How Can I Print My Property Tax Bill

The phone number for making property tax payments is 713-274-2273. Personal Property Tax Lookup And Print Receipt.

Current Payment Status Lake County Il

Click on the link for Personal PropertyMVLT and Real Estate.

How can i print my property tax bill. Delinquent notices are mailed in February. You also can check and update key information about your property such as. Select the Tax Bill Payment option which is the 6 th option.

An interest charge of 2 is assessed on 2020 delinquent property tax bills on January 6 2021. Harris County property tax bills can be paid by touch-tone phone at any time from any place in the world seven days a week. This website provides current year unsecured tax information and is available between March 1 and June 30 only.

The funds are withdrawn from the taxpayers bank account usually a checking account transferred over the ACH network then deposited into the Tax Collectors office bank account. Pay your property taxes conveniently and securely using our website. Postmark A United States Postal Service USPS marking on an envelope or package that indicates the date and time a mail piece was taken into custody by the USPS.

The only exception is that a property tax collector may wait to send a bill until the total taxes due for all taxing units the collector serves is 15 or more. A property owner may file a written request with the collector that a tax bill not be sent until the total amount of taxes due on the property is 15 or more. Find out if your delinquent taxes have been sold.

Steps to viewprint property tax payment information. You will need your Account Number to proceed with payment. FREE eCheck electronic check is a digital version of the paper check.

In addition you can use our website to look up taxes due request a duplicate bill and look up payment historyPlease CLICK HERE for more information on all payment optionsWe also created a TOP 5 DOs AND DONTS with helpful information on property tax payments including How To Avoid Penalties. Click on the Online Services tab at the top of the website. See property taxes paid in previous years.

If you lost the original bill and are making a payment you can pay electronically or print out and send in the online copy with your tax payment. If taxes are due you may pay online using the button below. See local governments debt and pensions.

You can always download and print a copy of your Property Tax Bill on this web site. The process mirrors paper checks but is done electronically. Enter the address or 9-digit OPA property number.

And enter the year and bill number. You can view and print property tax payment history for prior years online for free. Before you start.

To get property information duplicate tax bill or to pay your taxes click on the green Property Lookup Payments box. Property Tax Lookup Online Payments. Receipt available for current or past two years.

Property taxpayers may use any combination of credit cards andor e-Checks for payment. 2020 taxes are payable without interest through January 5 2021. Property Tax Bill Annually cities school districts special taxing districts and Maricopa County establish their own tax levy or the amount of taxes that will be billed.

You must pre-pay for the years requested by cash personal check or money order. To locate the amount of your Current Year Unsecured Taxes click the following link How much are my Unsecured taxes. Sign up to receive tax bills by email.

An interest charge of three-fourths of one percent 34 is assessed on February 1st and each month thereafter until the taxes are paid in full. Choose options to pay find out about payment agreements or print a payment coupon. Read The Pappas Study.

Select Yes I accept Select the information requested from the. However there is still a 100 fee for walk-in or mail requests. The PIN can be found on any original Secured Property Tax Bill.

You do not need to request a duplicate bill. Access the 20-Year Property Tax History. Download a copy of your tax bill.

Beyond the amount of taxes you owe the bills indicate where your taxes are going and how much more is being collected by your local governments each year. The information on the bill can also help you determine whether your assessment is accurate. To search for tax information you may search by the 10 digit parcel number OR last name of property owner OR site address.

Property tax bills and receipts contain a lot of helpful information for taxpayers. Review the tax balance chart to find the amount owed. Annually the Maricopa County Assessor determines the Full Cash and Limited Property values used to determine the assessed values on the tax bill calculations.

Credit and debit card payments are charged 255 of the total amount charged 195 minimum charge. If an Echeck payment is submitted with the incorrect account information or returned unpaid for any reason a fee of up to 5 may be charged per Florida Statute 1250105.

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

How To Get Duplicate Property Tax Bill Property Walls

How To Get Duplicate Property Tax Bill Property Walls

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

How To Get Duplicate Property Tax Bill Property Walls

How To Get Duplicate Property Tax Bill Property Walls

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

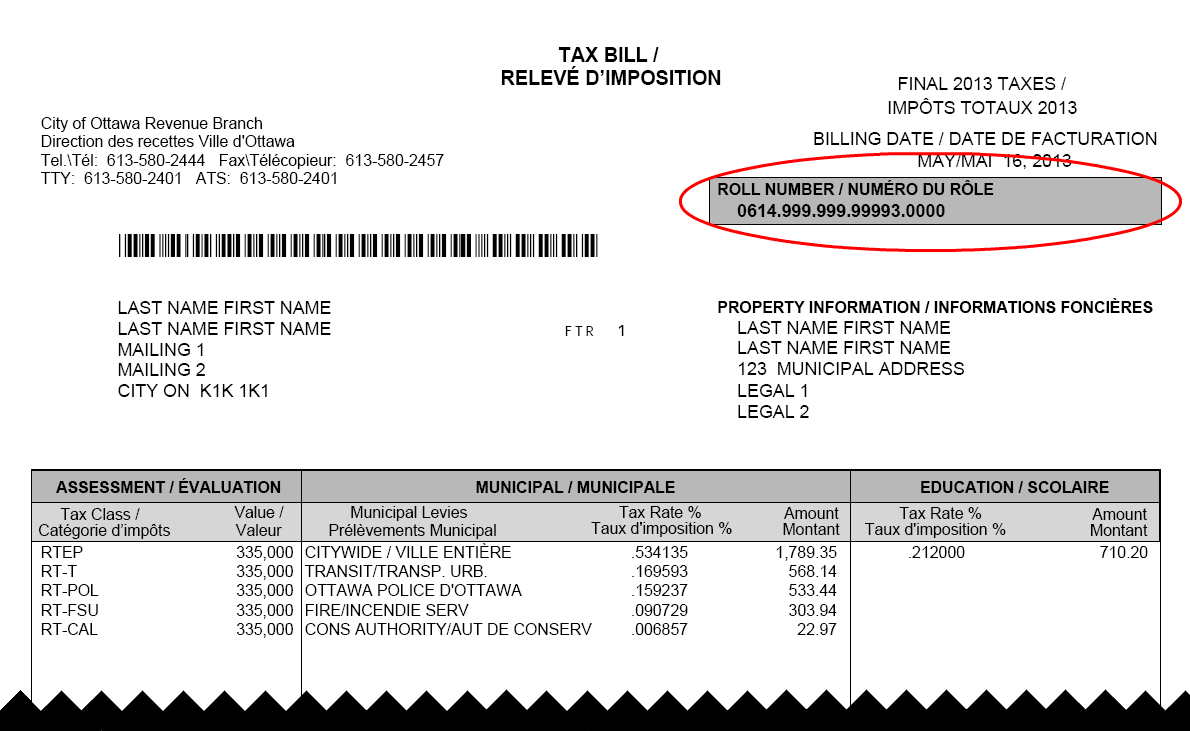

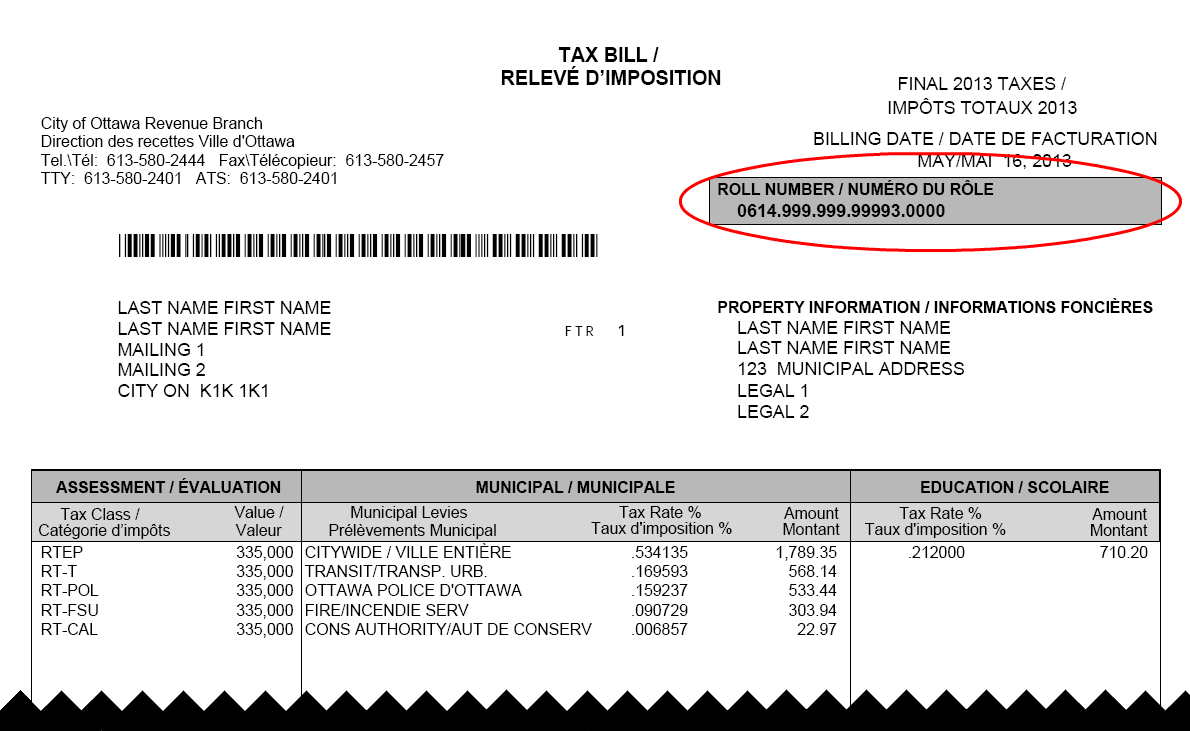

Archived How And When To Pay Your Property Tax And Water Bills City Of Ottawa

Archived How And When To Pay Your Property Tax And Water Bills City Of Ottawa

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Labels: print

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home