Missouri Property Tax Assessment Rates

Please contact the State Auditors Tax Rate Section if you have any questions regarding the calculation of property taxes. Assessment Department units can be reached as follows.

2019 Property Tax By State Property Tax States In America Estate Tax

2019 Property Tax By State Property Tax States In America Estate Tax

State Summary Tax Assessors Missouri has 115 counties with median property taxes ranging from a high of 237700 in St.

Missouri property tax assessment rates. The second factor used to determine school property taxes is the levy or what tax rate is levied on property. Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri. State law requires the Missouri State Auditor to annually review all property tax rates throughout Missouri as to their compliance with the state law.

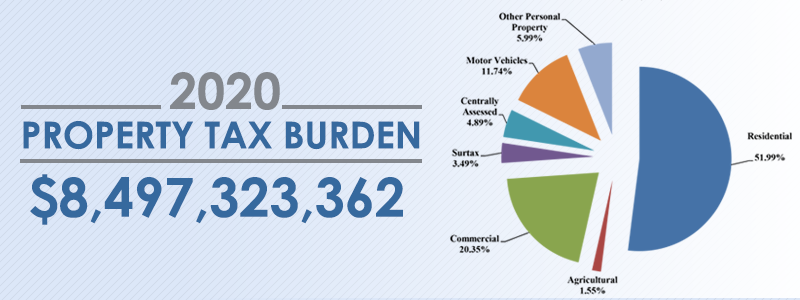

Agricultural property in Missouri a farm is assessed at 12 of actual value. Property taxes are due by December 31st. Findings in the review of 2020 Property Tax Rates Property taxes largely fund public schools and are the main source of revenue for many of Missouris special purpose political subdivisions and county boards.

Finally business property in Missouri is assessed at 33 of actual value. Individual Personal Property specifi. Rates in Missouri vary significantly depending on where you live though.

Tax amount varies by county. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The County Assessor is not part of the taxing districts budget or levy process the Assessors job was completed with the reassessment process.

The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Effective April 30 2020. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

Missouri Department of Revenue. The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Information and online services regarding your taxes.

116 rows The states average effective property tax rate is 093 somewhat lower than the national average of 107. TAX CALENDAR Property is assessed as of January 1. Charles County to a low of 34800 in Shannon County.

116 rows To find detailed property tax statistics for any county in Missouri click the countys name. Value Assessment Assessed Value Tax Rate Tax Levied Home 50000 19 9500 Cars 15000 333 5000 Total 14500 0570 82650 The figure of 0570 gives the same result as multiplying by 570 and then dividing by 100 since the tax rate is per 100 valuation. In-depth Missouri Property Tax Information.

The State Tax Commission of. Subsequently a farm with a 100000 actual value has an assessed value of 12000. Taxes are based on assessed value per 10000 of value.

Missouri law requires that property be assessed at the following percentages of true value. Kansas ranked 43 out of 51 with 51 being the worst has a rate of 205 percent. Business Personal Property specific.

2019 Property Tax Rates Results The State Auditor received supporting data and reviewed 4839 property tax rates for 2804 taxing authorities. 52 rows The total property tax as a percentage of state-local revenue is 1693 while the property. Of the rates reviewed 503 are debt service tax rates 127 are new property tax rates approved by voters and are 53 existing property tax rates that were increased by voter approval.

Counties in Missouri collect an average of 091 of a propertys assesed fair market value as property tax per year. Mississippis rate is 355 percent Virginias is 405 percent and Rhode Islands is 44 percent. The levies that are set determine your taxes for the year.

Personal property 33 13 percent Residential real property 19 percent Agricultural real property 12 percent All other real property 32 percent. The State Auditors Office and county officials assist local. Louis County for example the average effective tax rate is 138.

In Shannon County the rate is just 035. For more details about the property tax rates in any of Missouris counties choose. The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home.

Claim Hra Even If Company Not Paying Share Market Investing Income Tax

Claim Hra Even If Company Not Paying Share Market Investing Income Tax

Should I Borrow Against My 401k The Financial Gym The Borrowers Personal Savings Personal Budget

Should I Borrow Against My 401k The Financial Gym The Borrowers Personal Savings Personal Budget

Cities With The Highest And Lowest Costs Of Living Cost Of Living City Financial Tips

Cities With The Highest And Lowest Costs Of Living Cost Of Living City Financial Tips

Investment Risk Tolerance Assessment Quiz Personal Financial Planning Investing Financial Planning

Investment Risk Tolerance Assessment Quiz Personal Financial Planning Investing Financial Planning

How Much Mortgage Can I Afford Mortgage Qualification Calculator Budget Template Free Mortgage Qualifications

How Much Mortgage Can I Afford Mortgage Qualification Calculator Budget Template Free Mortgage Qualifications

Globe Building 1712 Main Built In 1902 Photo Circa 1940 Kansas City Downtown Kansas City Missouri City Pictures

Globe Building 1712 Main Built In 1902 Photo Circa 1940 Kansas City Downtown Kansas City Missouri City Pictures

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

The Giving Pledge Letters By The Pledgers The Giving Pledge Pledge Letters

The Giving Pledge Letters By The Pledgers The Giving Pledge Pledge Letters

Property Tax City Of Commerce City Co

Tips For Managing Property Taxes And Finding Tax Rates Exterior House Colors Siding Cost Colonial House

Tips For Managing Property Taxes And Finding Tax Rates Exterior House Colors Siding Cost Colonial House

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

This Map Shows The Job Googled More In Each State Than Anywhere Else In The Us Urban Farmer Happy Facts Map

This Map Shows The Job Googled More In Each State Than Anywhere Else In The Us Urban Farmer Happy Facts Map

Free Electricity Offer Electricity Clark Howard Average Electric Bill

Free Electricity Offer Electricity Clark Howard Average Electric Bill

Labels: assessment, missouri, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home