Quit Claim Deed A Property

A quitclaim deed is quick and easy because it transfers all of one persons interest in the property to another. That interest could be full title or it could be absolutely nothing.

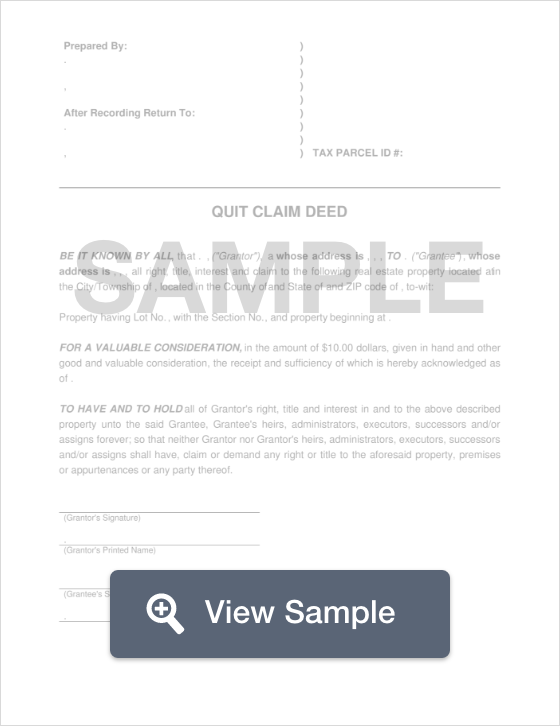

Browse Our Image Of Quit Claim Letter Template Quitclaim Deed Letter Templates Doctors Note Template

Browse Our Image Of Quit Claim Letter Template Quitclaim Deed Letter Templates Doctors Note Template

This means that a seller who owns a building or other property can give a quitclaim deed to a buyerand thereby transfer the sellers entire interest in that property to the buyer.

Quit claim deed a property. These fees are for the RP-5217 form. In sharp contrast to these warranty deeds a quitclaim deed contains no warranties of title at all. A Quit Claim Deed or quitclaim transfers the ownership or rights of property from a Grantor current owner to a Grantee new owner.

But while most deeds describe exactly what interest is being transferred quitclaims dont do this. A quitclaim deed passes only such right title and interest as the grantor has at the time of making the deed. A seller who gives a quitclaim deed is promising merely to convey whatever interest he or she might have in the property.

Used when a real estate property transfers ownership without being sold. However a quitclaim doesnt make any. Another potential hitch with using a quitclaim deed to own the family home together is what happens if one brother dies Simasko says.

A quitclaim deed is a relatively simple and easy way to transfer any and all interest you may have in a piece of real property to someone else. Fees to File a Quitclaim Deed in New York. The quitclaim deed only operates to convey to the sellers interest in the property to the buyer.

As of 2018 the basic fee for filing a quitclaim deed of residential or farm property is 125 while the fee for all other property is 250. A quitclaim deed is a legal document used to convey an interest in real property. This type of deed makes no guarantees if there are any other owners other than the Grantor.

It must be in writing and it must contain certain elements as outlined in Florida Statute Section 69526. No money is involved in the transaction no title search. The fee to file a New York state quit claim deed is unique to each county.

Typical in real estate sales this type of deed requires a title search and title insurance to ensure that there are no liens on the property. A quitclaim deed usually includes a legal description of the property the name of the person who is transferring their interest the name of the person who is receiving that interest. Prepared by statement name and address of the natural person preparing the Deed.

A quitclaim deed is used to transfer an interest in real property. This means that if a seller owns a building he can give a quitclaim deed to the buyer and the sellers entire interest has been transferred. A quitclaim deed is quite different.

A Quitclaim Deed is used to transfer any ownership that someone a grantor has in a piece of property to another party a grantee without providing a warranty. However as of 2018 the basic fee for filing a quit claim deed form ny of residential or farm property is 125 while the fee to file for quitclaim deed NY for all other property is. An alternative mechanism for transferring property is a warranty deed.

The fees to file a New York quitclaim deed vary from county to county but some of the fees are similar. This means that the grantor does not guarantee that there are no other claims to the property in existence.

Read more »