Kansas Vehicle Property Tax Refund

A Kansas Center for Entrepreneurship credit for those who make an eligible contribution to the center. Request for Access to Vehicle Records - TRDL302.

Kansas Car Registration Everything You Need To Know

Kansas Car Registration Everything You Need To Know

Owners will be eligible for a refund for the number of full months remaining in the unused portion of the registration fee and property tax.

Kansas vehicle property tax refund. Yes you can make this type of deduction on you Federal Individual Income Taxes but this is an Itemized Deduction reported in Schedule A. Refunds are calculated from the date your application is received in our office not. You may apply for a refund upon the sale of a vehicle.

For your convenience you may attach your Individual Income tax account to your login in the Kansas Customer Service Center Login with one of various pieces of identification. Sales tax will be collected in the tag office if the vehicle was bought from an individual or purchased out of state. Contact the Kansas Department of Revenue to learn how to claim this tax break and what may be required in the current tax year.

Current tag or plate along with the corresponding decals. Call Appraisers Office for estimates. After relocating to a new state you will need to return your Kansas license plates if applying for a property tax refund.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas. All the following items need to be submitted to the County Treasurers Office in the County in which the motor vehicle was registered. A property tax rebate of up to 700 which homeowners may be able to qualify for if they meet income age and other requirements.

To maximize your refund application should be made prior to the. A separate 75 rebate is available for eligible taxpayers 65 and older whose household income is 19800 or less. Tax Tag Refunds.

Repossession Affidavit - TR-84. You move PERMANENTLY to another state and register your vehicle there. Refunds are calculated from the month all necessary items are received and checks will be received in the mail within 2-3 weeks of turning in all necessary items.

Secretary Burghart is a lifelong Kansan. May 31 2019 943 PM. Last working day of the month the vehicle was sold.

The refund shall be made only for the period of time remaining in the registration year from the date of completion and filing of the application with and delivery of the license plate and attachments to the. If you register a vehicle out of the state of Kansas you may be eligible for a partial refund for the property taxes that were paid the last time the vehicle was registered in Kansas. Contact your county treasurers motor vehicle office for refund information.

The last time the data was loaded to this system was on Apr 15 2021 815PM. Schedule A is the form used to itemize all of the deductions that you may be entitled to. Can you deduct vehicle property tax paid in Kansas.

If you have recently sold a vehicle with a current tag or plate you may be eligible for a refund of the unused portion of registration and property tax. The refund is 75 of the 2019 general property tax paid or to be paid - as shown of the 2020 real estate tax statement for the residence in which the claimant lived in 2020. Relinquishment Letter - TR-716.

You may be eligible for a prorated taxtag refund if. Request and Consent for Kansas Title to be Issued with Lien - TR-42. Refunds will be given starting the next full month after the tag or plate and all documents are submitted.

Burghart is a graduate of the University of Kansas. These refunds are for homes owned and occupied by the veteran andor spouse as the primary residence. Kansas statute allows for a refund of the unused portion of the motor vehicle taxes when a resident of Kansas has sold a registered vehicle.

Payment for registration fees see Kansas Vehicle Registration Fees below and the personal property tax if required. Title fee is 800 tag fees vary according to type of vehicle. Named on the vehicle title or if worksheet is not signed by vehicle owner.

Kansas Department of Revenue Income and Homestead Refund Status Latest Information. If the plate has been lost or stolen you must obtain a police report. Out of State Worksheet.

On March 26 2019 the Kansas Senate confirmed Mark Burghart as the Secretary of Revenue. A food sales tax credit which allows eligible lower-income taxpayers who bought food in Kansas. Large truck refunds are mailed from the Kansas Department of Revenue and may take up to 90 days.

New vehicle registrations are valid from the time of purchase to the time of your required registrationrenewal which is based on the first. Call your appraisers office for estimates. You sell your vehicle and it is not replaced.

The date of sale. Property tax paid at time of registrationtitle application exceptions Heavy Trucks Trailers and Motorbikes. Replacement Plate and Decal Form - TR-211.

The 2020 property tax consists of the 1st half which is due Dec. 20 2020 and the 2nd half which is due May 10 2021. A Kansas car registration certificate is valid for 1 year except for new vehicles.

For your property tax amount refer to County Treasurer. Otherwise you are not required to return your Kansas license plates. Kansas State Motor Vehicle Tax Exemption for Qualifying Veterans.

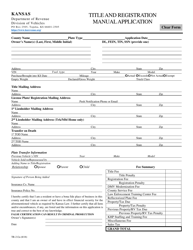

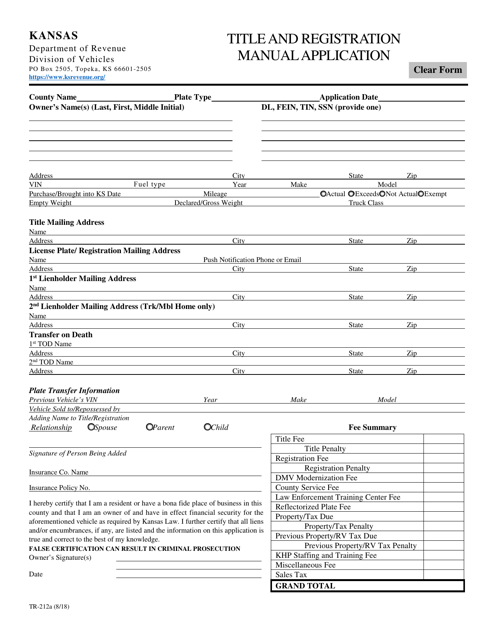

Form Tr 212a Download Fillable Pdf Or Fill Online Title And Registration Manual Application Kansas Templateroller

Form Tr 212a Download Fillable Pdf Or Fill Online Title And Registration Manual Application Kansas Templateroller

Form Tr 212a Download Fillable Pdf Or Fill Online Title And Registration Manual Application Kansas Templateroller

Form Tr 212a Download Fillable Pdf Or Fill Online Title And Registration Manual Application Kansas Templateroller

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Https Www Snco Us Ap Document Personal Property Assessment Form Pdf

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

Kansas Car Registration Everything You Need To Know

Kansas Car Registration Everything You Need To Know

1kansas Department Of Revenue Press Releases

1kansas Department Of Revenue Press Releases

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Kansas Car Registration Everything You Need To Know

Kansas Car Registration Everything You Need To Know

Https Www Jocogov Org Sites Default Files Documents Tre Sold Vehicle Refund Form Pdf

Https Www Jocogov Org Sites Default Files Documents Tre Sold 20vehicle 20refund 20form Pdf

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

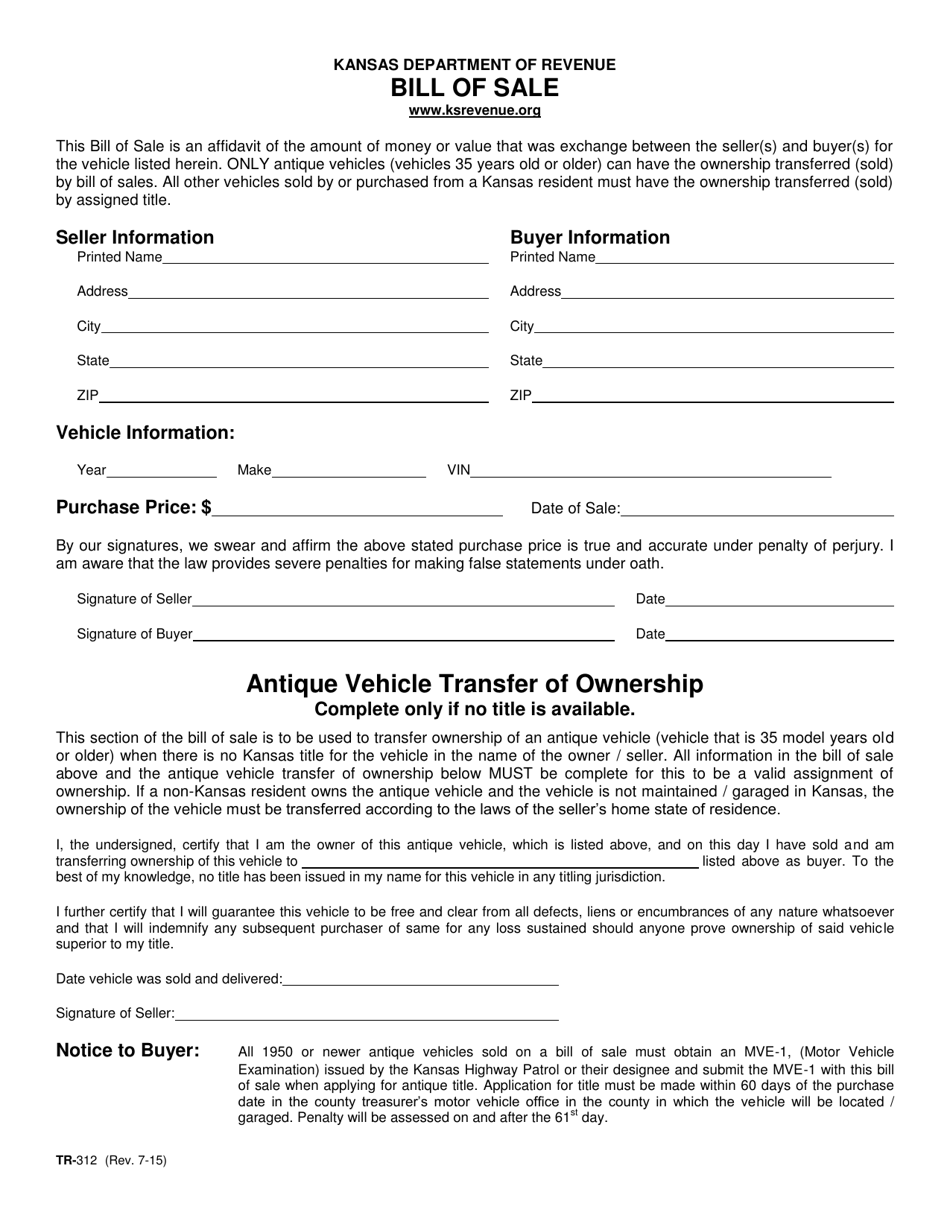

Form Tr 312 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Kansas Templateroller

Form Tr 312 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Kansas Templateroller

Https Www Sedgwickcounty Org Media 28145 Ous Taxrefund Pdf

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Kansas Department Of Revenue Online Services

Kansas Department Of Revenue Online Services

Form Tr 312 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Kansas Templateroller

Form Tr 312 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Kansas Templateroller

Vehicles Johnson County Kansas

Vehicles Johnson County Kansas

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home