How To Print Property Tax Statement

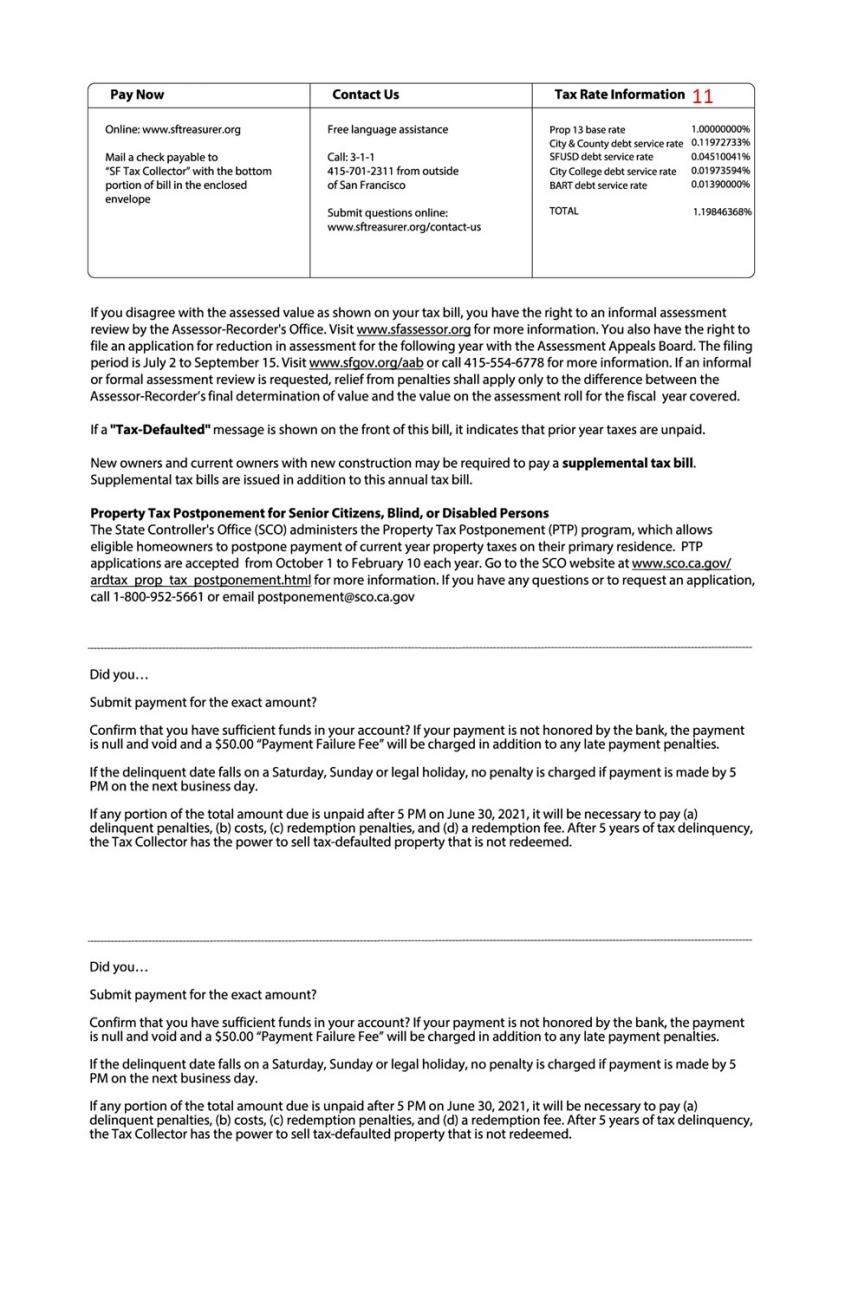

The term secured simply means taxes that are assessed against real property eg land or structures. Tax Code Section 3301 establishes the penalty and interest PI rates on delinquent property taxes.

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Select Yes I accept.

How to print property tax statement. The top of the tax statement shows the TAG tax district in which the property is located and the propertys Parcel Identification Number PIN - formerly known as the Schedule Number. Or go to departments and find public records. Any person that wants to pay on behalf of the owner by making a charitable gift.

A real property tax lien that is sold under article 3 of this chapter may be redeemed by. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. The property tax account is being reviewed prior to billing.

PTAD provides PI charts for use in calculating the total amount due on delinquent property tax bills. CREDITDEBIT CARD CONVENIENCE FEES APPLY. The Maricopa County Treasurer sends out the property tax bills for local jurisdictions this includes the county cities school districts special taxing districts and the state not just Maricopa County based on the assessed values and the calculated rates.

The owners agent assignee or attorney. Please contact 913-715-2600 for any questions or assistance. Just go to your county courthouses website.

Select the Tax Bill Payment option which is the 6 th option. Quick links 2019 Industrial property return 2019 Personal property return 2019 Real property return FAQ. Tax Waiver Statement of Non-Assessment How to obtain a Statement of Non-Assessment Tax Waiver.

The Maricopa County Supervisors only control a small portion of the property tax bill. Click Local Property Tax LPT on the Property Services card. Property tax is set by and paid to the county where your property is located.

Effective November 2020 Johnson County will no longer mail tax receipts directly to taxpayers that indicate such request on their tax statement remittance document. Any person who has a legal or equitable claim in the property including a certificate of purchase of a. You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements.

Search property taxes statements bills whatever. This website provides current year unsecured tax information and is available between March 1 and June 30 only. To view your Bills and Notices for the past three years you can use our e-Service View Property Tax Notices.

1 of the tax year but do not include additional penalties for attorney fees. Any overpaid property tax will be credited to your account. Sign in to LPT.

The charts include the rates for taxes delinquent on Feb. Some credits are treated differently. Property Assessment Appeals Information on how to appeal your Property Assessment from the Assessors Office.

You can request copies of property tax statements from your citytownshipvillagecounty assessors office or their web site. Only the owner of the property is able to view bills and notices relating to the property. In Person at the counter Property Tax Payment Fees.

You can view and print your Statement of Account SOA online by following the steps. Enter your PPSN property ID and property PIN and click Login. Steps to viewprint property tax payment information.

On the home screen click the View Property History button. Inquiresearch property tax information. Property Tax Payments can be made at all locations by cash check and most major credit cards.

The 2020 property taxes are. Register to Receive Certified Tax Statements by email. To locate the amount of your Current Year Unsecured Taxes click the following link How much are my Unsecured taxes.

The taxing authorities that levy taxes on the property are listed individually along with their mill levy and dollar amount and the total computed tax amounts. If you do nothing it will be automatically applied to your next tax bill. The tax is a lien that is secured by the landstructure even though no document was officially recorded.

If you are no longer the property owner you will. If the taxes remain unpaid after a period of five 5 years the property may be sold to cover the taxes owed. Print your tax statement by searching for your account and selecting the E-Statement button.

You can access the service through myAccount by following these steps. Links to county websites take me to ORMAP. You can find out how much your taxes are and make your payment by going to the Property Tax LookupPayment Application.

Click on the link for Personal PropertyMVLT and Real Estate. You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form. 209 of total minimum fee of 250.

And enter the year and bill number. Click on the Online Services tab at the top of the website.

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Vintage Paper Print Instructions Irs 1963 Gains Losses From Property Tax Form Tax Forms Printed Paper Property Tax

Vintage Paper Print Instructions Irs 1963 Gains Losses From Property Tax Form Tax Forms Printed Paper Property Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Reduction Tax

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Current Payment Status Lake County Il

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Michigan Homestead Property Tax Credit Tax Credits Property Tax Homestead Property

Michigan Homestead Property Tax Credit Tax Credits Property Tax Homestead Property

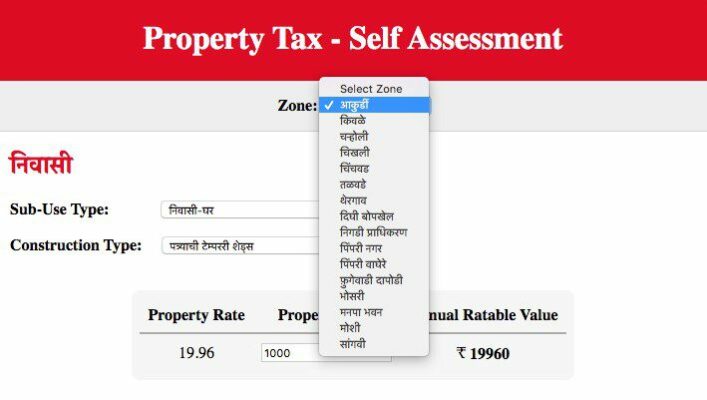

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses Fo Investment Property Being A Landlord Investing

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses Fo Investment Property Being A Landlord Investing

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

How To Read Your Property Tax Bill La County Property Tax Los Angeles Real Estate Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home