Property Tax Exemption For Senior Citizens And Disabled Persons

This is in addition to the General Homestead Exemption and any other applicable exemptions. The exemption program reduces the amount of property taxes owing on your primary residence.

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

To qualify you must be disa-.

Property tax exemption for senior citizens and disabled persons. Print out the appropriate application s below. This discount carries over to the veterans surviving. The value of your Washington State residence is frozen for property tax purposes and you become exempt from all excess and special levies and possibly regular levies resulting in a reduction in your property taxes.

If the owner qualifies for both the 10000 exemption for age 65 or older homeowners and the 10000 exemption for disabled homeowners the owner must choose one or the. File with the county auditor on or before December 31. Details of each qualification follows.

Disabled may receive a discount from tax on property that they own and use as homesteads. The persons name and position b The residents duties if any. Property tax exemption program for senior citizens and people with disabilities.

Click here to view the 2019 Department of Revenue brochure on property tax exemptions for senior citizens and disabled persons If you are a senior citizen andor disabled with your primary residence in Washington the Property Tax Exemption for Senior Citizens and Disabled Persons program may help you pay your property taxes. The same income limit applies. Combined service-connected evaluation rating of 80 or higher.

Disabled persons in Kansas can also claim an exemption in the form of a refund on their last property tax bill. Real Property Tax Exemption and Remission Office Use Only County application number. Age 65 or older and disabled exemptions.

At least 61 years of age or older. Qualifications The exemption program qualifications are based off of age or disability ownership occupancy and income. If the purpose of the property is to provide a place of residence for senior citizens submit all information required by RC.

2019 and prior Senior Citizen Disabled Person Property Tax Exemption Program PDF 2020 - 2024 Senior Citizen Disabled Person Property Tax Exemption Program PDF Special Land Classification Programs. Seniors or disabled persons residing in Spokane County who are interested in applying for tax exemption may. Real property and manufactured or mobile homes.

Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses. The discount is a percentage equal to the percentage of the veterans permanent service-connected disability as determined by the United States Department of Veterans Affairs. Attach all supporting documentation.

Retired from regular gainful employment due to a disability. The initial Form PTAX-343 Application for the Homestead Exemption for Persons with Disabilities along with the required proof of disability must be filed with the Chief County Assessment Office. Please read the instructions on the back of this form before you complete it.

If you are totally and permanently disabled or the surviving spouse of such a person you may qualify for the same exemption as seniors do. The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property tax exemptions is generally between the ages of 61 to 65. At least 61 years of age.

Property tax exemptions and property tax deferrals. Fill in the application according to the instructions attached to the application. Senior Citizen Disabled Persons Exemption Program.

Individuals age 65 or older or disabled residence homestead owners qualify for a 10000 homestead exemption for school district taxes in addition to the 25000 exemption for all homeowners. Age or disability By December 31 of the assessment year you must be any of the following. Disabled Persons Homestead Exemption PTAX 343 The Disabled Persons Homestead Exemption is entitled to an annual exemption of 2000 off the assessed value.

For persons age 65 or older or disabled Tax Code Section 1113c requires school districts to offer an additional 10000 residence homestead exemption and Tax Code Section 1113d allows any taxing unit the option to decide locally to offer a separate residence homestead exemption. Open Space Taxation Act Publication PDF Designated Forest Land Publication PDF Other Property Tax Relief Programs. Disabled applicants must complete form DTE 105E.

Property Tax Deferral. Assessment year to receive property tax relief in the tax year. Dependent Child Exemption If you live with a dependent child under the age of 18 you may be able to claim a refund on your property tax from the previous year.

Sign the application with two witnesses to verify your signature. State law provides two tax benefit programs for senior citizens and the disabled. Yet more than 26000 qualified seniors and disabled persons have yet to register for the exemption and only 1 in 100 of those eligible for deferrals are currently enrolled.

This exemption is an annual 2000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the payment of property taxes.

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Property Tax Exemptions Palatine Township

Property Tax Exemptions Palatine Township

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Http Assessmentandcollection1 Townofmanchester Org Index Cfm Property Tax Relief For Veterans Seniors And Disabled

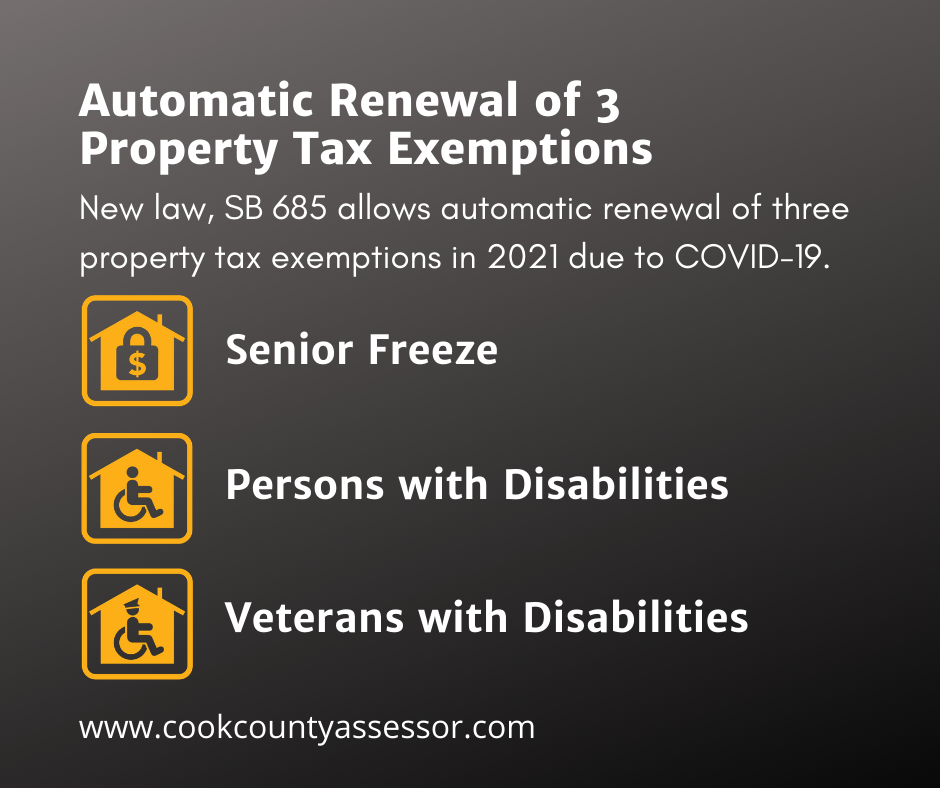

Automatic Renewal Of 3 Property Tax Exemptions In 2021 Due To Covid 19 Cook County Assessor S Office

Automatic Renewal Of 3 Property Tax Exemptions In 2021 Due To Covid 19 Cook County Assessor S Office

Https Www House Leg State Mn Us Hrd Pubs Ss Ssscptdp Pdf

Https Www Washingtonlawhelp Org Resource Property Tax Exemptions For Senior Citizens A Download 39297c5a Ff4b A168 B180 9bb77825210e Pdf

Nps National Pension Scheme Nps Login Benefits Of Nps Investing Pensions Nps

Nps National Pension Scheme Nps Login Benefits Of Nps Investing Pensions Nps

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

10 Tax Deductions For Seniors You Might Not Know About

10 Tax Deductions For Seniors You Might Not Know About

Click Here To View The Calculations Income Tax Income Tax

Click Here To View The Calculations Income Tax Income Tax

Https Www Dupageco Org Community Services Senior Services Docs Awd Directory 49869

Standard Deduction For Salaried Employees Impact Of Standard Deduction Income From Salary Standard Deduction Deduction Income

Standard Deduction For Salaried Employees Impact Of Standard Deduction Income From Salary Standard Deduction Deduction Income

Property Tax Exemptions Who Qualifies Rocket Mortgage

Property Tax Exemptions Who Qualifies Rocket Mortgage

Section 80ttb Senior Citizen Tax Exemption Deduction

Section 80ttb Senior Citizen Tax Exemption Deduction

Super Cool Taxtips To Help You Save Money To File Your Itr For Free Visit Https Tax2win In Itr Happyfiling Ta Income Tax Return Tax Return Income Tax

Super Cool Taxtips To Help You Save Money To File Your Itr For Free Visit Https Tax2win In Itr Happyfiling Ta Income Tax Return Tax Return Income Tax

International Day Of Disabled Person Income Tax Tax Deductions Tax

International Day Of Disabled Person Income Tax Tax Deductions Tax

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home