How To Print Tax Receipt Lhdn

Bayaran Cukai di Kaunter Pusat Bayaran LHDNM. Tax Payment Services via IRBM Collection Agents Banks and Post office Payment over the counter.

How To Do E Filling For Lhdn Malaysia Income Tax Md

How To Do E Filling For Lhdn Malaysia Income Tax Md

Go to the Income Tax Departments website.

How to print tax receipt lhdn. In other cases the name of the client or donor is also mentioned along with the amount for such purposes. They do not issue receipts for other modes of payment eg online bank counter ATM etc. Then look for the file that you want to save and click on View.

Thx for in advance. Click on Save and Print Acknowldegement to download your receipt. If you are seeking to renew your vehicle tags for a 2 year period you will need to present paid receipts for the prior 2 tax years.

Several transcript types available. This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness. Complete and mail Form 4506 to request a copy of a tax return.

So go and file your income tax immediately. Save the file and log out. The fee per copy is 50.

Mail the request to the appropriate IRS office listed on the form. Go to httpsezhasilgovmyCILoginaspx and login. Any1 can tell me how to trace back my previous e-filing from wwwhasilgovmy.

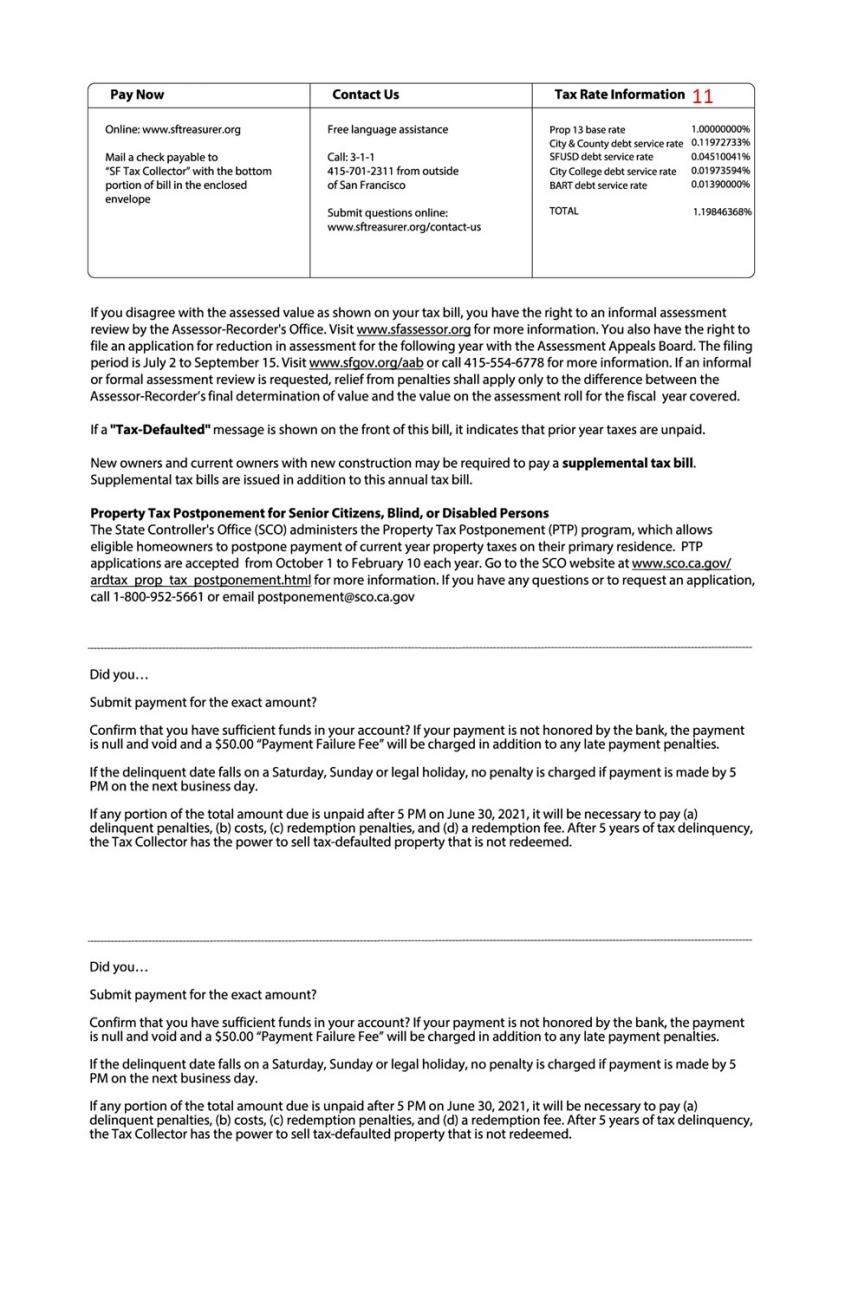

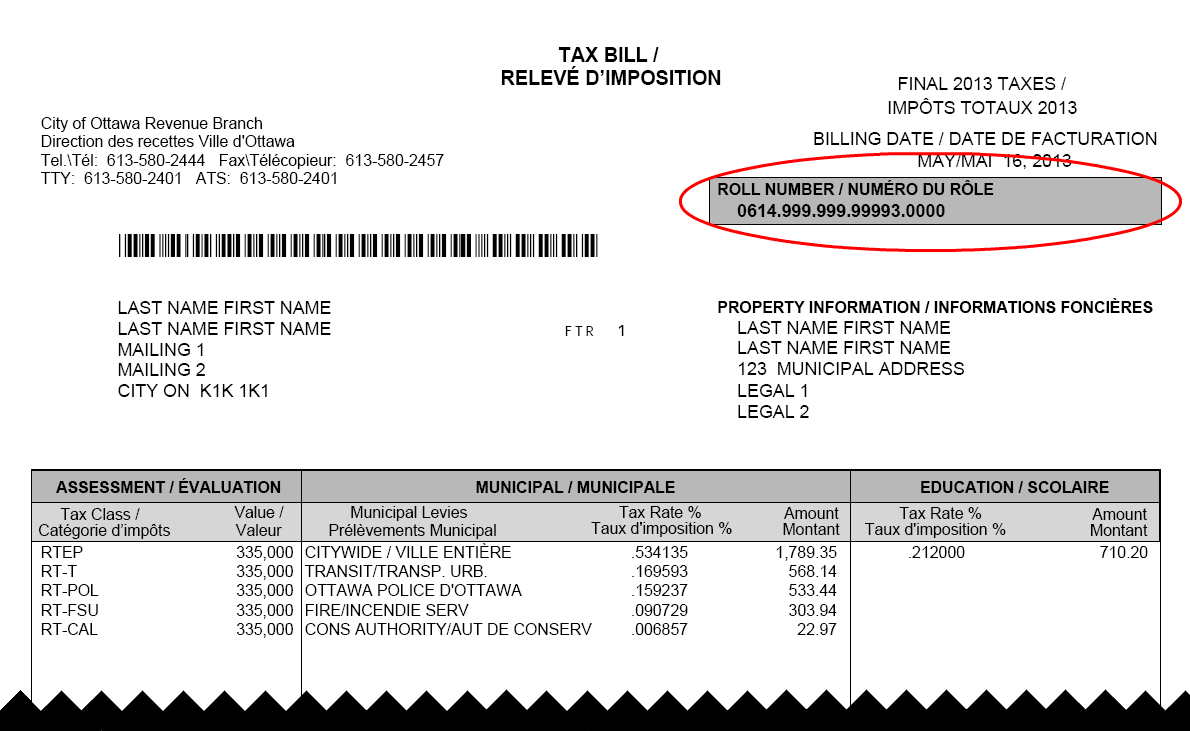

11 Payments of Income Tax and Real Property Gains Tax RPGT. To register your vehicle or renew your license plates you must present your paid county personal property tax receipt to the Department of Revenue license office. Of course Lembaga Hasil Dalam Negeri has some PDFs you can read through if youre totally lost.

Tax Receipt Format. To do that simply click on Submit PCBCP38 Data and select List of Verification Files from the drop-down menu. Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN.

Through the display on the current tax balance position taxpayer can distinguish whether he has a debit or credit balance. Bayaran Cukai Melalui FPX Perkhidmatan ini menggunakan FPX sebagai gateway untuk pembayaran cukai. For Desktop software you would open that file and FIRST check for e-file status from WITHIN that file.

Debit balance means an amount of tax is still outstanding while credit balance means an amount of tax overpaid. The tax receipt contains the name address and phone number of the organization. Official receipt will be issued on the amount received from the bank and after the complete payment information received by IRBM.

Lembaga Hasil Dalam Negeri Malaysia akan melakukan penstrukturan semula perkhidmatan kaunter Pusat Bayaran LHDNM di Kuala Lumpur Kuching dan Kota Kinabalu selaras dengan hasrat kerajaan untuk meningkatkan penggunaan medium bayaran secara dalam talian e-bayaran serta meningkatkan kecekapan proses pemungutan cukai. Blank Sample Tax. Official receipt will be issued on the amount received from the.

Receipting process will be delayed for payment with. Pengguna perlu mempunyai akaun perbankan internet dengan mana-mana bank. Youll be asked to present your passport EA Form with employer details your Income Tax Number from Step 1 above and your payslips after which youll get your printed LHDN e-Filing PIN 16 numbers in four sets of four.

People who live in a federally declared disaster area can get a free copy. And you get to enjoy your weekend too. Then click on Print Confirmation Slip.

Retrieve And Print Acknowledgement Receipt Please visit the main page of e-Filing Click Print Form Acknowledgement to retrieve Acknowledgement Receipt YA 2009 2008 Please select the type of e-Form BEBCR and others 53 Enter the NRIC No. Tax payment can also be made at any CIMB Bank Public Bank Maybank Affin Bank Bank Rakyat Bank Simpanan Nasional and POS Malaysia counters throughout Malaysia. Show posts by this member only.

And Password Click button to retrieve the receipt Click button to initiate the process again. To get it you would have to create a new PDF file from whatever software you used to send in the tax return. Select BE and the date that you need.

It helps that the PDFs have screenshots which makes it all easier to understand. Then re-start and open the. Dec 7 2010 0434 PM.

One up for usability. Nowadays LHDN only provides actual tax receipt for monies received if payment is made at Caw Pungjutan Jalan Duta or cheque sent via post to Jalan Duta. The faster you do it the less harassed and stressed youd be.

Next input your PAN and the assessment year 4. Please use the CP 207 payment slip as a guide to fill up IRBMs Bank In Slip provided at the bank to make payment. Click on ITR-V Receipt Status.

Enter the Captcha Code and submit. April 24 2016 042235 am by admin_tricia. Recently i recieve a letter said that i need to pay for tax which i already submit last year.

This will be given to you immediately. It is also to check whether tax assessment submitted through IRBM s e-Filing has been updated in the ledger. Under E-Filing click on acknowledgement.

It also contains details regarding the customer and the product such as product name code manufacturer and so on. Get your tax transcript online or by mail. You will also need to go to an LHDN office to do this.

We recommend generating the payment confirmation receipt in PDF to keep for your record. Find line by line tax information including prior-year adjusted gross income AGI and IRA contributions tax account transactions or get a non-filing letter.

Read more »