New York State Property Tax Assessment

This program rather is a credit for when an income tax return is. View Your Property Assessment Roll Data.

Your propertys assessment is one of the factors used by your local governments and school district to determine the amount of your property taxes.

New york state property tax assessment. Or log in to Online Assessment Community. Assessments and market value. New York State Taxes.

Your property tax bill will equal your final assessment amount multiplied by the local property tax rate. In New York City property tax rates are actually fairly low. Is a tax lien affecting your credit score property sale or bank account.

Information on Obtaining Public Property Information. Real property is defined as land and any permanent structures attached to it. NYC is a trademark and service mark of the City of New York.

9 days ago. 50 people watched 5. Unlike many states there is no personal property tax in New York.

In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107. Of that 62 percent. Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates.

Where the property tax goes. Learn how to resolve this right away. New York state laws includes New York consolidated laws on banking business corporations criminal procedure domestic relations estates crimes taxes and workers compensation.

The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169. Everything You Need To Know. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year.

Property tax rates change each year as well as the value of exemptions and abatements. The median property tax in New York is 375500 per year for a home worth the median value of 30600000. Property tax rates imposed by school districts tend to be the highest at an average of 1764 per each 1000 in assessed value as of 2019.

866 303-9595 or 845 764-9656 Schedule Consultation. How Do I Appeal My Property Assessment. What you should do.

CBSNewYork Property taxes are front and center in Nassau County. We have successfully challenged all types of NYS property assessments and can help you challenge your assessment if you are paying too much property taxes. Calculating Your Annual Property Tax To estimate your annual property tax.

In fiscal years ending in 2009 local governments and school districts outside of New York City levied 2887 billion in property taxes. Examples of real property. Is this different from the STAR program.

Personal property cars jewelry etc is not subject to property taxes in New York State. After a county-wide reassessment with more than half of homeowners taxes. Village of East Rockaway Clerks Office.

Local assessment officials See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff. The Department of Finance values your property every year as one step in calculating your property tax bill. New York State Estate Tax New York is one of the 14 states that charges taxes on the estates of the deceased with rates ranging from 306 percent to 16 percent on any estates that exceed the basic exclusion amount which is 525 million through the end of 2018.

New York State School Tax Relief STAR Exemption. Multiply the taxable value of your property by the current tax rate for your propertys tax class. All real property commonly known as real estate is assessed.

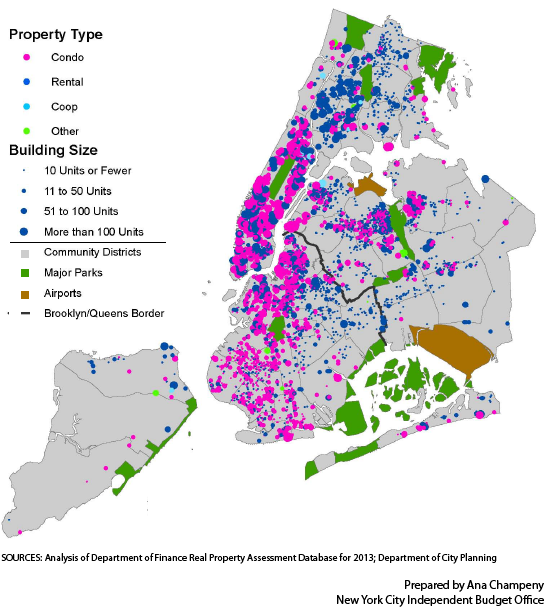

FY2022 Tentative Property Assessment Data All NYC Properties. Rather than taxing items such as jewelry and vehicles only real property is taxed. School districts are the largest users of the property tax.

New York property tax rates are set by local governments and they therefore vary by location. If an estate does exceed the BEA it pays. Property Tax Exemptions Includes information on veterans senior citizens and new construction exemptions.

The state budget enacts the circuit breaker for the tax years of 2021 2022 and 2023. The STAR program either directly reduces property taxes on the bill itself or sends a check to homeowners with the difference.

Property Tax Map Reforming Government

Property Tax Map Reforming Government

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

How To File Your Taxes After Working Remotely Trading Stocks And Surviving 2020 In 2021 Tax Remote Work Irs Taxes

How To File Your Taxes After Working Remotely Trading Stocks And Surviving 2020 In 2021 Tax Remote Work Irs Taxes

Apartment Viewing Tips For Buyers In Nyc Hauseit Nyc First Time Home Buyers Home Buying

Apartment Viewing Tips For Buyers In Nyc Hauseit Nyc First Time Home Buyers Home Buying

Lisle Township Assessor Property Tax Lisle Tax Rate

Lisle Township Assessor Property Tax Lisle Tax Rate

Assessor S Office Frequently Asked Questions Property Tax Q A Property Tax This Or That Questions Types Of Taxes

Assessor S Office Frequently Asked Questions Property Tax Q A Property Tax This Or That Questions Types Of Taxes

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

25 Illinois Counties With The Highest Median Property Taxes Property Tax Illinois Property

What Is Property Tax Calculator Tax Relief Center Property Tax Tax Help Instagram Growth

What Is Property Tax Calculator Tax Relief Center Property Tax Tax Help Instagram Growth

Honolulu Property Tax 2020 21 Fiscal Year

Taxes New York City By The Numbers

Taxes New York City By The Numbers

Chicago Real Estate Attorney Get The Best Local Legal Advice Property Tax Chicago Real Estate Legal Advice

Chicago Real Estate Attorney Get The Best Local Legal Advice Property Tax Chicago Real Estate Legal Advice

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Pin By Bobbie Persky Realtor On Finance Real Estate Property Tax Tax Attorney Debt Relief Programs

Sign In Property Tax Real Estate Infographic Infographic

Sign In Property Tax Real Estate Infographic Infographic

Honolulu Property Tax 2020 21 Fiscal Year

Detroit Homeowners Overtaxed 600 Million Thousands Of Detroit Residents Are Still In Debt After Skewed Property Assessments Detroit Detroit News Homeowner

Detroit Homeowners Overtaxed 600 Million Thousands Of Detroit Residents Are Still In Debt After Skewed Property Assessments Detroit Detroit News Homeowner

Kochi S Status As The Commercial Capital Of India S Kerala State Is Not Yet Reflected In The City Corporation S Revenue Mob Times Of India Revenue Property Tax

Kochi S Status As The Commercial Capital Of India S Kerala State Is Not Yet Reflected In The City Corporation S Revenue Mob Times Of India Revenue Property Tax

How Real Estate Property Taxes Work Brownstone Vintage New York Nyc

How Real Estate Property Taxes Work Brownstone Vintage New York Nyc

Commercial Properties See Major Tax Hikes Realestatenews Realestatetips Realestate Investor Mor Commercial Property Real Estate Investing Real Estate Tips

Commercial Properties See Major Tax Hikes Realestatenews Realestatetips Realestate Investor Mor Commercial Property Real Estate Investing Real Estate Tips

Labels: assessment, property, state

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home