How To Print Property Tax Bill

Review the tax balance chart to find the amount owed. Tax bill process is a long and involved process which starts with you.

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

It becomes delinquent and will be subject to a 10 percent penalty if payment is not received or postmarked by the United States Postal Service USPS on or before December 10.

How to print property tax bill. The phone number for making property tax payments is 713-274-2273. Property Tax Bill Annually cities school districts special taxing districts and Maricopa County establish their own tax levy or the amount of taxes that will be billed. Saying there needs to be more transparency in how property taxes are assessed in Texas the head of the House Ways and Means Committee unveiled legislation Friday that would reduce.

This will save taxpayers approximately 75k annually on mailing printing and processing costs. Property taxpayers may use any combination of credit cards andor e-Checks for payment. Download a copy of your tax bill.

Enter the address or 9-digit OPA property number. Access the 20-Year Property Tax History. WCF bills now appear on your Property Tax Bill as a separate fee of 90 per unit.

Tax Waiver Statement of Non-Assessment How to obtain a Statement of Non-Assessment Tax Waiver. The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more. Understanding your Tax Bill.

Property Assessment Appeals Information on how to appeal your Property Assessment from the Assessors Office. To find and pay property taxes. Annually the Maricopa County Assessor determines the Full Cash and Limited Property values used to determine the assessed values on the tax bill calculations.

After locating the account you can pay online by credit card or eCheck. Choose options to pay find out about payment agreements or print a payment coupon. The City eliminated the 50 late fee per unit for 2020 and all future WCF bills.

111825r of the Texas Property Tax Code the Gregg County Appraisal District gives public notice of the capitalization rate to be used for tax year 2021 to value properties receiving exemptions under this section. Tax Bill Options is where you can filter to print Advice Only and Changed Tax Bill Only For example if you do not wish to include tax bills with no current values ie split parcels that were set up in the system for future BOR activity you would check the box Exclude Tax Bills with Zero Levy. The first installment payment is due November 1.

Rent restricted properties vary widely. Annual Secured Property Tax Bills - The Annual Secured Property Tax Bill is mailed on or before November 1 of each year. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues.

These variations can have an effect on the valuation of the property. You do not need to request a duplicate bill. After locating the account you can also register to receive certified statements by e-mail.

You can search for any account whose property taxes are collected by the Gregg County Tax Office. Pacific Time on the delinquency date. If the delinquency date falls on a Saturday Sunday or a Los.

Please follow the instructions below. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty.

Find out if your delinquent taxes have been sold. Harris County property tax bills can be paid by touch-tone phone at any time from any place in the world seven days a week. Sign up to receive tax bills by email.

Greg Abbott on Thursday announced that both chambers of the Texas Legislature will push to curb property tax growth by limiting how. You also can check and update key information about your property such as. Flanked by the states top legislative leaders Gov.

See local governments debt and pensions. If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment. A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more.

Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm. Pursuant to California Revenue and Taxation Code Section 2922 Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax due and to pay the taxes before April 1.

Taxes are normally payable beginning November 1 of that year. The annual bill has two payment stubs. You can always download and print a copy of your Property Tax Bill on this web site.

Read The Pappas Study.

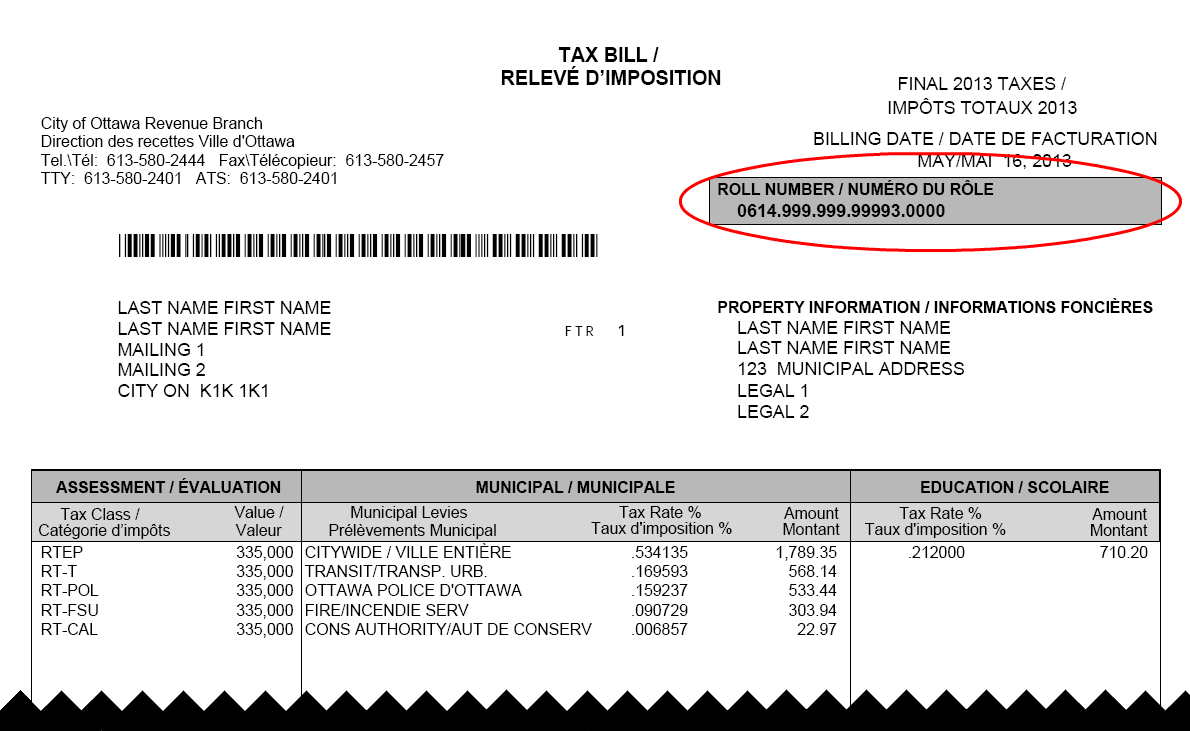

Property Tax Bill City Of Ottawa

Property Tax Bill City Of Ottawa

How To Pay Kmc Property Tax Bill Online Property Walls

How To Pay Kmc Property Tax Bill Online Property Walls

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

How To Print Property Tax Bill Online Kalyan Dombivali No Audio Youtube

How To Print Property Tax Bill Online Kalyan Dombivali No Audio Youtube

Current Payment Status Lake County Il

Kdmc Property Tax Payment Receipt Online Property Walls

Kdmc Property Tax Payment Receipt Online Property Walls

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home