Tennessee Property Tax Assessment Ratio

The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by your county commission at 320 per hundred of assessed value. Property is classified based on how the property is used.

Johnson City Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The ASSESSMENT RATIO for the different classes of property is established by state law residential and farm 25 of appraised value commercialindustrial 40 of appraised value and personalty.

Tennessee property tax assessment ratio. State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. What district am I in. Total assessment and estimates of other revenue are combined with budget projections to determine the property tax rate.

Appraising real estate for assessment purposes. Data on this site exists for 84 of Tennessees 95 counties. Real property is classified by the Tennessee Constitution into sub-classifications in order to determine the assessment ratio.

Assessed Value Assessed value is the foundation upon which taxing authorities determine the amount of real estate taxes to be paid. TENNESSEE PROPERTY TAX Dwayne W. Carter The authors wish to acknowledge the past contributions of Samuel F.

Property tax rate is established by the County Commission and city governing bodies. The information presented on this site is used by county Assessors of Property to assess the value of real estate for property tax purposes. For more information contact your local assessor of property or visit the Tennessee Comptroller of the Treasurys Division of Property Assessments.

The assessed value of a property varies according to whether the property is classified as farmresidential property 25 of fair market value commercialindustrial property 40 or. This property is listed as Residential with an assessment ratio of 25. Submit a report online here or call the toll-free hotline at 18002325454.

To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification. Tracks changes in ownership addresses and property boundaries. To figure the tax simply multiply the ASSESSED VALUE 25000 by the TAX RATE 320 per hundred dollars assessed.

Then multiply the product by the tax rate. Property taxes in Tennessee are calculated utilizing the following four components. Assessor provides assessed value totals to county and city governing bodies.

The Property Assessor is charged with identifying and valuing all property real or personal within the county. Assessed values can be found by multiplying the appraised value of the property which is public record by the assessment ratios for Tennessee. 2019 Real Estate Appraisal Ratio Report 2018 Real Estate Appraisal Ratio Report.

Links are provided at the bottom of this page for the counties not included here which are Bradley Chester Davidson Hamilton Hickman Knox. Miller Property Tax Deskbook 2010-2011 16th Edition 43-1. In Tennessee homeowners can calculate their tax bill by multiplying the assessed value of property by the tax rate in the propertys city and county.

The APPRAISED VALUE for each taxable property in a county is determined by the county property assessor. Multiply the Assessment Value times the Tax Rate 25000 X 299100 748 rounded to nearest dollar or 25000 X 0299 748 This gives you the amount of the county property tax bill for this particular property. The ratio of assessment to value of property in each class or subclass shall be equal and uniform throughout the state TCA.

25000100 250 x. Duty of the Property Assessor. The TAX RATE for each county and municipality is set by the mayor and the legislative body of the counties and municipalities based on the amount budgeted to fund services.

The required distribution of county local option sales tax revenue regardless of the location of the sale is 50 percent to education in the same manner as the property tax and 50 percent to the location where the sale occurred. The assessment ratio for each different classification of property is established by Tennessee Constitution Art2 28 and TCA 67-5-801 state law as follows. The Assessment Ratio for the different classes of property is.

Multiply the Assessment Value times the Tax Rate 25000 X 299100 748 rounded to nearest dollar or 25000 X 0299 748 This gives you the amount of the county property tax bill for this particular property. However a propertys taxable value or assessed value is based on a percentage of its market value. 4 rows ASSESSMENT RATIO.

For more information please see Local Option Sales Tax CTAS-1618 in e-Li. These ratios are used for several purposes including equalization of public utility and common carrier assessments equalization of local business personal property assessments determining tax relief payments for elderly and disabled homeowners and determining adjusted county property values under the Tennessee Education Finance Act. The current Davidson County property tax rate is 3155 per 100 of assessed value in the Urban Services District and 2755 per 100 in the General Services District.

Https Comptroller Tn Gov Content Dam Cot Pa Documents Tax Aggregate Reports 2018taxaggregatereport Pdf

Savannah Tennessee Tn 38372 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Where The Jobs For The Young Are And Aren T Retirement Locations Retirement Retirement Advice

Where The Jobs For The Young Are And Aren T Retirement Locations Retirement Retirement Advice

Best Community Colleges In Tennessee 2020 Bestcolleges

Best Community Colleges In Tennessee 2020 Bestcolleges

Trustee Jefferson County Government

Trustee Jefferson County Government

Tennessee Property Data Home Page Data Sale House Property

Tennessee Property Data Home Page Data Sale House Property

Nashville Davidson Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template You Are The Father List Template Memories

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template You Are The Father List Template Memories

Http Www Chattanoogachamber Com Images Uploads Pdfs Local State Tax Structure Pdf

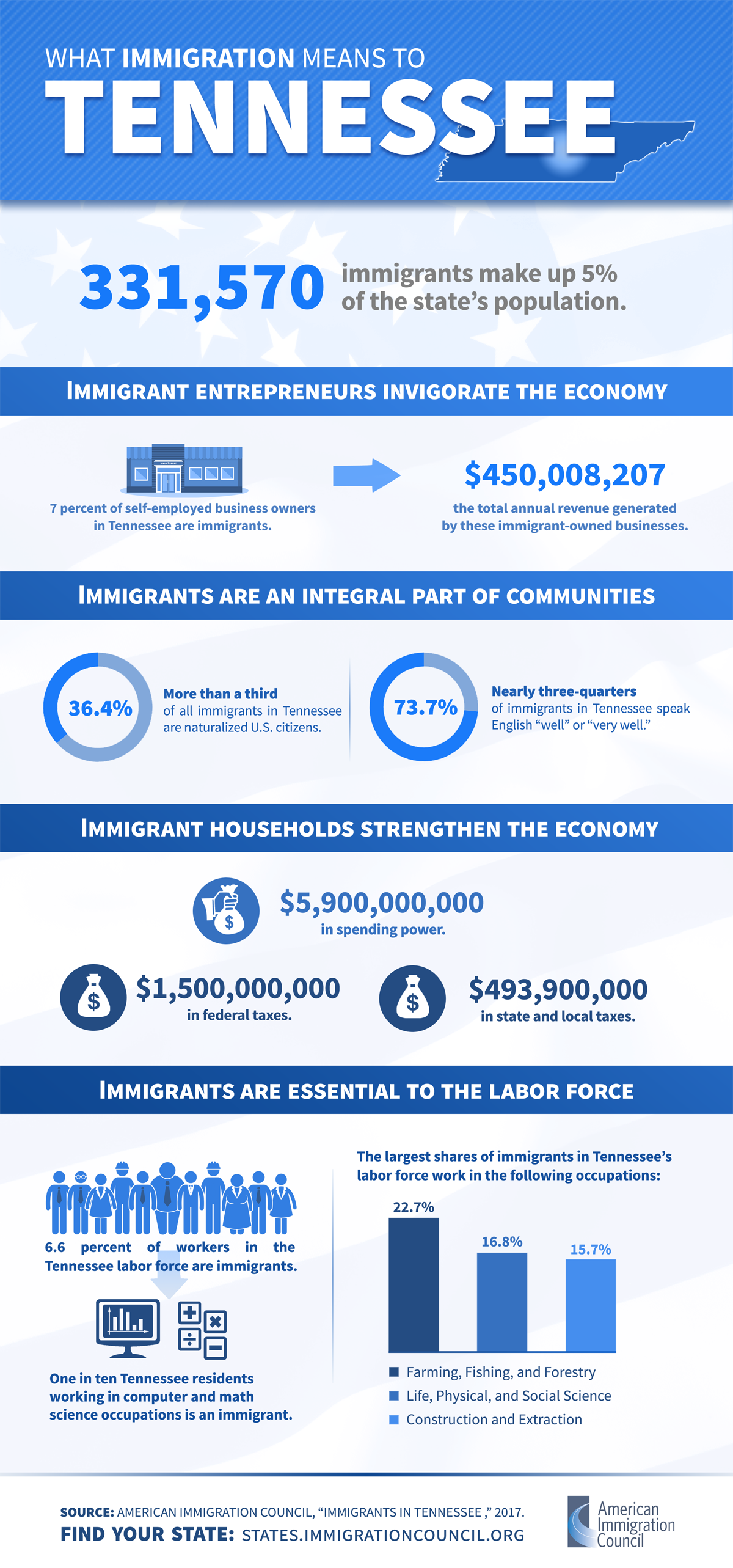

Immigrants In Tennessee American Immigration Council

Immigrants In Tennessee American Immigration Council

Create Free Pdf Invoice Online Finance Jobs Finance Accounting

Create Free Pdf Invoice Online Finance Jobs Finance Accounting

Tennessee Property Assessment Glossary

Tennessee Property Assessment Glossary

Adjectives For Resume Power Words Use Good Action Verbs Resumes Doc Resume Skills Resume Tips Cover Letter For Resume

Adjectives For Resume Power Words Use Good Action Verbs Resumes Doc Resume Skills Resume Tips Cover Letter For Resume

Tennessee County Tax Statistics Ctas

Tennessee Property Assessment Glossary

Tennessee Property Assessment Glossary

Labels: assessment, property, tennessee

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home