Quitclaim Deed Affect Property Tax

A quit claim deed is a well known and simple means of transferring real estate so much so that it is often mistakenly referred to as a quick claim deed But consider the tax consequences of a lifetime transfer of real property. When the Conveying Party Is the Owner Whoever is the registered property owner on county records is responsible for paying the property taxes.

Sample Printable Offer To Purchase Real Estate Pro Buyer Form Real Estate Forms Real Estate Templates Online Real Estate

Sample Printable Offer To Purchase Real Estate Pro Buyer Form Real Estate Forms Real Estate Templates Online Real Estate

There are two potential tax consequences of signing a quitclaim deed in a divorce.

Quitclaim deed affect property tax. Other transactions may be liable to property and gift taxes. Miami-Dade County is the only county with a different tax rate of 60 cents per 100. The quitclaim process is.

As to the tax question the IRS will view the addition of the letter writer via quitclaim deed as a gift. That means that any transfer of property for free or even under market value may be subject to. Once the claim is accepted it is up to the grantee to promptly deal with any back taxes to avoid a claim.

The IRS views quitclaim deeds as a gift and applies guidelines for determining its basis using those standards. In this circumstance the quitclaim deed has no effect on property taxes which are now the responsibility of the new owner. Capital gains taxes on home that was obtained via quit claim deed If your grandmother gave you the home but retained a life estate or life tenancy right to live there until she died then you inherited a stepped up basis based on the fair market value on the date she died in 2016.

If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax. Instead of your propertys value being reevaluated when you receive it your adjusted basis in the home is the same as the basis for the person who held. The tax is 70 cents per every 100 of the propertys sale price.

A quitclaim deed does not negate unpaid taxes. If back taxes are owed on the property the tax jurisdiction may place a claim to the property and the quitclaim deed can be negated. For example Florida charges 70 cents per 100.

An Inheritance Taxapplies to an individual who becomes heir to a property after the owners death. However due to their purpose sometimes quitclaim deeds do not list an actual sales price or they may list an arbitrary amount such as 1 or 10 so the tax might not be applicable. Speak to an Attorney About Potential.

However as of 2018 the basic fee for filing a quit claim deed form ny of residential or farm property is 125 while the fee to file for quitclaim deed NY for all other property is. How does a quitclaim deed affect property taxes. The excluded amount is taken off the taxpayers total allowable lifetime exclusion.

This is also known as the documentary stamp tax and is typically paid by the grantor. Transfer taxes both City transfer taxes and County transfer taxes. When you sell a house your taxable gain is the homes sale price minus its basis If you bought the house the basis is usually.

When the quitclaim deed is recorded with the county one of the parties must pay the transfer tax to the Clerk of the Court for the county. Effects of a Quitclaim Deed on Cost Basis. You can get this from a local appraiser using historical records.

Prepare for Gift Tax Liability On the other hand a gift via a quitclaim deed remains a gift. A Quit Claim deed is also not taxable when ownership is transferred to a spouse visit IRSgov for exceptions to Gift Taxes. Under the terms of the US.

Quitclaim deeds are not taxable when they transfer ownership to a spouse or a qualifying charity. The fee to file a New York state quit claim deed is unique to each county. Quitclaim deed taxes in this case are generally calculated by taking a percentage of the sales price listed on the deed multiplied by a standard rate.

Tax code gift taxes are paid by the giver so the brother would have to fill out a gift tax form 709 and he can apply the value of half the house to the lifetime maximum of 55 million he can give away under current estate tax rules. The legal ramifications of a quitclaim deed and its impact on community property claims will vary state to state.

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

What Is A Title Defect And How Do Settlement Agents Avoid Them Learn More About Payoff Tracking Helps Agents And Att Title Insurance Insurance Marketing Title

What Is A Title Defect And How Do Settlement Agents Avoid Them Learn More About Payoff Tracking Helps Agents And Att Title Insurance Insurance Marketing Title

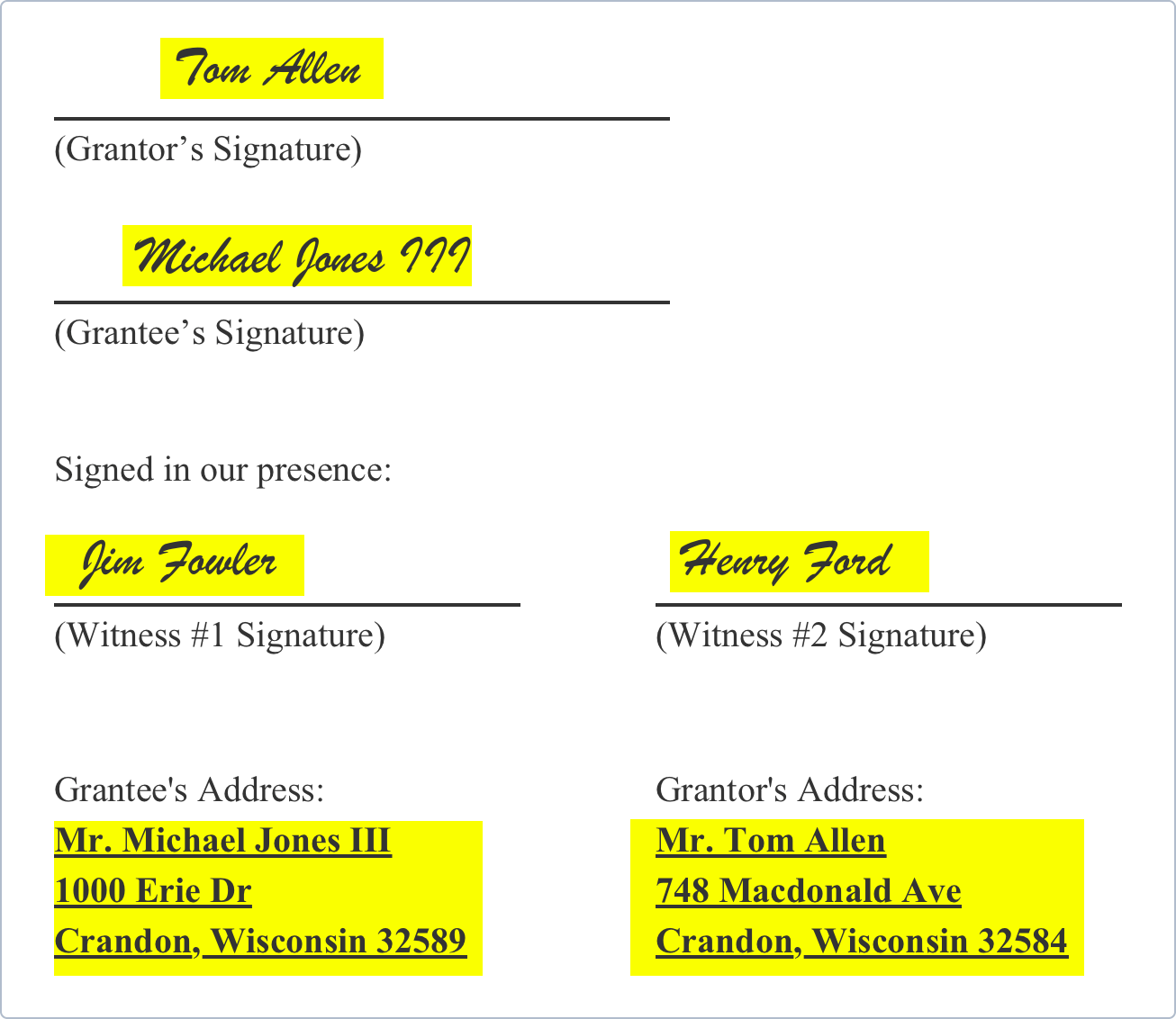

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Conveying Real Estate Through A Power Of Attorney Deeds Com

Conveying Real Estate Through A Power Of Attorney Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

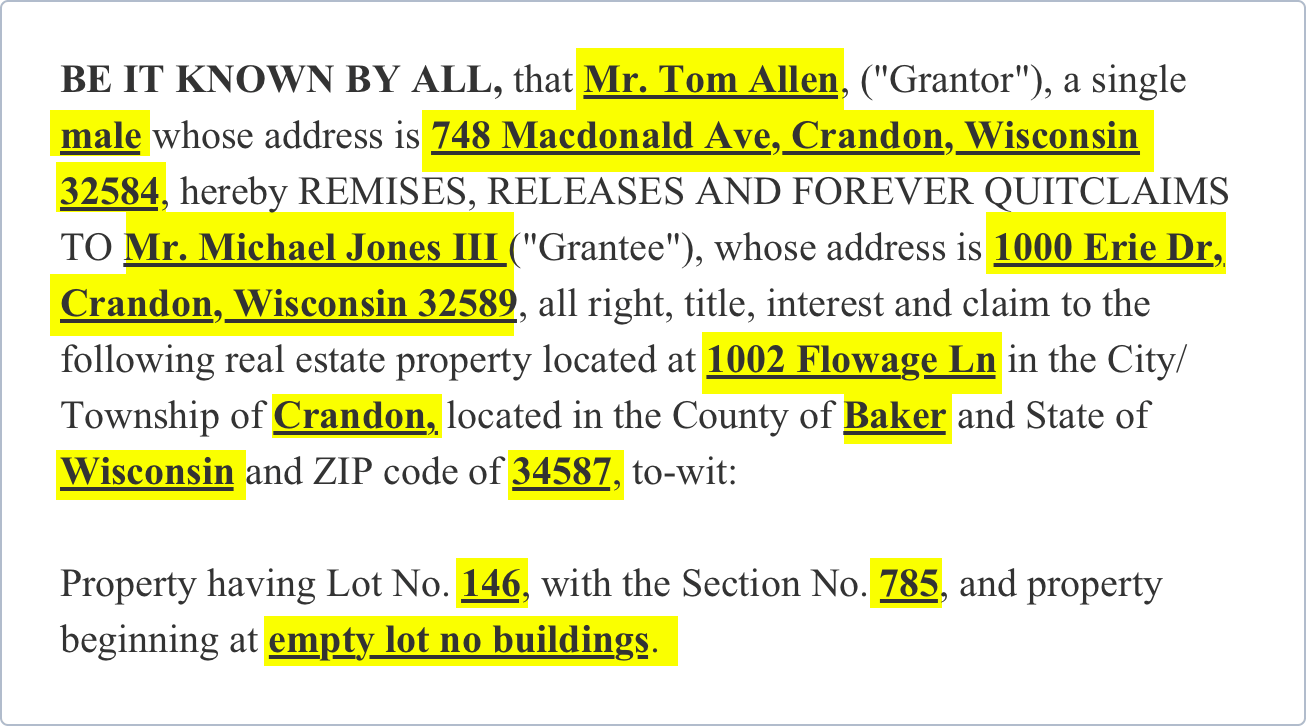

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

Ratlifflaw Line Of Succession Third Way Real Estate News

Ratlifflaw Line Of Succession Third Way Real Estate News

7 Reasons Why You Need An Attorney For A Quitclaim Deed Transaction

7 Reasons Why You Need An Attorney For A Quitclaim Deed Transaction

I Signed Over My House To My Daughter How Do I Reverse That The Washington Post

I Signed Over My House To My Daughter How Do I Reverse That The Washington Post

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Funeral Program Template Templates

Quit Claim Deed Form Free Quit Claim Deed Template With Sample Quitclaim Deed Funeral Program Template Templates

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Anatomy Of A Title Commitment Proplogix Title Insurance Estate Law Title

Anatomy Of A Title Commitment Proplogix Title Insurance Estate Law Title

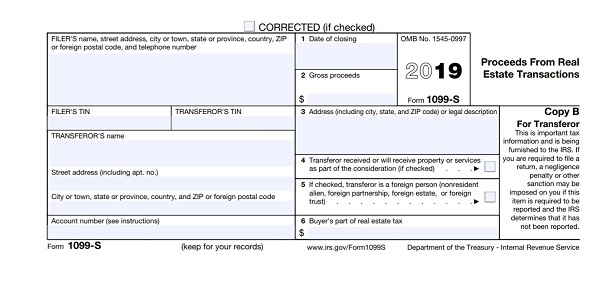

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quit Claim Deed Form Nj 5 Great Quit Claim Deed Form Nj Ideas That You Can Share With Your F Quitclaim Deed Letter Templates Free Templates

Quit Claim Deed Form Nj 5 Great Quit Claim Deed Form Nj Ideas That You Can Share With Your F Quitclaim Deed Letter Templates Free Templates

Should I Sign A Quitclaim Deed During Or After Divorce

Should I Sign A Quitclaim Deed During Or After Divorce

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Quitclaim Deed Form Create Download For Free Pdf Word Formswift

Reasons Why Hiring A Title Company Is Important Title Insurance Title Company

Reasons Why Hiring A Title Company Is Important Title Insurance Title Company

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home