How Do I Apply For Cook County Senior Property Tax Exemption

A Senior Exemption is calculated by multiplying the Senior Exemption savings amount 8000 by your local tax rate. The name and property address must verify the application.

Completion of Application for Senior Citizen and Disabled Persons Exemption from Real Property Taxes.

How do i apply for cook county senior property tax exemption. Or apply by mail download 2021 paper application and instructions. Cook County homeowners may take advantage of several valuable property tax -saving exemptions. There are currently four exemptions that must be applied for or renewed annually.

All exemptions are applied to second installment property tax bills issued in summer. This program works like a loan from the State of Illinois to qualified senior citizens with an annual interest rate of 6. Senior Citizen Exemption Application Cook County Assessors Office.

To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or older during the tax year in question. Senior CitizensDisabled Exemption Many more people in King County are now eligible for help with their property taxes. Any portion or all up to 5000 per year of the tax may be deferred until the house is sold or until the death of the taxpayer.

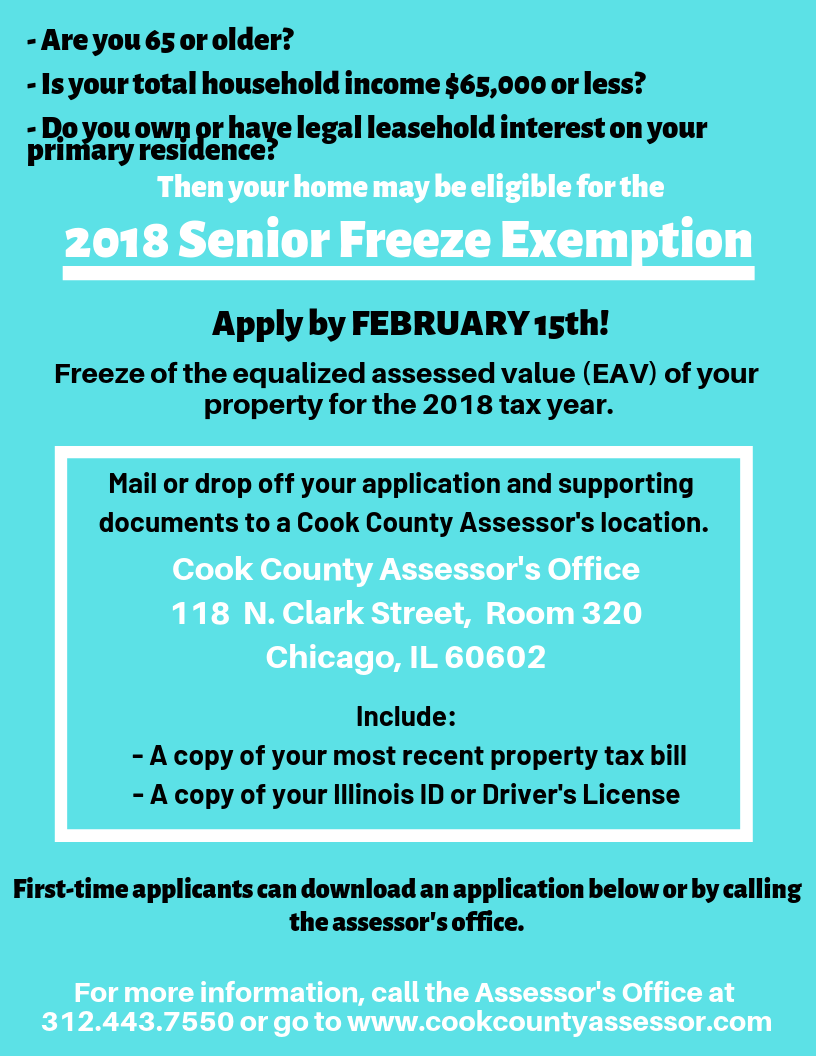

Copy of your recorded deed. Be a senior citizen with an annual household income of 65000 or less. To qualify applicants must.

If an exemption you were entitled to in a prior tax year was not applied to a second installment property tax bill in the past you may be able to apply for a refund read more about submitting a Certificate of Error. This exemption may be claimed in addition to the General Homestead Exemption. The Senior Citizen Homestead Exemption reduces the EAV of your home by 8000.

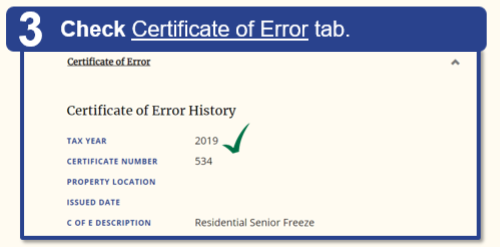

Exemption forms may be filed online or you can obtain one by calling one of the Assessors Office locations or your local township assessor. Please check the Cook County Portal to see if you received the Senior Freeze Exemption for the 2019 tax year before applying. Link to obtain further information about the various exemptions that are offered the documents and filing process required for each exemption to be claimed and answering questions about each exemption.

A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. For information and to apply for this homestead exemption contact the Cook County Assessors Office. A Person with Disabilities Exemption is for persons with disabilities and provides an annual 2000 reduction in the equalized assessed value EAV of the property.

Your local tax rate is determined each year by the Cook County Clerk and can be found on your second-installment tax bill or by contacting the Cook County Clerks Office at. Be 65 years of age or older. The date of issue must verify that you occupied this property on or before January 1 2020.

Own and live in the property as their principal residence. If you have never received a Homeowner Exemption on your home you will need to file an initial application. You may supply an Illinois Drivers License ID Card Matrícula Consular ID or City of Chicago ID Card.

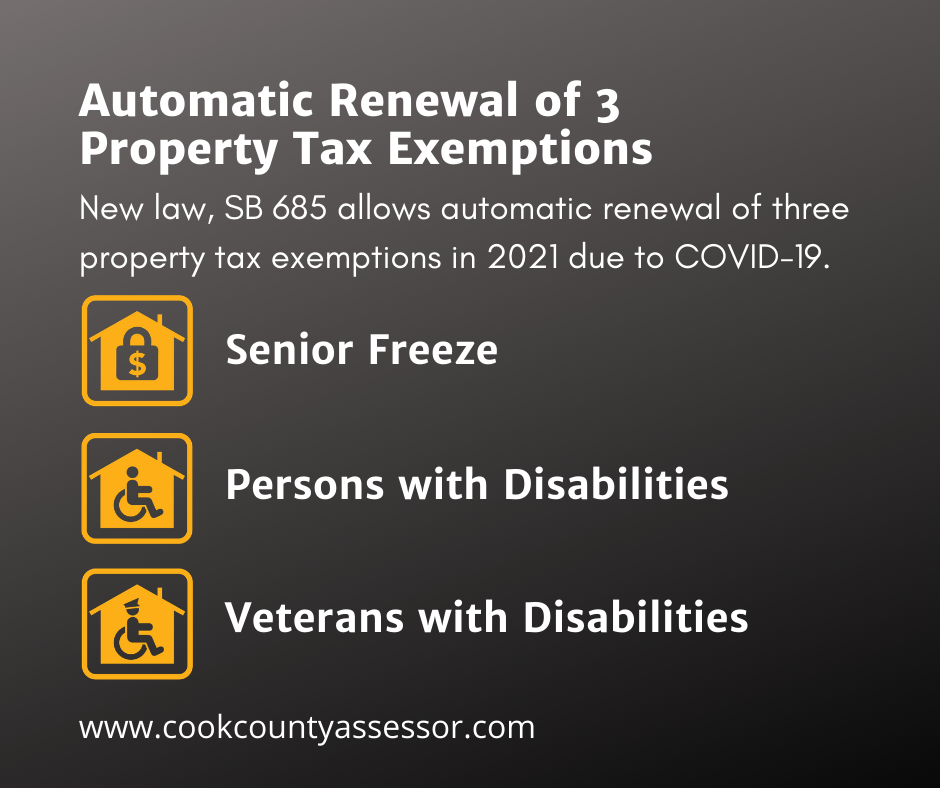

Yes for tax year 2020 only this exemption will automatically renew. Sign your parents name on the application and in parenthesis write deceased and underneath it write your name and in parenthesis write sondaughter Complete an Affidavit of Person Claiming Senior Citizens Freeze Exemption Due to a Deceased Taxpayer form. This exemption usually requires annual renewal but will be auto-renewed this year due to the COVID-19 pandemic.

The application due date is April 9 2021. Have owned and occupied the home on January 1 2019 and January 1 2020 and have been responsible for the 2019 and 2020 taxes to be eligible for Tax Year 2020 payable in 2021. Renewal required at least once.

Disabled person must provide written acknowledgment by Social Security or Veterans Administration or Proof of Disability Affidavit. Copy of current Tax Bill or PIN. The Homeowner Exemption Senior Citizen Homestead Exemption Senior Citizen Assessment Freeze Exemption and the Home Improvement Exemption.

To file for a Senior Citizen Homestead Exemption you will need. Properties that qualify for the Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General Homestead Exemption. To apply contact the Cook County Treasurers Office at 3124435100.

For households who need to apply or reapply please do so online. You can apply online here. Copy of your Birth Certificate Illinois Drivers License or Illinois State ID.

Applications can be filed with the Chief County Assessment Office or the local township assessors office. Property tax exemptions are provided for owners with the following situations. To apply for the senior freeze exemption the applicant must.

Check the Cook County Portal website then review the Exemption History and Status section. Property taxes are quite possibly the most widely unpopular taxes in the US. There is no annual renewal for this exemption.

35 ILCS 20015-168 Homestead Exemption for Persons with Disabilities. To apply for the Senior Exemption for tax year 2020 see documents required and application instructions here.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home