Property Tax Rates Andhra Pradesh

Ration card also acts as a valid government document. Yogi Adityanath led Uttar Pradesh cabinet approves this important order on property Lucknow April 6 IANS The Uttar Pradesh cabinet has approved the decision to bring in the Uttar Pradesh Regulation of Urban Premises Tenancy second Ordinance 2021.

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

The employers are entrusted with the responsibility of paying the profession tax on employees behalf after deducting it from their salary.

Property tax rates andhra pradesh. Stamp Duty fee is imposed on the absolute estimation of the property. Types of Profession Tax Payers. Who can invest in fixed deposit schemes.

Lets assume If you are earning a post-tax interest of 870 per annum on your fixed deposits the amount will double in 827 years. Andhra Pradesh has its own professional tax slab rate. Given below is the professional tax slab rate of Andhra Pradesh for the financial year 2019-2020 depending on the salary.

As on June 2017 Petrol prices in India are revised daily and this is called the dynamic fuel price method. In 2020-21 the civic body had estimated to collect Rs 6768 crore in property tax but the same was revised to Rs 4500 crore. Obtain all the important documents required for property registration.

Bhardwaj said the Bharatiya Janata Party BJP government has massively increased the prices of diesel petrol and LPG in the last several days and claimed that the AAP govt has not hiked any tax in the last. Petrol Price in Andhra pradesh Today. For example in Andhra Pradesh the base Andhra Pradesh Stamp Duty rate of apartment flat is 5 transfer duty is 15 and the registration fee is 05.

Andhra Pradesh Professional Tax Slab Rate. The price of Petrol in Andhra pradesh is at Rs 8724 per litre Today. The state government fixes stamp duty.

As this tax is a state subject the rate of profession tax varies from one state to another. Property tax of Rs 45452 crore was collected from K-west Andheri Jogeshwari Rs 39929 crore from G-south Worli Mahalaxmi and Rs 30368 crore from S ward Bhandup. The professional tax slab rate is revised every year.

Family staying in. Touted by the state government as a world first buying electric two-wheelers in such large quantities will translate to Rs 500-Rs 1000 crore worth sales for manufacturers. Andhra Pradesh Ration Card.

A ration card helps the person purchase food items under subisidised rates. The interest rates on LAP for all listed BSE public and private banks have been. Puraseva changing the face of civic grievance redressal system in State.

Heres a step-by-step guide register property in Andhra Pradesh. THE BRIHANMUMBAI Municipal Corporation BMC recovered property tax dues to the tune of Rs 513543 crore till March 31 2021 during its drive that began last year after the. Andhra Pradesh alter with chip based Garbage collection mode Municipal Commissioners back from Singapore to AP 05-Jul-2017.

The Andhra Pradesh government will help its employees buy more than 100000 electric two-wheelers by arranging for domestic as well as global financing at attractive rates. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Any individual HUF or Corporate can invest in a fixed deposit scheme.

Check Andhra Pradesh ration card list also find how to apply and make correction for name or address change in Andhra Pradesh ration card online and offline. The slab rates for profession tax are revised the Andhra government on an annual basis. Check the market rate stamp duty registration fee and user charges applicable on different types of property.

There is a lock- in for 5 years in such tax saving fixed deposits. No only Tax Saving FDs provided by banks can be used for tax deduction under Section 80C. The current slab rates are as follows.

However until December 2020 the civic bodys revenue receipts from property tax. Fill the complete form as applicable. The Kejriwal government reduced circle rates by 20 per cent while the BJP-ruled MCD increases property taxes by 34 per cent he said.

Petrol and diesel rates are revised at 0600 am. User should be ready with the following information while filling the form 26QB. Profession Tax Rates in Key States of India.

PAN of the seller buyer. Gurugrams district administration has increased the circle rates for FY2021-22 by up to 88 which will have a cascading impact on the property prices in the micro market. The BMC collected Rs 3800 crore in property tax as of Thursday.

You can use the rule of 72 to estimate the time in which the FD will double. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Instavat offers updated collated comprehensive and comparative statutory information about Service Tax Sales Tax VAT CST Entry Tax and Profession Tax keeping you updated with the ever-evolving indirect tax regime across India in real time on DVD Email alerts Online Utility and INSTA E-Book.

While some states might charge it as a percentage value other states tend to charge it as a fixed amount based on income slabs. That is time take for a fixed deposit to double is 72post-tax FD interest rate per annum Contact us for Deposits. The employees can.

Under TDS on sale of property click on Online form for furnishing TDS on property Form 26QB Select the applicable challan as TDS on Sale of Property. All about Andhra Pradesh RERA. The following are the professional tax rates in key states in India.

Interest Rates and Indicative EMIs on Loan Against Property of Rs 10 lakh for a 5-year Tenure Disclaimer. Property Registration Charges in Andhra Pradesh in 2019.

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

Telangana Vs Andhra A Comparison Of Their Fiscal Situation And More

Telangana Vs Andhra A Comparison Of Their Fiscal Situation And More

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

Why Ap Lags In Literacy Levels The Hindu Businessline

Property Tax Water Sewerage Charges Revised The New Indian Express

Property Tax Water Sewerage Charges Revised The New Indian Express

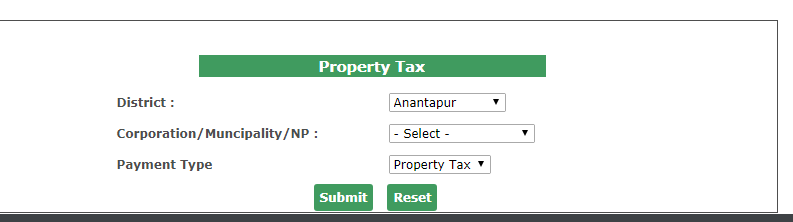

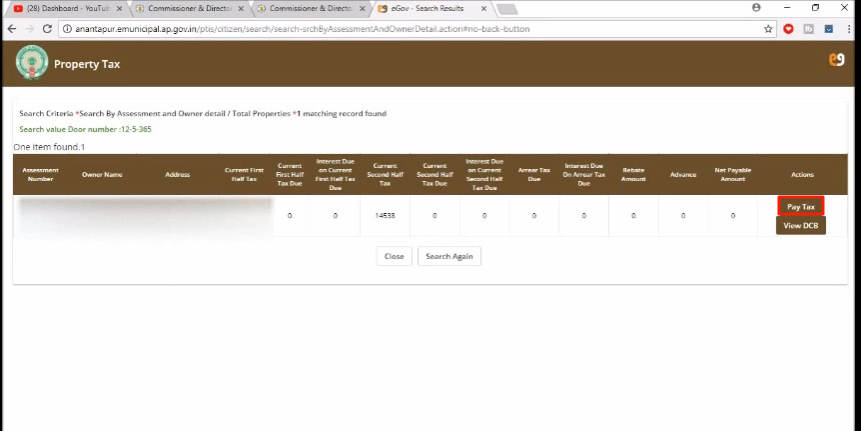

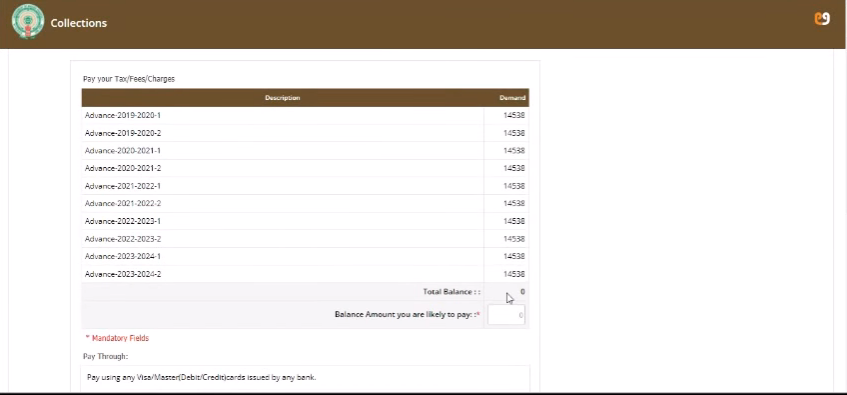

Andhra Pradesh Property Tax Online Payment Indiafilings

Andhra Pradesh Property Tax Online Payment Indiafilings

Telangana Vs Andhra A Comparison Of Their Fiscal Situation And More

Telangana Vs Andhra A Comparison Of Their Fiscal Situation And More

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

Why Ap Lags In Literacy Levels The Hindu Businessline

Andhra Pradesh Property Tax Online Payment Indiafilings

Andhra Pradesh Property Tax Online Payment Indiafilings

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

Andhra Pradesh Property Tax Online Payment Indiafilings

Andhra Pradesh Property Tax Online Payment Indiafilings

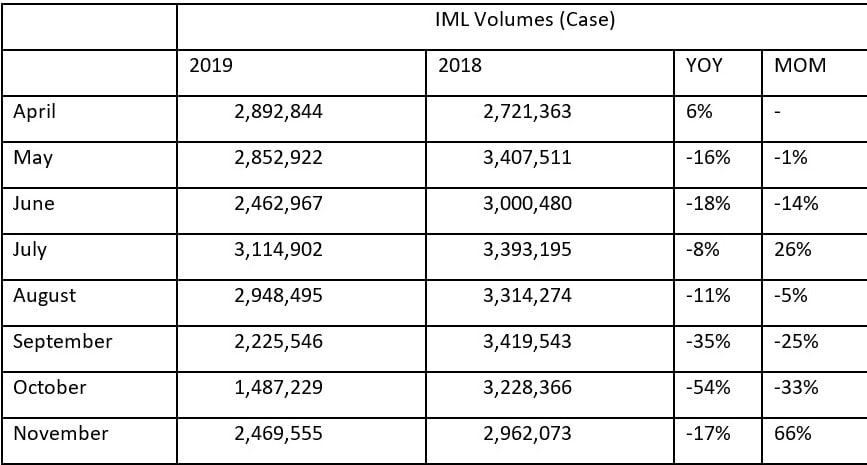

How Andhra Pradesh S Prohibition Is Impacting Alcohol Consumption In The State Cnbctv18 Com

How Andhra Pradesh S Prohibition Is Impacting Alcohol Consumption In The State Cnbctv18 Com

Ap Rera Registration Process Fees And How To File Complaints

Ap Rera Registration Process Fees And How To File Complaints

Tax Rates And Traiffs Commissioner And Director Of Municipal Administration

Tax Rates And Traiffs Commissioner And Director Of Municipal Administration

Property Tax Commissioner And Director Of Municipal Administration

Property Tax Commissioner And Director Of Municipal Administration

What Is The Procedure For Property Registration In Andhra Pradesh

What Is The Procedure For Property Registration In Andhra Pradesh

Andhra Pradesh Property Tax Online Payment Indiafilings

Andhra Pradesh Property Tax Online Payment Indiafilings

Pandemic Bites States Share Of Central Tax Kitty The Hindu Businessline

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home