Property Tax Assessment After Purchase

When that ownership changes hands the. The key is to understand the difference between the 2 values.

Property Tax Assessment And What It Means Quicken Loans

Property Tax Assessment And What It Means Quicken Loans

The buyer should pay the real estate taxes due after closing.

Property tax assessment after purchase. Property Tax Real Property. Buying a tax lien. The assessed value is based on the market value for the property at the time of purchase.

To qualify the larger refund or smaller tax liability must not be due to differences in data supplied by you your choice not to claim a deduction or credit positions taken on your return that are contrary to law or changes in federal or state tax laws after January 1 2019. If the online tax preparation or tax software makes an arithmetic. Each year the department calculates effective tax rates based on tax reduction factors that eliminate the effect of a change in the valuation of existing real property on certain voted taxes.

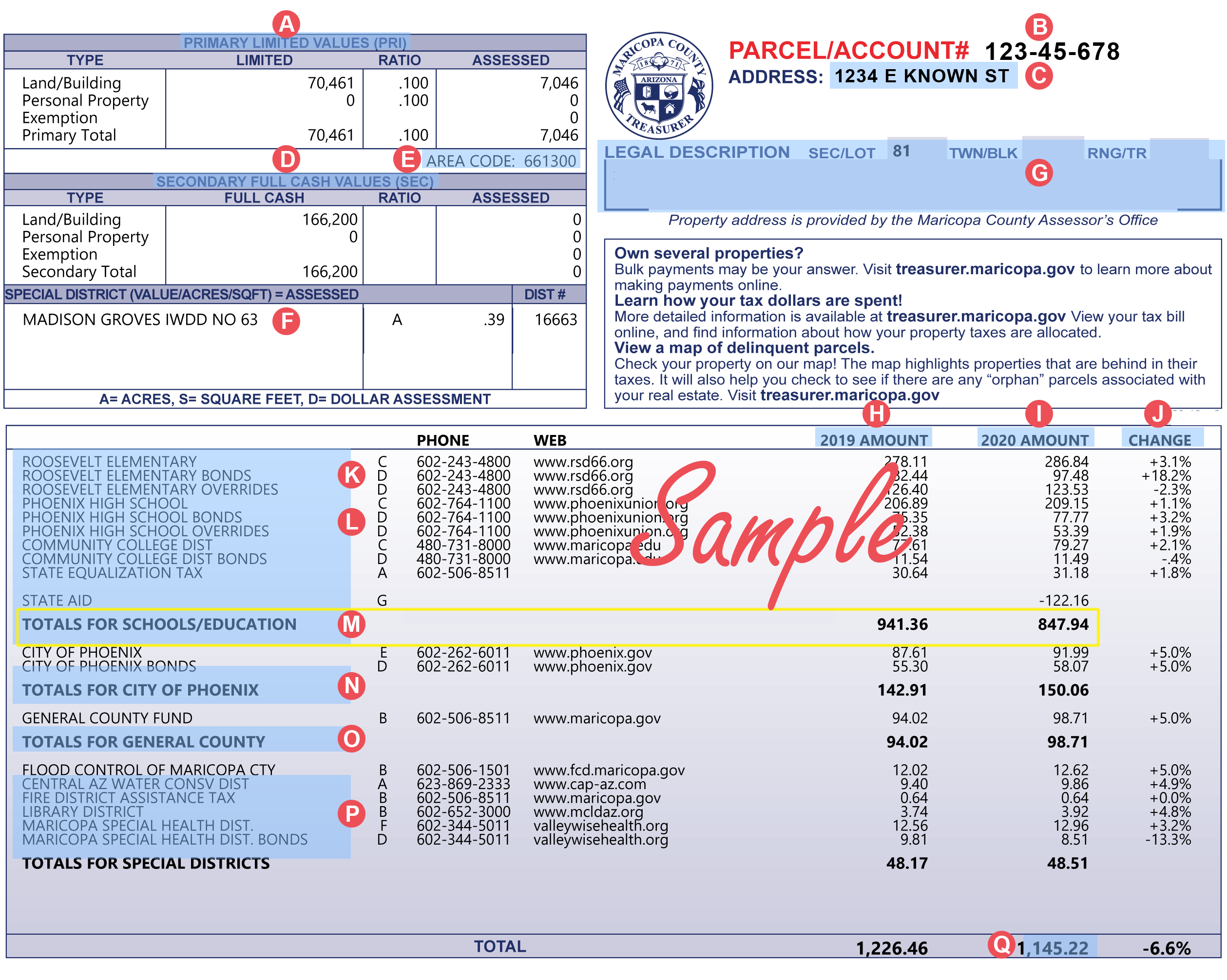

Prorated Property Taxes at Closing Property taxes typically are prepaid for the full year of ownership. This way the buyer and seller only pay the real estate taxes that accrued during the time they actually owned the property. The taxes due in 2020 for 2019 were 1375.

The property tax year in your area is the calendar year. In order to come up with your tax bill your tax office multiplies the tax rate by the. Property taxessometimes referred to as millage taxesare a tax levied on property most typically real estate property by county governments.

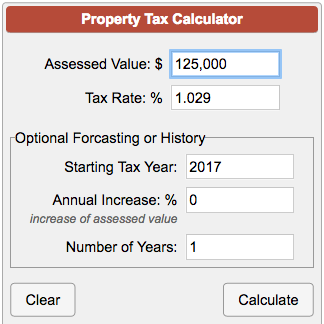

Your local tax collectors office sends you your property tax bill which is based on this assessment. After getting the assessed value it is multiplied by the mill levy to determine your property taxes due. The assessment for 2016 is 81600.

If you purchase your home before July 1st or before the taxes are fully paid you will be CREDITED the Sellers portion of the annual property taxes as you will be responsible for paying the full amount of the annual property taxes. Over time and with different sales in like areas the market value and assessed value may change but not based on the sale of one home. Hiogov 105 Tax reduction factors.

Common sense tells us that the seller should pay the taxes from the beginning of the real estate tax year until the date of closing. Note that your assessed value isnt just based on the purchase price of your home. What happens here is that you actually buy the liens at auction pay the back taxes.

Because the rates are determined county by county youll find a pretty large variance in property tax rates across the country from averages as high as 189 New Jersey to averages as low as 018 Louisiana. The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors. For example suppose the assessor determines that your property value is.

What Are Property Taxes. You bought your home on May 3 2020. First is 2017 Market Value and second is the Appraised Value.

I am looking at a home selling for 119K. Property tax calculators take into account the state and county you live in as well as the value of your property. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

The taxes for the previous year are assessed on January 2 and are due on May 31 and November 30. I After final costs known final assessments determined ii Publish notice of passage of ordinance once iii Recommend notice be given to property owner iv Provide period for payment v Assessments not paid bear interest at rate of debt issued in anticipation of collection of assessments or as determined by council. Along with buying the property outright you can also invest in tax liens.

I am wondering if purchasing the home more than 37K above assessment would increase the tax assessment thus increasing the property tax. County assessors do their own valuations and may come up. The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market.

The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. Delinquent tax refers to a tax that is unpaid after the payment due date. Under state law the taxes become a lien on May 31.

Your property tax bill will show two values in the cover letter. The real property tax is Ohios oldest tax. It has been an ad valorem tax meaning based on value since 1825.

You agreed to pay all taxes due after the date of sale.

Image Result For Tax Reduction Letter Sample Letter Sample Lettering Tax Reduction

Image Result For Tax Reduction Letter Sample Letter Sample Lettering Tax Reduction

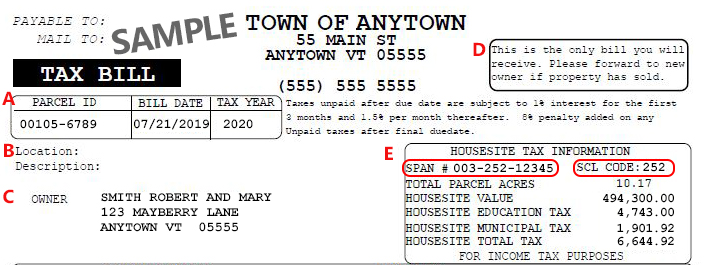

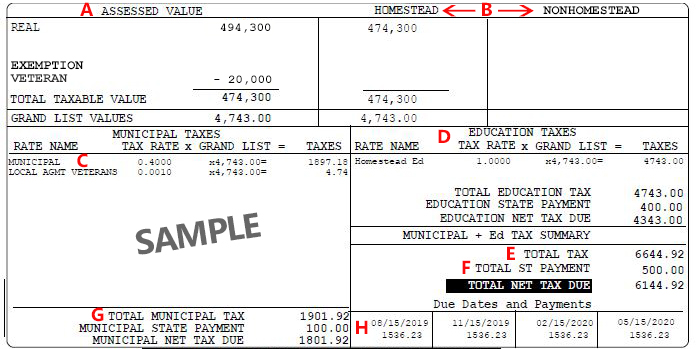

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

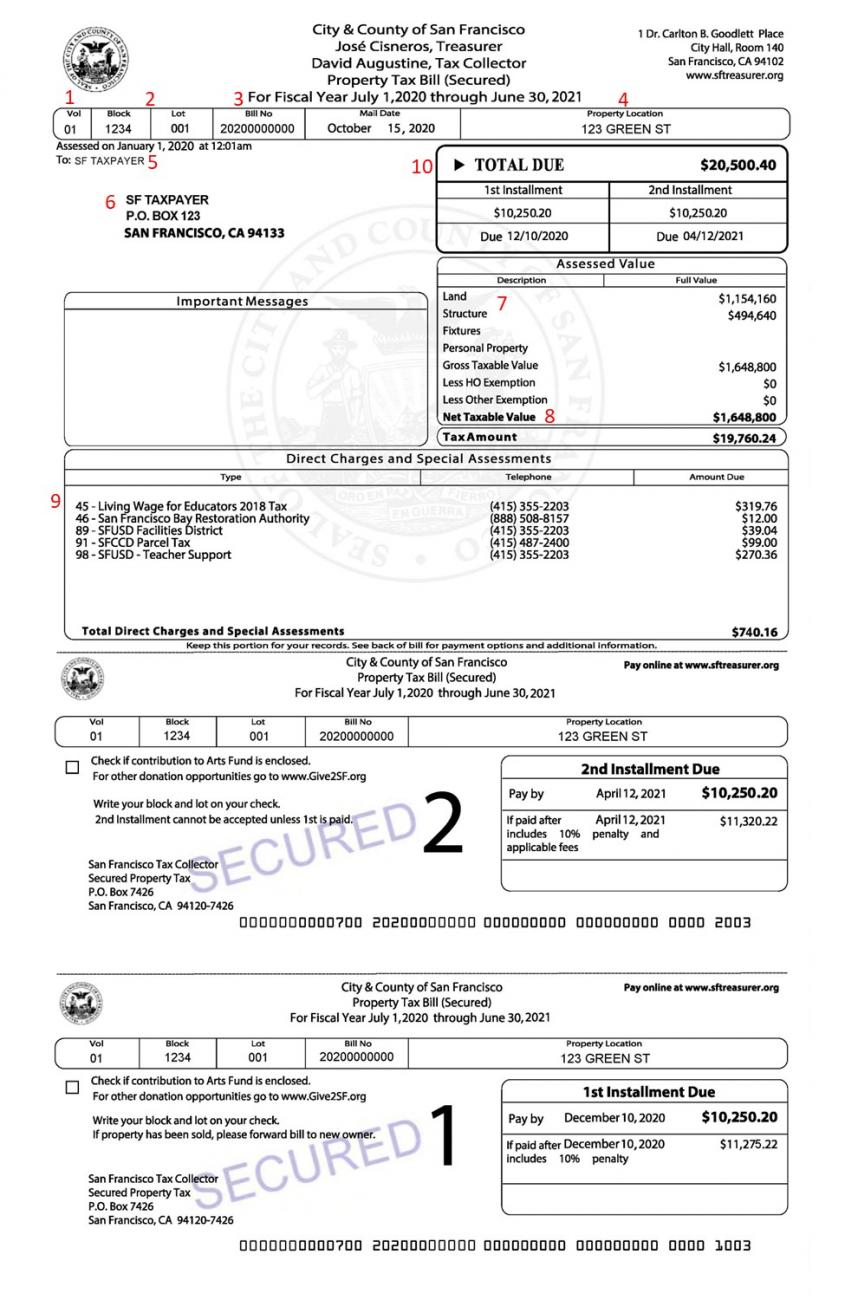

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Checklist To Keep Handy When Buying Plots In Chennai Plots For Sale Plots Real Estate Companies

Checklist To Keep Handy When Buying Plots In Chennai Plots For Sale Plots Real Estate Companies

Hugedomains Com Property Tax Mortgage Payoff Mortgage Tips

Hugedomains Com Property Tax Mortgage Payoff Mortgage Tips

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

How To Appeal A High Tax Assessment On A Home Real Estate Advice Real Estate Articles Real Estate Education

How To Appeal A High Tax Assessment On A Home Real Estate Advice Real Estate Articles Real Estate Education

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg) Your Property Tax Assessment What Does It Mean

Your Property Tax Assessment What Does It Mean

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Assessed Value Vs Market Value In 2021 Market Value Real Estate Articles Real Estate Prices

Assessed Value Vs Market Value In 2021 Market Value Real Estate Articles Real Estate Prices

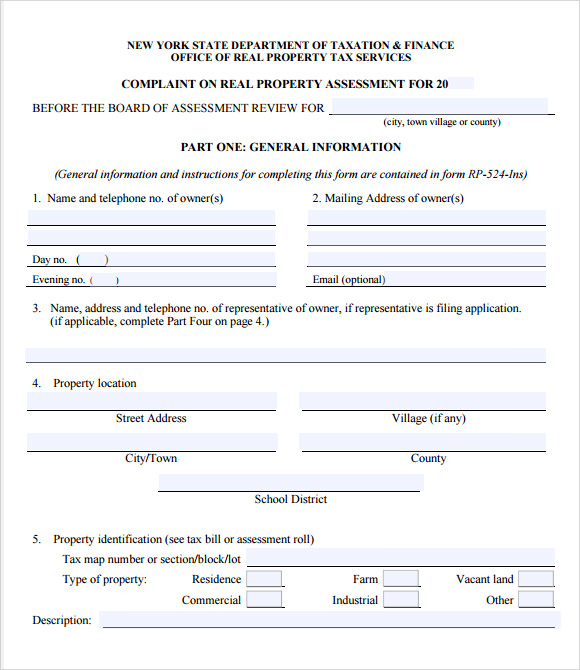

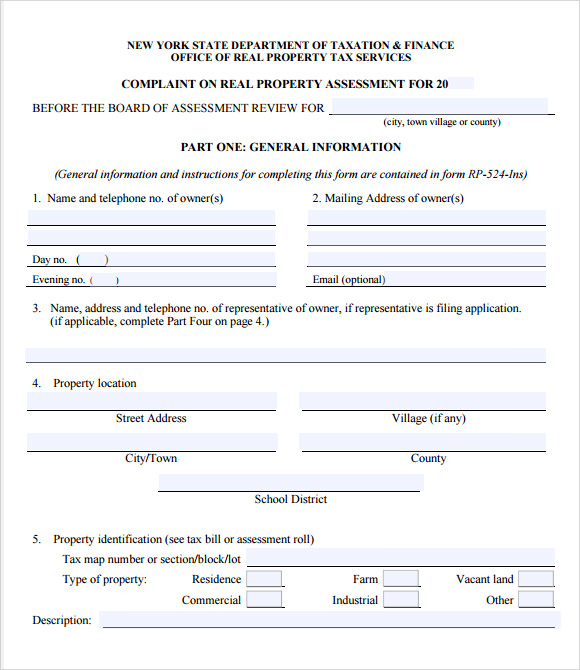

Free 5 Tax Assessment Samples In Pdf

Free 5 Tax Assessment Samples In Pdf

Supplemental Property Tax Information Property Tax Mortgage Companies Property

Supplemental Property Tax Information Property Tax Mortgage Companies Property

Understanding California S Property Taxes

Understanding California S Property Taxes

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Labels: assessment, property, purchase

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home