How To Get Property Tax Bill Online Pune

Enter Your Section ID. While making e-payment if receipt is not generated due.

Find Property Tax Account Number Pune Property Walls

Find Property Tax Account Number Pune Property Walls

Pay Water Meter Bill.

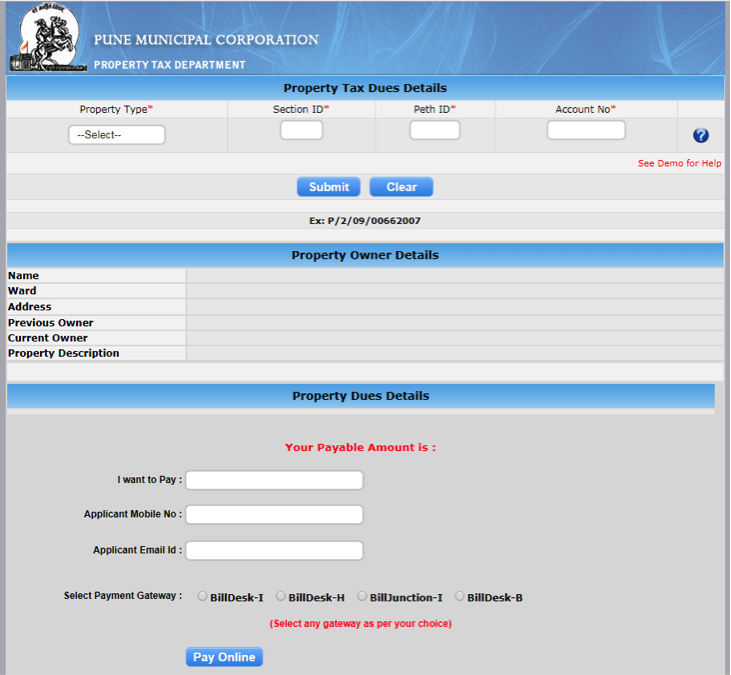

How to get property tax bill online pune. If debit is made from bank account and receipt is not. Click on Show option to view your property bill. Pcmcindiagovin You need to click on the property and water bill tax on the home page.

To pay property tax online you have to provide following details in the link given below. If you find any difficulties during online payment then please mail us on following mail-id. Go to bottom of this page.

Property tax is a levy issued by a government on a persons real or personal property. Please ensure that Mobile Number is Registered on Your Property Only on which you are going to Pay Property Tax. Change in Billing Name.

After Debit of amount Wait for 3 working days to get update your transaction Evenif its not get. Go to the link of Pune Corporation official website. All Tax payers are requested to pay all due tax amount on and before 31st March 2019 to avoid 5 fine on due tax amount.

Pay Property Tax to Pune Municipal Corporation with the help of these easy steps complete information. Search your property details by entering the zone number Gat number and owners name. Search for Total Amount to Pay Amount with Concession-Fajil Amount in the bill.

You should then get. Property Tax Dues Details. Property tax is one of the largest source of revenue in Pune.

How to change name in property tax online- Some vital tips. Does the property tax bill still have the name of the earlier owner of the property or the developer. Spelling mistake corrected shortly.

Taxpayer can pay the bill online at the Pimpri Chinchwad Municipal Corporation website. Visit PCMC Property Tax portal and click on Property Bill. Now pay property tax without any extra transaction charges.

P O F Step 2. Pune Municipal Corporation is solely responsible for levying and collecting property tax payment in Pune. The amount of tax owed is determined by multiplying the fair market value of the property by the current tax rate.

Property Tax Dues Details. Pay Water Meter Bill. Also please advise me about the property tax bill due.

It is not prudent to keep postponing an important property tax name change if it is required. PMC cover more than 10 lakh properties in its purview. This online service is for paying property tax get bill online.

The content available on the website is provided by Pune Municipal Corporation and all the information available on this website is authentic. Please follow the below procedure to pay your tax. Easy Pay - UPI EMI IMPS SI WALLET Cash Cards Credit Card Debit Card Internet Banking.

--Select-- O-Occupier P-Peth F-Flat. Search Pay Property Tax by Mobile Number Mobile Number Number must be registered on Property. Click on the link Pay Property Tax which is under Online Services tab.

The content available on the website is provided by Pune Municipal Corporation. -Select Type- O-Occupier P-Peth F-Flat. The property is assessed to give it a value and then that value is taxed.

Go To Home. My name shown on the property tax bill is Devidas Mahadevan instead of Devadas MadhavanPlease correct. Building Permissions and Public Works.

Select Any of Above Payment Gateway it includes All Banks to Pay your Property Tax. Pune Corporation Pay Property Tax. Select Your Property Type Eg.

Connectivity or technical problem please check your. Properyt Tax Bill Details. Bank account for debit and then proceed for next e-payment.

Pune has online as well as offline property tax payment facility.

Read more »