Is Property Tax On Vacant Land Deductible

For New York purposes Form IT-196 lines 5 6 and 7 your state and local taxes paid in 2020 are not subject to the federal limit and. Real estate commissions paid to agents by the owner usually are deductible from the amount realized from the sale of vacant land.

Thinking About Donating Your Plane Check Out Aircraftdonation Org They Accept Aircraft Of All Types And Even Accept Aircraft P Aircraft Used Aircraft Donate

Thinking About Donating Your Plane Check Out Aircraftdonation Org They Accept Aircraft Of All Types And Even Accept Aircraft P Aircraft Used Aircraft Donate

In its simplest application it provides that interest and taxes on vacant land are not deductible.

Is property tax on vacant land deductible. For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separateIn addition you can no longer deduct foreign taxes you paid on real estate. Deductible real estate taxes are generally any state local or foreign taxes on real property levied for the general public welfare. Real estate taxes are deductible even if the taxes were from vacant land.

Upon further review however this. This deduction is not limited to the amount of net investment income. If you itemize your deductions and hold the raw land for personal use as opposed.

An investor can also deduct property taxes paid on a vacant land as a personal itemized deduction on Schedule A. None of the other expenses on your closing statement will. Land Sale Deductions When you sell your land review your settlement statement carefully.

Advertising expenses and legal fees to prepare any contracts or documents necessary for the transfer of ownership may be deductible. Weve likely all heard the comment that a deduction for state and local taxes is limited on Schedule A to no more than 10000 5000 for a married individual filing a separate return so that real estate taxes imposed on raw land a taxpayer was holding for appreciation would be trapped by the 10000 cap along with their other state and. See the following from IRS Tax Topic 503 Deductible Taxes.

For example if your land is being used to develop a new commercial property any expenses associated with clearing or improving the property will qualify as tax deductible. If your land is located in a state or county that imposes property improvements taxes for such things as roads sewer lines or sidewalks you cant deduct those amounts. First of all claiming real estate taxes paid in the year vacant land is sold is not considered a deduction per se.

This deduction is not limited to the amount of net investment income. Nor is it subject to the 10000 annual limit on deducting property tax paid on a. That would be subsection 18 2 a very fine place to start.

An investor can also deduct property taxes paid on a vacant land as a personal itemized deduction on Schedule A. You might also write off the interest that you pay in your own land loan. Creative real estate brokers lawyers and their clients might benefit from remembering that the mansion tax is not applicable to vacant land is reduced in the case of a legal mixed-use property and is paid on the commercial aspects of the transaction if applicable.

This deduction is not limited to the amount of. Thats a pretty well-known concept. While the original tax was fixed at one percent for all trans-fers of residential property over 1.

Investment land tax deductions incorporate the bulk of expenses you will likely incur as you refine and promote your land. Nor is it subject to the 10000 annual limit on deducting property tax paid on a main or second home. Plus you dont have to file them on Schedule A with your other itemized deductions.

When transferring ownership of vacant land certain expenses may be tax deductible. Therefore it would appear at first that with the new rules in place these taxes would be subject to the 10000 cap. MANSION TAXES Today in New York City a large per-centage of residential transactions ex-ceed 1 million and the tax applies to many homes that would not be consid-ered mansions.

If you are assessed any property taxes as a part of the prorations youll be able to deduct them with your other property tax deductions. For starters all of your interest and property taxes are completely tax deductible. If residential premises are being constructed on vacant land being used to carry on a primary production business you can only claim a deduction for the costs of holding the land that is being used for primary production and not for that part of the land relating to the construction of residential premises.

The real estate taxes paid on vacant land before the passing of the Tax Cuts and Jobs Act were an itemized deduction on Schedule A. The amount you can deduct. State Local and Foreign Real Estate Taxes.

Vacant land tax deductions on the bright side as a property investor you are qualified to write off certain expenses related to owning your vacant property and that includes your property taxes. Since you file them on a Schedule E you still get to claim the expenses even if you dont itemize your personal deductions or if youre subject to the Alternative Minimum Tax. Property tax is deductible on Schedule A regardless of whether you are paying it on a house a condo or raw land.

To quote Maria von-Trapp lets start at the very beginning. An investor can also deduct property taxes paid on vacant land as a personal itemized deduction on Schedule A. It is an election to capitalize the annual real estate taxes paid on vacant land instead of claiming the real estate taxes paid as a deduction.

Real Estate Tax Deductions Guides Resources Millionacres

Real Estate Tax Deductions Guides Resources Millionacres

A Closer Look At Dc S Vacant Land Selling House Home Buying Process Vacant Land

A Closer Look At Dc S Vacant Land Selling House Home Buying Process Vacant Land

Owning Vacant Land Holds Tax Benefits Inman

Owning Vacant Land Holds Tax Benefits Inman

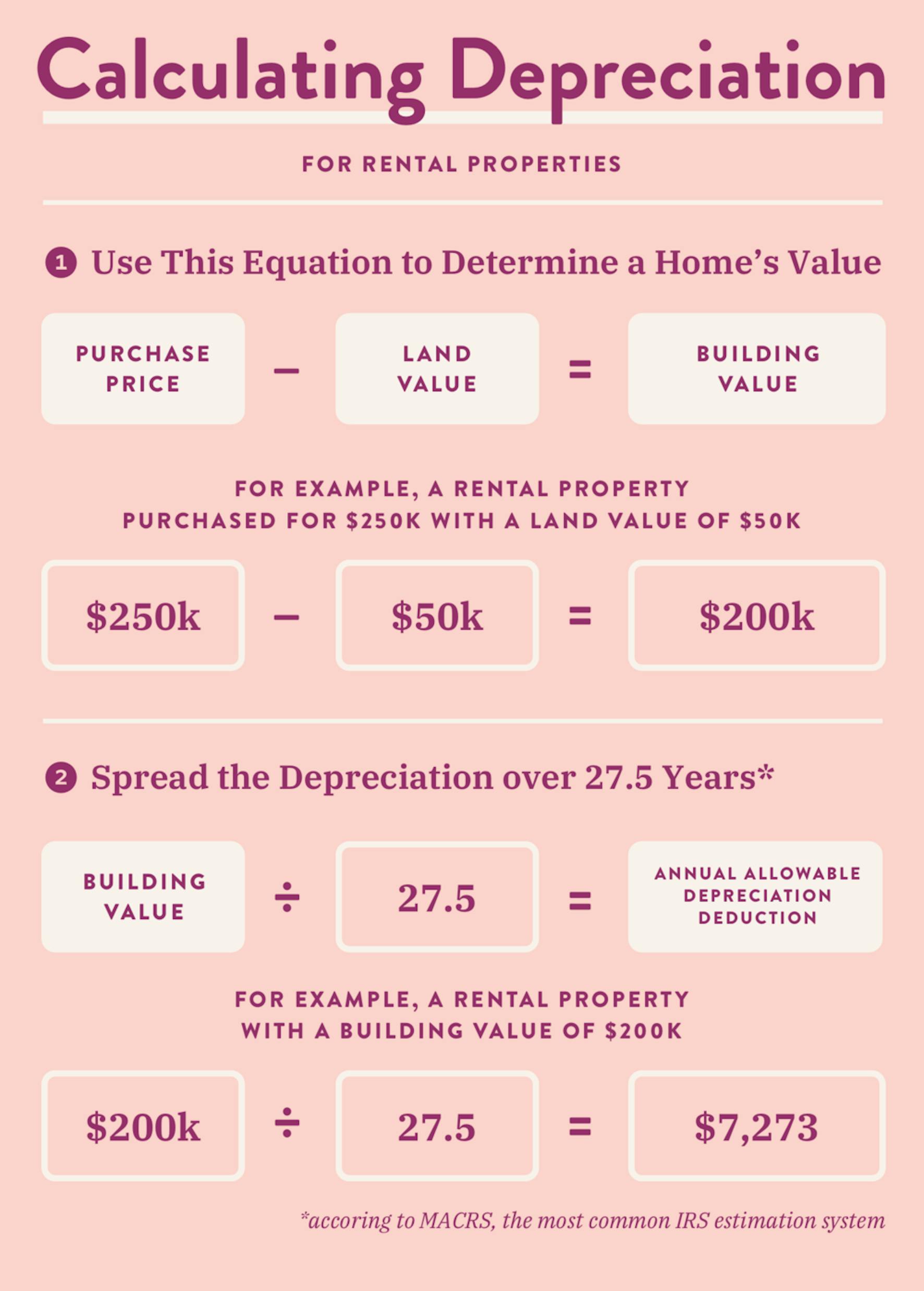

How To Deduct Rental Property Depreciation Wealthfit

How To Deduct Rental Property Depreciation Wealthfit

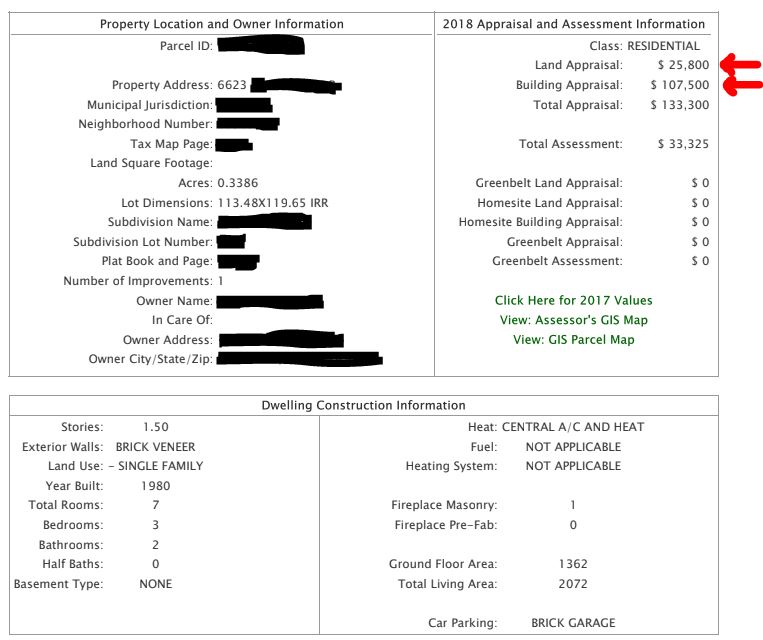

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

The 2020 Ultimate Guide To Irs Schedule E For Real Estate Investors

Real Estate Tax Deductions Guides Resources Millionacres

Real Estate Tax Deductions Guides Resources Millionacres

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Donate Real Estate To Giving Center Real Estate Estates Vacant Land

Donate Real Estate To Giving Center Real Estate Estates Vacant Land

Tax Deduction Donation Of Real Estate To Charity Tax Deductions Things To Sell Deduction

Tax Deduction Donation Of Real Estate To Charity Tax Deductions Things To Sell Deduction

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Real Estate Donation Donate Property To Charity Real Estate Undeveloped Land Vegetable Farming

Real Estate Donation Donate Property To Charity Real Estate Undeveloped Land Vegetable Farming

Owning Vacant Land Holds Tax Benefits Inman

Owning Vacant Land Holds Tax Benefits Inman

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers Property For Sale

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers Property For Sale

Rental Property Tax Deductions Property Tax Deduction

Rental Property Tax Deductions Property Tax Deduction

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Donate Real Estate Real Estate Donation Tax Deduction Donation Form

Donate Real Estate Real Estate Donation Tax Deduction Donation Form

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Pin By Wembley S Inc On Residential Real Estate Real Estate Marketing Real Estate Infographic Real Estate Trends

Pin By Wembley S Inc On Residential Real Estate Real Estate Marketing Real Estate Infographic Real Estate Trends

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Real Estate Tax Deductions 2021 Tax Guide Millionacres

Labels: deductible, property, vacant

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home