Does Quit Claim Deed Affect Property Taxes

Tax code gift taxes are paid by the giver so the brother would have to fill out a gift tax form 709 and he can apply the value of half the house to the lifetime maximum of 55 million he can give away under current estate tax rules. Either document would do the trick.

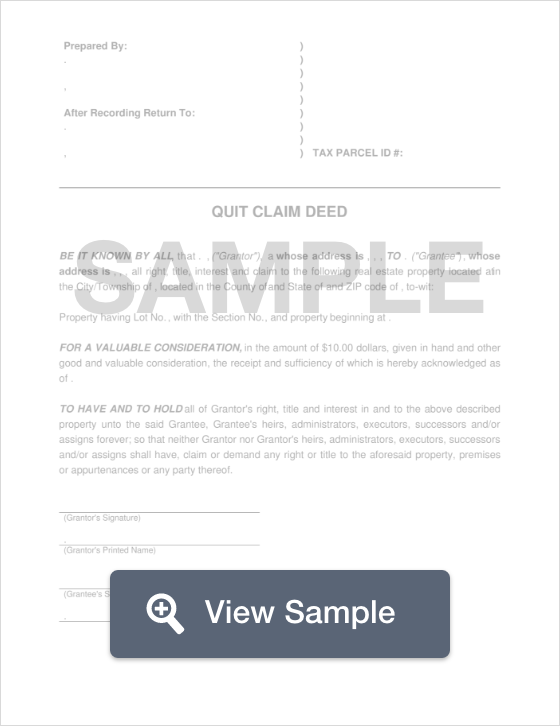

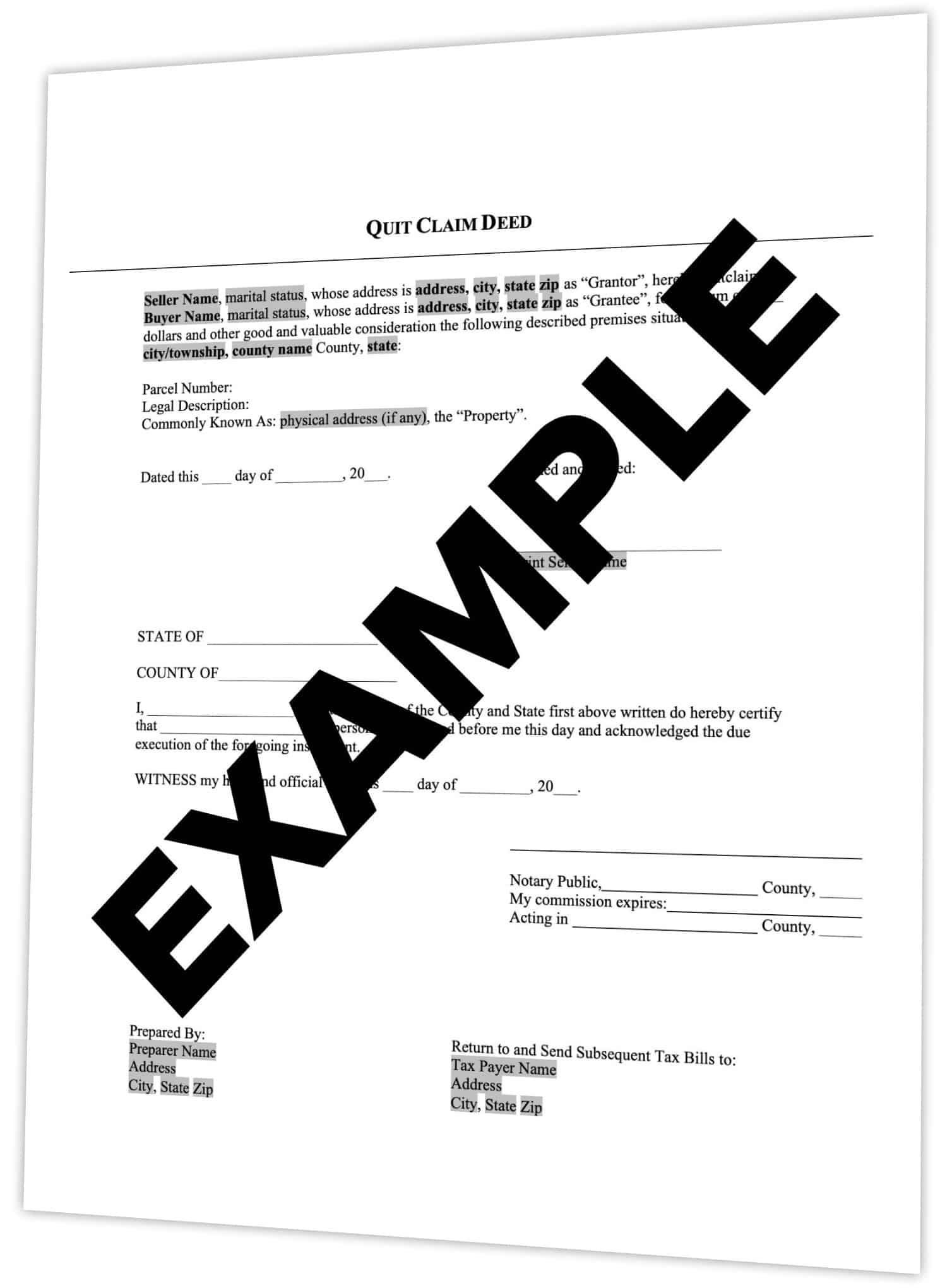

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

In this circumstance the quitclaim deed has no effect on property taxes which are now the responsibility of the new owner.

Does quit claim deed affect property taxes. Furthermore since a quit claim deed only transfers title if the person who transferred title or Grantor really had no legitimate interest in the property to begin with not only does the person on the receiving end of the quit claim deed or Grantee not have any title now but the person who wrongly conveyed the title to begin. A Quit Claim deed is also not taxable when ownership is transferred to a spouse visit IRSgov for exceptions to Gift Taxes. How does a quitclaim deed affect property taxes.

The tax is 70 cents per every 100 of the propertys sale price. Its getting the house as a gift that does it. Under the terms of the US.

On the other hand a gift via a quitclaim deed remains a gift. This is also known as the documentary stamp tax and is typically paid by the grantor. The easy answer on how to transfer title to your niece would be to convey it to her by warranty or quitclaim deed.

The legal ramifications of a quitclaim deed and its impact on community property claims will vary state to state. An Inheritance Taxapplies to an individual who becomes heir to a property after the owners death. When the quitclaim deed is recorded with the county one of the parties must pay the transfer tax to the Clerk of the Court for the county.

When I give her title to the property would there be issues with taxes. Since the property is generally gifted gift tax rules apply with respect to the value of the home. There are two potential tax consequences of signing a quitclaim deed in a divorce.

The excluded amount is taken off the taxpayers total allowable lifetime exclusion. That means that any transfer of property for free or even under market value may be subject to federal gift tax. Using a quitclaim deed doesnt affect the cost basis.

Quitclaim deed taxes in this case are generally calculated by taking a percentage of the sales price listed on the deed multiplied by a standard rate. Finally if you signed a quitclaim deed for a property you didnt own it would have no effect on the title. Like other deeds quitclaim deeds require payment of all back taxes before the grantee can receive the property.

It is known by a few different terms such as transfer tax stamp tax and excise tax. When the Conveying Party Is the Owner Whoever is the registered property owner on county records is responsible for paying the property taxes. A quitclaim deed does not negate unpaid taxes.

Once the claim is accepted it is up to the grantee to promptly deal with any back taxes to avoid a claim. If you have co-owners they retain their ownership stake. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax.

Transfer taxes both City transfer taxes and County transfer taxes. If back taxes are owed on the property the tax jurisdiction may place a claim to the property and the quitclaim deed can be negated. If your father used a warranty deed instead you would have the same basis.

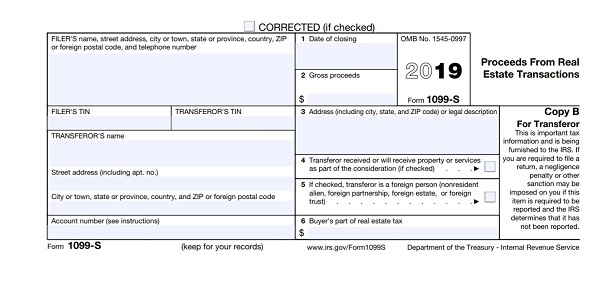

Most states impose a tax on the transfer of real property. If no money changes hands between the grantor and the grantee a gift tax applies and you must file a United States Gift and Generation-Skipping Transfer Tax Return Form 709. As to the tax question the IRS will view the addition of the letter writer via quitclaim deed as a gift.

Can I use a quitclaim deed. In addition to state-imposed fees some counties and cities impose a tax. A quitclaim deed transfers whatever interest you might have in a property.

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

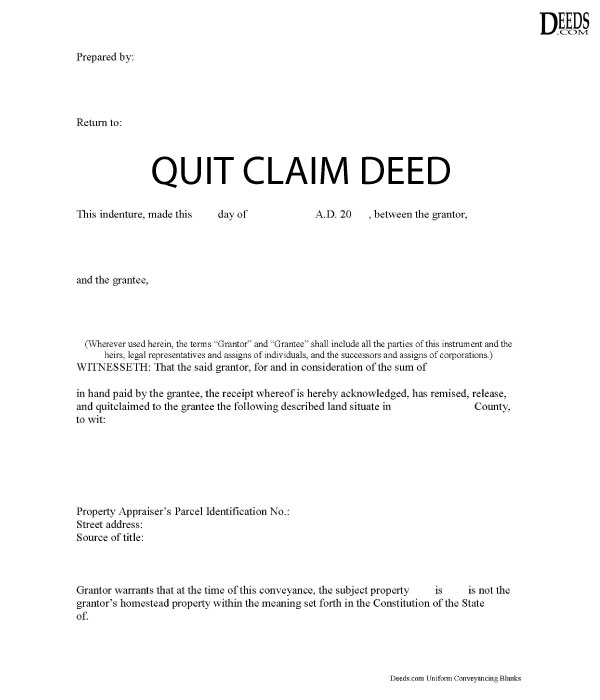

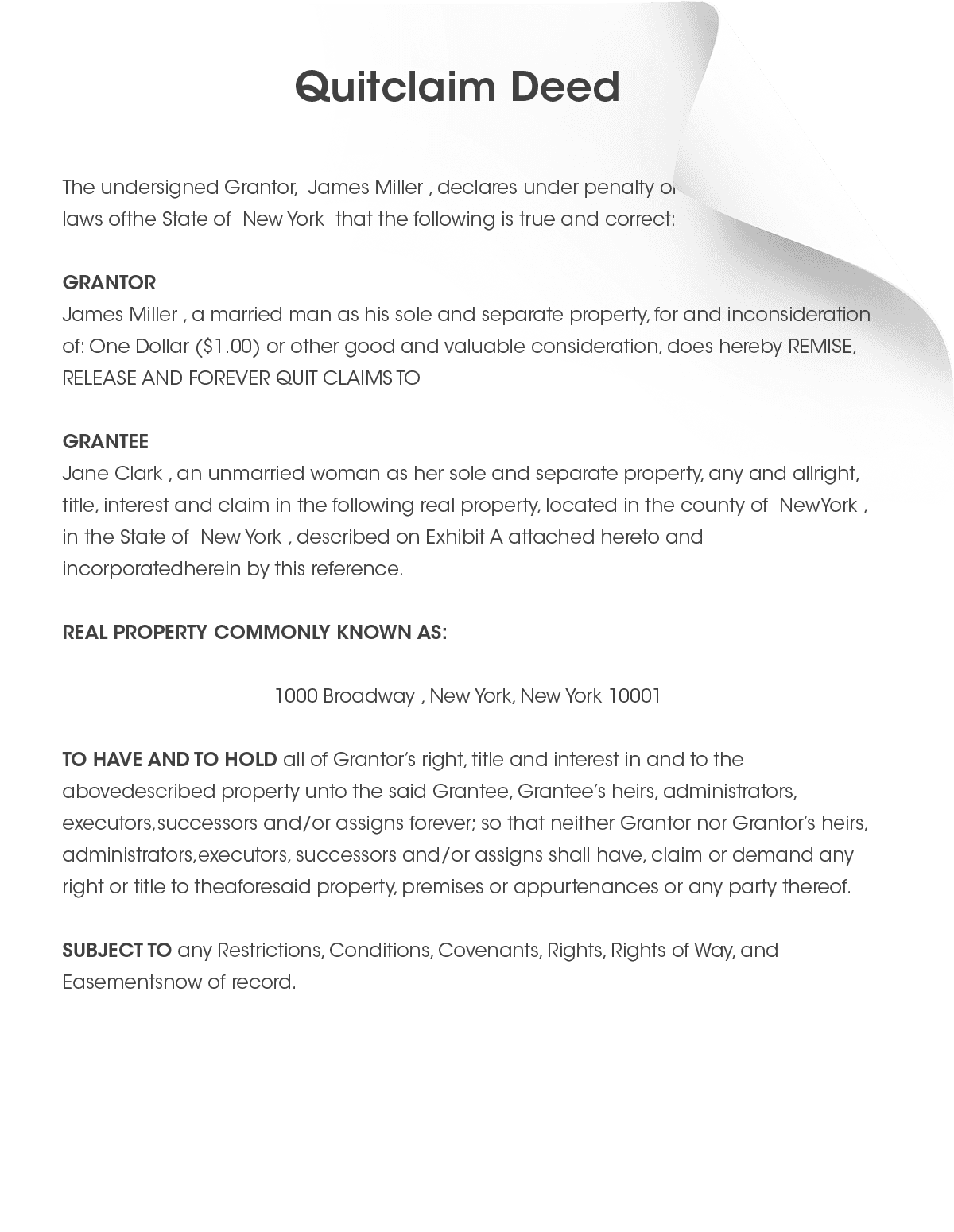

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

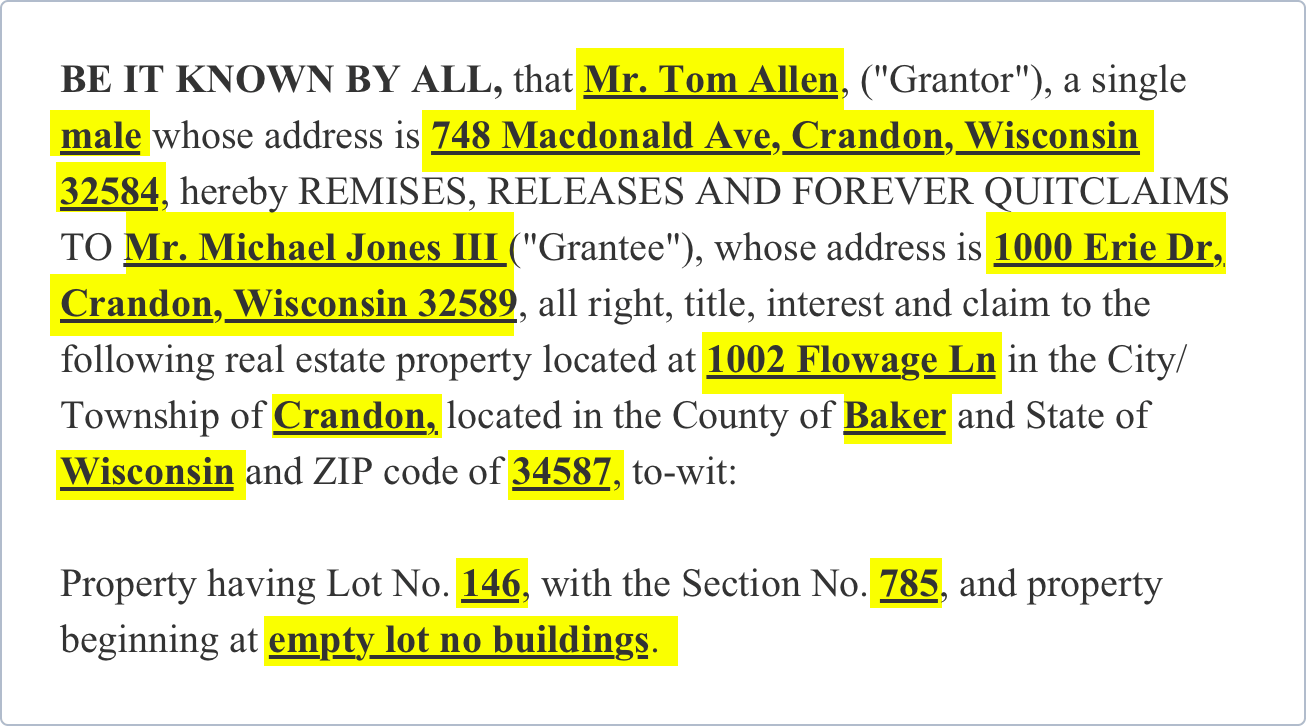

What Is A Quit Claim Deed Retipster Com

What Is A Quit Claim Deed Retipster Com

Quit Claim Deed Form Nj 5 Great Quit Claim Deed Form Nj Ideas That You Can Share With Your F Quitclaim Deed Letter Templates Free Templates

Quit Claim Deed Form Nj 5 Great Quit Claim Deed Form Nj Ideas That You Can Share With Your F Quitclaim Deed Letter Templates Free Templates

Quit Claim Deed Pdf Quitclaim Deed Quites Things To Sell

Quit Claim Deed Pdf Quitclaim Deed Quites Things To Sell

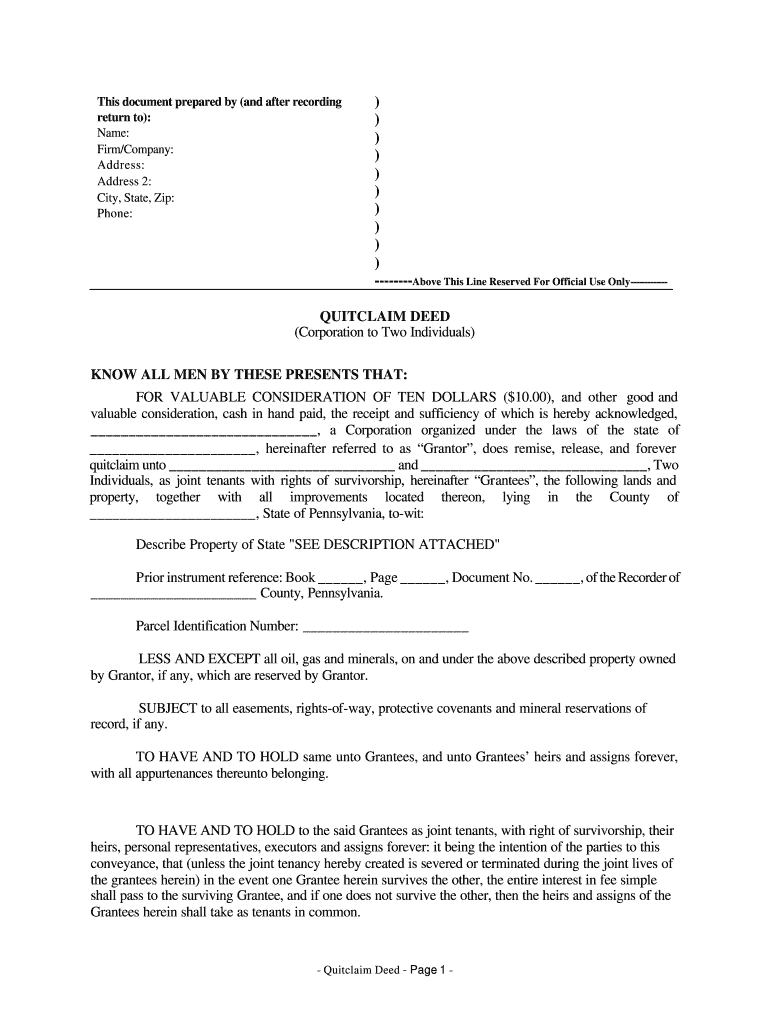

Idividual To Individual Quit Claim Deed Pa Form Complete Legal Document Online Us Legal Forms

Idividual To Individual Quit Claim Deed Pa Form Complete Legal Document Online Us Legal Forms

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Funeral Program Template Templates

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Funeral Program Template Templates

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

8 Printable Example Of A Quit Claim Deed Completed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

8 Printable Example Of A Quit Claim Deed Completed Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

Quit Claim Deed Form Florida Printable Fill Out And Sign Printable Pdf Template Signnow

Quit Claim Deed Form Florida Printable Fill Out And Sign Printable Pdf Template Signnow

7 Reasons Why You Need An Attorney For A Quitclaim Deed Transaction

7 Reasons Why You Need An Attorney For A Quitclaim Deed Transaction

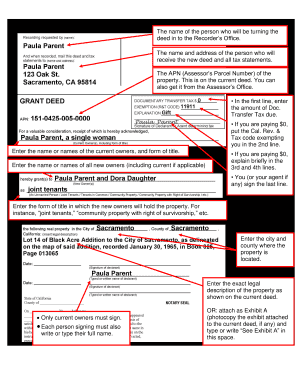

Quitclaim Deed Ez Estate Planner

Quitclaim Deed Ez Estate Planner

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home