maricopa County Webinar Apn

Land Academy Weekly Webinar April 27 2017 Maricopa County Webinar Apn

Equestrian Estate For Sale In Maricopa County Arizona Owned And Developed By The Iconic Al Dunning A 45 Time Equestrian Facilities Horse Property Hay Barn

Equestrian Estate For Sale In Maricopa County Arizona Owned And Developed By The Iconic Al Dunning A 45 Time Equestrian Facilities Horse Property Hay Barn

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Making Sense Of Maricopa County Property Taxes And Valuations

Making Sense Of Maricopa County Property Taxes And Valuations

Taxes Maricopa County Assessor S Office

Taxes Maricopa County Assessor S Office

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Maricopa County Arizona Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Residential Property Maricopa County Tech Company Logos Property

Residential Property Maricopa County Tech Company Logos Property

Pin On Everything Permaculture

Pin On Everything Permaculture

Pay Your Bills Maricopa County Az

Maricopa County Assessor S Office Mcassessor Twitter

Maricopa County Assessor S Office Mcassessor Twitter

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home